QBTS Stock's Upcoming Earnings: What To Expect

Table of Contents

Analyzing QBTS's Recent Performance and Trends

Analyzing recent performance is critical for predicting future QBTS stock movement. Understanding revenue growth and profitability trends provides a valuable foundation for assessing the upcoming earnings report.

Revenue Growth and Projections

Examining QBTS's recent quarterly revenue figures is crucial. We need to determine whether the company has shown consistent growth or experienced a decline. Comparing this performance to analyst projections for the upcoming quarter and to past performance helps gauge expectations.

- Year-over-year revenue growth comparison: A strong year-over-year increase suggests positive momentum, while a decline warrants closer scrutiny.

- Key drivers of revenue (e.g., new product launches, market expansion): Identifying the factors driving revenue growth (or decline) helps determine the sustainability of the trend. Successful new product launches or expansion into new markets are positive indicators.

- Comparison to competitor revenue growth: Benchmarking QBTS's revenue growth against competitors provides context and highlights relative market performance.

- Consensus analyst estimates vs. company guidance: Discrepancies between analyst expectations and the company's own guidance can signal potential surprises in the earnings report. A significant difference could lead to increased volatility in the QBTS stock price.

Profitability and Margins

Profitability is another critical aspect of QBTS's performance. Analyzing profit margins, operating income, and net income trends provides insights into the company's efficiency and financial health.

- Gross profit margin analysis: Analyzing gross profit margin reveals the profitability of QBTS's core business operations. Compression in margins might signal rising costs or pricing pressure.

- Operating expense trends: Monitoring operating expenses is essential for understanding the company's cost management effectiveness. Unexpected increases in expenses can negatively affect profitability.

- Impact of any recent acquisitions or divestitures: Mergers, acquisitions, or divestitures can significantly impact a company's financial performance. Understanding their effect on QBTS is crucial.

- Potential impact of inflation on margins: Inflationary pressures can erode margins if the company struggles to pass increased costs onto consumers.

Key Factors to Watch in the Upcoming Earnings Report

Beyond historical performance, several factors will significantly influence the upcoming earnings report and the subsequent reaction of the QBTS stock price.

Guidance for Future Quarters

Management's guidance for future revenue and earnings is a key indicator of their confidence in the company's prospects. Analyzing the historical accuracy of past guidance helps assess the reliability of their current predictions.

- Focus on any changes to long-term growth expectations: Any shifts in long-term growth expectations are crucial for investors, as they reveal management's perception of the company's future trajectory.

- Assessment of management's confidence level: The tone of management's commentary during the earnings call – cautious or optimistic – can impact investor sentiment.

- Impact of macroeconomic factors on future outlook: The overall economic climate and its potential impact on QBTS's performance should be considered. Macroeconomic headwinds can significantly affect results.

New Product Launches and Market Developments

New product launches and broader market developments will play a pivotal role in shaping QBTS's performance.

- Success or failure of recent product introductions: The success of newly launched products directly influences revenue growth and market share.

- Market share trends in key sectors: Analyzing market share trends helps determine QBTS's competitive position and growth potential.

- Competitive landscape analysis: Understanding the competitive landscape, including the actions of competitors, provides crucial context.

- Impact of any regulatory changes: New regulations or changes in existing ones can significantly impact a company's operations and profitability.

Potential Impact on QBTS Stock Price

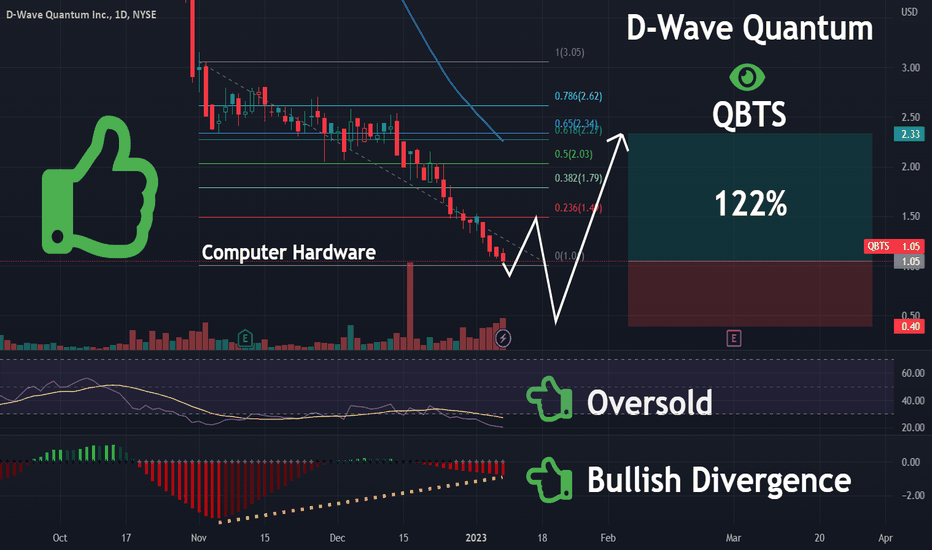

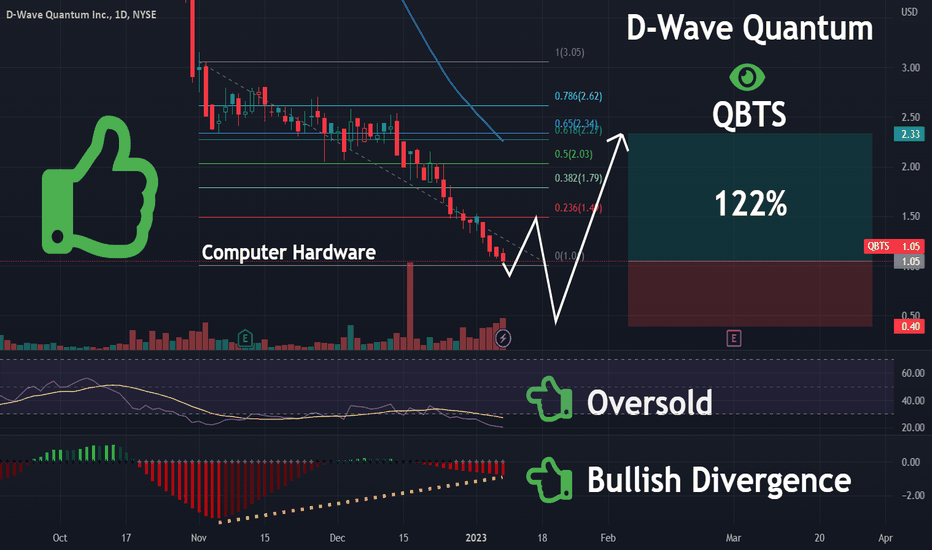

The QBTS stock price will likely react significantly to the upcoming earnings report. Understanding potential scenarios is crucial for making informed investment decisions.

Market Reaction Scenarios

The market's reaction could be positive, negative, or neutral, depending on the results.

- Price targets from leading analysts: Analyst price targets offer an indication of potential stock price movements after the earnings report.

- Historical stock price reaction to earnings announcements: Analyzing past stock price reactions to earnings announcements helps predict potential volatility.

- Potential for a short-squeeze or sell-off: Depending on the results, the QBTS stock could experience a short-squeeze (rapid price increase) or a sell-off.

- Impact of broader market conditions: The overall market environment will also impact the QBTS stock price reaction.

Long-Term Investment Implications

The earnings report provides valuable insights into the long-term prospects of QBTS.

- Valuation analysis based on various metrics (P/E ratio, etc.): Assessing the company's valuation using different metrics helps determine whether it's overvalued or undervalued.

- Assessment of long-term growth potential: The earnings report offers clues about the company's long-term growth trajectory.

- Comparison to other investments in the same sector: Comparing QBTS's performance and valuation to competitors helps make informed investment choices.

- Risks and potential rewards of investing in QBTS: Understanding the inherent risks and potential rewards is crucial before making any investment decisions.

Conclusion

The upcoming QBTS stock earnings report holds significant weight for investors. By carefully analyzing recent performance trends, key factors to watch during the earnings call, and potential market reactions, investors can better position themselves to navigate the volatility surrounding the announcement. Remember to conduct thorough due diligence and consult with a financial advisor before making any investment decisions related to QBTS stock. Stay informed about QBTS stock news and analysis to make informed investment choices. Understanding QBTS stock's performance is critical for successful investing.

Featured Posts

-

Analyzing The Blockbuster Acts Of The Bgt Special

May 21, 2025

Analyzing The Blockbuster Acts Of The Bgt Special

May 21, 2025 -

Nyt Mini Crossword Solutions For March 24 2025

May 21, 2025

Nyt Mini Crossword Solutions For March 24 2025

May 21, 2025 -

Moncoutant Sur Sevre Pres De Clisson Histoire D Une Diversification Centenaire

May 21, 2025

Moncoutant Sur Sevre Pres De Clisson Histoire D Une Diversification Centenaire

May 21, 2025 -

Logitechs Next Generation Designing A Truly Forever Mouse

May 21, 2025

Logitechs Next Generation Designing A Truly Forever Mouse

May 21, 2025 -

Big Bear Ai Holdings Inc Bbai Analyst Downgrade And Growth Concerns

May 21, 2025

Big Bear Ai Holdings Inc Bbai Analyst Downgrade And Growth Concerns

May 21, 2025