Analysis: The Unexpected Surge In Bitcoin Mining This Week

Table of Contents

Increased Hashrate and Network Difficulty

The most immediate indicator of the Bitcoin mining surge is the dramatic increase in hashrate and network difficulty. Hashrate represents the total computational power dedicated to mining Bitcoin, while network difficulty adjusts to maintain a consistent block generation time (approximately 10 minutes). A higher hashrate necessitates a higher network difficulty to prevent the network from becoming overwhelmed.

-

Significant increase in Bitcoin's hashrate this week: Preliminary data suggests a 15% increase in hashrate over the past seven days, a substantial jump that points to a significant influx of mining power. This unprecedented rise in Bitcoin mining activity is worthy of further investigation.

-

Consequent rise in network difficulty: The increased hashrate has led to a corresponding rise in network difficulty, making it more challenging for individual miners to solve the complex cryptographic puzzles required to validate transactions and earn Bitcoin rewards. This reflects the intense competition within the Bitcoin mining ecosystem.

-

Potential correlation between hashrate increase and Bitcoin price fluctuations: While not directly causal, a correlation often exists. Rising Bitcoin prices often incentivize more mining activity, creating a feedback loop. Recent price increases may have played a role in this Bitcoin mining surge.

-

[Insert chart/graph visualizing hashrate and network difficulty changes. Source should be cited].

Influx of New Mining Hardware and Capacity

The recent surge in Bitcoin mining can be attributed, in part, to the arrival of new and more efficient mining hardware, specifically Application-Specific Integrated Circuits (ASICs). These specialized chips significantly enhance mining capabilities.

-

Release of new, more efficient ASIC miners: Several manufacturers have recently launched new ASIC miners with improved hash rates and power efficiency, making mining more profitable for operators. This influx of advanced technology directly fuels the Bitcoin mining surge.

-

Increased availability of mining hardware: Improved supply chain conditions and increased manufacturing capacity have made mining hardware more readily available, lowering the barrier to entry for new miners.

-

Impact of economies of scale in large mining operations: Large-scale mining farms benefit from economies of scale, allowing them to acquire hardware at lower costs and operate more efficiently. This competitive advantage contributes to the concentration of mining power.

-

Potential for geographically concentrated mining power shifts: The increased availability of efficient mining hardware could lead to shifts in geographical concentration of mining power, potentially impacting regulatory landscapes and energy consumption patterns.

Regulatory Changes and Their Impact

Regulatory landscapes play a significant role in the profitability and location of Bitcoin mining operations. Changes in regulations can dramatically impact the global hashrate distribution.

-

Easing of regulations in certain countries: Some jurisdictions have recently adopted more favorable regulatory frameworks for Bitcoin mining, making it a more attractive investment opportunity. This can lead to significant increases in mining activity within those regions and, consequently, contribute to the overall Bitcoin mining surge.

-

Impact of stricter regulations in other regions on global hashrate distribution: Conversely, stricter regulations in other areas can force miners to relocate, potentially shifting global hashrate distribution and impacting the overall network security. This highlights the complex interplay between regulation and the Bitcoin mining surge.

-

Discussion of potential future regulatory changes and their predicted effects on the Bitcoin mining surge: Future regulatory developments, both positive and negative, will continue to shape the landscape of Bitcoin mining, impacting the intensity of future surges.

Energy Price Fluctuations

Energy costs are a crucial factor determining the profitability of Bitcoin mining. Fluctuations in energy prices directly impact the attractiveness of this activity.

-

Correlation between energy price drops and increased mining profitability: Lower energy prices significantly increase mining profitability, encouraging more miners to join the network and contributing to the Bitcoin mining surge. This is especially true for energy-intensive operations.

-

Impact of renewable energy sources on the sustainability and cost-effectiveness of Bitcoin mining: The increasing adoption of renewable energy sources, such as solar and hydro power, is making Bitcoin mining more sustainable and cost-effective in certain regions, influencing the location of mining operations.

-

Regional variations in energy costs influencing mining location choices: The cost of energy varies dramatically across different regions. Miners tend to gravitate towards areas with cheap and abundant energy, creating regional hubs of mining activity. This geographic disparity contributes to the dynamics of the Bitcoin mining surge.

Speculation and Market Sentiment

Market sentiment and speculation play a significant role in driving Bitcoin mining activity. Positive market sentiment often leads to increased investment and participation.

-

Increased investor confidence leading to more capital investment in mining operations: Periods of high investor confidence often translate into increased capital investment in Bitcoin mining infrastructure, boosting overall hashrate. This financial injection is a significant factor in the current Bitcoin mining surge.

-

Anticipation of future price increases motivating miners to increase capacity: If miners anticipate future price increases, they are more likely to invest in additional mining hardware and expand their operations, contributing to a surge in mining activity.

-

The relationship between Bitcoin price and mining profitability, and its impact on the Bitcoin mining surge: A positive correlation exists between Bitcoin's price and the profitability of mining. Higher prices incentivize increased mining activity, creating a feedback loop that can amplify price movements.

Conclusion

The unexpected Bitcoin mining surge this week is a complex phenomenon driven by several interacting factors. The increase in hashrate and network difficulty, influx of new mining hardware, shifting regulatory landscapes, fluctuating energy prices, and positive market sentiment all contributed to this notable increase in activity. This surge underscores the dynamic nature of the Bitcoin network and its sensitivity to various economic and regulatory forces. The long-term implications of this increase in mining activity will likely impact the network's security and scalability, requiring ongoing observation and analysis.

Call to Action: Stay informed about the dynamic world of Bitcoin mining and its impact on the cryptocurrency market. Continue to follow our analysis for further insights into the evolving landscape of the Bitcoin mining surge and its future trends. Subscribe to our newsletter for updates on Bitcoin mining news and analysis.

Featured Posts

-

Warfares Emotional Core 5 Military Movies That Deliver

May 08, 2025

Warfares Emotional Core 5 Military Movies That Deliver

May 08, 2025 -

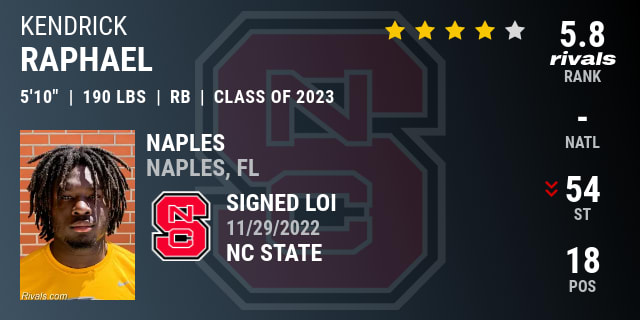

Nc State Recruiting Setback Loss Of Running Back Kendrick Raphael

May 08, 2025

Nc State Recruiting Setback Loss Of Running Back Kendrick Raphael

May 08, 2025 -

Broadcoms V Mware Acquisition At And T Exposes A 1 050 Price Hike

May 08, 2025

Broadcoms V Mware Acquisition At And T Exposes A 1 050 Price Hike

May 08, 2025 -

Darkseids Legion A Devastating Attack On Superman In Dcs July 2025 Comics

May 08, 2025

Darkseids Legion A Devastating Attack On Superman In Dcs July 2025 Comics

May 08, 2025 -

Darkseids Legions Attack New Details In Dcs July 2025 Superman Comics Solicitations

May 08, 2025

Darkseids Legions Attack New Details In Dcs July 2025 Superman Comics Solicitations

May 08, 2025

Latest Posts

-

Celtics Vs Nets Latest Injury Report And Tatums Playing Status

May 08, 2025

Celtics Vs Nets Latest Injury Report And Tatums Playing Status

May 08, 2025 -

Is Jayson Tatum Out Tonight Celtics Nets Injury News

May 08, 2025

Is Jayson Tatum Out Tonight Celtics Nets Injury News

May 08, 2025 -

Celtics Vs Nets Jayson Tatums Game Status And Injury Report

May 08, 2025

Celtics Vs Nets Jayson Tatums Game Status And Injury Report

May 08, 2025 -

Jayson Tatum Injury Update Will He Play Celtics Vs Nets

May 08, 2025

Jayson Tatum Injury Update Will He Play Celtics Vs Nets

May 08, 2025 -

Abc Promo Tnt Announcers Hilarious Take On Jayson Tatum And The Lakers Celtics Matchup

May 08, 2025

Abc Promo Tnt Announcers Hilarious Take On Jayson Tatum And The Lakers Celtics Matchup

May 08, 2025