Amundi Dow Jones Industrial Average UCITS ETF: A Guide To Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and how is it calculated for the Amundi Dow Jones Industrial Average UCITS ETF?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. In simpler terms, it's the intrinsic value of a single share in the ETF. For the Amundi Dow Jones Industrial Average UCITS ETF, this means the NAV reflects the collective value of the underlying holdings – shares in the 30 companies comprising the Dow Jones Industrial Average.

The calculation process is straightforward:

(Total Asset Value - Total Liabilities) / Number of Outstanding Shares = NAV

Amundi, as the ETF provider, is responsible for calculating and publishing the daily NAV. This calculation takes into account a variety of factors, ensuring transparency and accuracy. The NAV is typically updated daily, reflecting the closing prices of the underlying assets.

- Assets included in the NAV calculation: The market value of the holdings in the 30 Dow Jones Industrial Average companies, plus any accrued income (dividends) and cash reserves.

- Liabilities included in the NAV calculation: Management fees, expenses, and any other outstanding obligations of the ETF.

- Factors affecting the daily NAV fluctuation: Changes in the prices of the underlying Dow Jones Industrial Average stocks, dividend payments from those stocks, and currency fluctuations (if applicable, considering the ETF's currency denomination).

Why is understanding the Amundi Dow Jones Industrial Average UCITS ETF's NAV important for investors?

Understanding the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is paramount for several reasons:

-

Performance Assessment: Tracking the NAV over time allows investors to gauge the ETF's performance and compare it against benchmarks or other investments. A rising NAV generally indicates positive performance.

-

Investment Strategy & Risk: The NAV provides insights into the ETF's investment strategy and its inherent risks. Fluctuations in the NAV reflect the volatility of the underlying assets and the overall market conditions.

-

Informed Buy/Sell Decisions: While the share price of the ETF typically closely tracks the NAV, understanding the difference can be insightful. Significant deviations might signal arbitrage opportunities (although less likely with major, liquid ETFs like this one).

-

Comparison with Share Price: Although the share price and NAV should be very close, comparing the two can highlight potential discrepancies. While unlikely with a well-established ETF, understanding this relationship is crucial for any investor.

-

Bullet Points:

- Using NAV to track performance over time: By comparing the NAV at different points in time, investors can analyze the growth or decline of their investment.

- Comparing NAV to share price to identify potential arbitrage opportunities: While rare, understanding the difference between NAV and market price can reveal potential discrepancies offering short-term profit opportunities.

- Understanding the impact of dividends on NAV: Dividend payments from the underlying companies will generally increase the NAV, though this increase will be offset by a reduction in the market value of the underlying assets on the ex-dividend date.

Where can investors find the Amundi Dow Jones Industrial Average UCITS ETF's NAV?

Reliable sources for accessing the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF include:

- Amundi's official website: Check the dedicated ETF page for up-to-date NAV information.

- Financial news websites: Major financial news providers (e.g., Bloomberg, Yahoo Finance, Google Finance) usually display ETF NAV data.

- Brokerage platforms: Most online brokerage accounts provide real-time or delayed NAV data for ETFs held in your portfolio.

It's crucial to rely on credible sources to avoid misinformation. Be aware that there might be slight delays in reporting the NAV, depending on the source and the timing of market closures.

- Bullet Points:

- Specific links to relevant websites for accessing NAV data: (Insert relevant links here – this will require actual links to be added)

- Information on data feed providers: (Add information on data providers used by the websites listed above).

- Tips on interpreting NAV data from different sources: Pay close attention to the time stamp of the NAV data to ensure you are comparing apples to apples.

Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF's NAV

Several factors influence the daily fluctuations in the Amundi Dow Jones Industrial Average UCITS ETF's NAV:

-

Market Movements: Changes in the stock prices of the 30 companies within the Dow Jones Industrial Average directly impact the NAV. A positive market trend generally leads to a higher NAV, while a negative trend will result in a lower NAV.

-

Currency Fluctuations: If the ETF is denominated in a currency other than your base currency, exchange rate movements can influence the NAV expressed in your local currency.

-

Dividends and Corporate Actions: Dividend payments from the underlying companies affect the NAV positively (though temporarily reduced by the ex-dividend date reduction in the share price), while corporate actions such as stock splits or mergers can also cause adjustments.

-

Expense Ratios: The ETF's expense ratio, while small, gradually erodes the NAV over time.

-

Bullet Points:

- How changes in individual stock prices affect the overall NAV: The weight of each stock in the index determines its impact on the overall NAV. A significant price change in a heavily weighted stock will greatly influence the overall NAV.

- Examples of corporate actions (stock splits, mergers) and their impact: Stock splits adjust the number of shares and their price, affecting the NAV calculation. Mergers can result in changes to the underlying holdings and affect the overall value.

- The effect of expense ratios on NAV: Expense ratios are deducted from the ETF's assets, resulting in a slight reduction of the NAV over time.

Conclusion: Mastering the Amundi Dow Jones Industrial Average UCITS ETF's Net Asset Value

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for informed investment decisions. Regularly monitoring the NAV, combined with an understanding of the factors that influence it, allows investors to track performance, assess risk, and make better buy/sell decisions. Utilize the resources mentioned above to access accurate and timely NAV data. Learn more about the Amundi Dow Jones Industrial Average UCITS ETF and its Net Asset Value (NAV) to make informed investment decisions. Understand your investment better by regularly checking the NAV!

Featured Posts

-

Posthumous Promotion For Alfred Dreyfus A Step Towards Justice

May 24, 2025

Posthumous Promotion For Alfred Dreyfus A Step Towards Justice

May 24, 2025 -

Yevrobachennya 2025 Konchita Vurst Nazvala Chotirokh Potentsiynikh Peremozhtsiv

May 24, 2025

Yevrobachennya 2025 Konchita Vurst Nazvala Chotirokh Potentsiynikh Peremozhtsiv

May 24, 2025 -

Planning A Memorial Day Trip The Busiest Flight Days In 2025

May 24, 2025

Planning A Memorial Day Trip The Busiest Flight Days In 2025

May 24, 2025 -

Ot Evroviziya Do Dnes Neveroyatnata Transformatsiya Na Konchita Vurst

May 24, 2025

Ot Evroviziya Do Dnes Neveroyatnata Transformatsiya Na Konchita Vurst

May 24, 2025 -

Securing Bbc Radio 1 Big Weekend 2025 Tickets Full Artist List

May 24, 2025

Securing Bbc Radio 1 Big Weekend 2025 Tickets Full Artist List

May 24, 2025

Latest Posts

-

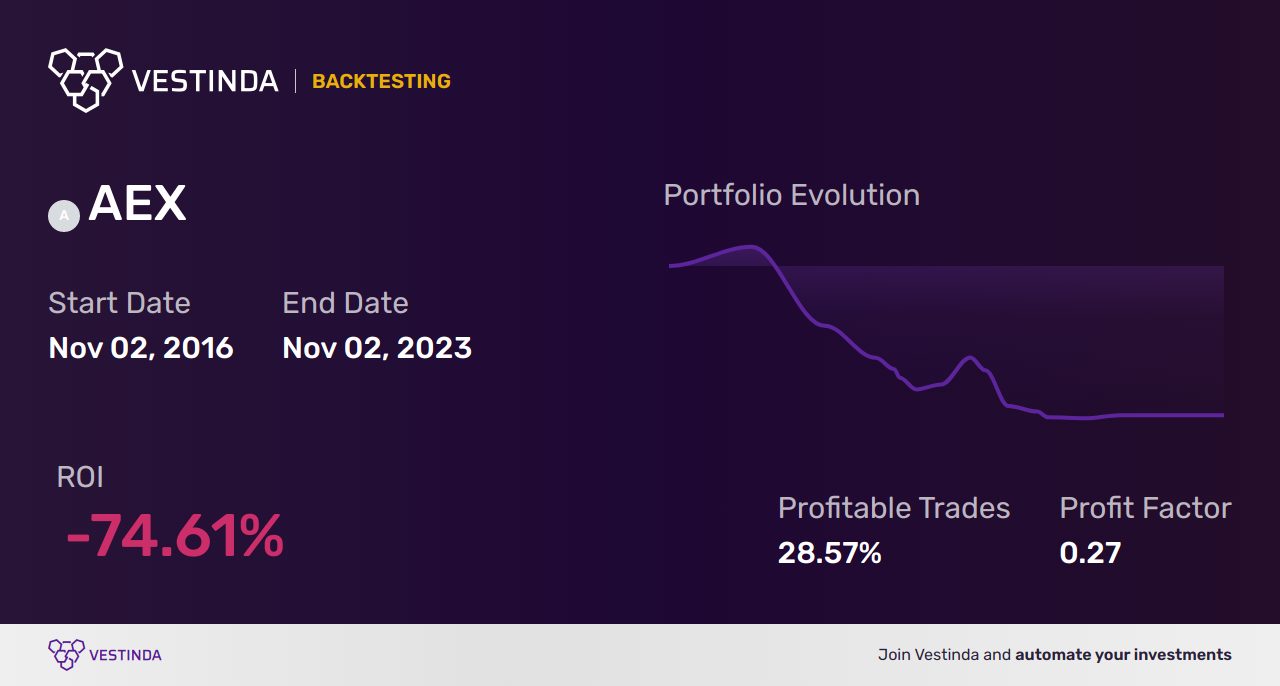

Na Uitstel Trump Sterke Winsten Voor Alle Aex Aandelen

May 24, 2025

Na Uitstel Trump Sterke Winsten Voor Alle Aex Aandelen

May 24, 2025 -

Aex Index Crumbles More Than 4 Loss Lowest Point In 12 Months

May 24, 2025

Aex Index Crumbles More Than 4 Loss Lowest Point In 12 Months

May 24, 2025 -

Aex Stijgt Na Trump Uitstel Positief Sentiment Voor Alle Fondsen

May 24, 2025

Aex Stijgt Na Trump Uitstel Positief Sentiment Voor Alle Fondsen

May 24, 2025 -

Amsterdam Aex Index Suffers Sharpest Fall In Over A Year

May 24, 2025

Amsterdam Aex Index Suffers Sharpest Fall In Over A Year

May 24, 2025 -

Amsterdam Exchange Down 2 Following Trumps Latest Tariff Increase

May 24, 2025

Amsterdam Exchange Down 2 Following Trumps Latest Tariff Increase

May 24, 2025