Amundi Dow Jones Industrial Average UCITS ETF: A Guide To Its Net Asset Value

Table of Contents

What is Net Asset Value (NAV)?

The Net Asset Value (NAV) represents the total value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. In simpler terms, it's the net worth of the ETF per share. For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV reflects the collective value of its holdings, which aim to mirror the composition of the Dow Jones Industrial Average.

The NAV calculation for this specific ETF involves several key components:

- Market Value of Holdings: This is the most significant component, representing the current market price of all the stocks held within the ETF, weighted according to their representation in the Dow Jones Industrial Average.

- Liabilities: These include expenses such as management fees, operational costs, and any other outstanding obligations.

- Other Assets: This might include any cash reserves the ETF holds.

The Amundi Dow Jones Industrial Average UCITS ETF NAV is typically calculated daily, providing investors with a daily snapshot of the ETF's net worth per share. It's crucial to understand that the NAV is different from the market price. The market price is the price at which the ETF is currently trading on the exchange, which can fluctuate throughout the day based on supply and demand.

Accessing the Amundi Dow Jones Industrial Average UCITS ETF NAV

Finding the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. Reliable sources include:

- Amundi's Website: The official website of Amundi, the ETF provider, is the most authoritative source for the current and historical NAV data.

- Financial News Websites: Many reputable financial news websites and data providers (e.g., Bloomberg, Yahoo Finance, Google Finance) display real-time and historical ETF NAV information.

- Brokerage Platforms: If you hold the ETF through a brokerage account, your account statement will typically show the NAV for the days you made transactions.

Accessing historical NAV data is also crucial for analyzing the ETF's long-term performance and understanding its historical volatility. Most of the sources listed above will provide this data, often allowing you to download it in a spreadsheet-friendly format.

Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF NAV

Several factors can influence the daily fluctuations in the Amundi Dow Jones Industrial Average UCITS ETF NAV:

- Performance of Dow Jones Industrial Average Companies: The primary driver of NAV changes is the performance of the 30 companies that constitute the Dow Jones Industrial Average. Positive performance in these companies will generally lead to an increase in the ETF's NAV, and vice-versa.

- Currency Exchange Rate Fluctuations: Since the Dow Jones Industrial Average is a US-dollar-denominated index, fluctuations in exchange rates (if you're not investing in USD) will impact the NAV when converting to your local currency.

- Dividend Payouts: When underlying companies in the Dow Jones Industrial Average pay dividends, this income is typically distributed to ETF holders, slightly impacting the NAV.

- Changes in Dow Jones Industrial Average Composition: While infrequent, changes to the composition of the Dow Jones Industrial Average (e.g., a company being added or removed) will directly affect the ETF's holdings and consequently its NAV.

Understanding the Relationship Between NAV and Market Price

While the NAV provides a measure of the intrinsic value of the ETF, the market price reflects the price at which the ETF is currently trading. Ideally, the market price and NAV should be very close, but discrepancies can occur due to several factors:

- Bid-Ask Spreads: The difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask) creates a spread. This spread contributes to minor discrepancies between NAV and market price.

- Market Liquidity: In less liquid markets, the market price might deviate more significantly from the NAV due to lower trading volume.

- Premium and Discount: Sometimes, the market price trades at a premium (higher than NAV) or a discount (lower than NAV) to the NAV. This can be influenced by investor sentiment, market conditions, and supply and demand dynamics.

Conclusion

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV is essential for making informed investment decisions. By regularly monitoring the NAV through reliable sources like Amundi's website and financial news platforms, investors can track the performance of their investment and assess its value accurately. Remember to consider the factors that influence the NAV and understand the relationship between NAV and market price. Staying informed about your Amundi Dow Jones Industrial Average UCITS ETF NAV is key to successful investing! Mastering the Amundi Dow Jones Industrial Average UCITS ETF NAV empowers you to make strategic investment choices.

Featured Posts

-

Escape To The Country Your Guide To A Peaceful Rural Retreat

May 24, 2025

Escape To The Country Your Guide To A Peaceful Rural Retreat

May 24, 2025 -

Borsa Europea Cauta Attesa Per La Fed Piazza Affari E Le Banche

May 24, 2025

Borsa Europea Cauta Attesa Per La Fed Piazza Affari E Le Banche

May 24, 2025 -

Nemecke Spolocnosti A Hromadne Prepustanie Analyza Situacie Na Trhu Prace

May 24, 2025

Nemecke Spolocnosti A Hromadne Prepustanie Analyza Situacie Na Trhu Prace

May 24, 2025 -

Sergey Yurskiy 90 Let Geniyu Paradoksov I Blestyaschemu Akteru

May 24, 2025

Sergey Yurskiy 90 Let Geniyu Paradoksov I Blestyaschemu Akteru

May 24, 2025 -

Glastonbury 2025 Lineup Confirmed Acts Include Olivia Rodrigo And The 1975

May 24, 2025

Glastonbury 2025 Lineup Confirmed Acts Include Olivia Rodrigo And The 1975

May 24, 2025

Latest Posts

-

Na Uitstel Trump Sterke Winsten Voor Alle Aex Aandelen

May 24, 2025

Na Uitstel Trump Sterke Winsten Voor Alle Aex Aandelen

May 24, 2025 -

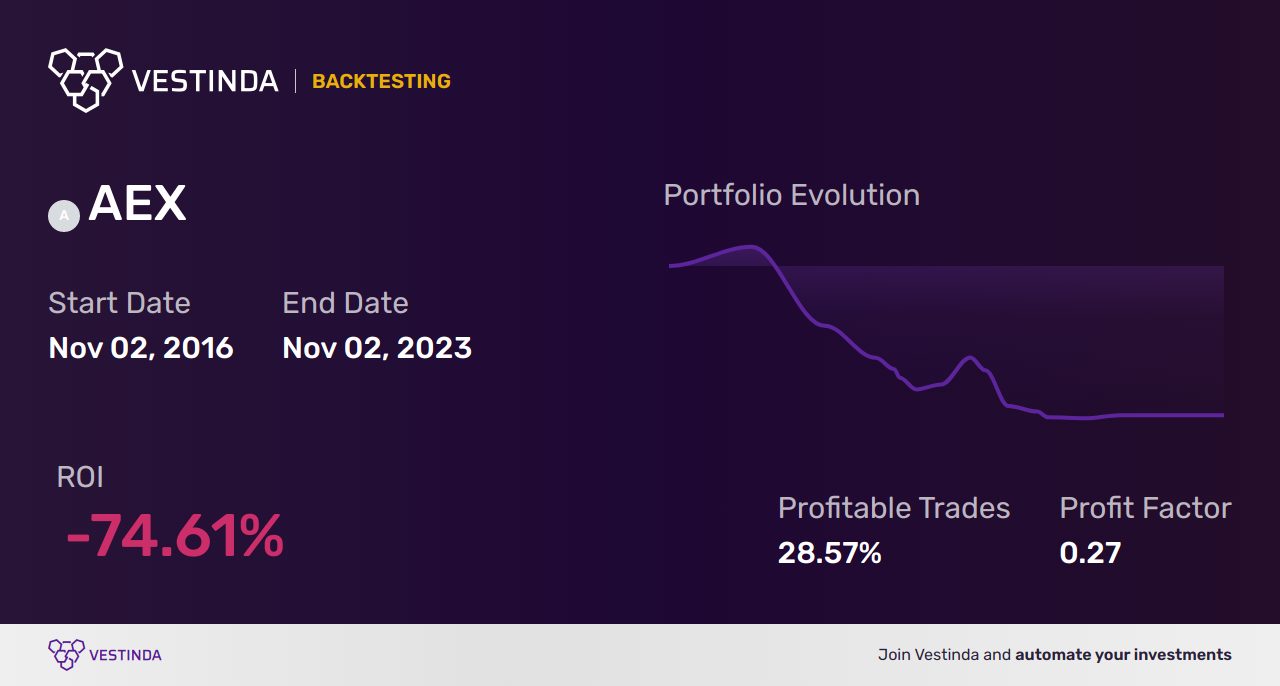

Aex Index Crumbles More Than 4 Loss Lowest Point In 12 Months

May 24, 2025

Aex Index Crumbles More Than 4 Loss Lowest Point In 12 Months

May 24, 2025 -

Aex Stijgt Na Trump Uitstel Positief Sentiment Voor Alle Fondsen

May 24, 2025

Aex Stijgt Na Trump Uitstel Positief Sentiment Voor Alle Fondsen

May 24, 2025 -

Amsterdam Aex Index Suffers Sharpest Fall In Over A Year

May 24, 2025

Amsterdam Aex Index Suffers Sharpest Fall In Over A Year

May 24, 2025 -

Amsterdam Exchange Down 2 Following Trumps Latest Tariff Increase

May 24, 2025

Amsterdam Exchange Down 2 Following Trumps Latest Tariff Increase

May 24, 2025