Analyzing The Japanese Bond Market: Swap Data And Foreign Investor Sentiment

Table of Contents

Understanding Swap Data in the Japanese Bond Market

Analyzing the Japanese Bond Market effectively necessitates a deep understanding of swap data. This data provides crucial insights into market expectations and risk assessments, offering valuable predictive capabilities.

Japanese Government Bond (JGB) Futures and Their Significance

Japanese Government Bonds (JGBs) are the bedrock of the Japanese bond market. JGB futures contracts play a vital role in hedging and speculation, allowing investors to manage risk and capitalize on anticipated price movements. The relationship between JGB futures prices and interest rate expectations is particularly strong. Changes in futures prices often precede shifts in interest rates, offering a valuable leading indicator.

- Example: A steepening yield curve (where longer-term JGB yields rise faster than shorter-term yields) in JGB futures often indicates market expectations of future interest rate hikes by the Bank of Japan (BOJ).

- Key Indices: Monitoring indices like the Nikkei 225 and TOPIX alongside JGB futures provides a holistic view of market sentiment and its influence on bond yields. The 10-year JGB yield is a particularly crucial benchmark to observe.

Interest Rate Swaps and Their Implications

Interest rate swaps are another critical component of the Japanese bond market. Market participants use these derivatives to manage interest rate risk, effectively transferring exposure from one interest rate to another. Swap spreads, the difference between the fixed rate on a swap and a comparable government bond yield, reflect credit risk and market expectations.

- Illustrative Example: Widening swap spreads can signal declining investor confidence in the Japanese economy, suggesting an increased perception of risk and a potential flight to safety.

- Key Benchmarks: The 10-year JGB-yen LIBOR spread is a widely followed benchmark indicating credit risk and market sentiment. Changes in this spread can be a significant signal in the Japanese Bond Market.

Analyzing Swap Data for Predictive Capabilities

Analyzing swap data for predictive purposes involves employing various techniques. Combining technical analysis with statistical models can help forecast future interest rate movements. However, it's crucial to acknowledge the limitations of using swap data in isolation.

- Technical Analysis: Techniques like trend analysis, support and resistance levels, and moving averages can be applied to swap data to identify potential future trends.

- Statistical Models: Time series analysis, including ARIMA and GARCH models, can be employed to forecast future swap rates and interest rate movements.

- Holistic Approach: Combining swap data with macroeconomic indicators, such as inflation rates, GDP growth, and central bank policies, is crucial for a more accurate prediction.

Foreign Investor Sentiment and its Impact on the Japanese Bond Market

Foreign investors play a significant role in shaping the dynamics of the Japanese Bond Market. Understanding their sentiment and investment strategies is crucial for accurate market analysis.

Identifying Key Foreign Investors

Major players in the Japanese Bond Market include central banks (like the US Federal Reserve), sovereign wealth funds, and large asset management firms. Their investment strategies and motivations significantly influence bond yields and market behavior.

- Influence of Central Banks: Central bank actions, such as quantitative easing (QE) programs, can dramatically impact JGB prices and yields.

- Investment Strategies: Different investors have varying investment horizons and risk tolerances, which affect their bond-buying behavior. Long-term investors, for instance, tend to be less sensitive to short-term fluctuations.

Gauging Foreign Investor Sentiment

Measuring foreign investor sentiment requires analyzing various data points. Capital flows data, provided by the Ministry of Finance, tracks the net inflow or outflow of foreign investment into JGBs. Survey data and news sentiment analysis also help assess overall investor confidence.

- Capital Flows: A consistent increase in foreign investment signals positive sentiment, likely pushing JGB prices higher and yields lower. Conversely, capital outflow signals negative sentiment.

- Correlation with Yields: Generally, positive foreign investor sentiment correlates with lower JGB yields and higher prices, while negative sentiment has the opposite effect.

The Impact of Global Economic Events on Foreign Investor Sentiment

Global economic events significantly influence foreign investor sentiment towards Japanese bonds. US interest rate policy changes, shifts in global risk aversion, and geopolitical events can all trigger substantial capital flows into or out of the Japanese Bond Market.

- US Interest Rate Hikes: Higher US interest rates often attract capital away from lower-yielding JGBs, increasing JGB yields.

- Global Risk Aversion: During periods of global uncertainty, investors often seek safe-haven assets, leading to increased demand for JGBs and lower yields.

Conclusion

Analyzing the Japanese Bond Market requires a holistic approach, incorporating both swap data and foreign investor sentiment. Swap data, particularly JGB futures and interest rate swaps, offer valuable insights into market expectations and risk perceptions. Understanding foreign investor behavior, their motivations, and the impact of global events is equally crucial. By combining these analyses, investors and analysts can gain a deeper understanding of the intricate dynamics of the Japanese Bond Market and make more informed decisions. To stay updated on the latest trends and developments in the Japanese Bond Market, continue to research and monitor key indicators such as swap spreads, JGB yields, and foreign investor flows. Regularly analyzing the Japanese Bond Market is essential for navigating this complex and important sector of global finance.

Featured Posts

-

Analyzing The Japanese Bond Market Swap Data And Foreign Investor Sentiment

Apr 25, 2025

Analyzing The Japanese Bond Market Swap Data And Foreign Investor Sentiment

Apr 25, 2025 -

What To Expect At Stagecoach Festival 2025 Country Roots Pop Surprises And More

Apr 25, 2025

What To Expect At Stagecoach Festival 2025 Country Roots Pop Surprises And More

Apr 25, 2025 -

Record High Equity Trading At Bnp Paribas Despite Increased Costs

Apr 25, 2025

Record High Equity Trading At Bnp Paribas Despite Increased Costs

Apr 25, 2025 -

The Ethics Of Wildfire Betting A Case Study Of Los Angeles

Apr 25, 2025

The Ethics Of Wildfire Betting A Case Study Of Los Angeles

Apr 25, 2025 -

Papal Conclave In Jeopardy Convicted Cardinals Unexpected Demand

Apr 25, 2025

Papal Conclave In Jeopardy Convicted Cardinals Unexpected Demand

Apr 25, 2025

Latest Posts

-

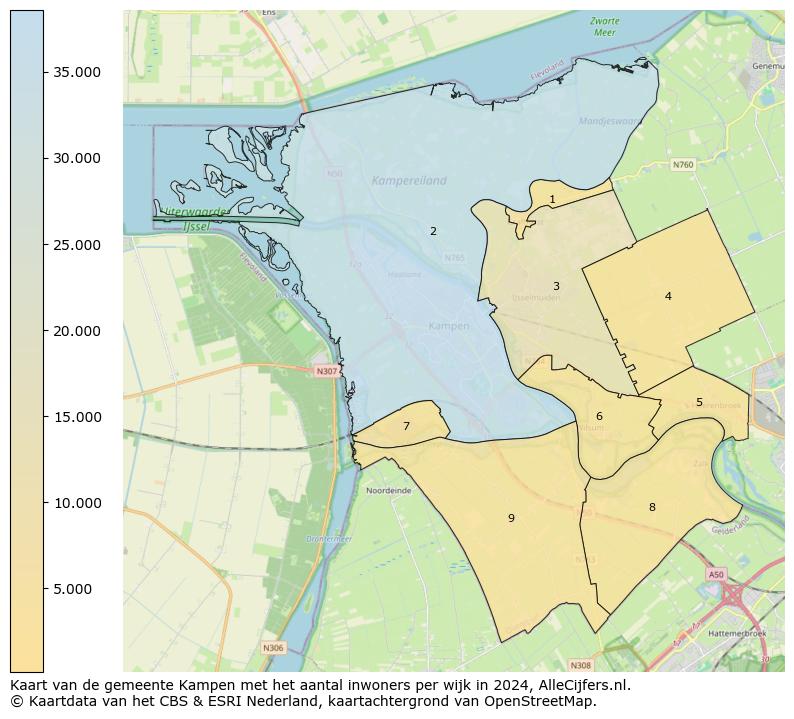

Rechtszaak Gemeente Kampen Eist Snelle Enexis Aansluiting

May 01, 2025

Rechtszaak Gemeente Kampen Eist Snelle Enexis Aansluiting

May 01, 2025 -

De Uitdaging Van Energievoorziening Voor Bio Based Basisscholen

May 01, 2025

De Uitdaging Van Energievoorziening Voor Bio Based Basisscholen

May 01, 2025 -

Kampen Start Kort Geding Tegen Enexis Over Stroomnet

May 01, 2025

Kampen Start Kort Geding Tegen Enexis Over Stroomnet

May 01, 2025 -

Bio Based School Noodgenerator Als Garantie Voor Continuiteit

May 01, 2025

Bio Based School Noodgenerator Als Garantie Voor Continuiteit

May 01, 2025 -

Gemeente Kampen Voert Kort Geding Tegen Enexis

May 01, 2025

Gemeente Kampen Voert Kort Geding Tegen Enexis

May 01, 2025