Amundi MSCI World II UCITS ETF USD Hedged Dist: NAV Analysis And Performance

Table of Contents

This article provides a comprehensive analysis of the Amundi MSCI World II UCITS ETF USD Hedged Dist, focusing on its Net Asset Value (NAV) performance and overall investment strategy. We will delve into its historical performance, dividend distribution policy, and the benefits of its USD-hedged structure for investors. Understanding these factors is crucial for determining if this ETF aligns with your investment goals.

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist

What is a UCITS ETF?

UCITS (Undertakings for Collective Investment in Transferable Securities) ETFs are a type of exchange-traded fund regulated under the European Union's UCITS Directive. This provides a high level of investor protection and ensures transparency.

- Regulatory Benefits: UCITS ETFs adhere to strict regulatory standards, providing investors with greater confidence and protection.

- International Investor Advantages: The UCITS structure makes these ETFs easily accessible and marketable across the EU and beyond, simplifying international investment.

- Transparency and Oversight: UCITS ETFs are subject to regular audits and reporting requirements, ensuring transparency in their operations and holdings.

The MSCI World Index Tracking

The Amundi MSCI World II UCITS ETF USD Hedged Dist tracks the MSCI World Index, a widely recognized benchmark representing the performance of large and mid-cap equities across developed markets globally. It’s a market-capitalization-weighted index, meaning larger companies have a greater influence on the index's performance.

- Global Diversification: Tracking the MSCI World Index provides investors with broad diversification across various sectors and geographies, reducing overall portfolio risk.

- Exposure to Global Equities: This ETF offers access to a wide range of leading global companies, providing exposure to a significant portion of the world's equity markets.

- Replication Strategy: The ETF utilizes a [specify full or sampling replication strategy here – check the ETF fact sheet]. This influences tracking error and trading costs.

The Significance of USD Hedging

The "USD Hedged" aspect of the ETF is crucial for investors. Currency hedging aims to mitigate the impact of fluctuations between the investor's base currency and the USD, in which the underlying assets are denominated.

- Mitigating Currency Risk: For non-USD investors, currency hedging reduces the risk of losses stemming from unfavorable exchange rate movements. If the USD weakens against your home currency, your returns won't be negatively impacted as much.

- Predictable Returns: Hedging can provide more predictable returns in your local currency, making it easier to budget and plan for long-term investment goals.

- Market Condition Impact: While hedging generally protects against currency fluctuations, it's important to note that in certain market conditions, a hedged strategy may underperform an unhedged one.

NAV Analysis and Performance Review

Historical NAV Performance

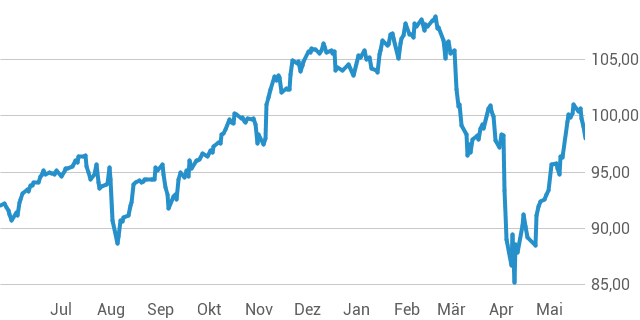

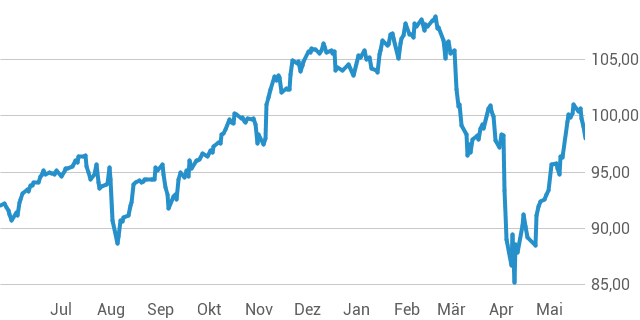

[Insert a chart here showing the historical NAV performance of the Amundi MSCI World II UCITS ETF USD Hedged Dist over 1-year, 3-year, and 5-year periods. Clearly label the axes and include a legend.]

Analysis of this chart should highlight periods of strong performance and periods of underperformance, comparing its trajectory against the MSCI World Index to demonstrate tracking accuracy. Mention significant market events (e.g., the COVID-19 pandemic) and their impact on the ETF's NAV.

Dividend Distribution Analysis

The Amundi MSCI World II UCITS ETF USD Hedged Dist distributes dividends [specify frequency, e.g., annually, semi-annually]. [Insert data on historical dividend payouts, if available].

- Payout Ratio: The ETF's dividend payout ratio [insert the ratio if available] shows the percentage of earnings distributed as dividends.

- Impact on Returns: Dividends contribute to overall investment returns, but their impact varies depending on the reinvestment strategy.

Expense Ratio and Fees

The ETF's expense ratio is [insert expense ratio here]. This is a key factor to consider, as it directly impacts overall returns. A comparison with similar ETFs will show how competitive its fees are.

- Fee Comparison: Compare the expense ratio to those of other MSCI World Index-tracking ETFs, highlighting any advantages or disadvantages.

- Impact on Returns: Even a small difference in expense ratios can significantly impact long-term investment returns due to the compounding effect.

Investment Considerations and Suitability

Risk Tolerance and Investment Goals

Investing in the Amundi MSCI World II UCITS ETF USD Hedged Dist involves a [moderate to high - specify level] level of risk, primarily due to the inherent volatility of global equity markets.

- Suitable Investors: This ETF is generally suitable for long-term, diversified investors with a moderate to high-risk tolerance.

- Portfolio Strategy: It can serve as a core holding within a globally diversified portfolio, providing broad market exposure.

Alternative Investments

Numerous other global equity ETFs track the MSCI World Index or similar benchmarks. Investors should compare several ETFs based on expense ratios, tracking accuracy, and dividend policies before making a decision.

- Comparison Factors: Key factors to compare include expense ratios, tracking error, dividend yield, and the specific replication method used by each ETF.

- Choosing the Right ETF: Thorough research and possibly consultation with a financial advisor are crucial for selecting the most suitable ETF for your individual needs and preferences.

Conclusion

This analysis of the Amundi MSCI World II UCITS ETF USD Hedged Dist reveals its potential as a core holding in a globally diversified portfolio. The USD hedging feature provides a significant advantage for non-USD investors seeking to mitigate currency risk. While the inherent volatility of global equity markets necessitates a moderate to high-risk tolerance, the ETF’s broad diversification and competitive expense ratio offer an attractive proposition for long-term investors.

Call to Action: Consider investing in the Amundi MSCI World II UCITS ETF USD Hedged Dist as part of your long-term investment strategy. However, remember to conduct further research and consult with a financial advisor before making any investment decisions. Always carefully review the fund's prospectus before investing.

Featured Posts

-

Pobeda Na Evrovidenii 2025 Prognoz Konchity Vurst I Chetyre Potentsialnykh Triumfatora

May 25, 2025

Pobeda Na Evrovidenii 2025 Prognoz Konchity Vurst I Chetyre Potentsialnykh Triumfatora

May 25, 2025 -

Police Helicopter Pursuit Drivers Text And Refuel At 90mph

May 25, 2025

Police Helicopter Pursuit Drivers Text And Refuel At 90mph

May 25, 2025 -

The Truth About Lauryn Goodmans Move To Italy Following Kyle Walkers Transfer

May 25, 2025

The Truth About Lauryn Goodmans Move To Italy Following Kyle Walkers Transfer

May 25, 2025 -

Frankfurt Equities Market Dax Continues Its Upward Trajectory

May 25, 2025

Frankfurt Equities Market Dax Continues Its Upward Trajectory

May 25, 2025 -

Walker Peters To Leeds Latest Transfer News And Updates

May 25, 2025

Walker Peters To Leeds Latest Transfer News And Updates

May 25, 2025

Latest Posts

-

Proposed Changes To Sentencing For Minors In France

May 25, 2025

Proposed Changes To Sentencing For Minors In France

May 25, 2025 -

Frances Juvenile Justice System Facing Calls For Reform

May 25, 2025

Frances Juvenile Justice System Facing Calls For Reform

May 25, 2025 -

Former French Pm Speaks Out Against Macrons Leadership

May 25, 2025

Former French Pm Speaks Out Against Macrons Leadership

May 25, 2025 -

Discrepancies Between Former French Pm And Macron Revealed

May 25, 2025

Discrepancies Between Former French Pm And Macron Revealed

May 25, 2025 -

Facing Retribution The Perils Of Advocating For Change

May 25, 2025

Facing Retribution The Perils Of Advocating For Change

May 25, 2025