XRP Price Prediction: Dubai License And Technical Analysis Point To $10 Potential

Table of Contents

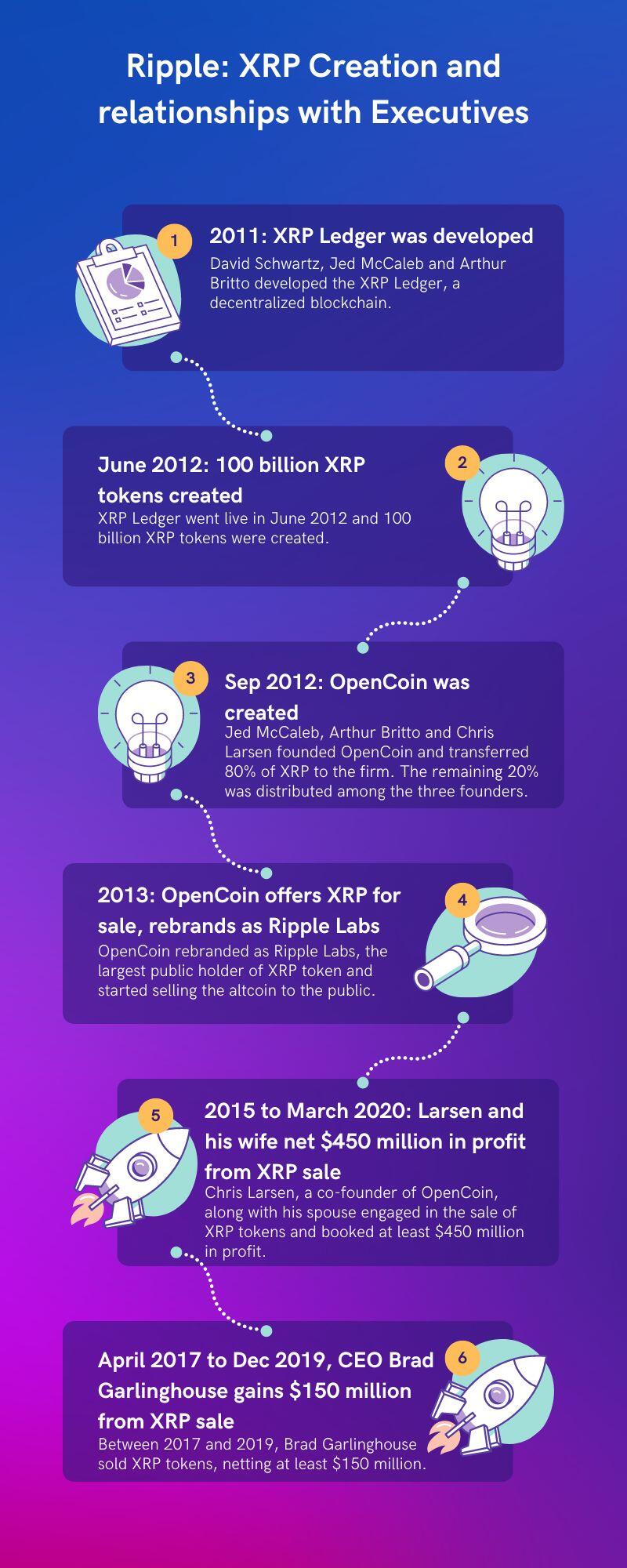

The Impact of the Dubai License on XRP's Price

The acquisition of a Virtual Asset Service Provider (VASP) license in Dubai represents a significant milestone for Ripple and XRP. This development holds substantial implications for XRP's price, primarily through increased regulatory clarity and broader adoption.

Regulatory Clarity and Increased Adoption

The Dubai license signals a notable step towards regulatory acceptance of Ripple and XRP. This increased legitimacy is likely to bolster investor confidence, attracting institutional investors who previously hesitated due to regulatory uncertainty.

- Increased legitimacy boosts investor confidence: Institutional investors often require regulatory clarity before committing significant capital to cryptocurrencies. The Dubai license reduces this risk, making XRP more attractive.

- Opens doors to new partnerships and collaborations within the Middle East: The license provides Ripple with a legal framework to expand its operations within the Middle East, a region with a rapidly growing fintech sector. This opens up numerous opportunities for strategic partnerships and collaborations.

- Expands the utility of XRP within the region's financial ecosystem: The Dubai license facilitates the use of XRP for cross-border payments and other financial transactions within the region, boosting its practical application and demand.

Dubai as a Global Fintech Hub

Dubai's strategic position as a global fintech hub is another critical factor. Its forward-thinking regulatory environment and ambition to become a leading cryptocurrency center create a fertile ground for XRP's growth.

- Access to a large and rapidly growing market: Dubai offers access to a substantial and rapidly expanding market for financial technology solutions.

- Potential for strategic partnerships with major financial institutions based in Dubai: The license increases the likelihood of partnerships with major banks and financial institutions based in Dubai, further driving XRP adoption.

- Enhanced network effects and liquidity: Increased adoption within a major financial hub like Dubai leads to enhanced network effects, increasing liquidity and potentially driving up the XRP price.

Technical Analysis: Chart Patterns Suggesting Potential for $10

While fundamental factors are important, technical analysis provides another lens through which to assess XRP's price potential. Examining key indicators offers insights into potential future price movements.

Analyzing Key Indicators

Analyzing XRP's price charts using technical indicators like moving averages (e.g., 50-day and 200-day MA), the Relative Strength Index (RSI), and trading volume can reveal potential bullish or bearish trends.

- Detailed explanation of specific indicators and their implications for price movements: A bullish crossover of the 50-day and 200-day moving averages, for instance, often suggests a strengthening upward trend. An RSI above 70 may indicate overbought conditions, while below 30 suggests oversold conditions. High trading volume during price increases confirms the strength of the upward momentum.

- Examination of support and resistance levels: Identifying key support and resistance levels on the chart can help predict potential price reversals or breakouts.

- Charts and graphs visualizing the technical analysis: Visual representations of price movements and technical indicators are crucial for understanding the analysis. (Note: Charts and graphs would be included here in a published article).

Historical Price Performance and Future Projections

Reviewing XRP's past price performance and comparing it to similar altcoin price rallies offers valuable insights. Identifying factors that contributed to past successes and failures helps formulate more accurate future projections.

- Comparison to previous bull markets and potential parallels: Analyzing past bull markets in the cryptocurrency space can help identify potential parallels with the current market conditions.

- Discussion of potential risks and downside scenarios: It's crucial to acknowledge potential risks, such as a broader cryptocurrency market downturn or negative regulatory developments.

- Inclusion of various price prediction models and their methodologies: Different predictive models, including those based on technical indicators, fundamental analysis, and sentiment analysis, can provide a more comprehensive outlook.

Factors that Could Influence XRP's Price Beyond $10

Reaching $10 is an ambitious target, but several factors beyond the Dubai license could propel XRP's price even higher.

Wider Cryptocurrency Market Trends

The overall cryptocurrency market significantly influences XRP's price. A positive market sentiment often benefits altcoins like XRP.

- Analysis of Bitcoin's influence on altcoin prices: Bitcoin’s price movements often dictate the overall trend in the altcoin market.

- Discussion of macroeconomic factors impacting the crypto market: Global economic conditions, inflation, and interest rate policies can significantly impact investor sentiment towards cryptocurrencies.

- Considerations of potential regulatory changes globally: Regulatory developments worldwide play a crucial role in shaping the cryptocurrency market landscape.

Ripple's Technological Developments

Continuous innovation and improvements to Ripple's technology are critical for increasing XRP's adoption and utility.

- Discussion of new features and upgrades to the RippleNet platform: Enhancements to RippleNet's speed, efficiency, and functionality can attract more users and financial institutions.

- Highlighting potential partnerships and collaborations with other companies: Strategic alliances can expand RippleNet's reach and integrate XRP into a wider range of financial applications.

- Analysis of the scalability and efficiency of the XRP Ledger: The XRP Ledger's scalability and transaction speed are vital for its long-term viability and adoption.

Conclusion

The Dubai license, coupled with a positive technical outlook, strengthens the case for a potential XRP price surge. While reaching $10 is a significant target, the combination of regulatory clarity, expanding adoption, and positive technical indicators suggests a substantial upside potential. However, remember that cryptocurrency investments are inherently risky. Always conduct thorough research and maintain a diversified portfolio. Conduct your own due diligence before investing in XRP and stay updated on the latest developments. Is XRP's journey to $10 realistic? The confluence of factors suggests a strong possibility. Keep following our analysis for updated XRP price predictions and insights into the future of this exciting cryptocurrency.

Featured Posts

-

Where To Stream Michael Sheen And Sharon Horgans Compelling British Drama

May 01, 2025

Where To Stream Michael Sheen And Sharon Horgans Compelling British Drama

May 01, 2025 -

Should You Buy Xrp Ripple Right Now While Its Under 3

May 01, 2025

Should You Buy Xrp Ripple Right Now While Its Under 3

May 01, 2025 -

Xrps Meteoric Rise A Deep Dive Into Ripples 15 000 Growth And Future Potential

May 01, 2025

Xrps Meteoric Rise A Deep Dive Into Ripples 15 000 Growth And Future Potential

May 01, 2025 -

Colorados Trip To Texas Tech Toppin Leads With 21 Points

May 01, 2025

Colorados Trip To Texas Tech Toppin Leads With 21 Points

May 01, 2025 -

Technical Failure Grounds Train Stranding Passengers In Kogi

May 01, 2025

Technical Failure Grounds Train Stranding Passengers In Kogi

May 01, 2025

Latest Posts

-

Legendary Dallas Figure Dies At 100

May 01, 2025

Legendary Dallas Figure Dies At 100

May 01, 2025 -

Dallas Mourns The Loss Of Its 100 Year Old Star

May 01, 2025

Dallas Mourns The Loss Of Its 100 Year Old Star

May 01, 2025 -

Death Of Beloved Dallas Star At 100

May 01, 2025

Death Of Beloved Dallas Star At 100

May 01, 2025 -

Centenarian Dallas Star Passes Away

May 01, 2025

Centenarian Dallas Star Passes Away

May 01, 2025 -

Dallas Icon Passes Away At Age 100

May 01, 2025

Dallas Icon Passes Away At Age 100

May 01, 2025