Amundi MSCI World II UCITS ETF Dist: Daily NAV And Its Implications

Table of Contents

Daily NAV Calculation and its Components

The daily NAV of the Amundi MSCI World II UCITS ETF Dist represents the net asset value per share. It's calculated at the close of each trading day, reflecting the collective value of the underlying assets minus any liabilities. This calculation is a crucial factor in understanding your investment's performance and value. Key components influencing this daily NAV include:

-

Underlying Asset Prices: The Amundi MSCI World II UCITS ETF Dist tracks the MSCI World Index, a broad market-capitalization weighted index representing large and mid-cap equities across developed markets globally. Daily fluctuations in the prices of these constituent companies directly impact the ETF's NAV. A rise in the index leads to a higher NAV, and vice versa.

-

Exchange Rate Fluctuations: As the ETF invests globally, exchange rate fluctuations between the base currency (typically EUR) and the currencies of the underlying assets can affect the NAV. A strengthening Euro against other currencies could slightly lower the NAV calculated in Euros, while a weakening Euro would have the opposite effect.

-

Dividend Distributions: The "Dist" in Amundi MSCI World II UCITS ETF Dist signifies that it distributes dividends received from the underlying companies to shareholders. These distributions reduce the ETF's asset base, resulting in a corresponding decrease in the NAV on the ex-dividend date.

-

Management Fees and Expenses: The ETF's management fees and operational expenses are deducted from the total asset value, impacting the final NAV calculation. These fees are usually expressed as a percentage of the assets under management.

Example: Imagine the total value of the ETF's underlying assets is €100 million, and liabilities (including management fees) are €1 million. If there are 10 million shares outstanding, the daily NAV would be (€100 million - €1 million) / 10 million shares = €9.90 per share.

Interpreting Daily NAV Changes

Daily NAV fluctuations are inherent in any market-linked investment. Understanding the reasons behind these changes is crucial for informed decision-making. Several factors contribute to daily NAV movements:

-

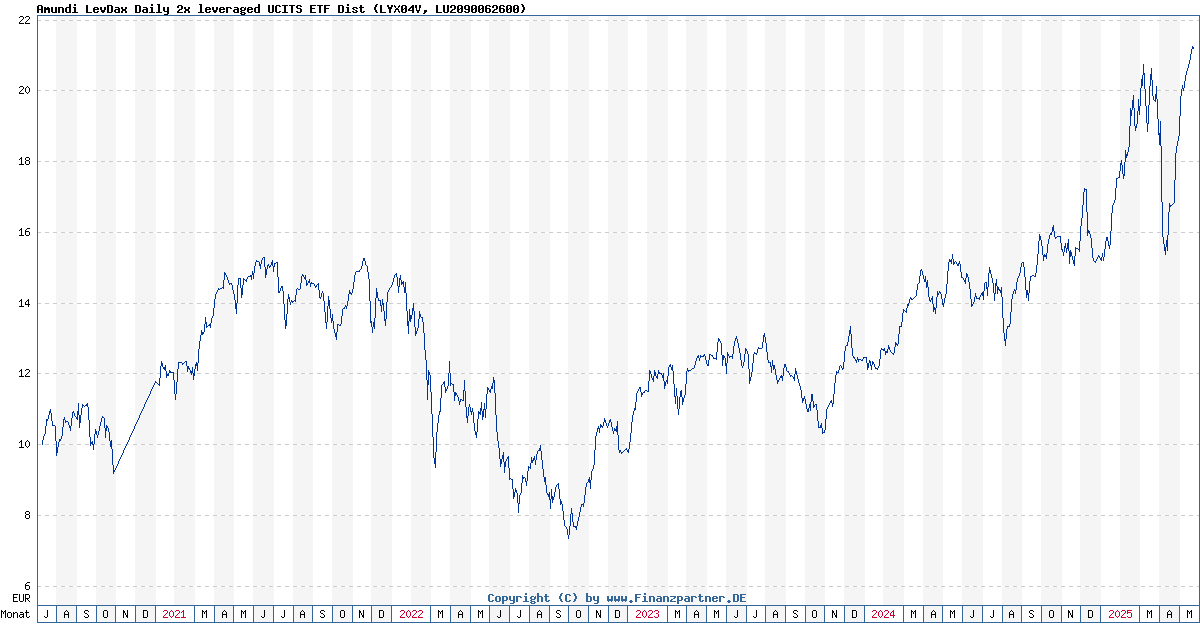

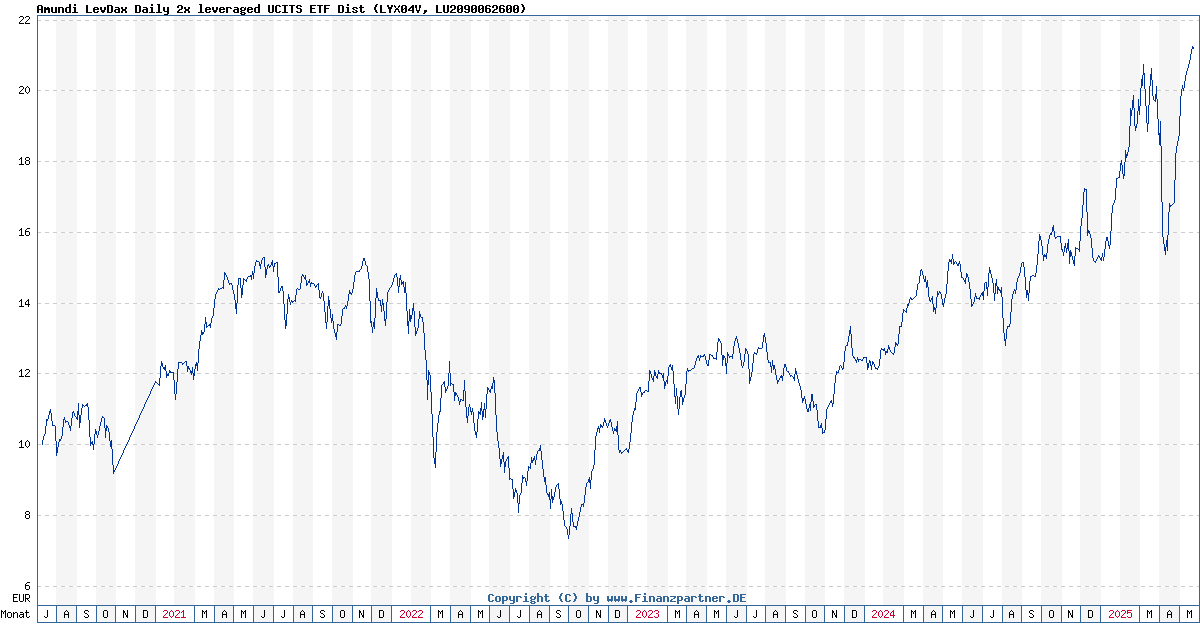

Market Movements: Bull markets generally lead to increased NAV, while bear markets cause declines. Broad market sentiment significantly influences the MSCI World Index and, consequently, the ETF's NAV.

-

Geopolitical Events: Global events, such as political instability, trade wars, or natural disasters, can create market volatility and impact the NAV.

-

Economic Indicators: Key economic indicators like inflation rates, interest rate changes, and employment data influence investor sentiment and market performance, subsequently affecting the NAV.

-

Company-Specific News: News related to individual companies within the MSCI World Index can cause fluctuations. Positive news about a major constituent can boost the NAV, while negative news can depress it.

It's essential to differentiate between the ETF's price and its NAV. The price you buy or sell the ETF at on the exchange may differ slightly from the NAV due to market supply and demand. However, over the long term, the ETF's price should closely track its NAV. Using daily NAV data helps to track the underlying asset performance and make better-informed investment choices.

Using Daily NAV for Investment Strategies

Daily NAV data can inform several investment strategies:

-

Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of the NAV, mitigates the risk of investing a lump sum at a market peak.

-

Value Averaging: Investing to maintain a target portfolio value, regardless of market fluctuations, can be a useful strategy for long-term investors.

-

Market Timing (with caveats): Attempting to buy low and sell high based on NAV movements is risky. Short-term market prediction is unreliable and can lead to significant losses.

Using daily NAV to determine entry and exit points requires caution. While monitoring NAV can support decision-making, relying solely on short-term NAV fluctuations is unwise. A long-term investment horizon is vital for success with ETFs like the Amundi MSCI World II UCITS ETF Dist.

Accessing and Utilizing Daily NAV Information

Investors can access the Amundi MSCI World II UCITS ETF Dist daily NAV through several channels:

-

Amundi's Official Website: The asset manager's website provides official NAV data.

-

Financial News Sources: Many reputable financial news websites and portals publish ETF NAV data.

-

Brokerage Accounts: Most brokerage platforms display the daily NAV of ETFs held within client accounts.

-

Financial Data Providers: Companies like Bloomberg and Refinitiv offer comprehensive financial data, including ETF NAVs.

Choosing reliable data sources is critical. Discrepancies can arise between different platforms due to data lags or reporting differences. Always prioritize official sources or well-established financial data providers.

Risks Associated with Daily NAV Fluctuations

While tracking daily NAV is valuable, remember that short-term fluctuations are inherent risks. Focusing on daily changes can lead to emotional decision-making, potentially resulting in poor investment outcomes. It's crucial to adopt a long-term investment strategy and avoid impulsive trading based solely on short-term NAV movements.

Conclusion: Making Informed Decisions with Amundi MSCI World II UCITS ETF Dist Daily NAV

Understanding the Amundi MSCI World II UCITS ETF Dist Daily NAV is essential for informed investment decisions. This article has highlighted how the NAV is calculated, the factors influencing its daily changes, and how this information can be utilized in investment strategies. While monitoring daily NAV can provide valuable insights, it is crucial to maintain a long-term perspective, avoid emotional trading, and consider your risk tolerance. Remember to consult with a qualified financial advisor before making any investment decisions. Regularly monitoring your Amundi MSCI World II UCITS ETF Dist Daily NAV and understanding its implications will contribute significantly to achieving your long-term financial goals. Learn more about the Amundi MSCI World II UCITS ETF Dist and its performance by visiting [link to relevant resource].

Featured Posts

-

When Are Flights Most Crowded Around Memorial Day 2025

May 25, 2025

When Are Flights Most Crowded Around Memorial Day 2025

May 25, 2025 -

A Realistic Guide To Escaping To The Country

May 25, 2025

A Realistic Guide To Escaping To The Country

May 25, 2025 -

Latest Update West Hams Bid For Kyle Walker Peters

May 25, 2025

Latest Update West Hams Bid For Kyle Walker Peters

May 25, 2025 -

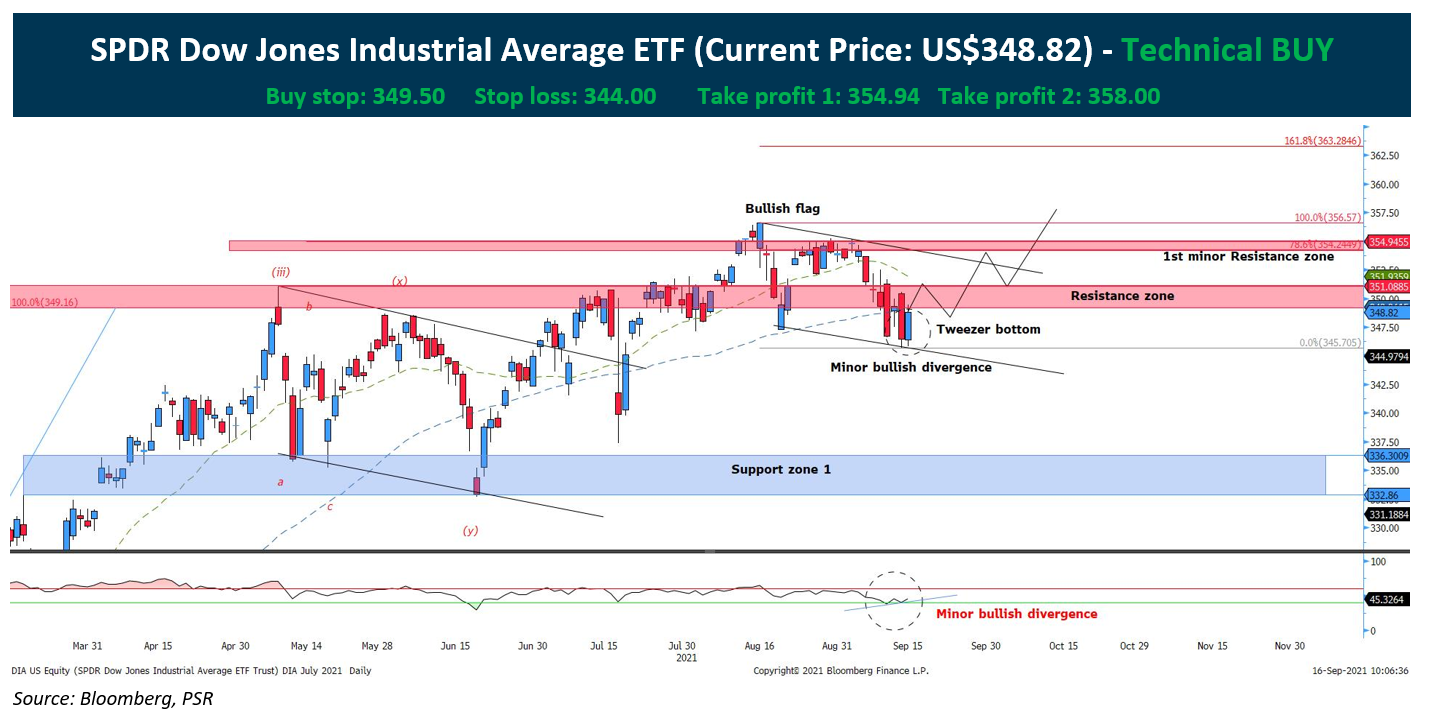

Investment In Amundi Dow Jones Industrial Average Ucits Etf Focus On Net Asset Value Nav

May 25, 2025

Investment In Amundi Dow Jones Industrial Average Ucits Etf Focus On Net Asset Value Nav

May 25, 2025 -

Evroviziya Zhivott Na Konchita Vurst Sled Pobedata Promeni I Transformatsii

May 25, 2025

Evroviziya Zhivott Na Konchita Vurst Sled Pobedata Promeni I Transformatsii

May 25, 2025

Latest Posts

-

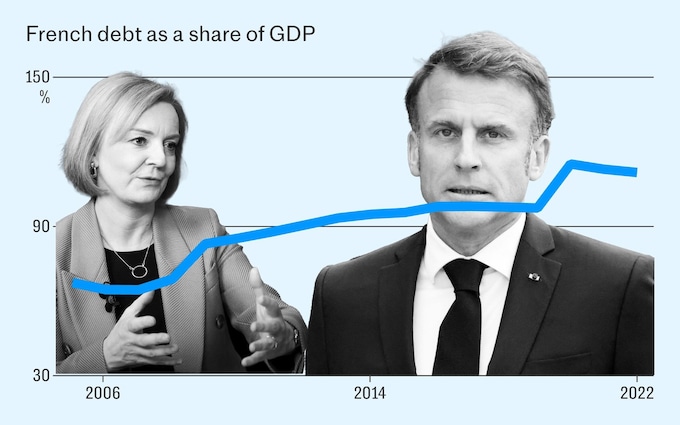

Former French Pm Speaks Out Against Macrons Leadership

May 25, 2025

Former French Pm Speaks Out Against Macrons Leadership

May 25, 2025 -

Discrepancies Between Former French Pm And Macron Revealed

May 25, 2025

Discrepancies Between Former French Pm And Macron Revealed

May 25, 2025 -

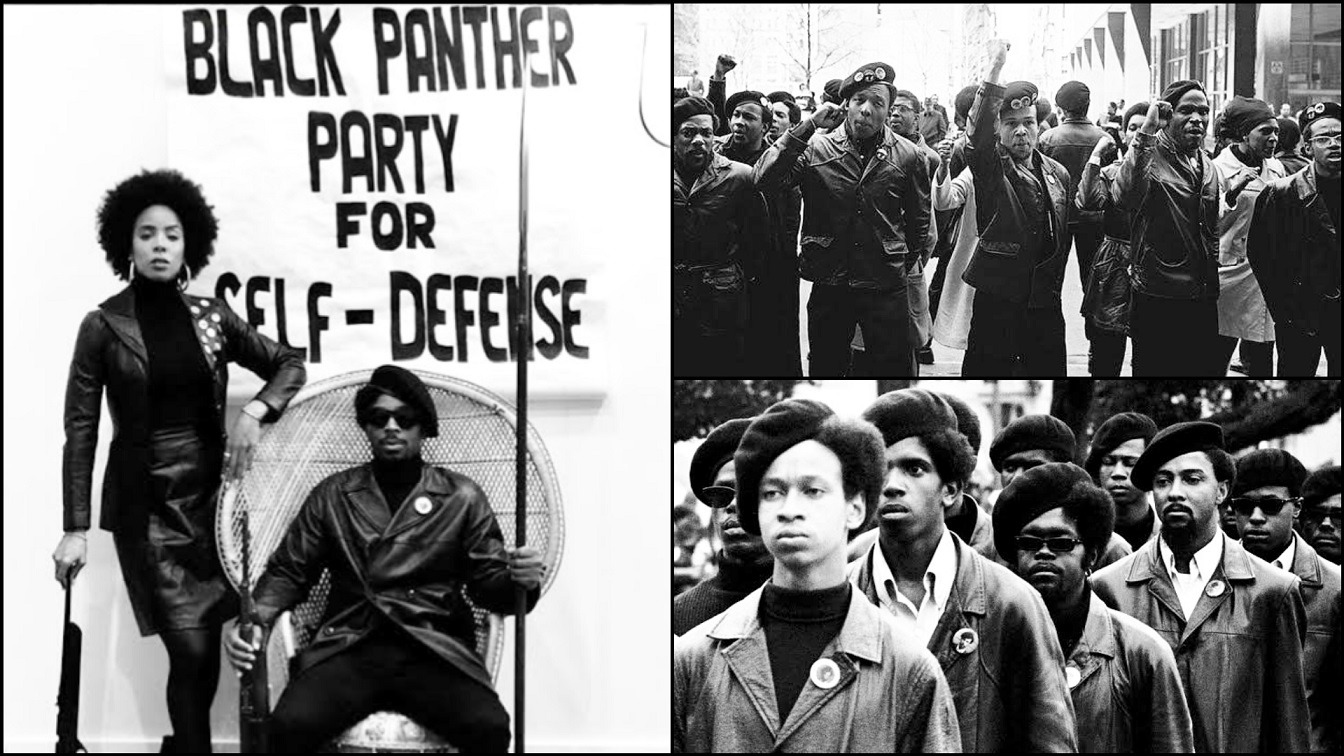

Facing Retribution The Perils Of Advocating For Change

May 25, 2025

Facing Retribution The Perils Of Advocating For Change

May 25, 2025 -

Gaga And Polansky A Hand In Hand Arrival At The Snl Afterparty

May 25, 2025

Gaga And Polansky A Hand In Hand Arrival At The Snl Afterparty

May 25, 2025 -

France Debates Harsher Penalties For Young Criminals

May 25, 2025

France Debates Harsher Penalties For Young Criminals

May 25, 2025