Analyzing Trump's Hints: The Potential Impact Of Privatized Student Loans

Table of Contents

Potential Benefits of Privatized Student Loans (According to Proponents):

Proponents of privatized student loan systems often highlight potential benefits centered around efficiency and reduced government involvement. However, it's crucial to examine these claims critically.

Increased Efficiency and Innovation:

The argument here is that private companies, driven by competition and profit motives, are inherently more efficient and innovative than government agencies. This could translate to improvements in several areas:

- Streamlined loan processing and faster disbursement of funds: Private lenders might offer quicker application approvals and faster release of loan funds, potentially benefiting students needing immediate financial assistance. This efficiency could be achieved through automation and streamlined processes.

- Development of more flexible repayment options tailored to individual circumstances: Private sector companies could introduce more innovative repayment plans, such as income-based repayment options or graduated repayment schedules, offering greater flexibility to borrowers. This could include options not currently available through federal programs.

- Potential for increased competition among lenders, leading to lower interest rates (theoretically): A competitive market could drive down interest rates, making loans more affordable for borrowers. However, this outcome is not guaranteed and depends heavily on the level of market regulation.

- Introduction of new technologies to improve loan management: Private lenders may be quicker to adopt new technologies for loan management, such as online portals and mobile apps, offering borrowers greater convenience and transparency.

Reduced Government Burden:

Shifting the responsibility of student loan management to the private sector could theoretically reduce the financial burden on taxpayers.

- Reduced government spending on administrative costs associated with loan programs: The government could save money by eliminating the administrative costs associated with managing federal student loan programs.

- Potential for a smaller federal deficit: The reduction in government spending could contribute to a smaller federal deficit.

- Freeing up government resources to focus on other priorities: This could allow the government to reallocate resources to other areas like education research or infrastructure development.

Potential Drawbacks and Risks of Privatized Student Loans:

While proponents highlight potential gains, the risks associated with privatizing student loans are substantial and cannot be ignored.

Increased Costs and Predatory Lending Practices:

A major concern is the potential for increased costs and the rise of predatory lending practices.

- Higher interest rates and fees compared to government-backed loans: Private lenders, focused on profit maximization, might charge higher interest rates and fees than government-backed loans, increasing the overall cost of borrowing.

- Increased risk of borrowers falling into debt traps due to aggressive lending tactics: Without strong regulations, borrowers could be vulnerable to aggressive lending tactics, resulting in unsustainable debt levels.

- Lack of consumer protections that exist with federal student loan programs: Federal student loan programs often include borrower protections, such as income-driven repayment plans and forgiveness programs, which might be absent in a privatized system.

- Difficulty accessing loans for students from low-income backgrounds: Private lenders may be hesitant to lend to students with lower credit scores or limited co-signers, potentially excluding low-income students.

Equity and Access Concerns:

Privatization could exacerbate existing inequalities in access to higher education.

- Private lenders may be less willing to lend to students with lower credit scores or limited co-signers: This could disproportionately affect students from disadvantaged backgrounds.

- Increased barriers to entry for students from disadvantaged backgrounds: The higher costs and stricter lending criteria could create significant barriers for students from low-income families.

- Potential for a widening gap in higher education attainment between different socioeconomic groups: Unequal access to loans could lead to a widening gap in higher education attainment between different socioeconomic groups.

Political and Regulatory Challenges:

Successfully implementing a privatized system would face significant political and regulatory hurdles.

- Need for comprehensive legislation to protect borrowers and regulate private lenders: Robust legislation is essential to prevent exploitation and ensure fair lending practices.

- Potential for lobbying efforts by private lenders to influence policy: Private lenders may exert significant lobbying pressure to shape regulations in their favor.

- Difficulties in overseeing and regulating a decentralized loan market: Supervising and regulating a decentralized market of private lenders would be a complex and challenging task.

Conclusion:

The potential shift towards privatized student loans presents a complex picture. While proponents point to increased efficiency and reduced government burden, significant concerns exist regarding increased costs for borrowers, predatory lending, and the exacerbation of existing inequalities. A thorough cost-benefit analysis, coupled with robust regulatory frameworks, is crucial to mitigate these risks. Careful consideration of the long-term implications of privatized student loans is essential to ensure that access to higher education remains equitable and affordable for all. Further research and public discussion on the potential consequences of privatized student loans are essential before any drastic policy changes are implemented. We need a careful, nuanced approach to avoid creating a system where the pursuit of higher education becomes financially unattainable for many. Let's continue the conversation about the best path forward for privatized student loans and responsible lending practices.

Featured Posts

-

2025s Leading Bitcoin And Crypto Casinos Players Guide

May 17, 2025

2025s Leading Bitcoin And Crypto Casinos Players Guide

May 17, 2025 -

Podcast Production Revolutionized Ais Role In Processing Repetitive Scatological Texts

May 17, 2025

Podcast Production Revolutionized Ais Role In Processing Repetitive Scatological Texts

May 17, 2025 -

After 48 Years Will Star Wars Finally Show Us This Planet

May 17, 2025

After 48 Years Will Star Wars Finally Show Us This Planet

May 17, 2025 -

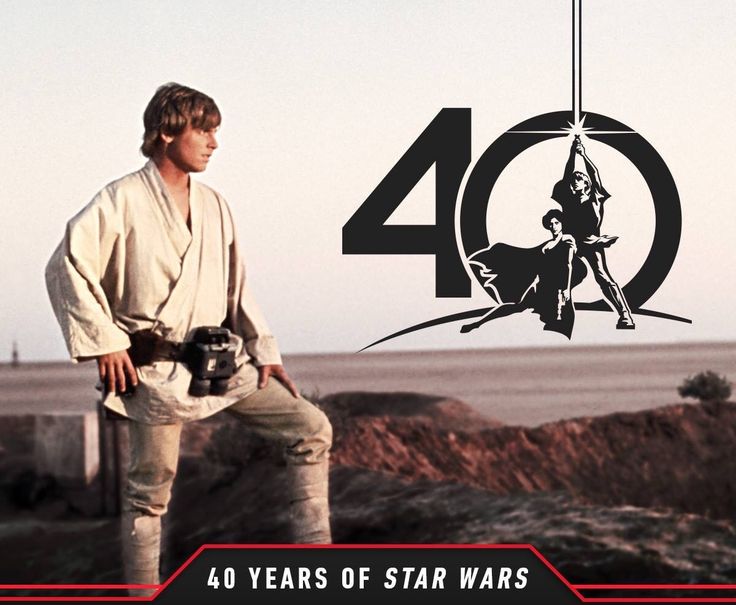

Xauusd Gold Price Recovery Us Economic Data And Fed Rate Hike Bets

May 17, 2025

Xauusd Gold Price Recovery Us Economic Data And Fed Rate Hike Bets

May 17, 2025 -

Hudsons Bay Offloads Name Stripes And Brands To Canadian Tire A 30 Million Deal

May 17, 2025

Hudsons Bay Offloads Name Stripes And Brands To Canadian Tire A 30 Million Deal

May 17, 2025