BigBear.ai investment and AI stock analysis.

BigBear.ai investment and AI stock analysis.

BigBear.ai operates in the rapidly expanding market of AI and big data solutions, primarily serving government and commercial clients. Its business model centers around providing sophisticated AI-powered analytics and decision support tools. This BigBear.ai business model leverages advanced technologies to help clients tackle complex challenges across various sectors.

However, navigating the competitive landscape of the AI and big data market presents both opportunities and challenges. BigBear.ai faces stiff competition from established tech giants and agile startups alike.

Competitive Advantages and Disadvantages:

Key Competitors and Market Share:

BigBear.ai competes with a range of companies, including both large multinational corporations and smaller, specialized firms. Precise market share data is often difficult to obtain, but analyzing competitor offerings reveals a landscape of both direct and indirect rivals. Identifying their strengths and weaknesses is crucial in understanding BigBear.ai's position.

Assessing BigBear.ai's financial health requires a thorough review of its financial statements, available through SEC filings. Examining revenue growth, profitability, and cash flow trends over several years paints a picture of the company's financial performance.

Key Financial Metrics:

Valuation Metrics:

Common valuation metrics like the Price-to-Earnings (P/E) ratio provide a comparative benchmark against industry peers. These metrics need to be interpreted cautiously, factoring in the company’s growth trajectory, market conditions, and overall risk profile.

The future of BigBear.ai hinges on several factors, including market trends, company strategy, and emerging technologies.

Growth Drivers:

Risks and Challenges:

Based on the analysis, a decision on whether to invest in BigBear.ai stock requires careful consideration. Remember, the information provided here should not be taken as financial advice.

Investment Strategies:

Pros and Cons of Investing in BigBear.ai Stock:

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Always conduct thorough due diligence and consider consulting a financial advisor before making any investment decisions. Consider alternative investment options within the AI and Big Data sector before committing to a single stock.

BigBear.ai operates in a dynamic and promising sector, but investing in its stock carries inherent risks. While the company possesses strong technological capabilities and government relationships, it faces intense competition and economic uncertainties. The decision of whether to invest in BigBear.ai stock ultimately depends on your individual risk tolerance, investment goals, and the results of your own thorough due diligence. Before making any investment decisions related to BigBear.ai stock or BigBear.ai investment, conduct your own comprehensive research and assess if it aligns with your overall investment strategy. Consider consulting with a qualified financial advisor for personalized guidance in the field of AI stock analysis.

Amazon Worker Union Challenges Warehouse Closures In Quebec Labour Tribunal

Amazon Worker Union Challenges Warehouse Closures In Quebec Labour Tribunal

Todays Nyt Mini Crossword Answers For March 8

Todays Nyt Mini Crossword Answers For March 8

I Xronia Kakodaimonia Ton Sidirodromon Stin Ellada Aities Kai Lyseis

I Xronia Kakodaimonia Ton Sidirodromon Stin Ellada Aities Kai Lyseis

Mondays Market Sell Off Why D Wave Quantum Qbts Shares Took A Hit

Mondays Market Sell Off Why D Wave Quantum Qbts Shares Took A Hit

Nyt Crossword Solutions April 25 2025

Nyt Crossword Solutions April 25 2025

Son Dakika Juergen Klopp Un Gelecegi Ve Yeni Takimi

Son Dakika Juergen Klopp Un Gelecegi Ve Yeni Takimi

Juergen Klopp Nereye Gidecek En Guencel Transfer Haberleri

Juergen Klopp Nereye Gidecek En Guencel Transfer Haberleri

Juergen Klopp Un Yeni Takimi Son Dakika Transfer Detaylari

Juergen Klopp Un Yeni Takimi Son Dakika Transfer Detaylari

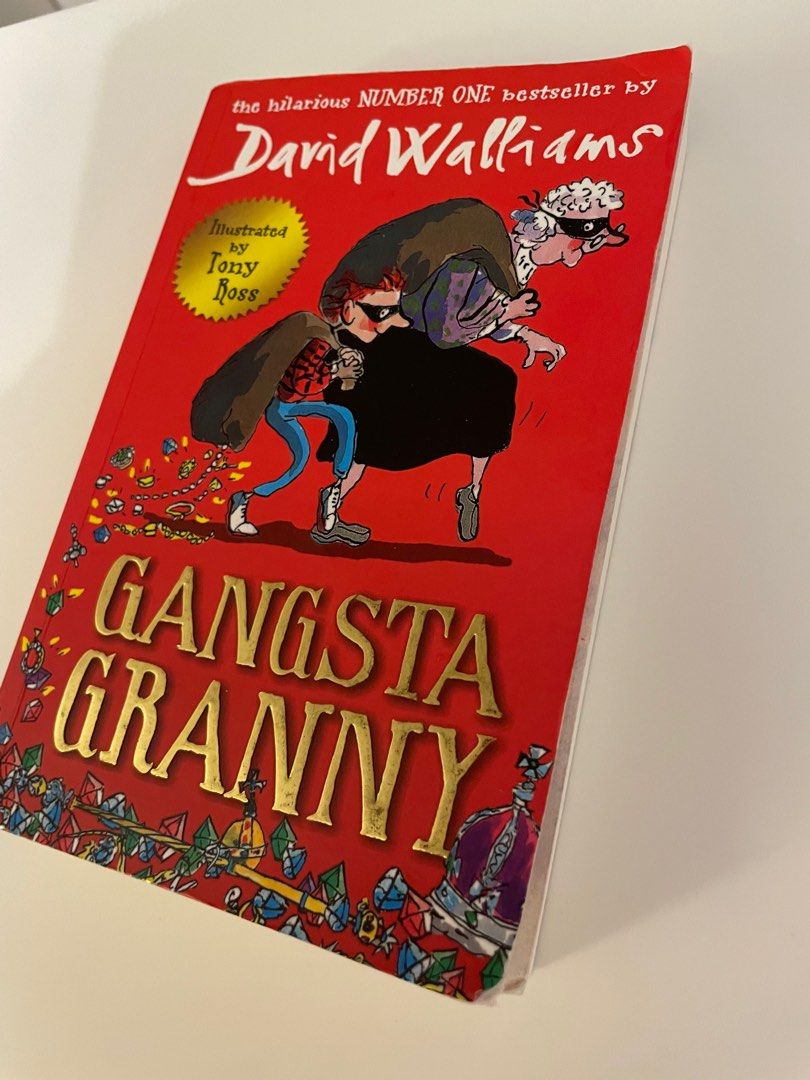

Understanding The Themes In David Walliams Gangsta Granny

Understanding The Themes In David Walliams Gangsta Granny

Gangsta Granny Activities Fun Projects Inspired By The Book

Gangsta Granny Activities Fun Projects Inspired By The Book