Analyzing The Saudi ABS Market's Post-Reform Trajectory

Table of Contents

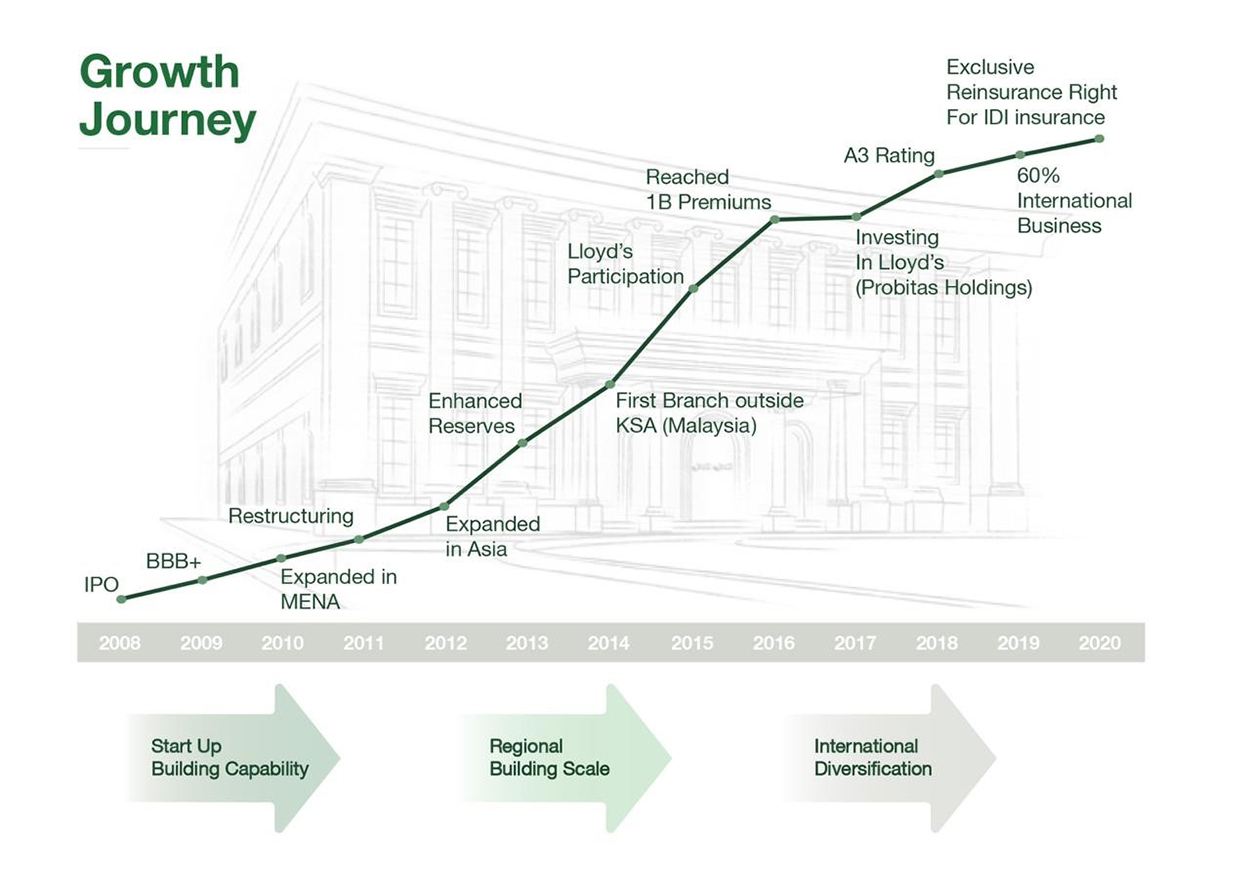

Growth and Development of the Saudi ABS Market Post-Reform

The Saudi Arabian financial sector reforms, implemented in recent years, have significantly impacted the growth and development of the Saudi ABS market. These reforms focused on enhancing regulatory frameworks, promoting transparency, and fostering a more competitive environment. This has directly resulted in a flourishing Saudi ABS market, attracting both domestic and international investment.

Increased Issuance of ABS

Post-reform, the Saudi ABS market has seen a substantial quantitative increase in ABS issuance. While precise figures may vary depending on the data source and reporting period, anecdotal evidence and industry reports suggest a significant rise.

- Examples of successful ABS issuances: Several major financial institutions have successfully issued ABS backed by auto loans, mortgages, and other asset classes. These successful issuances showcase the market's growing maturity and investor confidence.

- Sectors involved: The Saudi ABS market is witnessing growth across various sectors, including auto loans, mortgages, and consumer credit. The expansion into diverse sectors indicates the versatility and resilience of this asset class.

- Government initiatives: Government initiatives aimed at promoting financial inclusion and diversifying the economy have indirectly boosted the Saudi ABS market by creating a more favorable environment for investment and growth.

Expansion of Investor Base

The reforms have attracted a wider range of investors to the Saudi ABS market, both domestically and internationally. This diversification strengthens the market's resilience and liquidity.

- Types of investors: Institutional investors, including banks, insurance companies, and asset management firms, have shown increased interest. Furthermore, the participation of retail investors is gradually increasing, driven by improved transparency and understanding of the asset class.

- Factors contributing to increased investor interest: Improved regulatory clarity, enhanced transparency, and the relatively higher yields compared to other fixed-income instruments have all contributed to the growth of investor interest in the Saudi ABS market.

Development of Market Infrastructure

The improvement of market infrastructure is another key factor contributing to the growth of the Saudi ABS market. This development allows for smoother and more efficient trading and settlement processes.

- Examples of improved infrastructure: The introduction of electronic trading platforms and the establishment of robust clearing houses have streamlined transactions and reduced counterparty risk.

- Regulatory bodies and their role: The Saudi Central Bank (SAMA) and other regulatory bodies have played a crucial role in overseeing the development of the market infrastructure and ensuring its stability and integrity.

Challenges Facing the Saudi ABS Market

Despite significant progress, the Saudi ABS market still faces several challenges that need to be addressed to ensure its continued growth and sustainability.

Regulatory Hurdles

While reforms have improved the regulatory landscape, certain regulatory hurdles remain. These include aspects that need further standardization and harmonization to align with international best practices.

- Specific regulatory aspects needing improvement: Streamlining the regulatory approval process for new ABS issuances and enhancing the standardization of documentation would boost efficiency. Improved transparency in disclosure requirements is also vital for attracting further investor participation.

- Potential solutions: Collaboration between regulatory bodies and market participants to identify and address these regulatory gaps is crucial for creating a more favorable environment for growth.

Liquidity Concerns

Liquidity, while improving, remains a concern for some market participants. The relatively smaller size of the market compared to more established markets can sometimes affect liquidity.

- Factors affecting liquidity: The limited number of active market makers and the concentration of investment among a few key players can impact liquidity during periods of market stress.

- Potential solutions: Developing a more robust secondary market for Saudi ABS, encouraging the participation of more market makers, and promoting investor education can help improve liquidity.

Credit Risk Assessment

Robust credit risk assessment and management are paramount for the long-term health and stability of the Saudi ABS market.

- Methods for credit risk assessment: Utilizing sophisticated credit scoring models, incorporating macroeconomic factors into risk assessment, and maintaining transparent credit ratings are essential for managing credit risk effectively.

- Importance of transparency in credit ratings: Clear and transparent credit ratings enhance investor confidence and allow for better price discovery in the market.

Future Opportunities and Outlook for the Saudi ABS Market

The future outlook for the Saudi ABS market is positive, with several opportunities for growth and development on the horizon.

Potential for Growth in Specific Sectors

Certain sectors hold significant potential for future growth in the Saudi ABS market.

- Sectors with strong potential: The renewable energy sector, driven by the Kingdom's Vision 2030, and the infrastructure sector, fueled by large-scale development projects, are expected to generate substantial opportunities for ABS issuance.

- Reasons for potential: Government support for these sectors, coupled with increasing private sector investment, creates a favorable environment for ABS-backed financing solutions.

Role of Technology

Technological advancements will play a crucial role in shaping the future of the Saudi ABS market.

- Examples of technological advancements: The application of blockchain technology for enhanced transparency and security in transactions and the use of AI for more sophisticated credit risk assessment are expected to improve efficiency and reduce costs.

- Impact on efficiency and transparency: Technology will streamline operations, enhance transparency, and ultimately contribute to the growth and development of the market.

International Collaboration

International collaboration can significantly benefit the Saudi ABS market.

- Potential partnerships and collaborations: Partnerships with international financial institutions and exchanges can help attract foreign investment and enhance the market’s global profile.

- Benefits of internationalization: International collaboration can lead to knowledge sharing, best-practice adoption, and greater access to capital for Saudi entities seeking ABS financing.

Conclusion: The Future Trajectory of the Saudi ABS Market

The Saudi ABS market's post-reform trajectory has been marked by significant growth in issuance, an expansion of the investor base, and the development of crucial market infrastructure. However, challenges such as regulatory hurdles, liquidity concerns, and the need for robust credit risk assessment remain. Addressing these challenges is vital for unlocking the full potential of this dynamic sector. Understanding the post-reform trajectory of the Saudi ABS market is crucial for investors and stakeholders alike. Further research and strategic investment in this dynamic sector will be vital for unlocking its full potential and contributing to the broader economic growth of Saudi Arabia. The Saudi ABS market presents a compelling investment opportunity for those who recognize its potential and are willing to navigate the existing challenges.

Featured Posts

-

Milk And Honeys Electronic Music Division Gains New Head Andrew Goldstone

May 02, 2025

Milk And Honeys Electronic Music Division Gains New Head Andrew Goldstone

May 02, 2025 -

This Months Ps Plus An Underrated 2024 Game You Shouldnt Miss

May 02, 2025

This Months Ps Plus An Underrated 2024 Game You Shouldnt Miss

May 02, 2025 -

Improving Mental Health Literacy Through Education

May 02, 2025

Improving Mental Health Literacy Through Education

May 02, 2025 -

Zaboravljena Prica Zdravko Colic I Njegova Prva Ljubav

May 02, 2025

Zaboravljena Prica Zdravko Colic I Njegova Prva Ljubav

May 02, 2025 -

Riot Platforms Riot Stock Price Factors Contributing To The Drop

May 02, 2025

Riot Platforms Riot Stock Price Factors Contributing To The Drop

May 02, 2025

Latest Posts

-

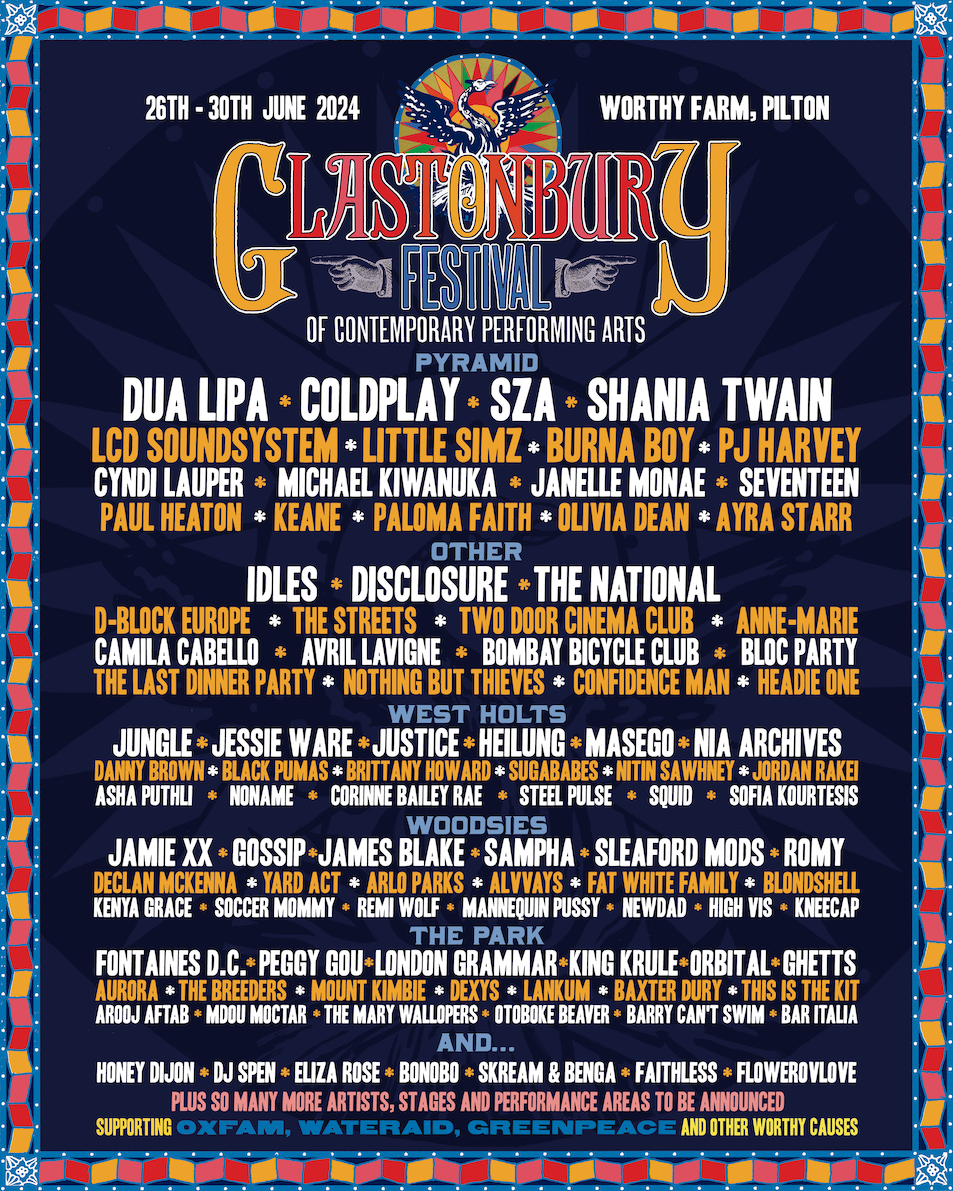

The 1975 And Olivia Rodrigo Glastonbury Festival 2024 Headliner Rumours

May 02, 2025

The 1975 And Olivia Rodrigo Glastonbury Festival 2024 Headliner Rumours

May 02, 2025 -

Daisy May Coopers Engagement To Anthony Huggins Details Revealed

May 02, 2025

Daisy May Coopers Engagement To Anthony Huggins Details Revealed

May 02, 2025 -

Glastonbury Headliners 2024 Speculation On The 1975 And Olivia Rodrigo

May 02, 2025

Glastonbury Headliners 2024 Speculation On The 1975 And Olivia Rodrigo

May 02, 2025 -

Daisy May Cooper Engaged To Boyfriend Anthony Huggins

May 02, 2025

Daisy May Cooper Engaged To Boyfriend Anthony Huggins

May 02, 2025 -

Glastonbury Festival 2024 The 1975 And Olivia Rodrigo Confirmed As Headliners

May 02, 2025

Glastonbury Festival 2024 The 1975 And Olivia Rodrigo Confirmed As Headliners

May 02, 2025