Amundi Dow Jones Industrial Average UCITS ETF: Factors Affecting Net Asset Value (NAV)

Table of Contents

Market Performance of Underlying Assets

The Amundi Dow Jones Industrial Average UCITS ETF's NAV is intrinsically linked to the performance of the 30 companies comprising the Dow Jones Industrial Average (DJIA). The DJIA's daily fluctuations directly translate into changes in the ETF's NAV. This means that the price movements of individual stocks within the index significantly impact the overall value. Positive performance by the underlying companies leads to a higher NAV, while negative performance results in a lower NAV.

- Fluctuations in individual stock prices within the DJIA: A strong performance by a single, heavily weighted stock can boost the overall NAV, even if other components underperform. Conversely, a significant drop in a major component can negatively affect the ETF's NAV.

- Impact of positive and negative economic news on the index: Positive economic news often leads to increased investor confidence, boosting stock prices and the ETF's NAV. Conversely, negative news, like rising inflation or geopolitical instability, can trigger market sell-offs and reduce the NAV.

- Influence of geopolitical events and global economic trends: Global events, such as trade wars or political uncertainty, can impact market sentiment and significantly influence the performance of the DJIA and, consequently, the ETF's NAV.

- Sectorial rotations and their effect on the ETF's NAV: Changes in investor preference towards specific sectors (e.g., a shift from technology to energy) can cause significant shifts in the DJIA and subsequently impact the ETF's NAV. Understanding these sectorial rotations can help anticipate potential NAV movements.

Currency Fluctuations

For investors whose base currency differs from the ETF's (which is typically USD), currency exchange rates play a significant role in the NAV calculation. The Amundi Dow Jones Industrial Average UCITS ETF's underlying assets are priced in USD. Therefore, fluctuations in the USD/EUR exchange rate (or other relevant pairs) will directly affect the NAV for non-USD investors.

- Impact of a strengthening or weakening USD on the ETF's NAV for non-USD investors: A strengthening USD will typically decrease the NAV for EUR-based investors, while a weakening USD will increase the NAV.

- Explanation of currency hedging and its effect on NAV stability: The ETF manager may employ currency hedging strategies to mitigate currency risk. Hedging can help stabilize the NAV, but it also comes with its own costs and complexities.

- How to interpret NAV changes considering currency fluctuations: It is essential to separate the impact of underlying asset performance from currency fluctuations when analyzing NAV changes.

ETF Expenses and Management Fees

The ETF's expense ratio, also known as the Total Expense Ratio (TER), represents the annual cost of holding the ETF. This expense ratio is deducted from the ETF's assets and, therefore, impacts the NAV over time. A lower expense ratio generally means more of your investment remains working for you.

- Definition and calculation of the expense ratio: The expense ratio is usually expressed as a percentage of the ETF's assets under management.

- Impact of expense ratio on long-term returns: Even a small expense ratio can significantly impact long-term returns due to the compounding effect.

- Comparison of expense ratios with similar ETFs: Before investing, compare the expense ratio of the Amundi Dow Jones Industrial Average UCITS ETF with similar ETFs to ensure you are getting competitive pricing.

Dividend Distributions

The underlying stocks within the DJIA pay dividends. These dividends are distributed to the ETF's shareholders, which impacts the NAV.

- Impact of dividend payments on the NAV before and after the ex-dividend date: Before the ex-dividend date, the NAV reflects the value including the upcoming dividend. After the ex-dividend date, the NAV is adjusted downwards to reflect the dividend distribution.

- Benefits of dividend reinvestment: Many ETFs offer the option to reinvest dividends automatically, allowing for compounding growth.

- How dividend payments are reflected in the NAV: The NAV is adjusted to reflect the payment of dividends. Investors receive the dividend separately from the ETF.

Conclusion

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF is influenced by a combination of factors, primarily the market performance of its underlying assets, currency fluctuations, and the ETF's expense ratio. Understanding these factors is key to making informed investment decisions. Monitor the Amundi Dow Jones Industrial Average UCITS ETF NAV and analyze the factors impacting its performance before investing. Consider consulting a financial advisor for personalized advice tailored to your investment goals and risk tolerance. Learn more about the Amundi Dow Jones Industrial Average UCITS ETF and its NAV performance to make well-informed choices for your investment portfolio.

Featured Posts

-

L Effetto Dei Dazi Sulle Importazioni Di Moda Negli Stati Uniti

May 24, 2025

L Effetto Dei Dazi Sulle Importazioni Di Moda Negli Stati Uniti

May 24, 2025 -

Gelungener Auftakt Radtouren Zu Essener Persoenlichkeiten

May 24, 2025

Gelungener Auftakt Radtouren Zu Essener Persoenlichkeiten

May 24, 2025 -

M56 Motorway Incident Car Overturn Results In Casualty

May 24, 2025

M56 Motorway Incident Car Overturn Results In Casualty

May 24, 2025 -

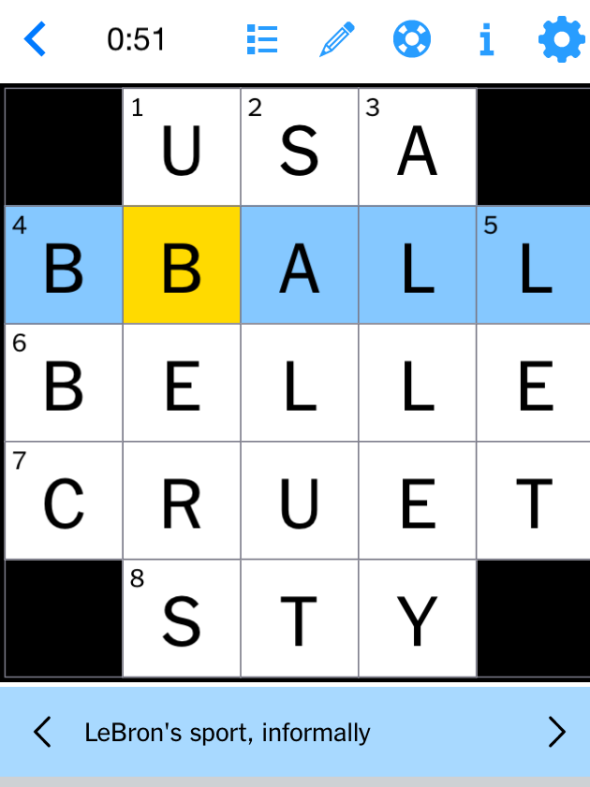

March 13 2025 Nyt Mini Crossword Clues Answers And Solutions

May 24, 2025

March 13 2025 Nyt Mini Crossword Clues Answers And Solutions

May 24, 2025 -

11 1 Win For Maryland Softball Aubrey Wursts Dominant Performance

May 24, 2025

11 1 Win For Maryland Softball Aubrey Wursts Dominant Performance

May 24, 2025

Latest Posts

-

Amsterdam Stock Market Crash 7 Plunge Amidst Trade War Fears

May 24, 2025

Amsterdam Stock Market Crash 7 Plunge Amidst Trade War Fears

May 24, 2025 -

Europese Aandelen Vs Wall Street Doorzetting Van De Snelle Koerswijziging

May 24, 2025

Europese Aandelen Vs Wall Street Doorzetting Van De Snelle Koerswijziging

May 24, 2025 -

Euronext Amsterdam Stock Market Reaction 8 Increase After Trumps Tariff Pause

May 24, 2025

Euronext Amsterdam Stock Market Reaction 8 Increase After Trumps Tariff Pause

May 24, 2025 -

Ai Stuwt Relx Groei Ondanks Zwakke Economie Vooruitzichten Tot 2025

May 24, 2025

Ai Stuwt Relx Groei Ondanks Zwakke Economie Vooruitzichten Tot 2025

May 24, 2025 -

Philips 2025 Agm Key Announcements And Shareholder Information

May 24, 2025

Philips 2025 Agm Key Announcements And Shareholder Information

May 24, 2025