Amundi MSCI All Country World UCITS ETF USD Acc: Understanding Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and how does it relate to the Amundi MSCI All Country World UCITS ETF USD Acc?

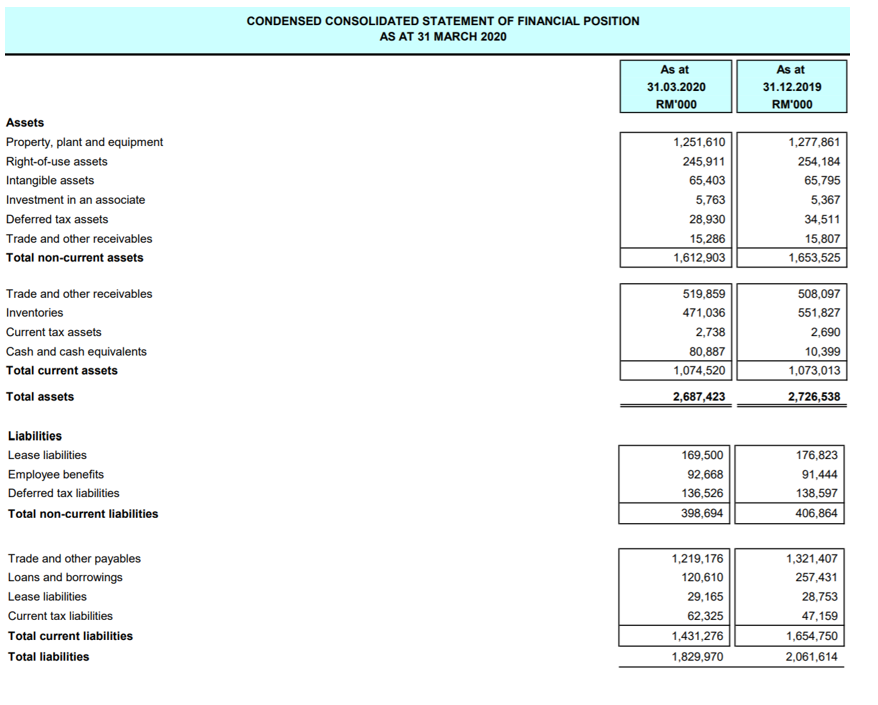

Net Asset Value (NAV) represents the net worth of an ETF's underlying assets. For the Amundi MSCI All Country World UCITS ETF USD Acc, this means the total value of all the stocks, bonds, and other securities it holds, minus any liabilities (like expenses). This value is then divided by the total number of outstanding shares to arrive at the NAV per share.

-

Components of NAV Calculation:

- Market Value of Assets: The current market price of all the securities held within the ETF. This is the largest component and fluctuates constantly based on market conditions. The Amundi MSCI All Country World UCITS ETF USD Acc, tracking a global index, will be highly sensitive to global market movements.

- Liabilities: These include expenses such as management fees, administrative costs, and any other outstanding debts. The Amundi MSCI All Country World UCITS ETF USD Acc's expense ratio directly impacts its NAV.

- Number of Outstanding Shares: The total number of ETF shares currently in circulation.

-

Simplified Example: Let's say the Amundi MSCI All Country World UCITS ETF USD Acc holds $100 million in assets and has liabilities of $1 million. If there are 10 million shares outstanding, the NAV per share would be (($100 million - $1 million) / 10 million shares) = $9.90. This is a simplified illustration; the actual calculation is far more complex, reflecting the diverse holdings of the fund. Keywords: NAV calculation, ETF valuation, asset valuation, liability, share price, market value.

Factors Affecting the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Several factors influence the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc:

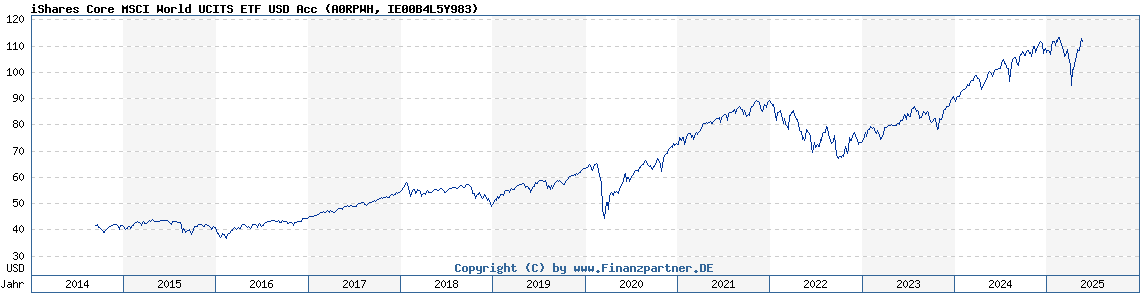

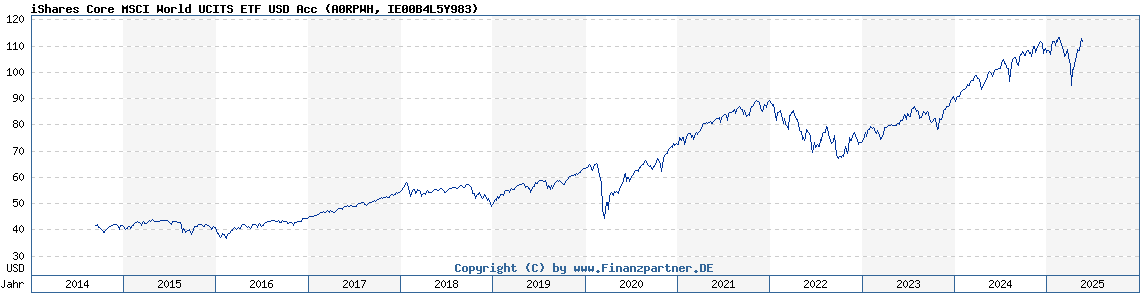

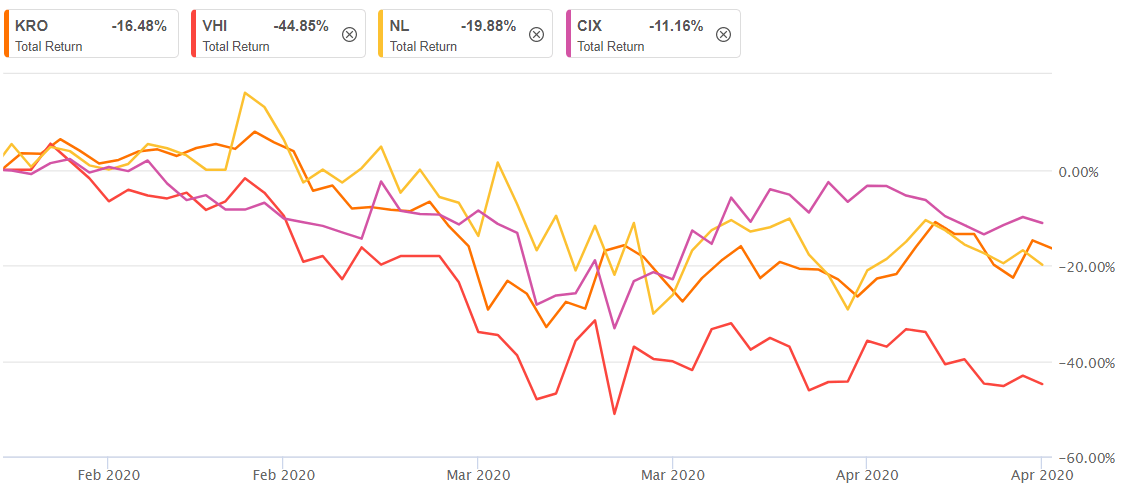

- Global Market Fluctuations: As a globally diversified ETF, the Amundi MSCI All Country World UCITS ETF USD Acc is susceptible to global market volatility. Positive market trends generally lead to a higher NAV, while negative trends result in a lower NAV.

- Currency Exchange Rates (USD Acc): The "USD Acc" designation signifies that the ETF is denominated in US dollars. Fluctuations in exchange rates against other currencies affect the value of the underlying assets held in different currencies, impacting the NAV.

- Dividends and Capital Gains Distributions: When the underlying holdings of the ETF pay dividends or generate capital gains, these distributions are typically passed on to investors, reducing the NAV.

- Expense Ratios: The expense ratio, representing the annual cost of managing the ETF, gradually reduces the NAV over time. A higher expense ratio will lead to a slower NAV growth compared to a lower-expense ETF. Keywords: market volatility, currency risk, dividend yield, expense ratio, portfolio performance.

How to Find and Interpret the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Finding the daily NAV for the Amundi MSCI All Country World UCITS ETF USD Acc is straightforward:

- Amundi's Website: The official Amundi website is the primary source for accurate and up-to-date NAV information.

- Financial News Sources: Many financial news websites and platforms provide real-time ETF data, including NAVs.

Interpreting the NAV involves comparing it to the ETF's share price. While ideally they should be very close, minor discrepancies can arise due to trading volume and bid-ask spreads. Monitoring NAV changes over time provides insights into the investment's performance. Keywords: NAV data, share price, investment performance, ETF tracking, price discovery.

NAV vs. Market Price: Understanding the Differences and Implications

The NAV represents the intrinsic value of the ETF, while the market price reflects the actual price at which the ETF shares are trading on the exchange. Intraday, the market price can fluctuate significantly due to factors like supply and demand.

- Discrepancies: Differences between NAV and market price can arise from:

- Bid-Ask Spread: The difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept.

- Trading Volume: Low trading volume can lead to greater discrepancies between NAV and market price.

However, for long-term investment decisions, the NAV provides a more reliable indication of the underlying asset value. Keywords: market price, bid-ask spread, trading volume, long-term investment.

Conclusion: Mastering the Amundi MSCI All Country World UCITS ETF USD Acc NAV for Informed Investment Decisions

Understanding the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is paramount for making informed investment decisions. By regularly monitoring the NAV and understanding the factors that influence it, you can effectively track your investment's performance and assess its value within your overall portfolio. Stay informed about your Amundi MSCI All Country World UCITS ETF USD Acc investment by regularly checking the NAV and consulting reputable financial resources. Learn more about the Amundi MSCI All Country World UCITS ETF USD Acc and its NAV by visiting [link to relevant resource].

Featured Posts

-

Teen Bailed In Fatal Shop Owner Stabbing Arrested Again

May 24, 2025

Teen Bailed In Fatal Shop Owner Stabbing Arrested Again

May 24, 2025 -

Konchita Vurst Dnes Nov Oblik I Pt Sled Evroviziya

May 24, 2025

Konchita Vurst Dnes Nov Oblik I Pt Sled Evroviziya

May 24, 2025 -

Seattles Green Space A Womans Refuge During The Early Pandemic

May 24, 2025

Seattles Green Space A Womans Refuge During The Early Pandemic

May 24, 2025 -

Ritka Porsche 911 80 Millio Forintos Extrak Kueloenlegessege

May 24, 2025

Ritka Porsche 911 80 Millio Forintos Extrak Kueloenlegessege

May 24, 2025 -

Bbc Radio 1 Big Weekend 2024 Jorja Smith Biffy Clyro Blossoms And More

May 24, 2025

Bbc Radio 1 Big Weekend 2024 Jorja Smith Biffy Clyro Blossoms And More

May 24, 2025

Latest Posts

-

Brbs Banco Master Acquisition A Challenge To Brazils Banking Giants

May 24, 2025

Brbs Banco Master Acquisition A Challenge To Brazils Banking Giants

May 24, 2025 -

Analyzing The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Analyzing The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Gun Trafficking In Massachusetts 18 Brazilians Charged Over 100 Firearms Confiscated

May 24, 2025

Gun Trafficking In Massachusetts 18 Brazilians Charged Over 100 Firearms Confiscated

May 24, 2025 -

News Corps Undervalued Assets A Comprehensive Analysis

May 24, 2025

News Corps Undervalued Assets A Comprehensive Analysis

May 24, 2025 -

Massachusetts Police Charge 18 Brazilian Nationals In Connection With Large Gun Seizure

May 24, 2025

Massachusetts Police Charge 18 Brazilian Nationals In Connection With Large Gun Seizure

May 24, 2025