Analyzing NCLH Stock: What Are Hedge Funds Saying?

Table of Contents

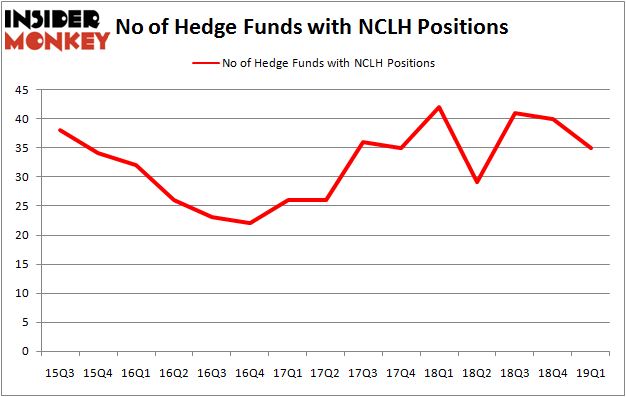

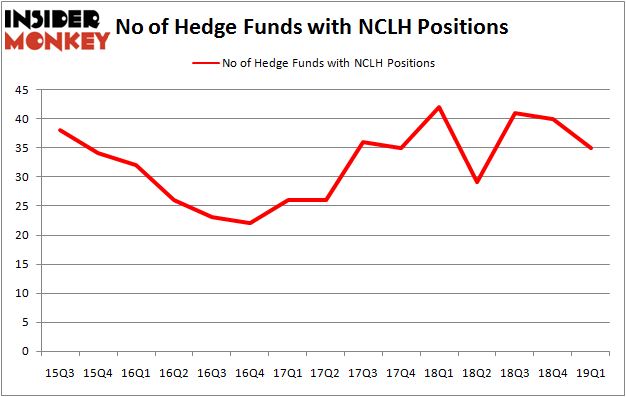

Recent Hedge Fund Activity in NCLH

Tracking hedge fund activity offers valuable insights into market sentiment surrounding NCLH stock. Analyzing their investment decisions helps gauge the overall confidence (or lack thereof) in the company's future prospects. While precise real-time data on all hedge fund holdings is not publicly available due to reporting lags, piecing together information from various sources can paint a useful picture.

Currently, we observe a mixed picture in the recent hedge fund activity concerning NCLH stock. While some prominent hedge funds have increased their holdings, indicating a bullish outlook, others have reduced their positions, signaling a degree of caution. Access to real-time data on hedge fund holdings requires specialized financial data providers, but publicly available news sources can offer valuable clues.

- XYZ Hedge Fund: Increased its NCLH holdings by 15% in Q3 2024 (Source: [Insert Link to Financial News Source]). This suggests a positive outlook on NCLH's recovery and future growth.

- ABC Capital: Reduced its NCLH stake by 8% in Q3 2024 (Source: [Insert Link to Financial News Source]). This could reflect concerns about near-term challenges or a desire to diversify their portfolio.

- Several smaller hedge funds: Initiated new positions in NCLH during Q3 2024 (Source: [Insert Link to Financial News Source]). This might indicate that they perceive NCLH as undervalued or believe the cruise industry's recovery is underestimated.

Remember to always verify such information using multiple reputable financial sources. Hedge fund reporting often involves delays, and the exact figures may vary depending on the data provider.

Interpreting Hedge Fund Signals

Understanding the rationale behind hedge fund decisions concerning NCLH stock is essential. Several factors contribute to their investment choices:

-

Macroeconomic conditions: Global economic growth, inflation rates, and interest rate changes can all influence investor sentiment towards NCLH and the broader cruise industry. A robust global economy generally benefits discretionary spending, while rising interest rates can increase borrowing costs for NCLH.

-

Industry-specific trends: The post-pandemic recovery of the cruise industry is a significant driver. Factors like booking trends, occupancy rates, and the pace of fleet expansion directly impact NCLH's performance and attractiveness to investors.

-

NCLH's financial performance: The company's revenue growth, profitability, debt levels, and cash flow all play crucial roles in shaping hedge fund decisions. Strong financial results often attract investors, while weak performance may lead to divestment.

-

Bullish sentiment: Increased holdings might reflect optimism about the cruise industry's rebound, anticipating strong future demand for cruises and believing NCLH is well-positioned to capitalize on this growth.

-

Bearish sentiment: Decreased holdings could suggest concerns about rising fuel costs, increased debt levels, or the potential for unforeseen disruptions to the cruise industry.

-

Undervaluation thesis: Increased holdings could indicate a belief that NCLH stock is currently undervalued in the market, offering a compelling investment opportunity.

NCLH's Fundamental Performance and Valuation

A thorough NCLH stock analysis must include a critical assessment of the company's financial fundamentals and valuation. Key metrics to consider include:

- Revenue and Earnings Growth: Analyze historical trends and projected future growth. Consider factors like passenger volume, average ticket prices, and onboard spending.

- Debt Levels and Liquidity: Assess NCLH's debt-to-equity ratio and its ability to service its debt obligations.

- Profitability Ratios: Examine key profitability metrics like gross profit margin and net profit margin. Compare these to historical data and industry competitors.

- Booking Trends and Occupancy Rates: Monitor the company's booking trends and occupancy rates as key indicators of demand and future revenue.

- Price-to-Earnings (P/E) Ratio: Compare NCLH's P/E ratio to its competitors to determine if it is overvalued or undervalued.

Risks and Considerations for NCLH Investors

Investing in NCLH stock, like any investment, carries inherent risks. The cruise industry is particularly susceptible to several factors:

-

Economic downturns: Recessions and economic uncertainty can significantly impact discretionary spending, leading to lower demand for cruises.

-

Geopolitical events: Global instability and political tensions can disrupt travel and negatively impact NCLH's operations.

-

Health crises: The COVID-19 pandemic highlighted the vulnerability of the cruise industry to health crises, which can lead to operational disruptions and significant financial losses.

-

Fuel price volatility: Fluctuations in fuel prices directly impact NCLH's operating costs and profitability.

-

Operational Risks: Accidents, safety concerns, and negative publicity can damage the company's reputation and deter passengers.

-

Competition: The cruise industry is competitive, with several major players vying for market share. NCLH's ability to compete effectively is crucial for its long-term success.

Conclusion: Analyzing NCLH Stock: The Hedge Fund Perspective and Your Next Steps

Analyzing NCLH stock requires a comprehensive approach. While hedge fund activity provides valuable insights into market sentiment, it's crucial to complement this analysis with a thorough examination of NCLH's fundamental performance, valuation, and the inherent risks associated with investing in the cruise industry. Remember that hedge fund positions are not guarantees of future performance. They merely offer a glimpse into the thinking of some sophisticated investors.

To make informed investment decisions regarding NCLH stock, conduct thorough independent research, consider your own risk tolerance, and, if needed, seek professional financial advice. Don't rely solely on hedge fund insights for your Norwegian Cruise Line Holdings investment strategy; use them as one piece of the larger puzzle in your NCLH stock analysis.

Featured Posts

-

Brtanwy Arkan Parlymnt Ka Kshmyr Ke Tnazee Ke Hl Ky Hmayt

May 01, 2025

Brtanwy Arkan Parlymnt Ka Kshmyr Ke Tnazee Ke Hl Ky Hmayt

May 01, 2025 -

Hugh Jackmans Easter Film A Netflix Top 10 Comeback

May 01, 2025

Hugh Jackmans Easter Film A Netflix Top 10 Comeback

May 01, 2025 -

Death Of Priscilla Pointer Dallas And The Carrie Diaries Actress Dies

May 01, 2025

Death Of Priscilla Pointer Dallas And The Carrie Diaries Actress Dies

May 01, 2025 -

Xrp Price Prediction Dubai License And Technical Analysis Point To 10 Potential

May 01, 2025

Xrp Price Prediction Dubai License And Technical Analysis Point To 10 Potential

May 01, 2025 -

Lich Su Nha Vo Dich Dau Tien Giai Bong Da Thanh Nien Sinh Vien Quoc Te

May 01, 2025

Lich Su Nha Vo Dich Dau Tien Giai Bong Da Thanh Nien Sinh Vien Quoc Te

May 01, 2025

Latest Posts

-

Addressing The Challenges Of Outdated Apps In The Age Of Ai

May 01, 2025

Addressing The Challenges Of Outdated Apps In The Age Of Ai

May 01, 2025 -

Outdated Business Applications The Hidden Cost Of Ai Failure

May 01, 2025

Outdated Business Applications The Hidden Cost Of Ai Failure

May 01, 2025 -

German Politics The Spds Role In The New Government

May 01, 2025

German Politics The Spds Role In The New Government

May 01, 2025 -

Lars Klingbeil Neuer Vorsitzender Der Spd Bundestagsfraktion

May 01, 2025

Lars Klingbeil Neuer Vorsitzender Der Spd Bundestagsfraktion

May 01, 2025 -

Bayern President Rejects Far Right Af D Involvement In Club Governance

May 01, 2025

Bayern President Rejects Far Right Af D Involvement In Club Governance

May 01, 2025