Amundi MSCI World II UCITS ETF USD Hedged Dist: A Guide To NAV And Its Implications

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

Net Asset Value (NAV) represents the net worth of an ETF's holdings. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, the NAV calculation considers the total market value of all underlying assets, taking into account their respective weights within the index (MSCI World Index). Crucially, it also includes the impact of the USD hedging strategy. The ETF aims to replicate the MSCI World Index, so the NAV reflects the performance of this benchmark, albeit with adjustments.

-

Illustrative Example: Imagine the ETF holds shares worth $100 million in various global companies, and it has $1 million in expenses. If the hedging strategy results in a net gain of $500,000 from currency fluctuations, the NAV would be approximately ($100 million + $500,000 - $1 million) = $99.5 million. This figure is then divided by the number of outstanding ETF shares to determine the NAV per share.

-

Factors Influencing Daily NAV Fluctuations: The daily NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist fluctuates due to:

- Movements in the prices of the underlying assets within the MSCI World Index.

- Changes in currency exchange rates (despite the hedging, some fluctuation is expected).

- Dividend payments from the underlying companies.

-

Finding the Daily NAV: You can usually find the daily NAV on the Amundi ETF website, major financial news websites (like Bloomberg or Yahoo Finance), and through your brokerage account.

The Significance of NAV in the Amundi MSCI World II UCITS ETF USD Hedged Dist

The NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is paramount for several reasons. It's the primary indicator of the ETF's intrinsic value. This impacts your investment decisions directly:

-

Buying and Selling: Comparing the ETF's market price to its NAV helps determine whether you're buying or selling at a premium or discount. A premium suggests the market price exceeds the NAV, while a discount indicates the opposite.

-

Assessing Performance: Tracking NAV changes over time allows you to evaluate the ETF's performance. Compare this to the MSCI World Index to assess how effectively the ETF tracks its benchmark. Remember, the USD hedge will affect the return in your local currency.

-

Understanding Returns: The NAV showcases the return in USD. However, the hedging strategy aims to minimize the impact of currency fluctuations on your returns in your local currency. Careful comparison of NAV to the price in your local currency helps understand the total return.

Understanding the Impact of Currency Hedging on NAV

The Amundi MSCI World II UCITS ETF USD Hedged Dist employs a currency hedging strategy to mitigate the risk associated with fluctuations in exchange rates between the USD and other currencies represented in the MSCI World Index.

-

How Hedging Affects NAV: The hedging strategy aims to minimize the impact of currency movements on the NAV, providing relative stability in USD terms. However, hedging isn't perfect, and some currency risk remains.

-

Advantages and Disadvantages of Currency Hedging:

- Advantages: Reduced volatility in USD terms, potentially smoother returns for USD-based investors.

- Disadvantages: Hedging strategies can be costly, potentially reducing overall returns compared to an unhedged ETF in certain market conditions. It also removes the potential benefit of currency appreciation.

-

Impact on NAV Volatility: The hedging generally reduces the volatility of the NAV compared to an unhedged equivalent. However, NAV will still fluctuate based on market performance of the underlying assets.

Using NAV to Monitor Your Investment in the Amundi MSCI World II UCITS ETF USD Hedged Dist

Regularly monitoring the NAV of your Amundi MSCI World II UCITS ETF USD Hedged Dist investment is essential for informed decision-making.

-

Using Online Platforms and Tools: Many brokerage accounts and financial websites provide tools to track NAV in real-time or on a daily basis.

-

Setting up Alerts: Set up alerts for significant NAV changes (e.g., a percentage drop or rise) to receive timely notifications and react appropriately.

-

Integrating NAV Data into Broader Investment Planning: Use NAV data alongside other metrics to evaluate the overall performance of your portfolio and make adjustments to your investment strategy as needed. This might involve rebalancing your portfolio or adjusting your investment timeline.

Conclusion: Mastering Amundi MSCI World II UCITS ETF USD Hedged Dist NAV for Informed Decisions

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is vital for making informed investment decisions. By regularly monitoring the NAV, comparing it to the market price, and considering the impact of the USD hedging strategy, you can effectively track your investment's performance and optimize your portfolio. Learn more about Amundi MSCI World II UCITS ETF USD Hedged Dist NAV today! Master your Amundi MSCI World II UCITS ETF USD Hedged Dist investment by understanding its NAV.

Featured Posts

-

M56 Motorway Closure Serious Crash Causes Traffic Delays

May 25, 2025

M56 Motorway Closure Serious Crash Causes Traffic Delays

May 25, 2025 -

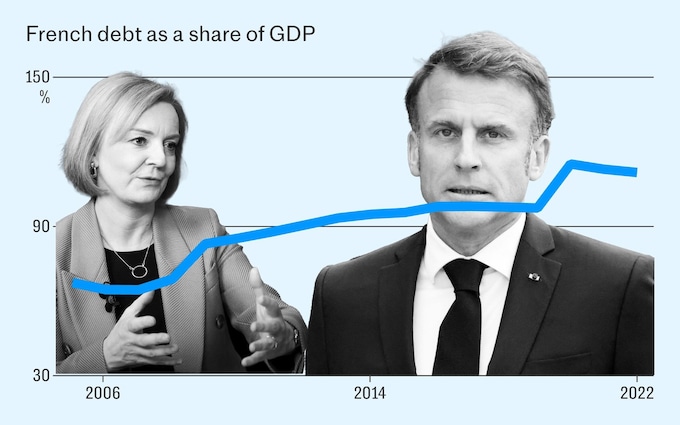

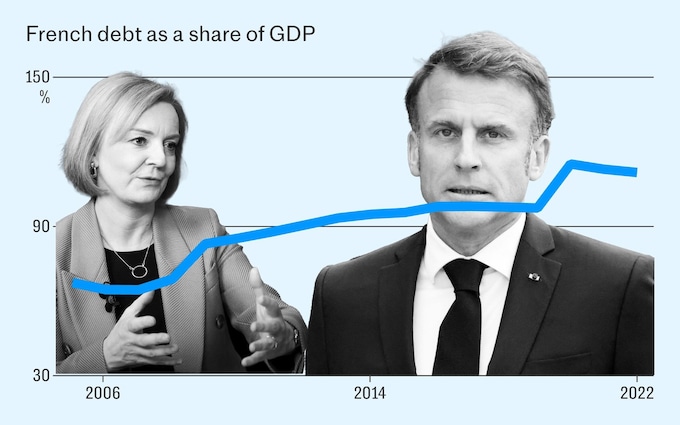

Discrepancies Between Former French Pm And Macron Revealed

May 25, 2025

Discrepancies Between Former French Pm And Macron Revealed

May 25, 2025 -

Prognoz Konchiti Vurst Na Peremozhtsiv Yevrobachennya 2025 Unian

May 25, 2025

Prognoz Konchiti Vurst Na Peremozhtsiv Yevrobachennya 2025 Unian

May 25, 2025 -

Kyle Walker Peters To Crystal Palace Free Transfer On The Cards

May 25, 2025

Kyle Walker Peters To Crystal Palace Free Transfer On The Cards

May 25, 2025 -

Escape To The Country Financing Your Rural Dream Home

May 25, 2025

Escape To The Country Financing Your Rural Dream Home

May 25, 2025

Latest Posts

-

Proposed Changes To Sentencing For Minors In France

May 25, 2025

Proposed Changes To Sentencing For Minors In France

May 25, 2025 -

Frances Juvenile Justice System Facing Calls For Reform

May 25, 2025

Frances Juvenile Justice System Facing Calls For Reform

May 25, 2025 -

Former French Pm Speaks Out Against Macrons Leadership

May 25, 2025

Former French Pm Speaks Out Against Macrons Leadership

May 25, 2025 -

Discrepancies Between Former French Pm And Macron Revealed

May 25, 2025

Discrepancies Between Former French Pm And Macron Revealed

May 25, 2025 -

Facing Retribution The Perils Of Advocating For Change

May 25, 2025

Facing Retribution The Perils Of Advocating For Change

May 25, 2025