Amundi Dow Jones Industrial Average UCITS ETF: Understanding Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated for the Amundi Dow Jones Industrial Average UCITS ETF?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. For the Amundi Dow Jones Industrial Average UCITS ETF, this calculation reflects the collective value of its holdings, which directly track the components of the Dow Jones Industrial Average. Think of it as the underlying worth of each share of the ETF.

The calculation process involves several key steps:

- Determining the Market Value of Holdings: This is the most significant component, representing the current market price of each of the 30 stocks that make up the DJIA, weighted according to their representation in the index.

- Accounting for Liabilities: This includes any expenses, fees, or other obligations associated with managing the ETF.

- Calculating Net Asset Value: This is done by subtracting the total liabilities from the total market value of the holdings and then dividing by the total number of outstanding shares.

Key features of the Amundi Dow Jones Industrial Average UCITS ETF NAV calculation:

- Frequency: The NAV is typically calculated daily, reflecting the closing prices of the DJIA components.

- Accessibility: You can find the daily NAV on the Amundi website, reputable financial news sources, and most brokerage platforms that offer the ETF.

The Importance of NAV in Evaluating the Amundi Dow Jones Industrial Average UCITS ETF Performance

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF acts as a direct reflection of its performance. Changes in the NAV directly represent the overall increase or decrease in the value of the underlying assets. This is especially important because the ETF aims to track the DJIA, meaning its NAV should closely mirror the index's performance.

- Tracking NAV Over Time: By monitoring the NAV over time, investors can readily assess the ETF's growth or decline. This long-term perspective is crucial for evaluating investment returns.

- NAV vs. Share Price: While the ETF's share price should closely mirror its NAV, there can be minor discrepancies due to market trading fluctuations. This difference is known as tracking error. For a well-traded ETF like this one, the tracking error is typically small.

- Comparative Analysis: Comparing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF with that of other similar ETFs tracking the DJIA allows investors to assess the relative performance and identify potentially better options.

Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF NAV

Several factors influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF. Understanding these factors is critical for making informed investment decisions.

- Underlying Asset Performance: The performance of the individual stocks within the DJIA has the most significant impact. A rise or fall in the price of these components directly influences the overall NAV.

- Currency Fluctuations: While the DJIA is a US dollar-denominated index, currency fluctuations could affect the NAV if the ETF holds assets in other currencies.

- ETF Expenses: The expense ratio of the ETF, representing the annual cost of managing the fund, slightly impacts the NAV. These costs are deducted from the fund's assets.

Specific factors to consider:

- Individual Stock Price Changes: Fluctuations in the price of any of the 30 DJIA components directly impact the ETF's NAV.

- Dividend Payments: Dividends paid by the underlying companies are generally reinvested into the ETF, positively influencing the NAV over time.

- Market Sentiment and Economic Factors: Broader market trends and overall economic conditions significantly influence the DJIA and, consequently, the ETF's NAV.

Understanding the Amundi Dow Jones Industrial Average UCITS ETF Prospectus for NAV Details

The prospectus, or offering document, provides crucial details about the Amundi Dow Jones Industrial Average UCITS ETF, including a comprehensive description of the NAV calculation methodology. It's essential to carefully review this document before investing.

- Investment Strategy and NAV: The prospectus details the ETF's investment strategy, including how it seeks to replicate the DJIA, which directly affects the NAV calculation and overall performance.

- Locating the Prospectus: The prospectus is usually available on the Amundi website and financial regulatory websites. Check with your broker or financial advisor if you need assistance locating it.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is paramount for successful investing. By monitoring the NAV, comparing it to the share price and other similar ETFs, and considering the various factors influencing it, investors can make informed decisions. Regularly review the ETF's prospectus for detailed information on the NAV calculation methodology and the fund's overall strategy. Learn more about the Amundi Dow Jones Industrial Average UCITS ETF and its NAV by visiting the Amundi website [link to Amundi website] and reviewing the prospectus [link to prospectus]. Understanding Amundi Dow Jones Industrial Average UCITS ETF NAV data is key to making informed investment decisions regarding this and other similar ETFs in your portfolio.

Featured Posts

-

Porsche 956 Nin Tavan Sergilemesinin Teknik Sebepleri

May 24, 2025

Porsche 956 Nin Tavan Sergilemesinin Teknik Sebepleri

May 24, 2025 -

Proposed Changes To Juvenile Sentencing In France

May 24, 2025

Proposed Changes To Juvenile Sentencing In France

May 24, 2025 -

Test Porsche Cayenne Gts Coupe Czy To Idealny Suv

May 24, 2025

Test Porsche Cayenne Gts Coupe Czy To Idealny Suv

May 24, 2025 -

The Kyle Walker Annie Kilner Story A Look At Recent Events

May 24, 2025

The Kyle Walker Annie Kilner Story A Look At Recent Events

May 24, 2025 -

Porsche Cayenne Gts Coupe Plusy I Minusy Po Jazdach Probowych

May 24, 2025

Porsche Cayenne Gts Coupe Plusy I Minusy Po Jazdach Probowych

May 24, 2025

Latest Posts

-

Na Uitstel Trump Sterke Winsten Voor Alle Aex Aandelen

May 24, 2025

Na Uitstel Trump Sterke Winsten Voor Alle Aex Aandelen

May 24, 2025 -

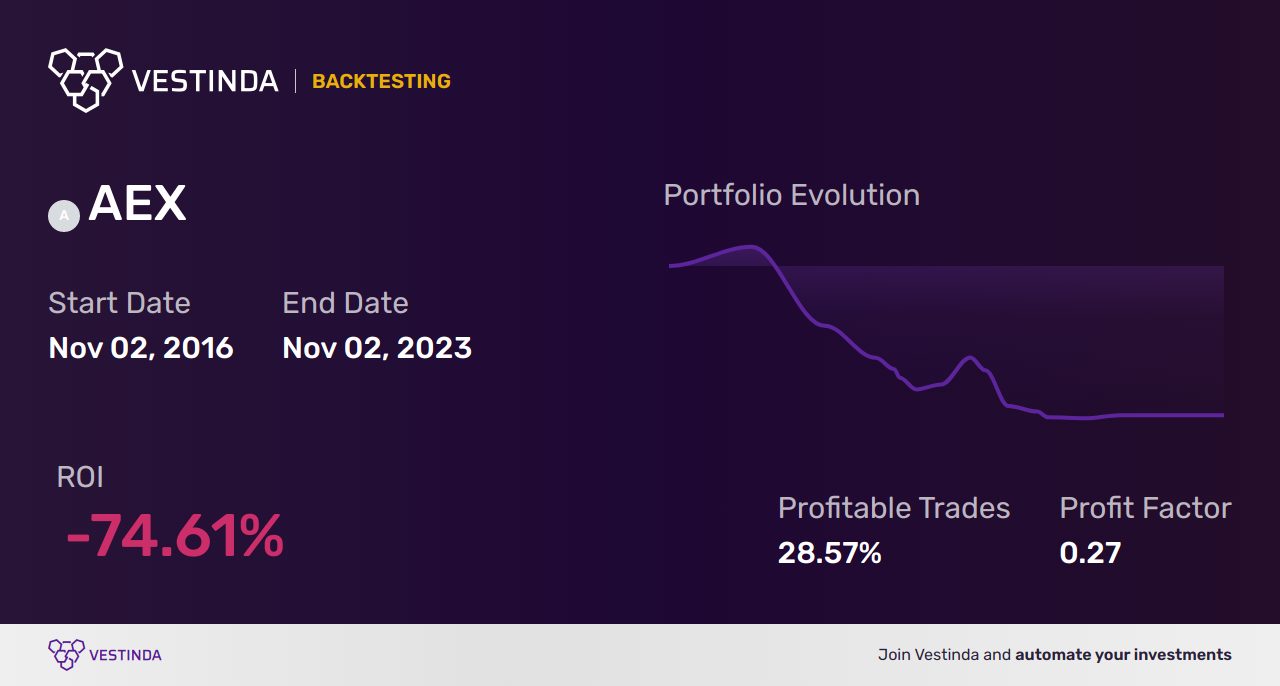

Aex Index Crumbles More Than 4 Loss Lowest Point In 12 Months

May 24, 2025

Aex Index Crumbles More Than 4 Loss Lowest Point In 12 Months

May 24, 2025 -

Aex Stijgt Na Trump Uitstel Positief Sentiment Voor Alle Fondsen

May 24, 2025

Aex Stijgt Na Trump Uitstel Positief Sentiment Voor Alle Fondsen

May 24, 2025 -

Amsterdam Aex Index Suffers Sharpest Fall In Over A Year

May 24, 2025

Amsterdam Aex Index Suffers Sharpest Fall In Over A Year

May 24, 2025 -

Amsterdam Exchange Down 2 Following Trumps Latest Tariff Increase

May 24, 2025

Amsterdam Exchange Down 2 Following Trumps Latest Tariff Increase

May 24, 2025