Riot Platforms (RIOT) Stock Price: Factors Contributing To The Drop

Table of Contents

Macroeconomic Headwinds Impacting RIOT Stock

Several macroeconomic factors have negatively influenced the Riot Platforms (RIOT) stock price. These external pressures, beyond the company's direct control, have created a challenging environment for cryptocurrency mining operations.

Bitcoin Price Volatility

The price of Bitcoin (BTC), the primary asset mined by Riot Platforms, is intrinsically linked to the company's revenue and profitability. Sharp drops in BTC's price directly translate to reduced revenue and negatively affect RIOT's valuation. A simple supply and demand principle applies: lower Bitcoin prices mean less revenue for mining operations, and this directly impacts the stock price.

- The Relationship: RIOT's revenue is directly proportional to the price of Bitcoin. A 10% drop in Bitcoin price can significantly impact RIOT's quarterly earnings.

- Recent Fluctuations: The recent cryptocurrency market downturn, witnessing significant drops in Bitcoin's price, has directly contributed to the decrease in RIOT's stock price. Analyzing historical price charts alongside RIOT's stock performance clearly illustrates this correlation.

- Impact on RIOT: These price fluctuations create uncertainty and volatility for investors, leading to sell-offs and a downward pressure on the Riot Platforms (RIOT) stock price.

Rising Energy Costs and Inflation

Increased energy costs are a significant challenge for cryptocurrency mining companies like Riot Platforms. The energy-intensive nature of Bitcoin mining means that even small increases in electricity prices can significantly impact profitability. This is further exacerbated by inflation, which erodes profit margins and increases operational costs across the board.

- Operational Expenses: A substantial portion of RIOT's operating costs is tied to energy consumption. Rising electricity prices directly translate to higher operational expenses, squeezing profit margins.

- Mitigation Strategies: RIOT has invested in renewable energy sources to mitigate some of these cost pressures. However, the overall impact of inflation and rising energy prices remains a significant headwind.

- Investor Sentiment: High energy costs and inflation negatively impact investor sentiment, reducing confidence in the long-term profitability of RIOT and other cryptocurrency mining companies.

Regulatory Uncertainty in the Cryptocurrency Market

The evolving regulatory landscape for cryptocurrencies globally adds another layer of uncertainty for cryptocurrency mining companies. Negative regulatory developments, even in specific regions, can trigger investor apprehension and lead to sell-offs.

- Regulatory Concerns: Regulations concerning cryptocurrency mining, taxation of Bitcoin mining profits, and environmental concerns surrounding energy consumption are key areas of regulatory uncertainty impacting RIOT.

- Legislative Changes: Proposed or implemented legislation in various jurisdictions can significantly affect the operational costs and profitability of cryptocurrency mining operations.

- Investor Confidence: Regulatory uncertainty reduces investor confidence, increasing the risk perception associated with investing in RIOT and other similar companies.

Company-Specific Factors Affecting RIOT's Stock Performance

While macroeconomic factors play a significant role, several company-specific issues also contributed to the decline in the Riot Platforms (RIOT) stock price.

Mining Efficiency and Hashrate

Riot Platforms' profitability is directly tied to its mining efficiency (measured in hash rate) and the competitiveness of its mining operations. A decline in efficiency or a decrease in hashrate relative to competitors can lead to reduced profitability and downward pressure on the stock price.

- Competitive Landscape: The cryptocurrency mining industry is highly competitive. RIOT's performance relative to competitors in terms of hash rate and mining efficiency is crucial for its profitability and stock price.

- Technological Advancements: The constant evolution of mining technology requires ongoing investments to maintain competitiveness. Falling behind competitors in technological advancements can impact efficiency and profitability.

- Impact on Profitability: Lower mining efficiency translates to higher operating costs per Bitcoin mined, reducing overall profitability and potentially impacting the Riot Platforms (RIOT) stock price.

Debt and Financial Leverage

High levels of debt can make a company vulnerable to market downturns. Investors are naturally concerned about RIOT's ability to manage its debt burden during periods of low profitability.

- Debt Levels: Analyzing RIOT's financial statements reveals its debt levels and leverage ratios. High debt-to-equity ratios can signal increased financial risk.

- Interest Payments: Interest payments on debt reduce profitability, particularly during periods of low Bitcoin prices and reduced revenue.

- Investor Sentiment: High debt levels can negatively impact investor sentiment, leading to a decrease in investor confidence and downward pressure on the Riot Platforms (RIOT) stock price.

Expansion and Capital Expenditure

Significant capital expenditures for expanding mining operations can strain a company's finances, particularly during market downturns. While expansion is essential for long-term growth, it can negatively impact short-term profitability.

- Expansion Plans: RIOT's expansion plans involve significant capital investments in new mining facilities and equipment.

- Financial Strain: These investments can strain the company's finances, particularly during periods of low Bitcoin prices and reduced revenue.

- Impact on Stock Price: The need for significant capital expenditure can lead to concerns about financial health, which may negatively impact the Riot Platforms (RIOT) stock price.

Conclusion

The decline in Riot Platforms (RIOT) stock price is multifaceted, resulting from a combination of macroeconomic headwinds and company-specific factors. Understanding the interplay between Bitcoin price volatility, rising energy costs, regulatory uncertainty, mining efficiency, debt levels, and expansion plans is crucial for investors. By carefully assessing these factors, investors can make more informed decisions about their investment in RIOT. Stay informed about the latest developments in the cryptocurrency mining industry and continue monitoring the Riot Platforms (RIOT) stock price for potential opportunities and risks. Consider diversifying your portfolio to mitigate risk associated with the volatile cryptocurrency market and individual company performance. Thorough due diligence is essential before investing in Riot Platforms (RIOT) stock or any other cryptocurrency-related asset.

Featured Posts

-

Us Sec Considers Xrp A Commodity Implications Of Ripple Settlement Talks

May 02, 2025

Us Sec Considers Xrp A Commodity Implications Of Ripple Settlement Talks

May 02, 2025 -

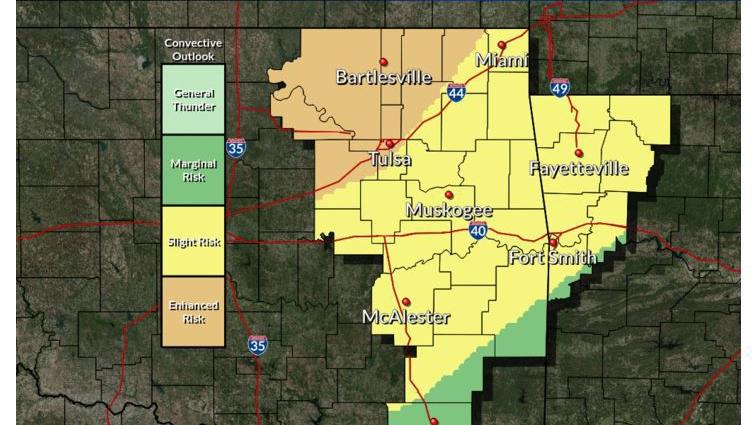

Tulsa Area Increased Severe Storm Risk After 2 Am

May 02, 2025

Tulsa Area Increased Severe Storm Risk After 2 Am

May 02, 2025 -

India Renews Demand For Justice Following Rubios De Escalation Plea

May 02, 2025

India Renews Demand For Justice Following Rubios De Escalation Plea

May 02, 2025 -

Robinson Nuclear Plants Safety Inspection License Renewal Possible Until 2050

May 02, 2025

Robinson Nuclear Plants Safety Inspection License Renewal Possible Until 2050

May 02, 2025 -

1 Million Debt Forgiven Michael Sheens Act Of Kindness

May 02, 2025

1 Million Debt Forgiven Michael Sheens Act Of Kindness

May 02, 2025

Latest Posts

-

Nigel Farage Afghan Migrants Death Threat On Uk Bound Flight

May 03, 2025

Nigel Farage Afghan Migrants Death Threat On Uk Bound Flight

May 03, 2025 -

Farage Lowe Clash Leaked Texts Detail Heated Exchange

May 03, 2025

Farage Lowe Clash Leaked Texts Detail Heated Exchange

May 03, 2025 -

Afghan Migrant Threatens Nigel Farage Details Of Uk Journey Incident

May 03, 2025

Afghan Migrant Threatens Nigel Farage Details Of Uk Journey Incident

May 03, 2025 -

Aide Humanitaire A Gaza Macron Denonce Le Risque De Militarisation Par Israel

May 03, 2025

Aide Humanitaire A Gaza Macron Denonce Le Risque De Militarisation Par Israel

May 03, 2025 -

Leaked Texts Expose Bitter Feud Between Nigel Farage And Rupert Lowe

May 03, 2025

Leaked Texts Expose Bitter Feud Between Nigel Farage And Rupert Lowe

May 03, 2025