Amundi Dow Jones Industrial Average UCITS ETF: Daily NAV And Its Significance

Table of Contents

What is the Daily NAV and How is it Calculated?

The Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. For the Amundi Dow Jones Industrial Average UCITS ETF, this calculation reflects the collective value of its holdings, which aim to mirror the composition of the Dow Jones Industrial Average. Understanding how the daily NAV is calculated is paramount for comprehending your investment's performance.

- Definition of NAV: NAV is the market value of the ETF's assets less its liabilities, all divided by the number of outstanding shares.

- Components included in NAV calculation: The calculation considers the market value of each holding within the ETF (the 30 constituent companies of the DJIA), accrued income, any expenses incurred, and liabilities.

- Frequency of NAV calculation: The NAV is typically calculated at the end of each trading day, reflecting the closing prices of the underlying assets.

- Sources for asset valuation: The valuation of the underlying assets is determined using the closing prices of the stocks comprising the DJIA from a reputable exchange like the New York Stock Exchange (NYSE).

The Significance of Monitoring Daily NAV for Amundi DJIA UCITS ETF Investors

Tracking the daily NAV of the Amundi DJIA UCITS ETF offers several key benefits to investors:

- Assessing daily performance against benchmarks: By comparing the daily NAV to the DJIA's performance, investors can assess how closely the ETF tracks its benchmark index.

- Identifying trends and patterns: Monitoring the daily NAV helps identify short-term and long-term trends, allowing investors to adjust their investment strategy accordingly.

- Evaluating investment strategy effectiveness: Regularly checking the NAV allows investors to evaluate the effectiveness of their investment strategy and make necessary adjustments based on performance.

- Making buy/sell decisions based on NAV changes: While not the sole factor, NAV changes can inform buy/sell decisions, particularly when considering potential arbitrage opportunities (differences between the NAV and market price of the ETF).

- Comparing NAV to ETF market price: Discrepancies between the NAV and the ETF's market price can present arbitrage opportunities for sophisticated investors.

Where to Find the Daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Reliable access to the daily NAV is crucial. You can find this information from several sources:

- Amundi's official website: The Amundi website is the primary source for accurate and up-to-date NAV information.

- Major financial news outlets: Reputable financial news sources such as Bloomberg, Reuters, and Yahoo Finance often publish ETF NAV data.

- Investor's brokerage account: Most brokerage platforms provide real-time or end-of-day NAV data for ETFs held in your account.

- Dedicated financial data providers: Companies specializing in financial data, such as Refinitiv or FactSet, offer comprehensive ETF data, including NAVs.

Understanding NAV Fluctuations and their Impact

Daily fluctuations in the Amundi DJIA UCITS ETF's NAV are influenced by various factors:

- Market Volatility: Changes in the overall stock market significantly affect the value of the underlying DJIA stocks, leading to NAV fluctuations.

- Economic Factors: Economic news, such as interest rate announcements or GDP reports, can influence investor sentiment and impact the DJIA and consequently, the ETF's NAV.

- Global Events: Geopolitical events, unexpected economic crises, or significant company-specific news can also trigger NAV fluctuations.

- Investment Risk: Understanding these potential fluctuations is crucial for managing investment risk and setting realistic expectations. The NAV reflects the inherent volatility of the underlying DJIA.

Conclusion

Monitoring the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF is vital for informed investment decision-making. By understanding how the NAV is calculated, its significance in performance tracking, and where to find this data, you can better manage your investment in this popular ETF. Regularly assessing the NAV allows you to identify trends, evaluate your investment strategy, and react to market changes effectively. Start tracking the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF today! Learn more about utilizing the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF for optimal investment strategies.

Featured Posts

-

Krasivaya Data 89 Svadeb Na Kharkovschine

May 25, 2025

Krasivaya Data 89 Svadeb Na Kharkovschine

May 25, 2025 -

Lauryn Goodman And Kyle Walker Unpacking The Italian Relocation Mystery

May 25, 2025

Lauryn Goodman And Kyle Walker Unpacking The Italian Relocation Mystery

May 25, 2025 -

Your Escape To The Country Choosing The Right Location And Lifestyle

May 25, 2025

Your Escape To The Country Choosing The Right Location And Lifestyle

May 25, 2025 -

Protecting Your Ferrari Essential Gear And Maintenance Tools

May 25, 2025

Protecting Your Ferrari Essential Gear And Maintenance Tools

May 25, 2025 -

18 Brazilians Face Charges In Massachusetts Gun Trafficking Ring

May 25, 2025

18 Brazilians Face Charges In Massachusetts Gun Trafficking Ring

May 25, 2025

Latest Posts

-

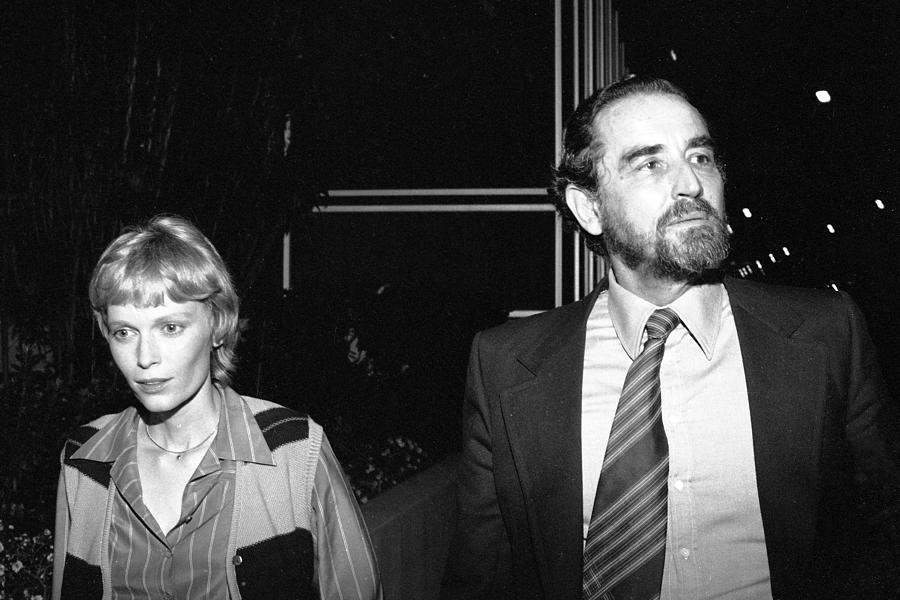

Sadie Sink And Mia Farrow Broadways Photo 5162787 Moment

May 25, 2025

Sadie Sink And Mia Farrow Broadways Photo 5162787 Moment

May 25, 2025 -

Photo Mia Farrow Supports Fellow Tony Nominee Sadie Sink On Broadway

May 25, 2025

Photo Mia Farrow Supports Fellow Tony Nominee Sadie Sink On Broadway

May 25, 2025 -

Mia Farrow And Sadie Sink Broadway Stars Meet

May 25, 2025

Mia Farrow And Sadie Sink Broadway Stars Meet

May 25, 2025 -

Apple Stock Price Falls On Tariff Announcement

May 25, 2025

Apple Stock Price Falls On Tariff Announcement

May 25, 2025 -

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 25, 2025

Buffetts Apple Investment Navigating The Impact Of Trump Era Tariffs

May 25, 2025