XRP To $5 In 2025: Analysis And Potential

Table of Contents

XRP's Technological Advantages and Scalability

Fast and Efficient Transactions

XRP boasts several technological advantages that contribute to its potential for growth. Its speed and low transaction fees are key differentiators compared to other cryptocurrencies like Bitcoin and Ethereum. The "transaction speed" of XRP is significantly faster, allowing for near-instantaneous transactions. This "low fees" structure makes it a highly attractive option for high-volume transactions and cross-border payments. The underlying technology supports exceptional "scalability," handling a large number of transactions without compromising speed or efficiency.

- XRP's Consensus Mechanism: XRP utilizes a unique consensus mechanism, the Ripple Protocol Consensus Algorithm (RPCA), enabling fast transaction processing and confirmation. This contrasts with the slower, more energy-intensive mechanisms used by other cryptocurrencies.

- Transaction Cost Comparison: While Bitcoin and Ethereum transactions can incur substantial fees, especially during periods of network congestion, XRP transactions typically cost a fraction of a cent. This "transaction cost" advantage is crucial for its adoption in large-scale payment systems.

- Scalability for Cross-Border Payments: XRP's scalability makes it particularly well-suited for facilitating cross-border payments. Its ability to handle a high volume of transactions efficiently is a significant advantage over other cryptocurrencies in this space.

Growing Adoption and Partnerships

Increasing Institutional Interest

The increasing adoption of XRP by financial institutions and payment providers is another crucial factor influencing its potential price appreciation. "Institutional adoption" is gaining momentum, with several major players recognizing XRP's value proposition. Ripple, the company behind XRP, has actively pursued strategic partnerships, fostering the growth of XRP's ecosystem. This "Ripple partnerships" strategy is a key driver of increased "institutional adoption." The "on-demand liquidity" solution offered by Ripple further strengthens the adoption rate, facilitating seamless cross-border payments.

- Key Partnerships: Ripple has forged partnerships with numerous banks and financial institutions globally, integrating XRP into their payment infrastructure. These partnerships demonstrate growing confidence in XRP's technology and its potential to revolutionize cross-border payments.

- Use Cases in Remittances: XRP's low transaction costs and speed make it an ideal solution for cross-border remittances, reducing the fees and processing times associated with traditional methods. This impact on "remittance costs" is significant for both senders and recipients.

- Future Partnership Potential: Further partnerships with major financial institutions could significantly boost XRP's adoption and drive its price upward. The potential for future alliances is a compelling factor in predicting XRP's future trajectory.

Regulatory Landscape and Legal Battles

The SEC Lawsuit and its Implications

The ongoing SEC lawsuit against Ripple and its impact on XRP's price remain significant uncertainties. The "SEC lawsuit" is a major factor affecting market sentiment and investor confidence. The outcome of this "legal battle" will significantly influence the future of XRP. "Regulatory uncertainty" surrounding cryptocurrencies in general, and XRP specifically, creates volatility.

- Key Arguments in the Lawsuit: The lawsuit revolves around the classification of XRP as a security. The SEC argues that XRP was sold as an unregistered security, while Ripple maintains that XRP is a digital currency.

- Potential Outcomes and Impact: A favorable outcome for Ripple could lead to a surge in XRP's price, while an unfavorable outcome could result in significant price drops. The uncertainty surrounding the outcome contributes to the volatility of XRP's price.

- Broader Regulatory Landscape: The broader regulatory landscape for cryptocurrencies remains uncertain, posing a challenge to all cryptocurrencies, including XRP. Navigating this "regulatory uncertainty" will be crucial for XRP's long-term success.

Market Sentiment and Price Prediction Models

Analyzing Market Trends and Forecasting

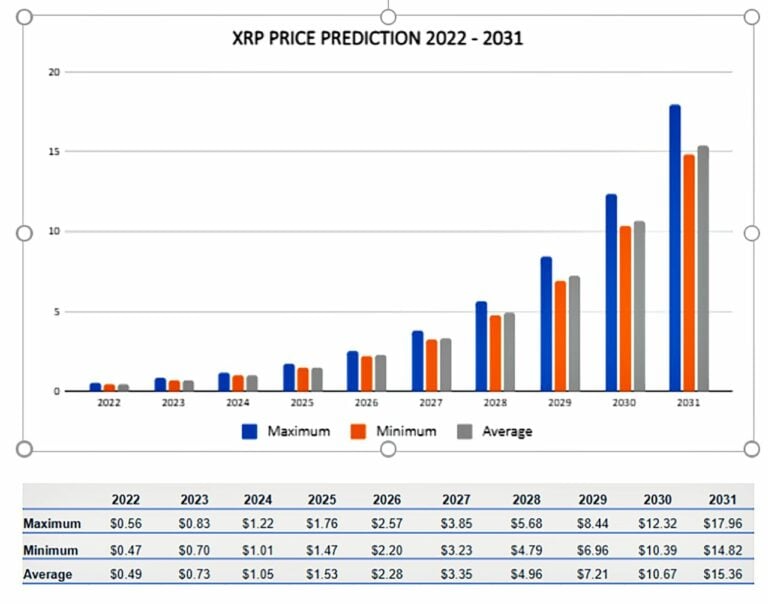

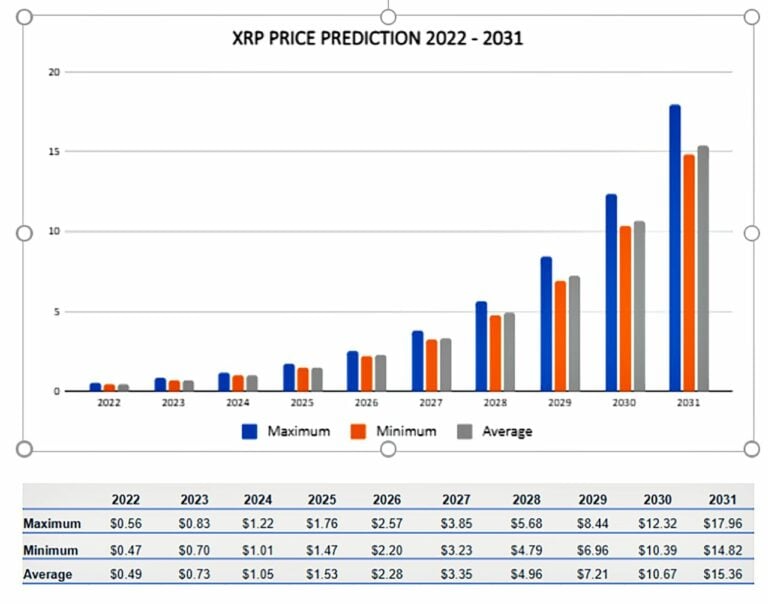

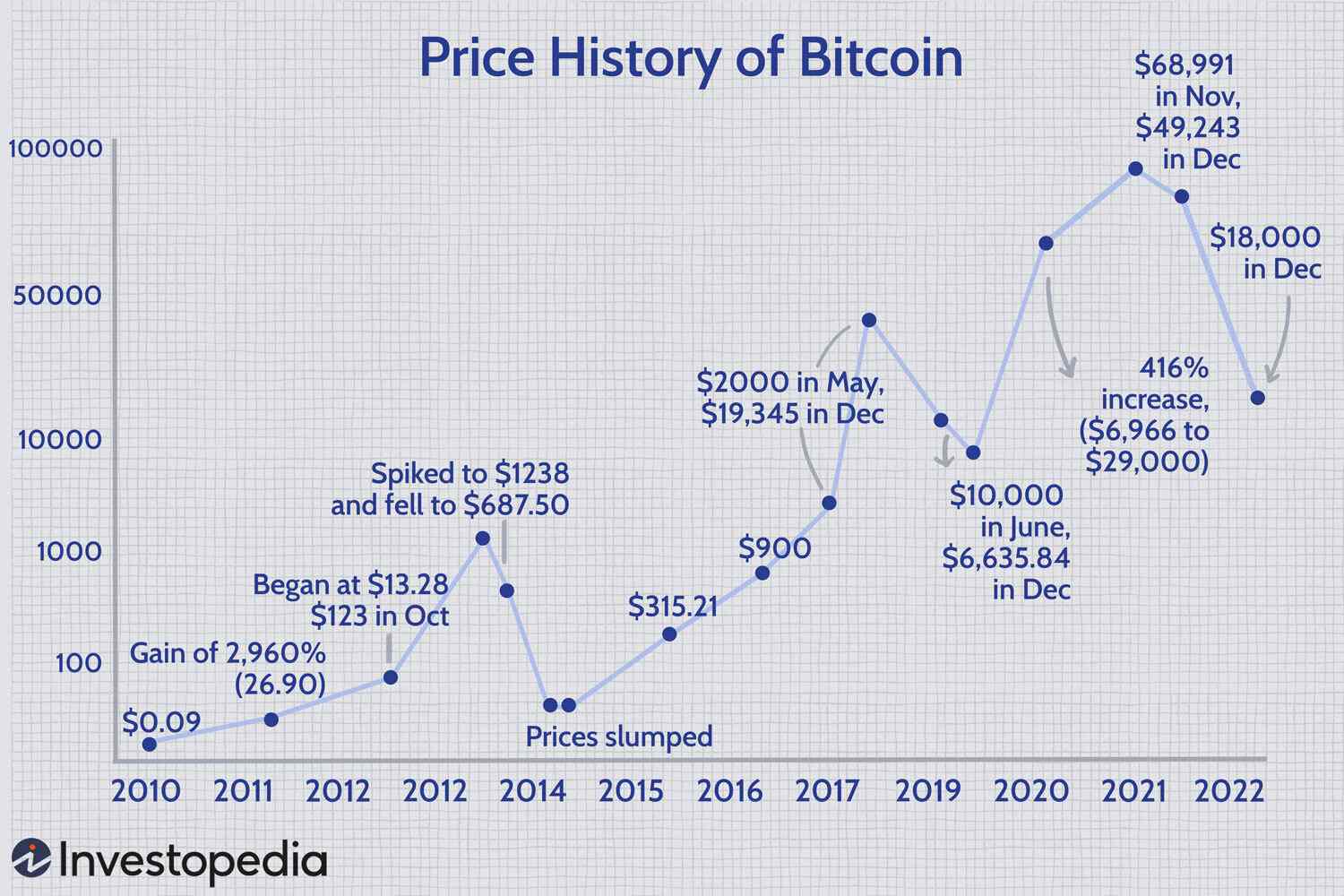

Analyzing market sentiment and applying various "price prediction models" is crucial for assessing XRP's potential. "Market sentiment" often reflects investor confidence and expectations. While "technical analysis" and "fundamental analysis" can provide insights, they are not foolproof methods for predicting future prices. Various "XRP price forecast" models exist, ranging from simple trend analysis to complex algorithms.

- Influencing Factors: XRP's price is influenced by factors such as market capitalization, trading volume, media coverage, and overall market trends. Understanding these factors is essential for interpreting price movements.

- Price Prediction Models: Different price prediction models exist, each with its own methodology and limitations. It is important to approach these predictions with caution and understand their limitations.

- Importance of Independent Research: Conducting your own research is crucial. Relying solely on external price predictions is risky. Always consider your own risk tolerance before making any investment decisions.

Conclusion: Is XRP Reaching $5 in 2025 a Realistic Goal?

Whether XRP reaches $5 by 2025 depends on several interconnected factors. While its technological advantages, growing adoption, and potential partnerships are positive indicators, the ongoing SEC lawsuit and broader regulatory uncertainty pose significant risks. Analyzing market sentiment and employing price prediction models can offer insights, but these should be considered alongside fundamental analysis and a thorough understanding of the risks involved. The "XRP price outlook" remains uncertain, highlighting the importance of careful consideration before investing. The "future of XRP" hinges on the resolution of the legal battles and the continued growth of its adoption. This "XRP investment potential" warrants further research and careful consideration of your personal risk tolerance. Remember to conduct your own research before making any investment decisions. The information provided here is for educational purposes only and not financial advice.

Featured Posts

-

Ayesha Curry Prioritizes Marriage Over Children Her Honest Revelation

May 07, 2025

Ayesha Curry Prioritizes Marriage Over Children Her Honest Revelation

May 07, 2025 -

Nhl Konflikt Ny Stjaernturnering Pa Gang

May 07, 2025

Nhl Konflikt Ny Stjaernturnering Pa Gang

May 07, 2025 -

What Is A Conclave Understanding The Papal Election Process

May 07, 2025

What Is A Conclave Understanding The Papal Election Process

May 07, 2025 -

Self Promotion Or Hilarious Gaffe Anthony Edwards And The Randle Interview

May 07, 2025

Self Promotion Or Hilarious Gaffe Anthony Edwards And The Randle Interview

May 07, 2025 -

V Roku 2028 Sa Vrati Svetovy Pohar Hokeja Nhl Vydala Oficialne Stanovisko

May 07, 2025

V Roku 2028 Sa Vrati Svetovy Pohar Hokeja Nhl Vydala Oficialne Stanovisko

May 07, 2025

Latest Posts

-

Bitcoin Rebound Investing Strategies For The Future

May 08, 2025

Bitcoin Rebound Investing Strategies For The Future

May 08, 2025 -

1 500 Bitcoin Growth Analyzing The Prediction And Its Implications

May 08, 2025

1 500 Bitcoin Growth Analyzing The Prediction And Its Implications

May 08, 2025 -

Understanding Bitcoins Rebound Risks And Opportunities

May 08, 2025

Understanding Bitcoins Rebound Risks And Opportunities

May 08, 2025 -

2024

May 08, 2025

2024

May 08, 2025 -

The Bitcoin Rebound Signs Of A Lasting Recovery

May 08, 2025

The Bitcoin Rebound Signs Of A Lasting Recovery

May 08, 2025