Should You Buy Apple Stock After Wedbush's Price Target Revision?

Table of Contents

Understanding Wedbush's Price Target Revision

Wedbush Securities, a prominent investment bank, recently revised its price target for Apple stock. This revision carries significant weight in the financial world, influencing investor sentiment and market perception of Apple's future prospects. Understanding the specifics of this change is crucial for any investor considering Apple stock.

Let's delve into the details:

- Previous Price Target: [Insert previous Wedbush price target here].

- Revised Price Target: [Insert Wedbush's revised price target here]. This represents a [percentage change]% increase/decrease compared to the previous target.

- Rationale Behind the Revision: Wedbush based its revised price target on several key factors:

- Strong iPhone Sales: [Insert data on recent iPhone sales and their positive impact on Apple's revenue].

- Anticipated Product Launches: Wedbush anticipates strong performance from upcoming product releases, such as the [mention expected new products]. These launches are expected to drive significant sales and boost Apple's market share.

- Positive Market Trends: The overall positive trend in the technology sector, combined with Apple's strong brand loyalty, contributed to Wedbush’s optimistic outlook.

- Comparison with Other Analysts: While Wedbush's revision is significant, it's essential to compare it with other analysts' price targets. [Summarize the range of price targets from other analysts and highlight any discrepancies].

Apple's Current Financial Performance and Future Outlook

Apple's recent financial reports paint a picture of a company performing well, despite global economic headwinds. To understand the implications of Wedbush's price target revision, let's examine key performance indicators:

- Key Financial Metrics:

- Revenue: [Insert Apple's recent revenue figures and year-over-year growth].

- Earnings Per Share (EPS): [Insert Apple's EPS and year-over-year growth].

- Profit Margins: [Insert Apple's profit margin data and any trends].

- Market Position and Competitive Landscape: Apple continues to dominate the smartphone market with a significant market share. [Insert market share data]. However, increasing competition from [mention key competitors] poses a challenge.

- Growth Drivers: Apple's future growth hinges on several key factors:

- New Product Launches: The success of new products like the [mention specific products] will significantly impact revenue growth.

- Services Revenue: Apple's services segment, including Apple Music, iCloud, and Apple Pay, is a crucial source of recurring revenue and demonstrates robust growth potential. [Insert data on services revenue growth].

- Expansion into New Markets: Expanding into new markets and strengthening its presence in existing ones presents further opportunities for growth.

Assessing the Risks and Rewards of Investing in Apple Stock

While the outlook for Apple stock seems positive based on Wedbush's revision and its financial performance, investors should carefully weigh the potential risks:

- Potential Downsides:

- Market Volatility: The stock market is inherently volatile, and Apple's stock price can fluctuate significantly based on various macroeconomic factors.

- Competition: Increased competition from other tech giants could negatively impact Apple's market share and profitability.

- Economic Downturns: A global economic downturn could dampen consumer spending, affecting demand for Apple products.

- Risk Tolerance: Investors should assess their own risk tolerance before investing in Apple stock. A higher risk tolerance might be appropriate for investors with a longer-term horizon and a greater capacity to absorb potential losses.

- Diversification: It's crucial to diversify your investment portfolio to mitigate the risk associated with investing in a single stock, even one as seemingly stable as Apple.

Alternative Investment Strategies and Expert Opinions

While Apple stock presents an attractive investment opportunity based on Wedbush's positive outlook, investors should explore alternative strategies:

- Alternative Tech Stocks: Consider diversifying your portfolio with other promising technology stocks, such as [mention alternative tech companies].

- Other Analyst Opinions: [Summarize opinions from other financial analysts regarding Apple stock, highlighting any dissenting views].

- Diversification Strategies: Consider index funds or ETFs that offer broad exposure to the technology sector as part of a diversified portfolio.

Conclusion: Should You Buy Apple Stock After Wedbush's Price Target Revision?

Wedbush's revised price target for Apple stock reflects a positive outlook based on strong sales, anticipated product launches, and overall market trends. However, investors must acknowledge the inherent risks associated with any stock investment, including market volatility, competition, and economic uncertainty. Apple's strong financial performance and growth potential are attractive, but a balanced approach is necessary. Before making any decisions, conduct thorough research, consider your personal risk tolerance, and consult with a qualified financial advisor. Ultimately, the decision of whether or not to buy Apple stock rests with you. Conduct thorough research and consult with a financial professional before making any investment decisions related to Apple stock.

Featured Posts

-

Heineken Tops Revenue Expectations Reaffirms Outlook Despite Tariff Worries

May 24, 2025

Heineken Tops Revenue Expectations Reaffirms Outlook Despite Tariff Worries

May 24, 2025 -

Porsche 911 Extrak Amik 80 Millio Forintba Kerueltek

May 24, 2025

Porsche 911 Extrak Amik 80 Millio Forintba Kerueltek

May 24, 2025 -

European Leaders Receive Exclusive Briefing Putins War Strategy Unchanged Says Trump

May 24, 2025

European Leaders Receive Exclusive Briefing Putins War Strategy Unchanged Says Trump

May 24, 2025 -

The Woody Allen Dylan Farrow Case Sean Penns Perspective

May 24, 2025

The Woody Allen Dylan Farrow Case Sean Penns Perspective

May 24, 2025 -

Federal Investigation Millions Lost In Office365 Executive Account Compromise

May 24, 2025

Federal Investigation Millions Lost In Office365 Executive Account Compromise

May 24, 2025

Latest Posts

-

Federal Investigation Millions Lost In Office365 Executive Account Compromise

May 24, 2025

Federal Investigation Millions Lost In Office365 Executive Account Compromise

May 24, 2025 -

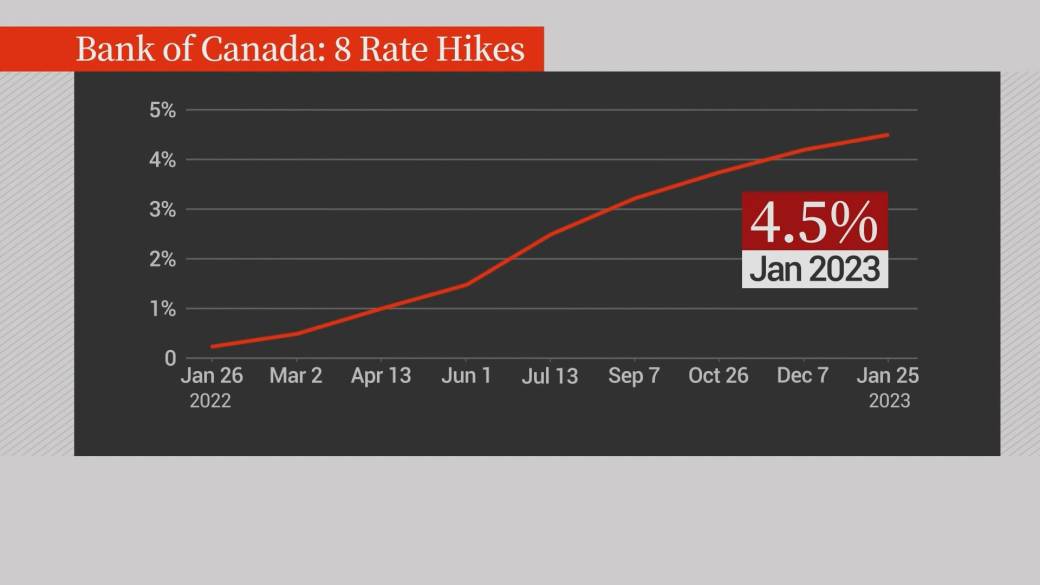

Desjardins Forecasts Three Additional Bank Of Canada Interest Rate Cuts

May 24, 2025

Desjardins Forecasts Three Additional Bank Of Canada Interest Rate Cuts

May 24, 2025 -

Long Term Effects Of Toxic Chemicals From Ohio Train Derailment On Buildings

May 24, 2025

Long Term Effects Of Toxic Chemicals From Ohio Train Derailment On Buildings

May 24, 2025 -

Section 230 And Banned Chemicals The Impact On E Bay Listings

May 24, 2025

Section 230 And Banned Chemicals The Impact On E Bay Listings

May 24, 2025 -

Ohio Derailment Investigation Into Lingering Toxic Chemicals In Buildings

May 24, 2025

Ohio Derailment Investigation Into Lingering Toxic Chemicals In Buildings

May 24, 2025