Analyzing QBTS Stock Performance After Upcoming Earnings

Table of Contents

Factors Influencing QBTS Stock Price Post-Earnings

The price movement of QBTS stock following the earnings report will depend on a complex interplay of several factors. Let's examine the key influencers:

Earnings Results: Dissecting the Numbers

The most immediate factor affecting QBTS stock price is the actual earnings report itself. Meeting or exceeding expectations is crucial. Key metrics to watch include:

- EPS (Earnings Per Share): A higher-than-expected EPS generally boosts stock prices, while a lower EPS can lead to significant drops.

- Revenue Growth: Consistent revenue growth indicates a healthy and expanding business, positively impacting investor sentiment. A decline in revenue, however, raises concerns.

- Profitability: Analyzing profit margins helps investors understand the company's efficiency and ability to generate profits from its revenue. Strong profit margins are generally viewed favorably.

Market Sentiment: The Broader Economic Context

The overall market climate and investor sentiment play a significant role. Even strong earnings can be overshadowed by broader market downturns.

- Market Volatility: High market volatility can amplify the impact of the earnings report, leading to more dramatic price swings.

- Investor Confidence: Positive investor sentiment towards the overall economy and the specific sector QBTS operates in contributes to higher stock prices.

- Market Trends: Prevailing market trends, such as sector-specific growth or decline, can influence the reaction to QBTS's earnings.

Analyst Ratings and Recommendations: Expert Opinions

Post-earnings, analyst ratings and recommendations significantly influence investor behavior.

- Analyst Upgrades: Positive upgrades from leading analysts typically boost investor confidence and lead to price increases.

- Buy/Sell Recommendations: Strong buy recommendations can drive up demand, while sell recommendations can trigger selling pressure.

- Stock Ratings: Changes in overall stock ratings from major financial institutions affect the perception of QBTS among investors.

Company Guidance: Looking Ahead

QBTS's future outlook and guidance play a vital role in shaping investor expectations.

- Future Outlook: Management's commentary on future prospects and anticipated growth significantly impacts investor confidence.

- Company Guidance: Specific numerical targets provided by the company for upcoming quarters or years set expectations for future performance.

- Forward Guidance: Realistic and achievable forward guidance increases investor trust and minimizes volatility.

Competitive Landscape: The Battle for Market Share

The performance of QBTS's competitors influences its stock price.

- Market Competition: Intense competition can squeeze profit margins and impact growth prospects, affecting stock performance.

- Industry Trends: Favorable industry trends benefit QBTS, while negative trends can lead to reduced investor interest.

- Competitive Advantage: QBTS's unique competitive strengths or weaknesses influence its ability to navigate the competitive landscape.

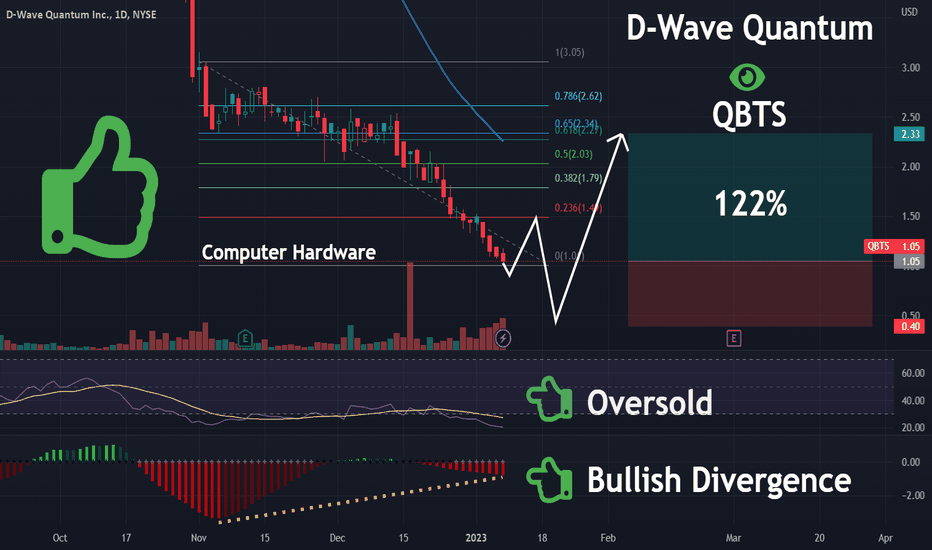

Technical Analysis of QBTS Stock

Technical analysis can provide insights into potential QBTS stock price movements.

Chart Patterns: Visualizing Price Trends

Identifying chart patterns can help predict future price directions.

- Support and Resistance Levels: These levels indicate potential price floors and ceilings, offering insights into potential price reversals.

- Trendlines: Uptrends suggest bullish momentum, while downtrends signal bearish sentiment.

Indicators: Gauging Momentum and Sentiment

Technical indicators offer valuable insights into momentum and sentiment.

- Moving Averages: These help smooth out price fluctuations and identify trends.

- RSI (Relative Strength Index): This indicator helps assess whether QBTS stock is overbought or oversold.

- MACD (Moving Average Convergence Divergence): This indicator helps identify potential buy and sell signals.

Volume Analysis: Understanding Trading Activity

Analyzing trading volume helps understand the strength behind price movements.

- Trading Volume: High volume during price increases suggests strong buying pressure, while high volume during price decreases indicates significant selling pressure.

- Volume Analysis: Comparing price movements with trading volume helps gauge the conviction behind price changes.

- Price Momentum: Strong volume alongside significant price changes confirms the strength of the movement.

Fundamental Analysis of QBTS Stock

Fundamental analysis focuses on the company's intrinsic value and long-term prospects.

Financial Statements: The Heart of Fundamental Analysis

Carefully reviewing QBTS's financial statements is essential.

- Financial Statements: The balance sheet, income statement, and cash flow statement reveal the company's financial health.

- Balance Sheet: Provides information on assets, liabilities, and equity.

- Income Statement: Shows revenue, expenses, and profits over a specific period.

- Cash Flow Statement: Highlights cash inflows and outflows, revealing the company's cash generation abilities.

Valuation Metrics: Determining Fair Value

Several valuation metrics provide insights into QBTS's fair value.

- Valuation Metrics: These help determine if QBTS stock is undervalued or overvalued.

- P/E Ratio (Price-to-Earnings Ratio): A common valuation metric that compares the stock price to earnings per share.

- Market Capitalization: Represents the total market value of all outstanding shares.

- Intrinsic Value: The underlying value of the company, independent of its market price.

Long-Term Growth Potential: Assessing Future Prospects

Assessing QBTS's long-term growth potential is crucial for long-term investors.

- Long-Term Growth: Factors like innovation, market expansion, and competitive advantages contribute to long-term growth.

- Future Prospects: Analyzing future market opportunities and potential challenges helps assess the company's future earnings potential.

- Sustainable Growth: The ability to maintain consistent growth over the long term is vital for long-term investment success.

Conclusion: Navigating QBTS Stock After Earnings Release

Analyzing QBTS stock performance post-earnings requires a thorough understanding of various factors, including earnings results, market sentiment, analyst ratings, company guidance, and competitive landscape. Both technical and fundamental analysis are vital for making informed investment decisions. Remember that careful consideration, diversification, and thorough research are key to navigating the complexities of the stock market. Conduct comprehensive research, develop a well-informed QBTS investment strategy, and analyze QBTS stock meticulously before making any investment decisions. Stay updated on QBTS stock outlook and refine your QBTS stock analysis as new information becomes available.

Featured Posts

-

Is Big Bear Ai Bbai Among The Best Ai Penny Stocks To Buy Right Now

May 21, 2025

Is Big Bear Ai Bbai Among The Best Ai Penny Stocks To Buy Right Now

May 21, 2025 -

Qbts Stocks Upcoming Earnings What To Expect

May 21, 2025

Qbts Stocks Upcoming Earnings What To Expect

May 21, 2025 -

Canadas Position On Us Tariffs A Rebuttal To Recent Report

May 21, 2025

Canadas Position On Us Tariffs A Rebuttal To Recent Report

May 21, 2025 -

Wayne Gretzky And Donald Trump A Loyalty Questioned

May 21, 2025

Wayne Gretzky And Donald Trump A Loyalty Questioned

May 21, 2025 -

Peppa Pigs Mummy A Memorable Gender Reveal Party In London

May 21, 2025

Peppa Pigs Mummy A Memorable Gender Reveal Party In London

May 21, 2025