Trade War Fears Trigger 7% Plunge In Amsterdam Stock Market

Table of Contents

The Impact of Global Trade Tensions on the Amsterdam Stock Market

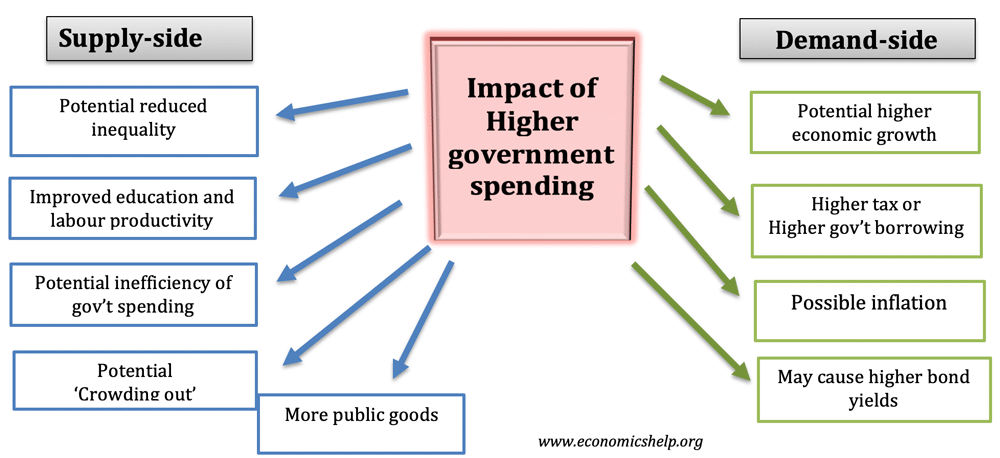

Escalating trade tensions, characterized by increased tariffs, sanctions, and trade restrictions between major global powers, create significant uncertainty in the international marketplace. This uncertainty directly impacts investor confidence, leading to a decrease in investment and market volatility. The ripple effect is felt across various sectors and economies.

- Increased uncertainty leading to decreased investment: Investors become hesitant to commit capital in a volatile environment, preferring to wait for clearer market signals before making investment decisions. This reduces overall market liquidity.

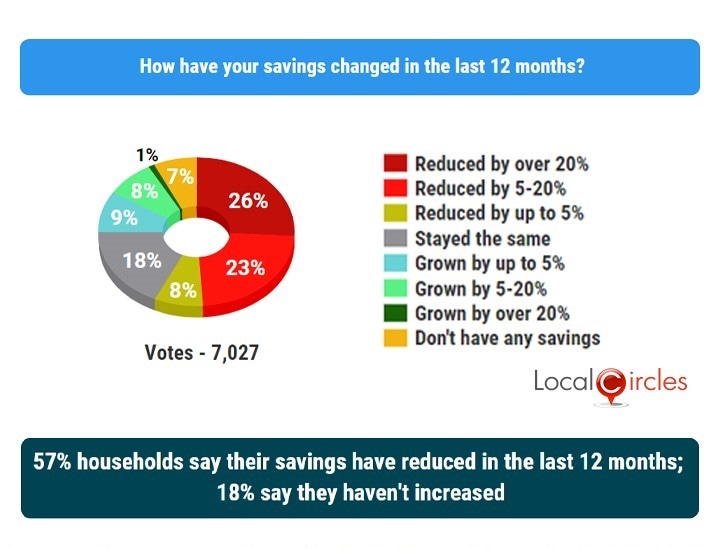

- Reduced consumer spending due to anticipated price increases: Tariffs and trade wars often lead to higher prices for imported goods, impacting consumer spending and potentially slowing economic growth.

- Impact on specific sectors heavily reliant on international trade (e.g., technology, manufacturing): Export-oriented industries in Amsterdam, such as technology and manufacturing, are particularly vulnerable to trade disruptions. Reduced export demand can lead to decreased production, job losses, and ultimately, a decline in stock prices.

- The ripple effect on related markets and industries: The negative impact isn't limited to directly affected sectors. The downturn in one area can trigger a chain reaction, affecting related industries and markets across the Amsterdam Stock Exchange.

Specific concerns triggering today's 7% drop include the renewed threat of higher tariffs on European goods from major trading partners and uncertainty surrounding the future of international trade agreements. Experts are pointing to this escalating uncertainty as the primary driver behind the sharp decline in the Amsterdam Stock Exchange.

Vulnerable Sectors within the Amsterdam Stock Market

The Amsterdam Stock Market plunge hit various sectors unevenly. Export-oriented industries, particularly those heavily reliant on international trade, bore the brunt of the decline.

- Analysis of stock performance in key sectors (e.g., technology, financials, consumer goods): The technology sector, with its significant reliance on global supply chains, experienced the most significant losses, followed by the manufacturing and export-oriented consumer goods sectors. Financial institutions also experienced declines due to increased uncertainty.

- Specific examples of companies experiencing significant losses: Several prominent Amsterdam-based companies in the technology and manufacturing sectors saw double-digit percentage drops in their share prices. (Specific company names and percentage drops would be inserted here for a real-time article.)

- Mention any government responses or industry reactions: The Dutch government has yet to issue an official statement, but industry representatives are calling for greater clarity and stability in the global trade environment.

Investor Sentiment and Market Volatility

Trade war fears have a profound psychological impact on investor behavior. The uncertainty fosters a climate of fear, leading to risk aversion and a “flight to safety.”

- Explain the concept of “flight to safety” and how investors react to uncertainty: Investors often move their capital into safer assets like government bonds during times of uncertainty, reducing investment in riskier stocks.

- Analyze the trading volume and volatility during the market plunge: Trading volume spiked significantly during the plunge, indicating heightened investor activity and panic selling. Volatility indices reached multi-year highs, reflecting the extreme market uncertainty.

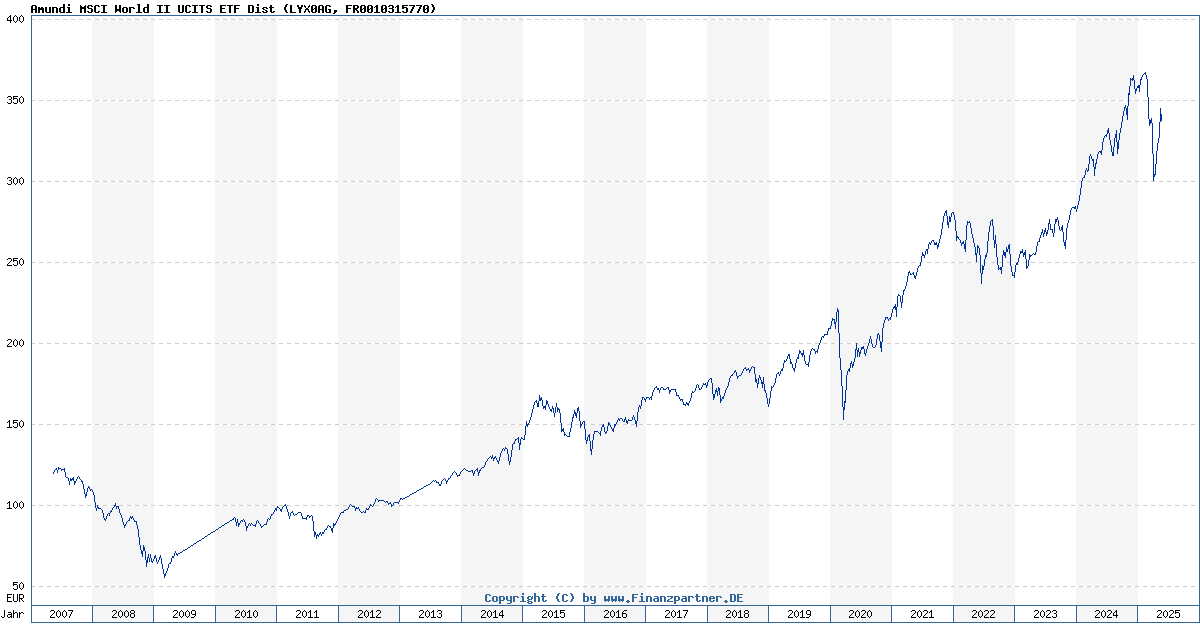

- Mention any shifts in investor confidence and expectations: Investor confidence has plummeted, with many expecting further volatility in the short term. Market expectations have shifted towards a more pessimistic outlook. (Charts and graphs illustrating trading volume and volatility would be added here for a real-time article.)

Predicting Future Market Trends in Amsterdam

Predicting the future is inherently challenging, but several factors will influence the recovery or further decline of the Amsterdam Stock Market.

- Possible scenarios for recovery or further decline: A swift resolution to trade tensions could lead to a rapid market recovery. However, prolonged uncertainty could result in a more protracted and severe downturn.

- The role of government intervention or international cooperation: Government intervention, both domestically and internationally, could play a significant role in stabilizing the market. International cooperation to de-escalate trade disputes is crucial.

- Expert predictions and market analyses from reputable sources: Market analysts are divided on the short-term outlook, with some anticipating a bounce-back while others predict further declines. (Specific predictions from reputable analysts would be included here for a real-time article.)

Conclusion

The 7% Amsterdam Stock Market plunge is a direct consequence of escalating trade war fears, highlighting the market’s vulnerability to global economic uncertainty. The impact was felt across various sectors, particularly those heavily reliant on international trade, causing significant investor anxiety and a "flight to safety." Understanding the factors driving this Amsterdam Stock Market plunge is crucial for investors.

Call to Action: Stay informed about developments in the global trade landscape and monitor the Amsterdam Stock Market closely for further updates. Understanding the factors driving the Amsterdam Stock Market plunge is crucial for investors to make informed decisions and mitigate risks. Keep an eye on future market analysis regarding the Amsterdam Stock Market and the impact of global trade developments. Regularly reviewing market updates will help navigate this period of uncertainty and manage investment portfolios accordingly.

Featured Posts

-

Atp Indian Wells Drapers Breakthrough Masters 1000 Win

May 24, 2025

Atp Indian Wells Drapers Breakthrough Masters 1000 Win

May 24, 2025 -

Ferrari Opens Flagship Bangkok Facility A New Era Begins

May 24, 2025

Ferrari Opens Flagship Bangkok Facility A New Era Begins

May 24, 2025 -

Tracking The Nav Of Amundi Msci World Ex United States Ucits Etf Acc

May 24, 2025

Tracking The Nav Of Amundi Msci World Ex United States Ucits Etf Acc

May 24, 2025 -

Bbc Radio 1 Big Weekend 2025 Tickets Full Lineup And Booking Info

May 24, 2025

Bbc Radio 1 Big Weekend 2025 Tickets Full Lineup And Booking Info

May 24, 2025 -

Royal Philips 2025 Annual General Meeting Of Shareholders Update

May 24, 2025

Royal Philips 2025 Annual General Meeting Of Shareholders Update

May 24, 2025

Latest Posts

-

Sses 3 Billion Spending Cut A Response To Economic Slowdown

May 24, 2025

Sses 3 Billion Spending Cut A Response To Economic Slowdown

May 24, 2025 -

Sse Cuts 3 Billion Spending Impact On Growth And Future Plans

May 24, 2025

Sse Cuts 3 Billion Spending Impact On Growth And Future Plans

May 24, 2025 -

La Fire Aftermath Celebrity Highlights Landlord Price Gouging

May 24, 2025

La Fire Aftermath Celebrity Highlights Landlord Price Gouging

May 24, 2025 -

Investing In The Future Identifying The Countrys Promising Business Hotspots

May 24, 2025

Investing In The Future Identifying The Countrys Promising Business Hotspots

May 24, 2025 -

La Fires Fuel Landlord Price Gouging Claims A Celebrity Weighs In

May 24, 2025

La Fires Fuel Landlord Price Gouging Claims A Celebrity Weighs In

May 24, 2025