Analyzing The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

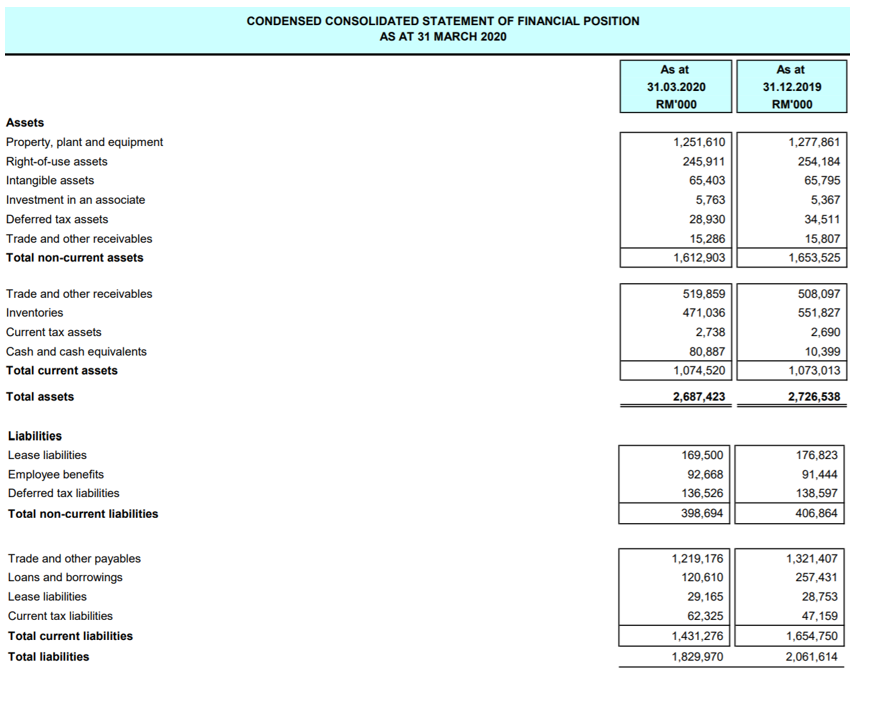

Net Asset Value (NAV) represents the net value of an ETF's assets after deducting its liabilities. In simpler terms, it's the per-share value of the ETF's underlying holdings. For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV calculation is straightforward:

(Total assets - Total liabilities) / Number of outstanding shares

This calculation is performed daily, and the resulting NAV is typically published at the close of market hours. Understanding this daily calculation is key to tracking the Amundi Dow Jones Industrial Average UCITS ETF NAV.

- Assets: Primarily comprise the holdings of the 30 companies that make up the Dow Jones Industrial Average index. The value of these holdings fluctuates constantly based on the market performance of each individual stock.

- Liabilities: Include operational expenses of the ETF, management fees, and any other outstanding obligations. These liabilities are subtracted from the total asset value to arrive at the net asset value.

- NAV Updates: The frequency of NAV updates is typically daily, providing investors with a current valuation of the ETF. This daily update is crucial for tracking the Amundi Dow Jones Industrial Average UCITS ETF NAV performance.

- Underlying Assets: A thorough understanding of the underlying assets (the 30 Dow Jones stocks) is crucial for predicting potential NAV fluctuations. Knowing the composition of the holdings helps investors anticipate the effects of market movements on the ETF's NAV.

Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF NAV

Several factors significantly influence the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF. Understanding these factors is crucial for interpreting NAV changes.

-

Dow Jones Industrial Average Performance: The primary driver of the ETF's NAV is the overall performance of the Dow Jones Industrial Average. A rising index generally leads to an increased NAV, while a falling index results in a decreased NAV. Tracking the index's performance is essential for understanding the movement of the Amundi Dow Jones Industrial Average UCITS ETF NAV.

-

Currency Fluctuations: If the ETF holds assets denominated in currencies other than the base currency of the ETF, currency fluctuations can impact the NAV. Changes in exchange rates can positively or negatively affect the value of these assets.

-

Dividends from Underlying Stocks: Dividends paid by the companies within the Dow Jones Industrial Average are usually reinvested into the ETF, increasing its overall asset value and contributing to NAV growth. Understanding dividend payout schedules can help predict short-term Amundi Dow Jones Industrial Average UCITS ETF NAV movements.

-

Expense Ratios: While seemingly small, expense ratios (the annual fees charged for managing the ETF) subtly erode the NAV over time. This is a consistent, albeit small, factor affecting long-term NAV growth.

-

Individual Stock Price Movements: The price movement of each individual stock within the Dow Jones significantly influences the overall NAV. A strong performance from one or several components can boost the NAV, while poor performance can drag it down.

-

Economic News and Events: Major economic news and global events (e.g., interest rate changes, geopolitical events) can significantly impact the overall market and, consequently, the Dow Jones and the ETF's NAV.

-

Correlation between Dividends and NAV Changes: Dividend payouts from underlying stocks directly influence NAV changes. Consistent dividend payments usually contribute positively to the long-term NAV trend.

-

The Subtle but Consistent Effect of Expense Ratios: Expense ratios represent a continuous, albeit minor, deduction from the NAV over time. It's essential to account for this in long-term NAV projections.

Interpreting the Amundi Dow Jones Industrial Average UCITS ETF NAV for Investment Decisions

Understanding how to interpret the NAV is critical for making informed investment decisions.

-

NAV vs. Market Price: The ETF's market price can sometimes deviate slightly from its NAV. This difference might represent a premium or discount, reflecting investor sentiment and market dynamics. Comparing the NAV with the market price can reveal potential buying or selling opportunities.

-

NAV Trends Over Time: Analyzing the NAV's historical performance through charts reveals long-term growth trends and volatility levels. This allows for a better understanding of the ETF's risk profile.

-

NAV for Performance Analysis: The NAV is crucial for measuring the ETF's performance over time, both against its benchmark (the Dow Jones Industrial Average) and compared to other similar ETFs.

-

Premiums and Discounts: A premium occurs when the market price exceeds the NAV, while a discount is when the market price is below the NAV. Understanding the factors contributing to these discrepancies is important for making strategic investment decisions.

-

Identifying Buying/Selling Opportunities: Comparing the current market price to the NAV can indicate potential buying opportunities (when the price is below the NAV) or selling opportunities (when the price is significantly above the NAV).

-

Analyzing NAV Charts: Graphing the NAV over time provides valuable insights into the ETF's long-term growth trajectory, volatility patterns, and potential risk levels.

-

Benchmark Comparison: Comparing the ETF's performance (as reflected in the NAV) against its benchmark (the Dow Jones Industrial Average) is essential for evaluating its effectiveness as an investment vehicle.

-

Understanding Premiums/Discounts: Factors contributing to premiums or discounts relative to NAV include market sentiment, supply and demand, and anticipated future performance of the underlying assets.

Where to Find the Amundi Dow Jones Industrial Average UCITS ETF NAV

Reliable sources for accessing the daily NAV data for the Amundi Dow Jones Industrial Average UCITS ETF include:

-

Amundi Website: The official website of Amundi is the primary source for accurate and up-to-date NAV information. Look for sections dedicated to ETF factsheets or performance data.

-

Financial News Websites: Major financial news providers like Bloomberg, Yahoo Finance, and Google Finance typically list ETF NAVs.

-

Brokerage Platforms: Most online brokerage platforms display real-time or near real-time NAV information for ETFs held in client accounts.

-

Specific Link to Amundi Website (example, this will vary): [Insert a hypothetical link here, e.g., www.amundi.com/en/etf/amundi-dow-jones-industrial-average-ucits-etf-nav]

-

Reputable Financial Data Providers: Bloomberg Terminal, Refinitiv Eikon, and other professional data services offer comprehensive ETF data, including NAV.

-

Interpreting the Data: Ensure you understand the time zone and the currency in which the NAV is presented to avoid misinterpretations.

Conclusion

Understanding the Net Asset Value (NAV) is critical for making informed investment decisions regarding the Amundi Dow Jones Industrial Average UCITS ETF. By analyzing factors influencing the NAV, comparing it to the market price, and monitoring trends, investors can gain valuable insights into the ETF's performance and potential. Regularly reviewing the Amundi Dow Jones Industrial Average UCITS ETF NAV, alongside other key metrics, will empower you to optimize your investment strategy. Start monitoring the Amundi Dow Jones Industrial Average UCITS ETF NAV today!

Featured Posts

-

Analisi Borsa Fed Banche Italiane E Il Futuro Di Piazza Affari

May 24, 2025

Analisi Borsa Fed Banche Italiane E Il Futuro Di Piazza Affari

May 24, 2025 -

Amerikaanse Beurs In De Rode Cijfers Aex Toont Veerkracht

May 24, 2025

Amerikaanse Beurs In De Rode Cijfers Aex Toont Veerkracht

May 24, 2025 -

Prezzi Moda Negli Usa Dopo L Introduzione Dei Dazi

May 24, 2025

Prezzi Moda Negli Usa Dopo L Introduzione Dei Dazi

May 24, 2025 -

Glastonbury 2025 Olivia Rodrigo And The 1975 Join The Lineup

May 24, 2025

Glastonbury 2025 Olivia Rodrigo And The 1975 Join The Lineup

May 24, 2025 -

Konchita Vurst Kak Se Promeni Bradatata Pobeditelka Ot Evroviziya

May 24, 2025

Konchita Vurst Kak Se Promeni Bradatata Pobeditelka Ot Evroviziya

May 24, 2025

Latest Posts

-

8 Stock Market Jump On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025

8 Stock Market Jump On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025 -

Economische Recessie Relx Blijft Groeien Dankzij Ai

May 24, 2025

Economische Recessie Relx Blijft Groeien Dankzij Ai

May 24, 2025 -

Royal Philips 2025 Annual General Meeting Of Shareholders Update

May 24, 2025

Royal Philips 2025 Annual General Meeting Of Shareholders Update

May 24, 2025 -

Trumps Tariff Halt Sends Euronext Amsterdam Stocks Up 8

May 24, 2025

Trumps Tariff Halt Sends Euronext Amsterdam Stocks Up 8

May 24, 2025 -

Sterke Resultaten Relx Ai Als Motor Voor Groei Tot 2025

May 24, 2025

Sterke Resultaten Relx Ai Als Motor Voor Groei Tot 2025

May 24, 2025