Amsterdam Stock Market: Three Days Of Significant Losses Totaling 11%

Table of Contents

Causes of the Amsterdam Stock Market Decline

The recent sharp decline in the Amsterdam Stock Market is attributable to a confluence of factors, creating a perfect storm of negative market sentiment. Market volatility is at an elevated level, driven by several key concerns:

-

Increased Geopolitical Uncertainty: The ongoing war in Ukraine continues to fuel uncertainty, disrupting global supply chains and impacting energy prices. This geopolitical instability creates a climate of fear and hesitation among investors, leading to sell-offs across various sectors. The ripple effects of this conflict are far-reaching and significantly impact investor confidence.

-

Persistent High Inflation and Rising Interest Rates: Persistent high inflation across Europe and the subsequent aggressive interest rate hikes by the European Central Bank (ECB) are significantly impacting investor confidence. Higher interest rates increase borrowing costs for businesses, potentially slowing economic growth and reducing corporate profits. This makes investors less inclined to invest in the Amsterdam Stock Market, contributing to the decline.

-

Soaring Energy Prices: The war in Ukraine has exacerbated existing energy price pressures, placing a substantial strain on Dutch businesses and consumer spending. High energy costs reduce profitability for companies, forcing them to cut back on investments and potentially impacting employment numbers. This negatively impacts the overall health of the Dutch economy and, by extension, the Amsterdam Stock Market.

-

Growing Fears of a Potential Global Recession: The combination of high inflation, rising interest rates, and geopolitical uncertainty has fueled growing fears of a potential global recession. This fear leads to risk aversion among investors, prompting them to sell off assets, including those listed on the Amsterdam Stock Market, to safeguard their investments.

-

Specific Sector Performance: The energy sector, unsurprisingly, has been particularly hard hit, with several energy companies experiencing significant share price declines. However, the technology sector has also felt the pressure, reflecting broader concerns about slowing economic growth and reduced consumer spending. Companies like ASML Holding, a major player in the semiconductor industry, experienced notable losses, further contributing to the overall market decline.

Impact on the Dutch Economy and Investors

The 11% drop in the Amsterdam Stock Market has significant implications for both the Dutch economy and individual investors.

-

Effect on Dutch GDP Growth Projections: The decline in the AEX index suggests a weakening economy and will likely lead to downward revisions in Dutch GDP growth projections for the coming quarters. Reduced investor confidence and decreased business investment will hinder economic expansion.

-

Impact on Investor Confidence and Potential Capital Flight: The market downturn has undoubtedly eroded investor confidence. This could lead to capital flight, as investors seek safer havens for their investments in more stable markets. This outflow of capital could further exacerbate the economic challenges facing the Netherlands.

-

Analysis of Losses Incurred: Individual investors and pension funds holding significant AEX-linked investments have suffered considerable losses. The magnitude of these losses will vary depending on individual portfolio compositions and risk tolerance.

-

Portfolio Diversification: The recent events highlight the crucial role of portfolio diversification in mitigating risks. Investors with diversified portfolios across different asset classes and geographies are likely to experience less severe losses compared to those heavily invested in the Dutch stock market.

-

Potential Government Interventions: The Dutch government may consider implementing economic stimulus measures or other policy interventions to mitigate the impact of the market downturn on the broader economy. These measures might include tax cuts or increased public spending.

Analyzing the Future of the Amsterdam Stock Market

Predicting the future of the Amsterdam Stock Market is inherently challenging, but several factors will play a key role in shaping its trajectory.

-

Potential Market Recovery Scenarios: While a swift and complete recovery is not guaranteed, a gradual recovery is possible if geopolitical tensions ease, inflation begins to cool, and economic growth shows signs of stabilizing.

-

Analysis of Key Economic Indicators: Close monitoring of key economic indicators, such as inflation rates, consumer confidence indices, and unemployment figures, will provide crucial insights into the direction of the market.

-

Revised Investment Strategies: Investors need to reassess their investment strategies, considering the heightened market volatility. A more cautious approach, with a focus on risk management and diversification, is recommended.

-

Importance of Risk Assessment and Long-Term Planning: Long-term investment planning remains crucial. Investors should carefully assess their risk tolerance and adjust their portfolios accordingly, focusing on investments aligned with their long-term financial goals.

-

Expert Opinions and Market Forecasts: While market forecasts are inherently uncertain, consulting reputable financial analysts and economists can provide valuable perspectives on the potential future trajectory of the Amsterdam Stock Market.

Conclusion

The three-day, 11% plunge in the Amsterdam Stock Market represents a significant event with far-reaching consequences for the Dutch economy and investors. The causes are multifaceted, encompassing geopolitical instability, inflation, rising interest rates, high energy prices, and recessionary fears. Understanding these interconnected factors is crucial for navigating the current market volatility and making informed investment decisions.

Call to Action: Stay informed about the Amsterdam Stock Market’s performance and potential recovery. Monitor key economic indicators like the AEX index closely, and consider adjusting your investment strategy to minimize risk and potentially capitalize on future opportunities within the Amsterdam Stock Market. Regularly consult reputable financial news sources for updates on the AEX index and the overall market situation. Careful analysis and proactive adjustments to your investment portfolio are essential during periods of heightened market volatility.

Featured Posts

-

Get Your Bbc Radio 1 Big Weekend Tickets A Step By Step Guide

May 24, 2025

Get Your Bbc Radio 1 Big Weekend Tickets A Step By Step Guide

May 24, 2025 -

Amundi Msci All Country World Ucits Etf Usd Acc Net Asset Value Nav Explained

May 24, 2025

Amundi Msci All Country World Ucits Etf Usd Acc Net Asset Value Nav Explained

May 24, 2025 -

Nyi Rafdrifinn Porsche Macan Hvad T Harftu Ad Vita

May 24, 2025

Nyi Rafdrifinn Porsche Macan Hvad T Harftu Ad Vita

May 24, 2025 -

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025 -

Demna Gvasalia Reshaping The Gucci Brand Identity

May 24, 2025

Demna Gvasalia Reshaping The Gucci Brand Identity

May 24, 2025

Latest Posts

-

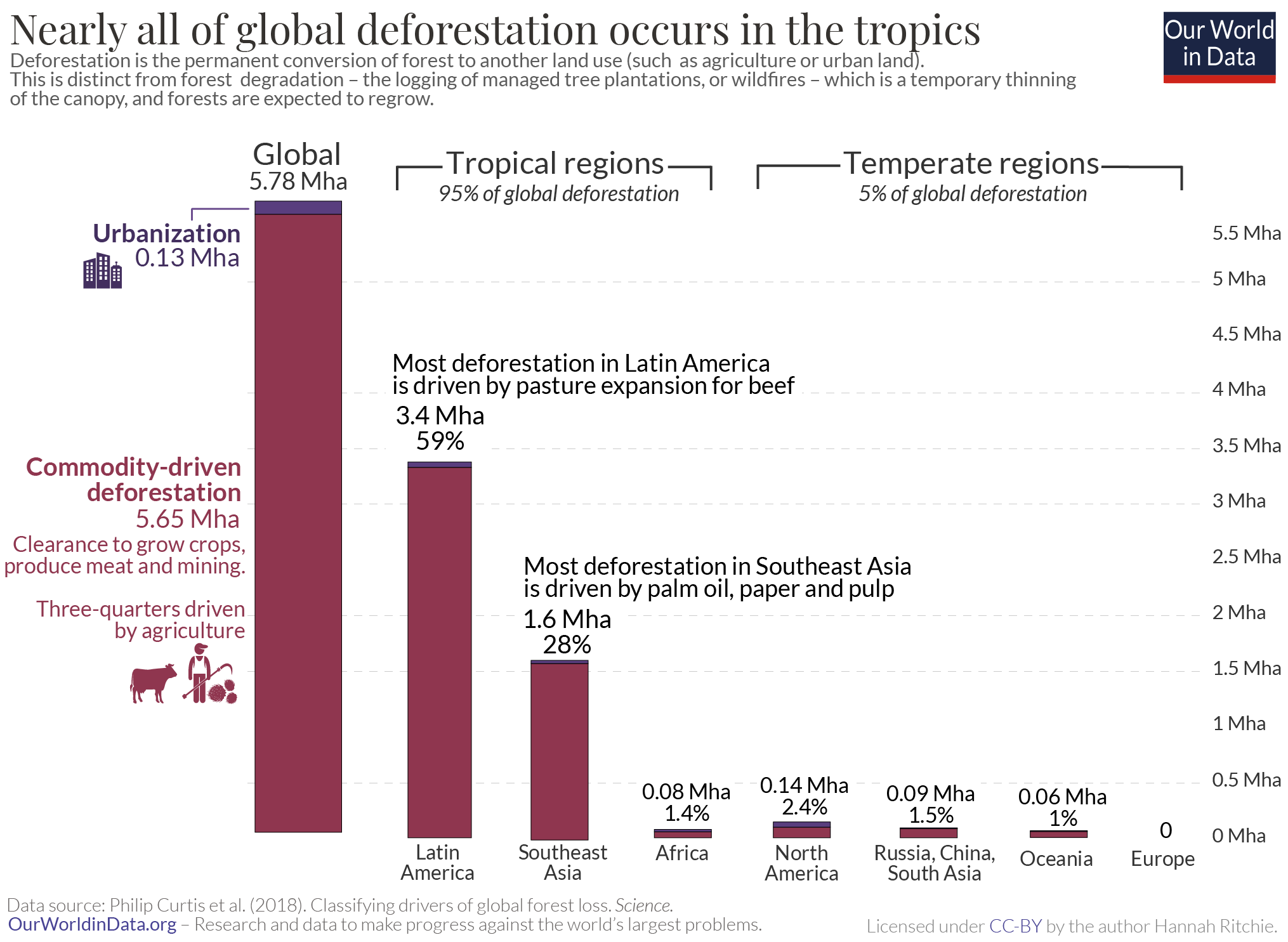

Record Breaking Forest Loss Wildfires Intensify Global Deforestation

May 24, 2025

Record Breaking Forest Loss Wildfires Intensify Global Deforestation

May 24, 2025 -

2002 Submarine Bribery Case French Investigation Points To Malaysias Former Pm Najib

May 24, 2025

2002 Submarine Bribery Case French Investigation Points To Malaysias Former Pm Najib

May 24, 2025 -

Rethinking Middle Management Their Vital Role In Modern Organizations

May 24, 2025

Rethinking Middle Management Their Vital Role In Modern Organizations

May 24, 2025 -

The Unsung Heroes Of Business The Value Of Middle Management

May 24, 2025

The Unsung Heroes Of Business The Value Of Middle Management

May 24, 2025 -

The China Market And Its Implications For Bmw Porsche And Other Automakers

May 24, 2025

The China Market And Its Implications For Bmw Porsche And Other Automakers

May 24, 2025