Euronext Amsterdam Stock Market Reaction: 8% Increase After Trump's Tariff Pause

Table of Contents

The Immediate Impact of the Tariff Pause on Euronext Amsterdam

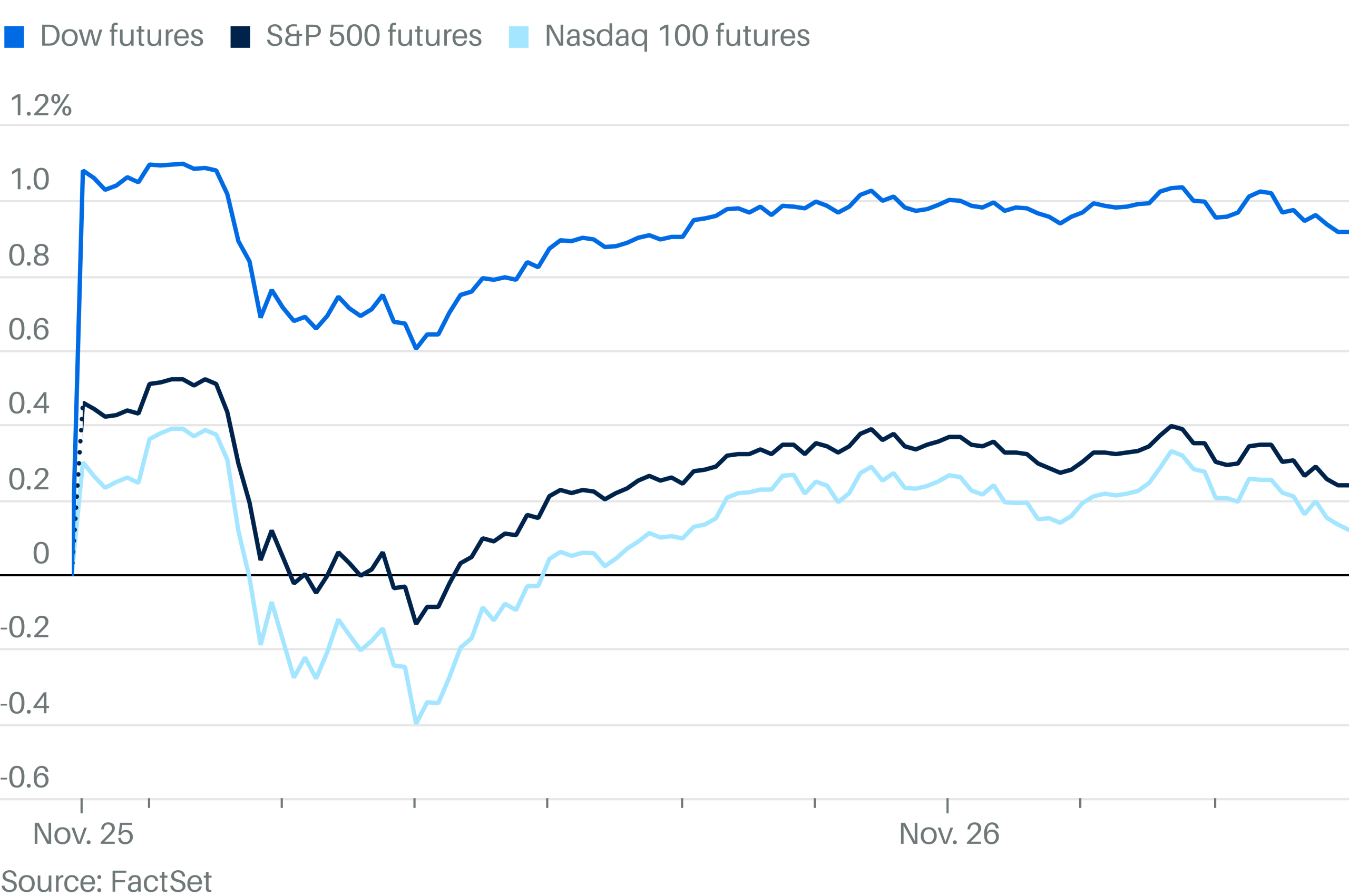

The announcement of a temporary pause on US tariffs triggered an immediate and dramatic 8% increase in the Euronext Amsterdam stock market. This sharp rise wasn't uniform across all sectors; certain industries experienced significantly larger gains. Export-oriented sectors, particularly technology companies heavily reliant on US markets, saw the most substantial increases. The initial market reaction was swift and pronounced, showcasing the market's immediate sensitivity to changes in global trade relations.

- Sharp increase in trading volume: The pause led to a significant surge in trading activity on Euronext Amsterdam, indicating heightened investor interest and engagement.

- Positive investor response reflected in increased market capitalization: The overall value of companies listed on the exchange saw a substantial boost, reflecting the positive investor sentiment.

- Analysis of specific stock performances: Prominent companies like ASML Holding, a major player in the semiconductor industry, and several other export-focused firms, experienced disproportionately large gains, underscoring the direct link between tariff policy and specific company performance on Euronext Amsterdam.

Underlying Factors Contributing to the Market's Response

The market's positive response wasn't solely a reaction to the tariff pause itself. It was a complex interplay of factors, reflecting the broader context of US trade policy uncertainty and its impact on investor confidence. The uncertainty surrounding the trade war had negatively impacted business investment and consumer confidence in Europe. The pause provided a much-needed respite.

- Reduction in trade war uncertainty: The temporary pause reduced uncertainty surrounding future trade relations between the US and Europe, thereby boosting investor confidence.

- Improved outlook for European exports to the US: The easing of tariffs improved the outlook for European businesses exporting to the US, leading to increased optimism and investment.

- Impact of the pause on business investment and consumer confidence: The positive news helped alleviate concerns about a prolonged trade war, thereby improving business investment and consumer sentiment.

Analysis of Long-Term Implications for Euronext Amsterdam

While the short-term impact was undeniably positive, the long-term implications for Euronext Amsterdam remain uncertain. The sustained growth following the tariff pause depends heavily on the trajectory of US-EU trade negotiations. While the pause is encouraging, the underlying geopolitical issues remain.

- Potential for continued volatility depending on future trade negotiations: The market's sensitivity to trade policy suggests continued volatility depending on the future direction of US-EU trade talks.

- Long-term effects on specific sectors within the Euronext Amsterdam market: The long-term impact will vary depending on the specific sector and its reliance on US trade.

- Comparison to other European stock markets' reactions: Analyzing how other European markets reacted to the tariff pause provides valuable context for understanding the unique aspects of Euronext Amsterdam's response.

Comparing the Euronext Amsterdam Reaction to Other European Markets

The tariff pause had a ripple effect across European stock markets, though the magnitude of the response varied. Understanding these differences requires considering each market's unique relationship with US trade and its overall economic health.

- Comparison of percentage changes in major European indices (e.g., FTSE 100, DAX): A comparison of percentage changes in major European indices like the FTSE 100 (London) and DAX (Frankfurt) reveals the extent to which the tariff pause impacted different markets.

- Analysis of sector-specific responses across different markets: Analyzing sector-specific responses in each market provides further insights into the relative importance of US trade for different sectors.

- Discussion of the relative importance of US-EU trade for different economies: The extent to which each European economy relies on trade with the US significantly influenced the market response to the tariff pause.

Conclusion

The Euronext Amsterdam stock market's 8% increase following the Trump administration's temporary tariff pause clearly demonstrates the significant impact of global trade policy on investor sentiment. This reaction, while positive in the short-term, highlights the market’s inherent vulnerability to shifts in international trade relations. The complex interplay of factors influencing investor confidence underlines the need for careful monitoring of ongoing developments.

Call to Action: Stay informed about the ongoing developments in US-EU trade relations and their potential impact on the Euronext Amsterdam stock market. Monitor the Euronext Amsterdam performance for further insights into market reactions to global trade policy. Continue to analyze the Euronext Amsterdam stock market’s response to future shifts in global trade. Understanding these dynamics is crucial for effective investment strategies within the Euronext Amsterdam market.

Featured Posts

-

Amsterdam Stock Market Suffers 2 Drop Due To Trump Tariff Announcement

May 24, 2025

Amsterdam Stock Market Suffers 2 Drop Due To Trump Tariff Announcement

May 24, 2025 -

Dazi E Borse L Unione Europea Risponde Alla Crisi Con Misure Senza Precedenti

May 24, 2025

Dazi E Borse L Unione Europea Risponde Alla Crisi Con Misure Senza Precedenti

May 24, 2025 -

Avrupa Borsalari Karisik Bir Guenuen Ardindan

May 24, 2025

Avrupa Borsalari Karisik Bir Guenuen Ardindan

May 24, 2025 -

Crystal Palace Eye Free Transfer For Kyle Walker Peters

May 24, 2025

Crystal Palace Eye Free Transfer For Kyle Walker Peters

May 24, 2025 -

Lewis Hamiltons Comments Criticized As Unfair By Ferrari Team Principal

May 24, 2025

Lewis Hamiltons Comments Criticized As Unfair By Ferrari Team Principal

May 24, 2025

Latest Posts

-

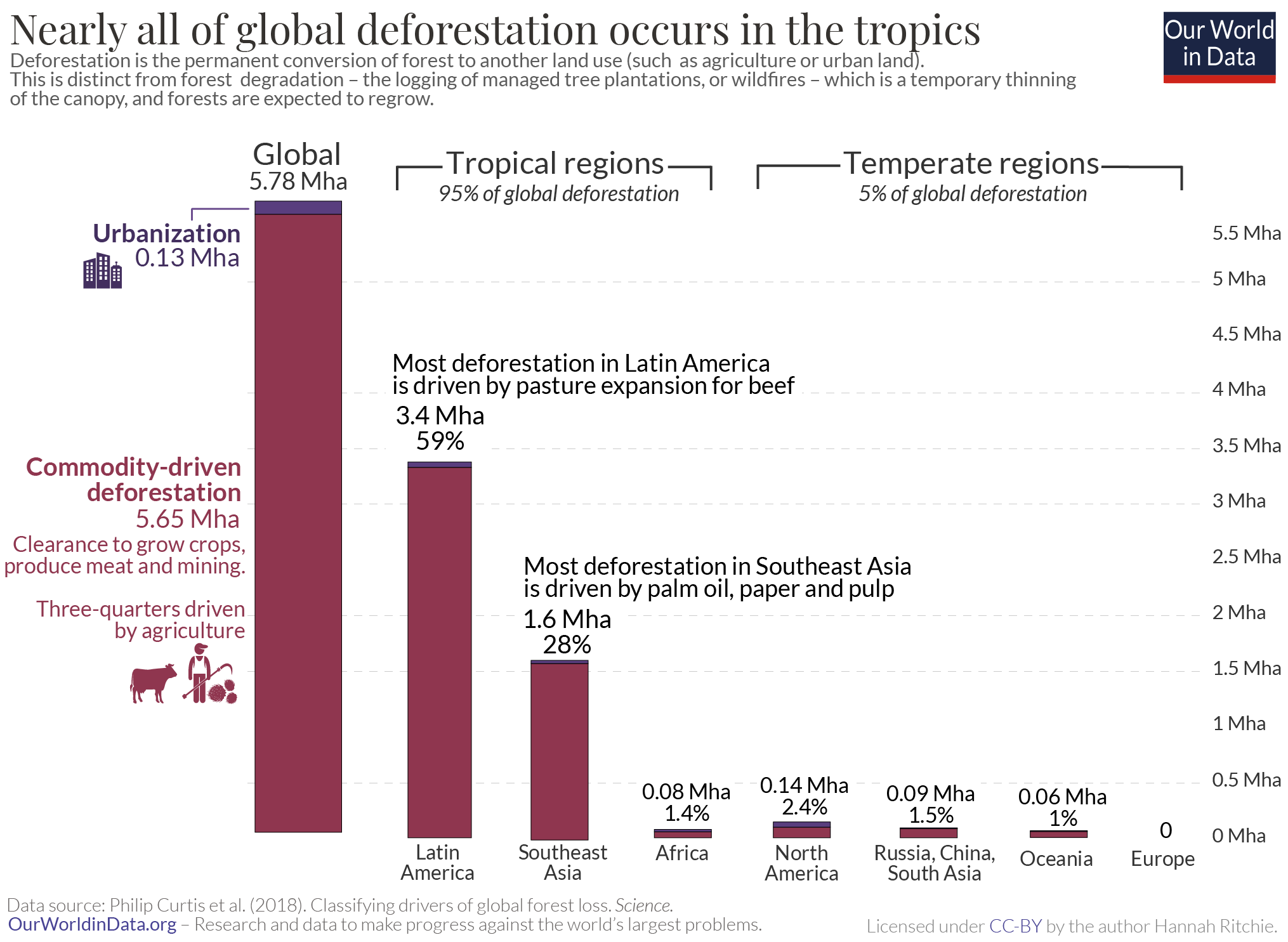

Record Breaking Forest Loss Wildfires Intensify Global Deforestation

May 24, 2025

Record Breaking Forest Loss Wildfires Intensify Global Deforestation

May 24, 2025 -

2002 Submarine Bribery Case French Investigation Points To Malaysias Former Pm Najib

May 24, 2025

2002 Submarine Bribery Case French Investigation Points To Malaysias Former Pm Najib

May 24, 2025 -

Rethinking Middle Management Their Vital Role In Modern Organizations

May 24, 2025

Rethinking Middle Management Their Vital Role In Modern Organizations

May 24, 2025 -

The Unsung Heroes Of Business The Value Of Middle Management

May 24, 2025

The Unsung Heroes Of Business The Value Of Middle Management

May 24, 2025 -

The China Market And Its Implications For Bmw Porsche And Other Automakers

May 24, 2025

The China Market And Its Implications For Bmw Porsche And Other Automakers

May 24, 2025