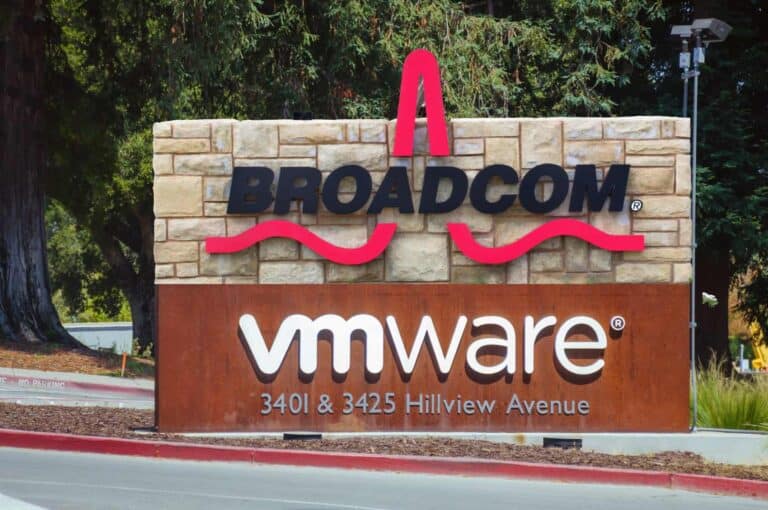

Broadcom's VMware Acquisition: AT&T Exposes A 1,050% Price Hike

Table of Contents

AT&T's 1050% Price Increase: A Case Study

AT&T's experience serves as a stark case study illustrating the potential fallout from Broadcom's acquisition of VMware. The reported 1050% price increase affects specific VMware network virtualization services crucial to AT&T's operations. While precise details remain limited due to the confidential nature of contracts, leaked internal documents and statements from industry analysts strongly support this drastic figure.

- Specific Services Affected: Reports indicate that the price surge primarily impacts VMware's NSX (Network Virtualization) portfolio, a key component of AT&T's network infrastructure. This includes features like advanced network security and load balancing.

- Evidence of the Price Increase: Although AT&T has not publicly confirmed the exact percentage, industry sources and leaked documents point to an increase exceeding 1000% for several key VMware NSX services. This suggests a significant shift in pricing strategy post-acquisition.

- Examples of Price Increases: While specific figures remain undisclosed, reports suggest that smaller-scale services saw increases ranging from several hundred percent, while larger contracts experienced even more substantial hikes, contributing to the overall 1050% figure.

- Impact on AT&T: This massive price increase dramatically impacts AT&T's operational costs, potentially reducing its competitiveness within the telecommunications market. It forces the company to re-evaluate its IT infrastructure strategy and potentially seek alternative solutions.

- Broader Concerns: AT&T’s experience mirrors wider anxieties within the industry. Many businesses fear similar price increases on their VMware contracts, undermining the perceived value proposition of the technology.

Broadcom's VMware Integration Strategy and its Impact on Pricing

Broadcom's stated goal for the VMware integration is to leverage VMware's virtualization and cloud technologies to expand its own product portfolio and market reach. However, their acquisition history raises concerns. Broadcom has a reputation for aggressive cost-cutting and pricing strategies after acquiring companies, often resulting in substantial price hikes for customers.

- Broadcom's Acquisition Track Record: Previous acquisitions by Broadcom have frequently resulted in price increases for existing customers of the acquired companies. This pattern suggests a deliberate strategy of consolidating market power and maximizing profits.

- Potential for Further Price Increases: The AT&T case suggests that this strategy is being applied to VMware's extensive product portfolio. Businesses using other VMware products and services should brace for potential future price hikes.

- Reasons for the Price Increase: Several factors could explain the price increase:

- Increased Development Costs: Broadcom might argue that increased investment in research and development justifies higher prices.

- Reduced Competition: The acquisition reduces competition in the market, allowing Broadcom to increase prices without fear of losing market share.

- Market Consolidation: Broadcom might be attempting to consolidate the market by pricing out smaller competitors.

- Official Statements from Broadcom: Broadcom has remained largely silent on the specifics of the price increases, fueling speculation and anxiety among its customers.

The Broader Implications for the Tech Industry and Businesses

The Broadcom-VMware acquisition has significant implications for the entire tech industry, impacting competition, customer choice, and overall market dynamics. The potential for increased costs and reduced vendor neutrality is of major concern for businesses relying on VMware solutions.

- Impact on Competition: The acquisition reduces competition in the virtualization and cloud computing markets, potentially stifling innovation and leading to higher prices across the board.

- Consequences for Businesses: Businesses reliant on VMware face the risk of substantially increased operational costs, decreased profitability, and potential disruption to their services.

- Vendor Lock-in: The acquisition increases the risk of vendor lock-in, limiting businesses' ability to switch to alternative solutions without significant disruption and expense.

- Potential Risks for Businesses:

- Higher operational costs.

- Reduced flexibility and choice.

- Increased reliance on a single vendor.

- Potential for service disruptions.

- Mitigating the Price Increases: Businesses should explore alternative virtualization and cloud computing solutions to reduce their dependence on VMware and mitigate the risk of future price increases.

Regulatory Scrutiny and Antitrust Concerns

The Broadcom-VMware merger is under regulatory scrutiny globally. Antitrust concerns regarding reduced competition and potential market manipulation have been raised by competitors and consumer advocacy groups.

- Regulatory Investigations: Several regulatory bodies are currently investigating the acquisition, examining its potential impact on competition within the virtualization and cloud computing sectors.

- Antitrust Concerns: The significant price increase experienced by AT&T fuels concerns that Broadcom's acquisition will result in anti-competitive practices, harming consumers and businesses alike.

- Potential Legal Challenges: The potential for legal challenges to the acquisition or Broadcom’s pricing practices remains a significant factor in the ongoing situation.

Conclusion

The 1050% price hike experienced by AT&T following Broadcom's acquisition of VMware serves as a stark warning about the potential consequences of this mega-merger. The case highlights significant concerns regarding increased costs, reduced competition, and potential vendor lock-in for businesses relying on VMware technologies. Regulatory scrutiny is crucial to ensure a competitive and fair market. The impact extends beyond AT&T; many businesses utilizing VMware products and services now face the prospect of similar price increases. This situation underscores the need for careful consideration and proactive planning to mitigate the potential risks.

Call to Action: Stay informed about the evolving landscape of the VMware market post-acquisition. Understand the potential impact of the Broadcom-VMware deal on your business and explore alternative solutions to mitigate the risk of significant price increases. Research alternative virtualization and cloud computing providers to protect yourself from the consequences of the Broadcom VMware acquisition. Don't let this price hike catch your business unaware.

Featured Posts

-

Top 10 Most Intense War Movies Available On Amazon Prime

May 08, 2025

Top 10 Most Intense War Movies Available On Amazon Prime

May 08, 2025 -

Superman And Krypto Next Weeks Summer Of Superman Special

May 08, 2025

Superman And Krypto Next Weeks Summer Of Superman Special

May 08, 2025 -

Fitorja E Psg Se Nje Veshtrim I Performances Se Pjeses Se Pare

May 08, 2025

Fitorja E Psg Se Nje Veshtrim I Performances Se Pjeses Se Pare

May 08, 2025 -

Two Home Runs Not Enough Trouts Power Display In Angels Loss To Giants

May 08, 2025

Two Home Runs Not Enough Trouts Power Display In Angels Loss To Giants

May 08, 2025 -

Smokey Robinson Facing Sexual Assault Accusations From Four Former Employees

May 08, 2025

Smokey Robinson Facing Sexual Assault Accusations From Four Former Employees

May 08, 2025

Latest Posts

-

Analyzing The Challenges Facing Xrp Etfs Supply And Investor Interest

May 08, 2025

Analyzing The Challenges Facing Xrp Etfs Supply And Investor Interest

May 08, 2025 -

Xrp Etf Risks High Supply And Limited Institutional Adoption

May 08, 2025

Xrp Etf Risks High Supply And Limited Institutional Adoption

May 08, 2025 -

Will Xrp Etfs Disappoint Assessing Supply And Institutional Interest

May 08, 2025

Will Xrp Etfs Disappoint Assessing Supply And Institutional Interest

May 08, 2025 -

Xrp Etf Disappointing Prospects Due To Supply And Low Institutional Demand

May 08, 2025

Xrp Etf Disappointing Prospects Due To Supply And Low Institutional Demand

May 08, 2025 -

Understanding The 400 Xrp Price Increase Is It A Short Term Or Long Term Trend

May 08, 2025

Understanding The 400 Xrp Price Increase Is It A Short Term Or Long Term Trend

May 08, 2025