Analyzing Thailand's Negative Inflation And Its Impact On Interest Rates

Table of Contents

Thailand's economy has recently experienced a period of negative inflation, a phenomenon that has significant implications for its monetary policy and interest rates. This article analyzes the causes and consequences of this unexpected economic downturn, exploring its impact on consumers, businesses, and the overall economic stability of the Kingdom. We will delve into the factors contributing to negative inflation in Thailand and discuss the potential responses from the Bank of Thailand (BOT). Understanding Thailand's negative inflation is crucial for navigating the current economic landscape.

H2: Understanding Negative Inflation in Thailand

H3: Defining Deflation and its Differences from Disinflation:

Negative inflation, or deflation, is a sustained decrease in the general price level of goods and services in an economy. This is different from disinflation, which is a slowing of the rate of inflation – prices are still rising, just at a slower pace. Deflation is concerning because it can create a vicious cycle. Consumers delay purchases anticipating further price drops, leading to decreased demand, which in turn forces businesses to lower prices further, potentially leading to lower profits and job losses.

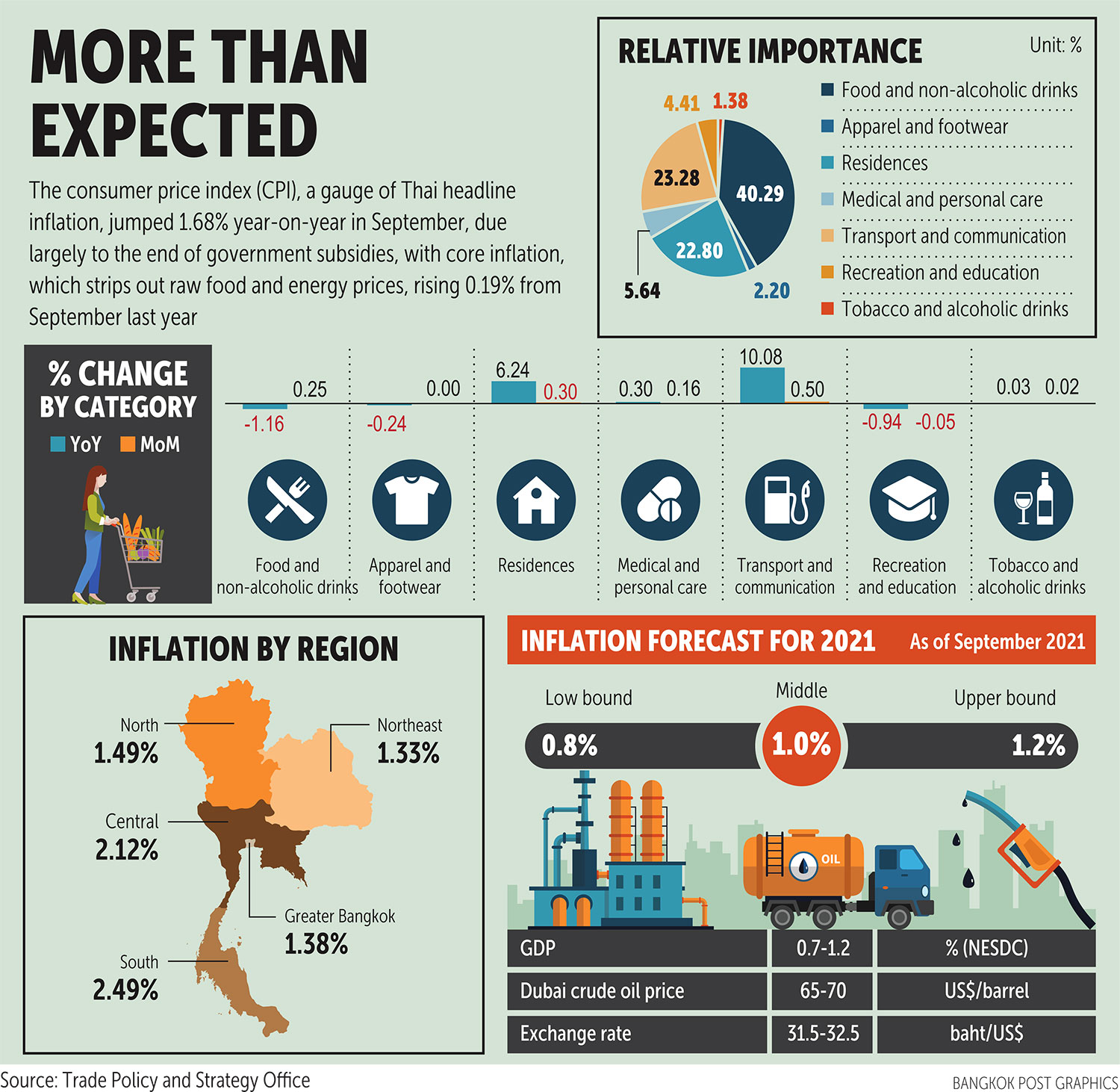

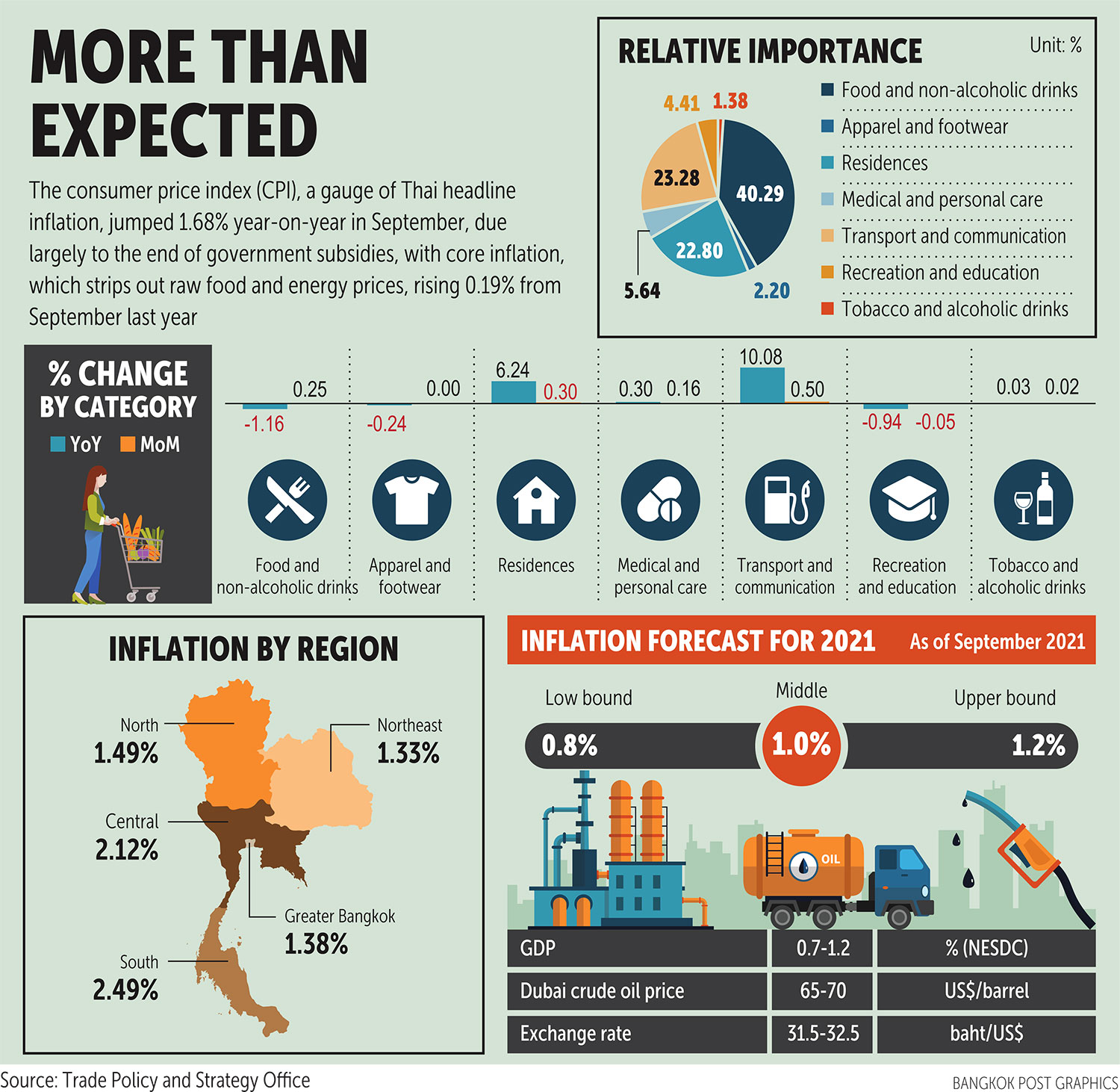

- Current State of Thailand's Inflation Rate: Thailand recently reported negative inflation, indicating a decline in the overall price level. The exact figures fluctuate, but this persistent negative trend is the key concern.

- Key Differences Between Deflation and Disinflation: Deflation is a decrease in the price level; disinflation is a decrease in the rate of inflation. Deflation is harmful; disinflation can be a sign of a stabilizing economy.

- Potential Dangers of Prolonged Deflationary Periods: Prolonged deflation can lead to a debt deflation spiral, where the real value of debt increases, leading to defaults and economic contraction. It can also depress investment and economic growth.

H2: Causes of Negative Inflation in Thailand

H3: The Role of Falling Commodity Prices:

Global commodity price fluctuations significantly impact Thailand’s export-oriented economy. The decline in prices of key commodities has been a major contributor to Thailand's negative inflation.

- Impact of Lower Oil Prices: Reduced oil prices directly lower transportation and production costs, impacting the overall price level.

- Effect of Decreased Agricultural Product Prices: Thailand is a significant agricultural exporter. Lower global demand and oversupply have driven down prices for key agricultural products, impacting farmers' incomes and overall inflation.

- Influence of Weaker Global Demand: Reduced global demand for Thai exports, influenced by factors like the global economic slowdown and trade wars, puts downward pressure on prices.

H2: Impact on Interest Rates and Monetary Policy

H3: The Bank of Thailand's Response:

The Bank of Thailand (BOT) faces the challenge of stimulating economic growth while mitigating the risks of deflation.

- Potential for Interest Rate Cuts: The BOT might cut interest rates to encourage borrowing and investment, boosting economic activity. However, excessively low interest rates can have unintended consequences.

- Effectiveness of Quantitative Easing (QE) as a Policy Tool: QE, involving the injection of money into the financial system, is another potential tool. Its effectiveness in Thailand's specific context remains to be seen, and it carries risks of inflation in the long term.

- Challenges Faced by the BOT: The BOT must carefully balance stimulating economic activity with the risk of fueling asset bubbles or exacerbating other economic imbalances.

H2: Economic Consequences of Thailand's Negative Inflation

H3: Effects on Businesses and Consumers:

Thailand's negative inflation impacts various sectors differently.

- Impact on Consumer Spending and Debt Levels: Consumers may postpone purchases, leading to decreased demand, while the real value of debt increases, creating financial strain for households.

- Effects on Businesses, Particularly Those with High Debt Levels: Businesses face falling revenues and increased debt burdens, leading to potential bankruptcies and job losses. Businesses with significant foreign currency debt are particularly vulnerable to exchange rate fluctuations.

- Possible Impact on Employment and Investment: Reduced demand and business uncertainty can lead to decreased investment and job creation, exacerbating the economic slowdown.

Conclusion:

Thailand's current experience with negative inflation presents complex challenges. Understanding the causes—from falling commodity prices to weaker global demand—is crucial for predicting its impact on interest rates and the broader economy. The Bank of Thailand's actions will be vital in navigating this economic climate. Continued monitoring of Thailand's negative inflation and its effects on interest rates is essential for both businesses and consumers. Stay informed about the evolving economic landscape and plan accordingly. Further research into the ongoing effects of Thailand's negative inflation is encouraged. Understanding the implications of Thailand's negative inflation is key to effective economic planning.

Featured Posts

-

Xrp To 5 In 2025 Analysis And Potential

May 07, 2025

Xrp To 5 In 2025 Analysis And Potential

May 07, 2025 -

Podcast Production Revolution Ais Role In Transforming Repetitive Data

May 07, 2025

Podcast Production Revolution Ais Role In Transforming Repetitive Data

May 07, 2025 -

Mariners Defeat Reds In 10 Innings Arozarenas Impact

May 07, 2025

Mariners Defeat Reds In 10 Innings Arozarenas Impact

May 07, 2025 -

Cobra Kai A Deep Dive Into Its Karate Kid Continuity

May 07, 2025

Cobra Kai A Deep Dive Into Its Karate Kid Continuity

May 07, 2025 -

Tom Holland And Zendayas Family Plans A Surprise Announcement

May 07, 2025

Tom Holland And Zendayas Family Plans A Surprise Announcement

May 07, 2025

Latest Posts

-

Cleveland Cavaliers Mitchells Pre Game Popcorn Prediction Comes True

May 07, 2025

Cleveland Cavaliers Mitchells Pre Game Popcorn Prediction Comes True

May 07, 2025 -

Popcorn Prank Donovan Mitchell And The Cleveland Cavaliers Rookie

May 07, 2025

Popcorn Prank Donovan Mitchell And The Cleveland Cavaliers Rookie

May 07, 2025 -

Donovan Mitchells Popcorn Prediction Cavs Rookie Car Prank

May 07, 2025

Donovan Mitchells Popcorn Prediction Cavs Rookie Car Prank

May 07, 2025 -

Nba Lyderiu Istorinis Pasirodymas Pakartotas Klubo Rekordas

May 07, 2025

Nba Lyderiu Istorinis Pasirodymas Pakartotas Klubo Rekordas

May 07, 2025 -

Klubo Rekordas Pagerintas Nba Lyderiu Istorinis Ritmas

May 07, 2025

Klubo Rekordas Pagerintas Nba Lyderiu Istorinis Ritmas

May 07, 2025