Analyzing The U.S. Dollar's Early Performance: A Nixon-Era Comparison

Table of Contents

The Bretton Woods System and its Collapse

Understanding the Fixed Exchange Rate Regime

The Bretton Woods system, established in 1944, defined the post-World War II global monetary order. It was a system of fixed exchange rates, where the value of each currency was pegged to the U.S. dollar, which in turn was convertible to gold at a fixed rate of $35 per ounce. This "gold standard" provided a semblance of stability and predictability in international trade and finance.

- Definition of pegged exchange rates and the role of the US dollar: Currencies were not freely traded; their values were fixed against the dollar, making international transactions simpler and less prone to wild fluctuations. The US dollar served as the anchor for the entire system.

- The role of gold in the system: Gold acted as the ultimate guarantor of value, underpinning the dollar's stability and providing a credible benchmark for other currencies. Central banks held gold reserves to back their currencies.

- Growing strains on the system due to US balance of payments deficits: The U.S., however, faced persistent balance of payments deficits, meaning more dollars were flowing out of the country than coming in. This put pressure on its gold reserves.

- The impact of increased demand for US dollars and the outflow of gold: As the dollar became increasingly overvalued, other countries demanded more gold in exchange for their dollar holdings, threatening the system's integrity.

The Nixon Shock and its Immediate Impact on the U.S. Dollar

August 15, 1971: The End of Dollar-Gold Convertibility

On August 15, 1971, President Richard Nixon announced a series of economic measures known as the "Nixon shock." The most significant of these was the closure of the "gold window," ending the dollar's convertibility to gold. This effectively ended the Bretton Woods system.

- Explanation of President Nixon's decision: Faced with mounting economic pressures, including inflation and balance of payments deficits, Nixon sought to devalue the dollar to boost U.S. exports and curb imports.

- Immediate market reactions and the volatility of the U.S. dollar: The announcement triggered immediate market turmoil. The dollar's value fluctuated wildly against other currencies, initiating a period of unprecedented exchange rate volatility.

- Initial responses from other countries: Other nations responded with a mix of shock, anger, and uncertainty. The stability of the global monetary system was shattered, leading to a period of significant adjustment.

- Impact on international trade and investment: The shift to a floating exchange rate system initially created uncertainty in international trade and investment. Businesses struggled to adapt to the fluctuating exchange rates.

Analyzing the U.S. Dollar's Performance in the Early Post-Bretton Woods Era

Fluctuations and Volatility

The early post-Bretton Woods era witnessed significant fluctuations in the dollar's value. The shift to a floating exchange rate system meant that currency values were determined by market forces – supply and demand.

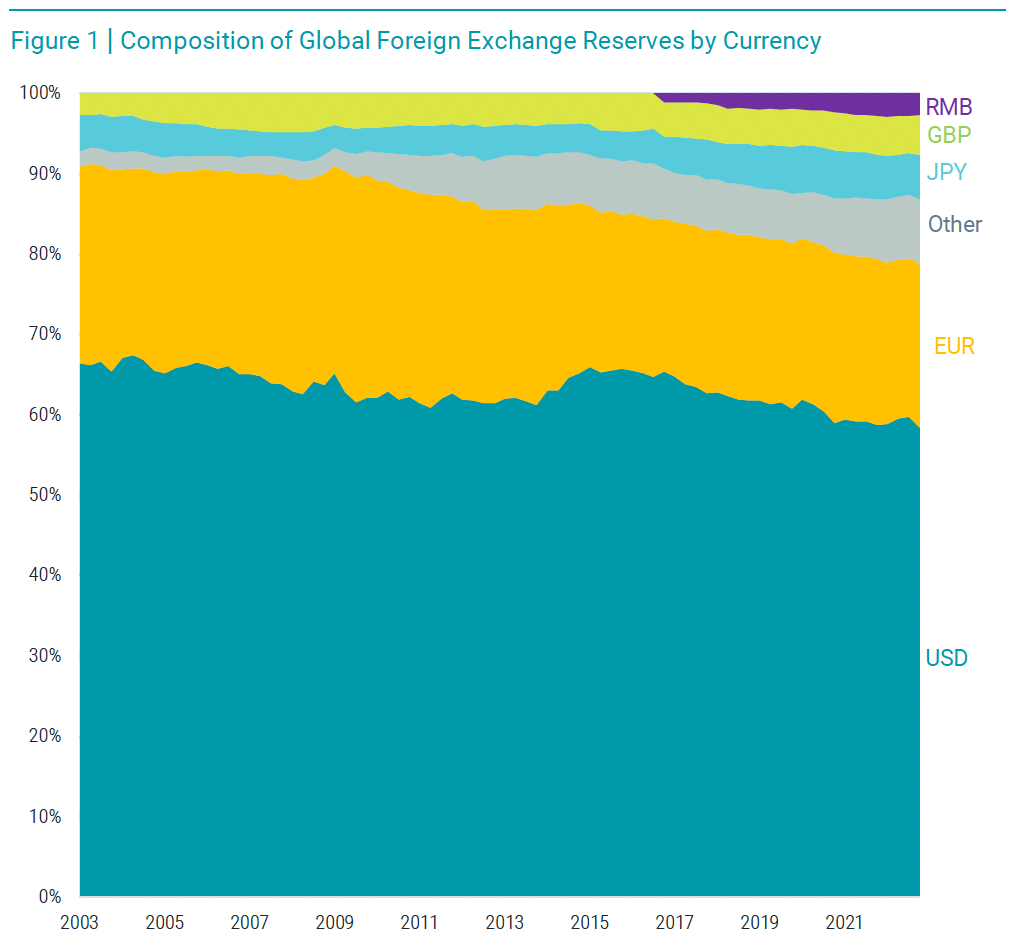

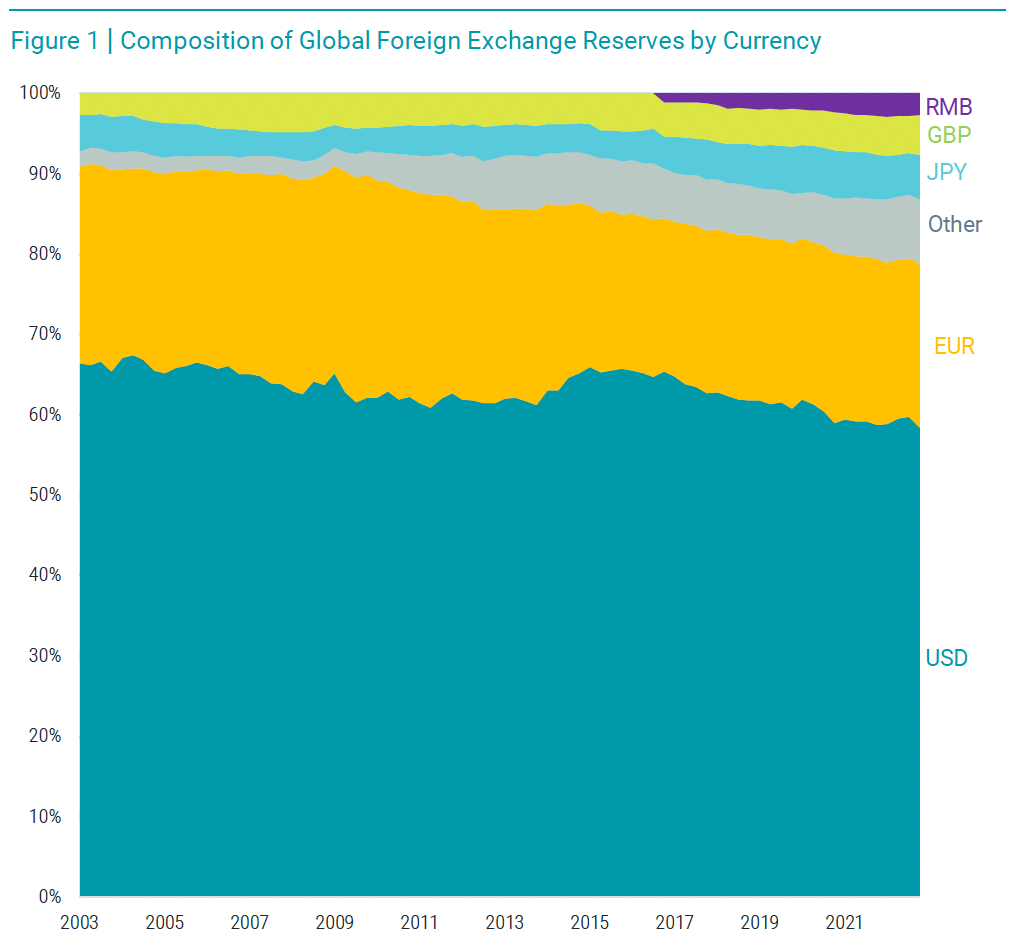

- Examine specific periods of strength and weakness for the dollar: The dollar experienced both periods of strength and weakness against major currencies like the German Mark, the British Pound, and the Japanese Yen. These fluctuations were driven by various economic factors.

- Analyze the factors contributing to these fluctuations (e.g., inflation, interest rates, economic growth): Inflation, interest rate differentials, and relative economic growth significantly influenced the dollar's value. High inflation in the U.S. often led to dollar depreciation.

- Compare the dollar's performance to other major currencies: The dollar's performance relative to other major currencies was a complex interplay of these economic factors, creating a dynamic and often unpredictable exchange rate environment.

Comparing the Nixon Era Economic Policies to the Dollar's Early Performance

Economic Policies and their Influence

Nixon's economic policies played a substantial role in shaping the U.S. dollar's performance in this period.

- Discuss Nixon's focus on inflation control (e.g., wage and price controls): Nixon initially implemented wage and price controls to combat inflation, but their effectiveness was limited and ultimately contributed to economic distortions.

- Analyze the impact of the expansionary fiscal policy in the early 1970s: Expansionary fiscal policies, aimed at stimulating economic growth, further fueled inflation and put additional pressure on the dollar.

- Consider the role of international trade negotiations in shaping the dollar's trajectory: International trade negotiations, while aiming to promote global economic growth, also had indirect effects on the value of the U.S. dollar through shifts in the balance of trade.

Conclusion

The U.S. dollar's early performance after the collapse of the Bretton Woods system was characterized by significant volatility and uncertainty. The Nixon shock marked a fundamental shift in the global monetary order, moving from a system of fixed exchange rates to a system where currency values were determined by market forces. This transition, coupled with the economic policies of the Nixon administration, created a complex and challenging environment for the U.S. dollar. The volatility of the U.S. dollar's early performance highlights the importance of understanding the interplay between domestic economic policy and international monetary systems. Further study of the U.S. dollar's early performance is crucial for understanding the evolution of the global financial system and the challenges inherent in managing a reserve currency in a floating exchange rate environment. Understanding the U.S. dollar's early performance requires a nuanced examination of the complex interplay of economic factors, political decisions, and global market dynamics.

Featured Posts

-

New Developments In Us China Trade Targeted Tariff Exemptions Announced

Apr 28, 2025

New Developments In Us China Trade Targeted Tariff Exemptions Announced

Apr 28, 2025 -

Ohio Train Derailment Toxic Chemical Lingering In Buildings Months Later

Apr 28, 2025

Ohio Train Derailment Toxic Chemical Lingering In Buildings Months Later

Apr 28, 2025 -

2 Year Old U S Citizens Deportation Federal Judge Sets Hearing

Apr 28, 2025

2 Year Old U S Citizens Deportation Federal Judge Sets Hearing

Apr 28, 2025 -

New X Financials Debt Sale Impacts And Company Transformation

Apr 28, 2025

New X Financials Debt Sale Impacts And Company Transformation

Apr 28, 2025 -

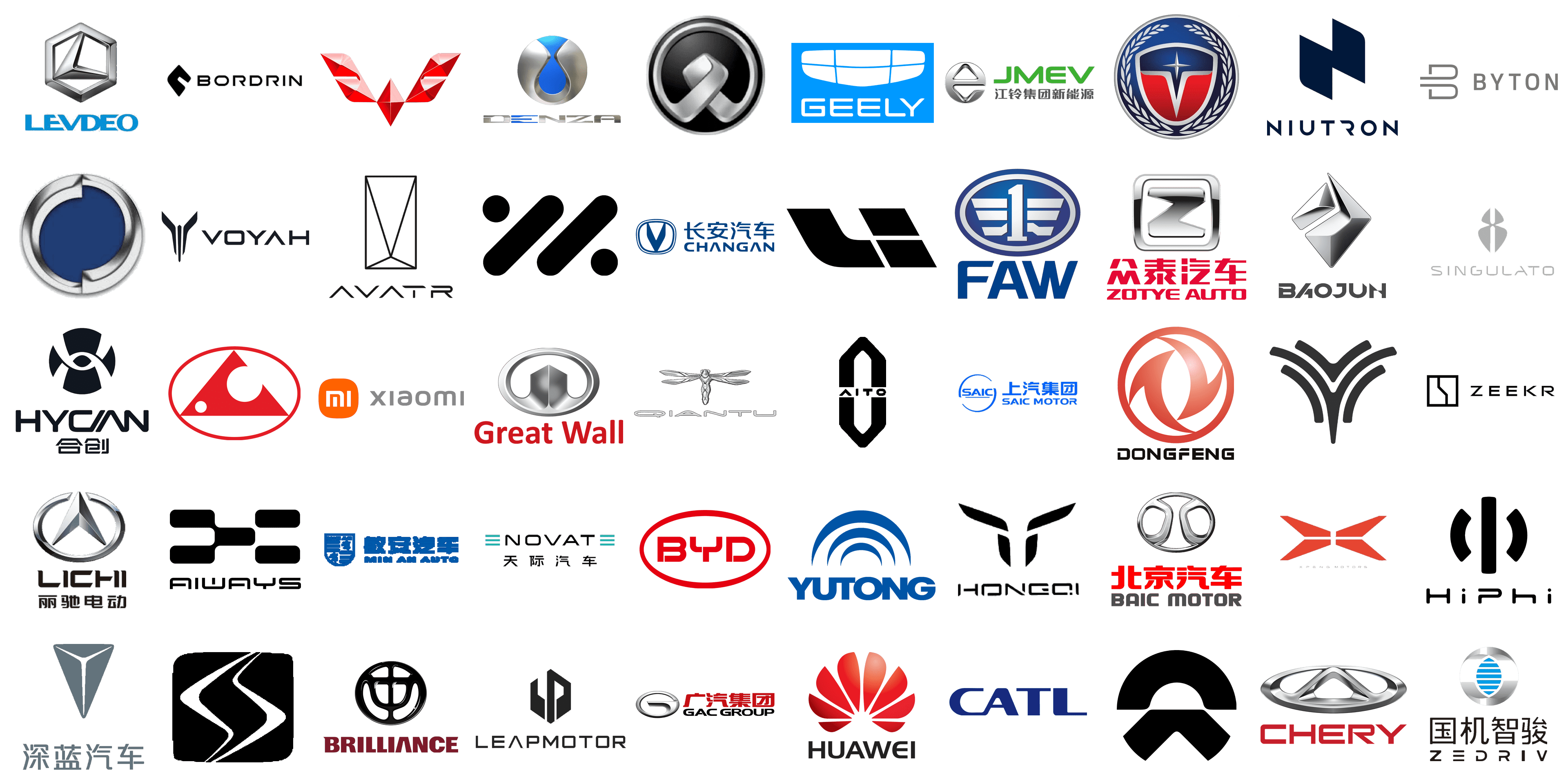

Analyzing The Headwinds Why Luxury Car Brands Face Challenges In China

Apr 28, 2025

Analyzing The Headwinds Why Luxury Car Brands Face Challenges In China

Apr 28, 2025

Latest Posts

-

Updated Red Sox Lineup Casas Moved Down Outfielder Returns From Injury

Apr 28, 2025

Updated Red Sox Lineup Casas Moved Down Outfielder Returns From Injury

Apr 28, 2025 -

Red Sox Starting Lineup Casas Position Shift Outfielders Comeback

Apr 28, 2025

Red Sox Starting Lineup Casas Position Shift Outfielders Comeback

Apr 28, 2025 -

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025 -

Jarren Duran 2 0 This Red Sox Outfielders Potential For A Breakout Season

Apr 28, 2025

Jarren Duran 2 0 This Red Sox Outfielders Potential For A Breakout Season

Apr 28, 2025 -

The Curse Is Broken Orioles Announcer And The 160 Game Hit Streak

Apr 28, 2025

The Curse Is Broken Orioles Announcer And The 160 Game Hit Streak

Apr 28, 2025