Analyzing Apple Stock's (AAPL) Future Price Movement

Table of Contents

Apple's Financial Health and Performance

Understanding Apple's financial health is crucial to predicting its stock price. We'll analyze key metrics from recent financial reports to gauge its strength and future potential.

Revenue and Earnings Growth

Apple's revenue growth, net income, and earnings per share (EPS) are critical indicators of its financial performance. Examining trends in iPhone sales, services revenue, and other product categories provides insight into its overall health.

- iPhone Sales: While the iPhone remains Apple's flagship product, analyzing year-over-year growth and market share is vital. Any slowdown in iPhone sales could negatively impact AAPL earnings.

- Services Revenue: Apple's services sector, encompassing the App Store, Apple Music, iCloud, and other subscription services, is a significant revenue driver and demonstrates strong growth potential. Analyzing its growth trajectory is crucial for predicting AAPL’s future.

- Other Product Categories: The performance of products like iPads, Macs, wearables (Apple Watch, AirPods), and accessories also contributes significantly to Apple's overall revenue. Analyzing the growth or decline in these categories helps determine the overall financial health. Tracking Apple revenue growth across these segments is crucial for understanding the company's diversification strategy and its effect on its bottom line.

Analyzing Apple's financial statements, particularly its revenue and EPS, allows for a more robust forecast of future AAPL earnings. Consistent year-over-year growth in these areas is generally viewed as positive for stock price appreciation.

Cash Flow and Debt

A robust cash flow and manageable debt levels signify a financially stable company. Apple's strong cash position allows for future investments, acquisitions, and dividend payouts.

- Free Cash Flow: Apple's free cash flow (FCF) indicates its ability to generate cash after covering operational expenses and capital expenditures. Strong FCF is vital for future growth and shareholder returns.

- Capital Expenditures: Apple's investments in research and development, infrastructure, and other capital expenditures highlight its commitment to innovation and long-term growth. Monitoring capital expenditures relative to revenue can indicate the health and sustainability of the company's future growth.

- Debt-to-Equity Ratio: Analyzing Apple's debt-to-equity ratio provides insight into its financial leverage. A lower ratio suggests lower financial risk and improved financial stability, potentially bolstering investor confidence. Analyzing Apple’s debt load and its capacity to service it is critical for assessing long-term financial stability.

Analyzing Apple cash flow and its debt profile gives investors a clearer picture of its financial strength and its ability to fund future growth and return value to shareholders through dividends or stock buybacks.

Market Trends and Economic Factors

Macroeconomic conditions and market trends significantly impact Apple stock's performance.

Overall Market Sentiment

The overall health of the stock market, particularly the tech sector, directly influences investor sentiment towards Apple. A bullish market generally supports higher stock prices, while bearish conditions can lead to declines.

- Interest Rate Hikes: Interest rate increases by central banks can impact investor sentiment, potentially leading to a shift away from riskier assets like tech stocks. This is a crucial factor when forecasting AAPL stock.

- Inflation: High inflation can erode consumer spending, potentially impacting Apple's product sales and, subsequently, its stock price. This needs to be factored in any AAPL stock forecast.

- Geopolitical Events: Global events, such as political instability or trade wars, can create market uncertainty and influence investor decisions concerning AAPL and other tech companies.

Analyzing market sentiment, interest rates, inflation, and geopolitical risks is crucial for predicting the general direction of the stock market and its influence on AAPL's performance.

Industry Competition and Technological Innovation

Apple operates in a highly competitive landscape. Its innovation pipeline and ability to maintain a competitive edge are key factors influencing its stock price.

- Competition from Samsung and Google: Samsung and Google are major competitors to Apple in various product categories. Analyzing their market share and product launches helps determine Apple’s position.

- New Product Launches: Apple's new product releases, such as new iPhones, wearables, and services, significantly impact its market share and investor expectations. Anticipating these launches and their market reception is key to understanding future performance.

- Technological Innovation: Apple's commitment to R&D and its ability to consistently introduce innovative products and services are vital to maintaining its competitive advantage. Analyzing the technological innovation of competitors is crucial for determining the competitive landscape and its impact on Apple's market share.

Considering the competitive landscape and Apple's innovation pipeline is essential for a holistic prediction of AAPL stock's future performance.

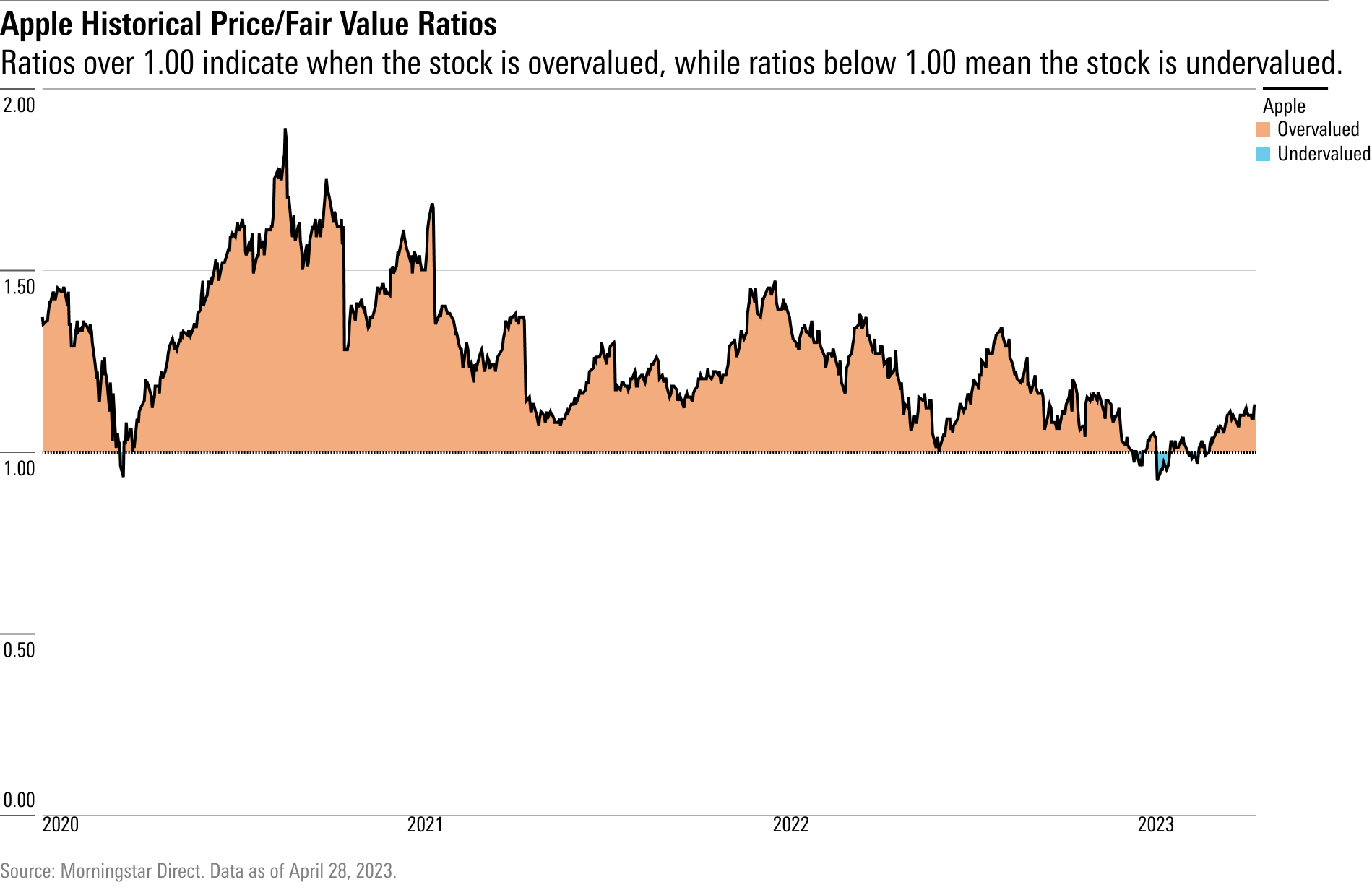

Technical Analysis of Apple Stock (AAPL)

Technical analysis employs chart patterns and indicators to predict future price movements.

Chart Patterns and Indicators

Technical indicators such as moving averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) can help identify potential trends and support/resistance levels.

- Moving Averages: Moving averages smooth out price fluctuations, helping to identify trends and potential support and resistance levels. This is a fundamental tool in technical analysis.

- RSI: The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. This can signal potential reversals in price trends.

- MACD: The MACD identifies momentum changes by comparing two moving averages. Crossovers of the MACD lines can indicate buy or sell signals.

Analyzing Apple stock charts using technical indicators provides additional insights into potential future price movements. Support and resistance levels, trend lines, and other patterns are also valuable indicators.

Volume and Price Action

Analyzing trading volume in conjunction with price movements provides crucial context for interpreting price action. High volume often confirms breakouts or reversals in price trends.

- Volume Confirmation: High volume during a price breakout confirms the strength of the move, suggesting a sustained trend. Conversely, low volume during a price move suggests weakness and potential for reversal.

Understanding the relationship between volume and price is key for validating technical signals and improving accuracy when predicting future price movement.

Conclusion: Predicting Apple Stock's (AAPL) Future

Predicting Apple stock's future price movement requires a comprehensive analysis of its financial health, market trends, and technical indicators. While this analysis offers insights, it's crucial to remember that predicting stock prices is inherently complex and uncertain. This analysis does not constitute financial advice.

Remember, market conditions are dynamic, and unforeseen events can significantly impact AAPL stock.

Continue your research and make informed decisions regarding AAPL stock, consulting with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Bangladesh Europe Collaboration A Path To Shared Economic Growth

May 24, 2025

Bangladesh Europe Collaboration A Path To Shared Economic Growth

May 24, 2025 -

Should You Buy Apple Stock After Wedbushs Price Target Revision

May 24, 2025

Should You Buy Apple Stock After Wedbushs Price Target Revision

May 24, 2025 -

Analyse Der Essener Leistungstraeger Golz Und Brumme

May 24, 2025

Analyse Der Essener Leistungstraeger Golz Und Brumme

May 24, 2025 -

Analiz Stati Gryozy Lyubvi Ili Ilicha V Gazete Trud

May 24, 2025

Analiz Stati Gryozy Lyubvi Ili Ilicha V Gazete Trud

May 24, 2025 -

Serious M56 Crash Car Overturns Paramedic Response Underway

May 24, 2025

Serious M56 Crash Car Overturns Paramedic Response Underway

May 24, 2025

Latest Posts

-

U S Senate Resolution Strengthening The Canada U S Partnership

May 24, 2025

U S Senate Resolution Strengthening The Canada U S Partnership

May 24, 2025 -

Museum Funding Crisis The Legacy Of Trumps Budgetary Decisions

May 24, 2025

Museum Funding Crisis The Legacy Of Trumps Budgetary Decisions

May 24, 2025 -

How Trumps Budget Cuts Reshape Museum Programming In America

May 24, 2025

How Trumps Budget Cuts Reshape Museum Programming In America

May 24, 2025 -

The Fate Of Museum Programs Post Trump Administration Budget Reductions

May 24, 2025

The Fate Of Museum Programs Post Trump Administration Budget Reductions

May 24, 2025 -

Federal Funding Cuts And The Future Of Museum Programs

May 24, 2025

Federal Funding Cuts And The Future Of Museum Programs

May 24, 2025