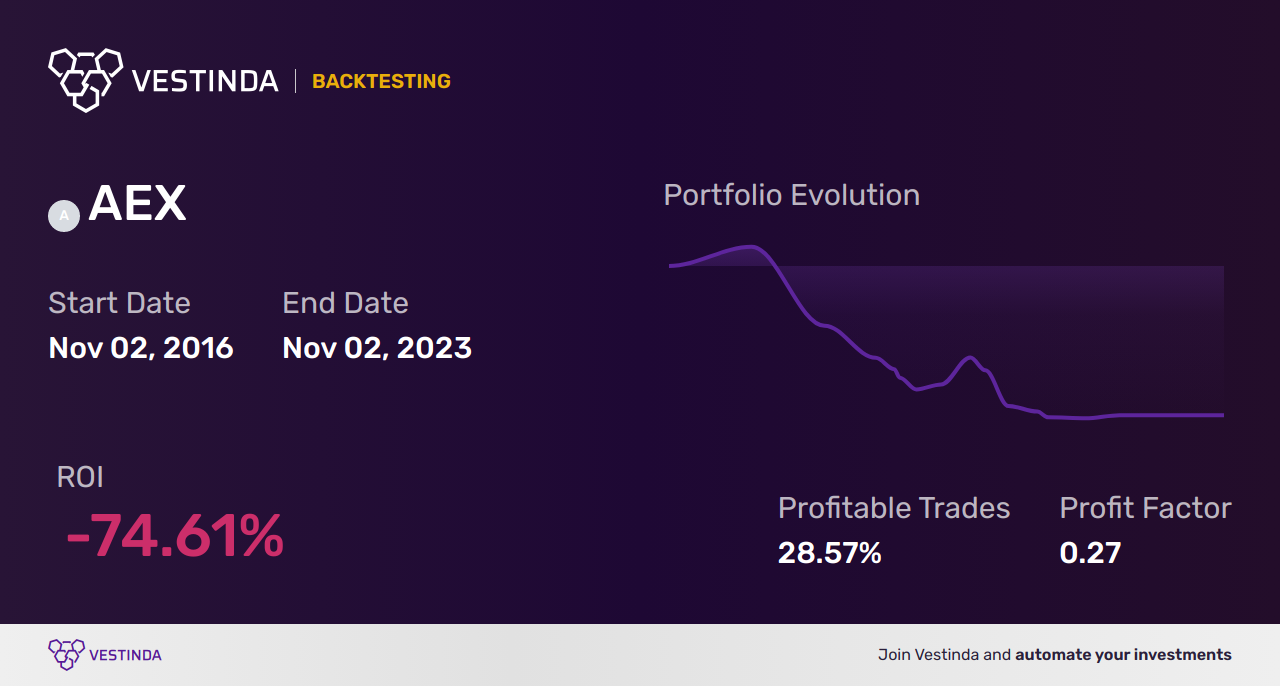

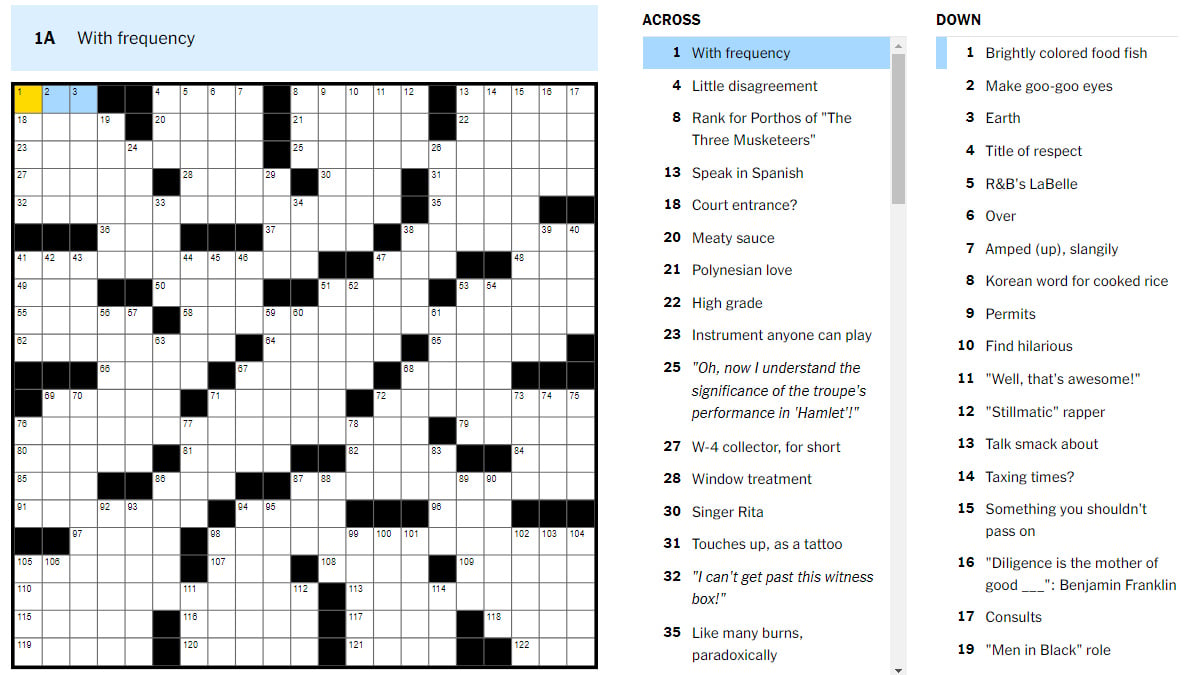

AEX Index Crumbles: More Than 4% Loss, Lowest Point In 12 Months

Table of Contents

Causes of the AEX Index Decline

The AEX Index's dramatic fall is not attributable to a single factor but rather a confluence of interconnected global and regional issues. Understanding these contributing elements is crucial to predicting future market behavior and mitigating potential risks.

Global Economic Uncertainty

The current global economic climate is characterized by significant uncertainty, significantly impacting investor sentiment and contributing to the AEX Index's decline.

-

Rising Interest Rates: Central banks worldwide are aggressively raising interest rates to combat persistent inflation. This increases borrowing costs for businesses, dampening investment and economic growth. Higher interest rates also make bonds more attractive compared to stocks, leading to capital flight from the equity market, including the AEX. Keywords: global economic slowdown, market volatility, interest rate hikes, recession fears.

-

Recession Fears: The aggressive interest rate hikes and persistent inflation have fueled fears of a global recession. This uncertainty prompts investors to adopt a risk-averse strategy, selling off assets considered riskier, like stocks. The AEX, as a barometer of the Dutch economy, is particularly susceptible to these global recession fears.

-

Geopolitical Tensions: Ongoing geopolitical instability, particularly the ongoing conflict in Ukraine and its impact on energy prices and global supply chains, adds to the overall uncertainty and contributes to market volatility. These uncertainties further erode investor confidence and lead to market sell-offs.

-

Specific Events: The recent release of weaker-than-expected inflation data in several major economies, coupled with concerns about further interest rate hikes by the European Central Bank (ECB), likely exacerbated the AEX's decline.

Sector-Specific Weakness

The AEX Index decline isn't uniform across all sectors. Certain sectors within the Dutch economy experienced disproportionately larger losses.

-

Technology Sector: The tech sector, often sensitive to interest rate changes and economic downturns, saw significant losses. Higher borrowing costs make it more expensive for tech companies to fund expansion and innovation, leading to decreased valuations. Keywords: AEX sector performance, stock market decline, sectoral weakness.

-

Energy Sector: Despite high energy prices, the energy sector also witnessed a downturn, likely due to concerns about future demand in the face of potential recession and increased competition from renewable energy sources.

-

Financial Sector: Increased uncertainty and potential economic slowdown negatively affected the financial sector, reflecting concerns about loan defaults and reduced profitability.

Impact of Inflation and Energy Prices

Persistent high inflation and volatile energy prices significantly contribute to the AEX's fall.

-

Inflation's Grip: High inflation erodes purchasing power, impacting consumer spending and business investment. This diminished economic activity directly translates into lower corporate earnings, impacting stock prices within the AEX. Keywords: inflation impact, energy price volatility, consumer spending, business investment.

-

Energy Price Volatility: The ongoing uncertainty surrounding energy supply and prices continues to weigh heavily on businesses and consumers alike, further dampening economic activity and investor confidence. This volatility creates uncertainty in forecasting future profits, leading to lower stock valuations.

Implications of the AEX Index Fall

The sharp decline in the AEX Index carries significant implications for the Dutch economy and the broader European market.

Impact on the Dutch Economy

The AEX Index's fall is a concerning indicator for the Dutch economy.

-

Economic Growth: The decline suggests a potential slowdown in economic growth, impacting various sectors and potentially leading to lower employment rates. Keywords: Dutch economy, economic growth, employment rates.

-

Business Confidence: The market downturn is likely to dampen business confidence, potentially leading to reduced investments and hiring.

Broader European Market Concerns

The AEX's plunge may reflect broader concerns within the European market.

- Market Contagion: The decline could signal potential weakness in other European markets, with the possibility of a "contagion effect" impacting indices across the continent. Keywords: European markets, market contagion, European stock markets.

Investor Sentiment and Future Outlook

Investor sentiment has clearly turned negative, given the AEX's significant drop.

-

Investor Confidence: The current low investor confidence indicates a cautious outlook for the near future. Keywords: investor confidence, market outlook, future predictions.

-

Future Scenarios: While a recovery is possible, several factors need to be considered, including inflation control, the resolution of geopolitical tensions, and a clearer economic outlook. Further declines are certainly possible depending on global economic developments.

Conclusion

The AEX Index's dramatic 4%+ plunge represents a significant setback, marking its lowest point in a year. This decline is attributable to a complex interplay of global economic uncertainty, sector-specific weaknesses, and the persistent impact of inflation and energy prices. The implications extend beyond the Dutch economy, raising concerns about the broader European market. Understanding these factors is crucial for navigating this period of volatility.

Call to Action: Stay informed about the evolving situation of the AEX Index and its potential recovery. Continue monitoring market developments and consider consulting a financial advisor to navigate this period of volatility. Understanding the fluctuations of the AEX index is crucial for informed investment decisions. Learn more about the factors affecting the AEX index performance by following our regular market updates.

Featured Posts

-

Escape To The Country Nicki Chapmans Profitable Home Investment

May 24, 2025

Escape To The Country Nicki Chapmans Profitable Home Investment

May 24, 2025 -

M62 Resurfacing Westbound Closure Between Manchester And Warrington

May 24, 2025

M62 Resurfacing Westbound Closure Between Manchester And Warrington

May 24, 2025 -

Kueloenleges Porsche 911 Extrak 80 Millio Forintert

May 24, 2025

Kueloenleges Porsche 911 Extrak 80 Millio Forintert

May 24, 2025 -

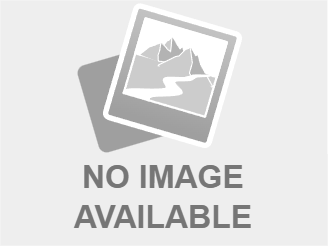

Nyt Mini Crossword March 24 2025 Solutions And Strategies

May 24, 2025

Nyt Mini Crossword March 24 2025 Solutions And Strategies

May 24, 2025 -

Trumps Tariff Halt Sends Euronext Amsterdam Stocks Up 8

May 24, 2025

Trumps Tariff Halt Sends Euronext Amsterdam Stocks Up 8

May 24, 2025

Latest Posts

-

Sean Penn Weighs In On Dylan Farrows Accusations Against Woody Allen

May 24, 2025

Sean Penn Weighs In On Dylan Farrows Accusations Against Woody Allen

May 24, 2025 -

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy

May 24, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy

May 24, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025 -

Sean Penns Response To Dylan Farrows Allegations Against Woody Allen

May 24, 2025

Sean Penns Response To Dylan Farrows Allegations Against Woody Allen

May 24, 2025