Apple Stock Dip: Key Levels Before Q2 Earnings

Table of Contents

Analyzing the Recent Apple Stock Dip

The recent Apple stock decline is a complex issue influenced by several interconnected factors. While Apple remains a dominant player in the tech sector, several macroeconomic and microeconomic forces are at play. Understanding these factors is crucial for assessing the current Apple stock price and predicting future performance.

-

Impact of inflation and rising interest rates: High inflation and rising interest rates globally impact investor sentiment and the overall stock market. These factors can decrease consumer spending and affect corporate profits, potentially influencing Apple's performance. The increased cost of borrowing also makes expansion and investment more expensive for companies.

-

Competition in the smartphone and tech markets: Apple faces stiff competition from companies like Samsung, Google, and other emerging tech brands. Intense competition can impact market share and potentially affect revenue growth, putting pressure on the Apple stock price.

-

Supply chain disruptions and their potential effects: Ongoing supply chain disruptions can impact Apple's ability to produce and deliver its products, affecting sales and potentially leading to lower-than-expected earnings. These disruptions can cause delays and shortages, which ripple through the market.

-

Investor sentiment and market speculation: Negative news, analyst downgrades, or broader market volatility can heavily influence investor sentiment towards Apple stock. Speculation surrounding future product releases and market trends can also significantly impact the Apple stock price.

Key Technical Levels to Watch

Technical analysis offers valuable insights into potential price movements. Monitoring key support and resistance levels is crucial for understanding the Apple stock price trajectory before the Q2 earnings.

-

Explanation of support and resistance levels and their significance: Support levels represent prices where buying pressure is expected to outweigh selling pressure, preventing further price declines. Resistance levels, conversely, are prices where selling pressure is expected to overcome buying pressure, halting price increases. Breaks above resistance or below support often signal significant shifts in momentum.

-

Identification of key chart patterns (e.g., head and shoulders, double bottom): Chart patterns, such as head and shoulders (suggesting a bearish reversal) or double bottom (suggesting a bullish reversal), can provide additional insights into potential price movements. Identifying these patterns helps anticipate shifts in the Apple stock price trend.

-

Discussion of potential breakout levels: A breakout above a resistance level signifies a bullish signal, while a breakdown below a support level suggests a bearish signal. Monitoring these breakout levels can help investors time their entry and exit points.

-

Mention of relevant technical indicators (e.g., moving averages, RSI): Technical indicators like moving averages (to identify trends) and the Relative Strength Index (RSI) (to assess momentum) can provide further signals about potential price direction and overbought/oversold conditions in the Apple stock.

Q2 Earnings Expectations and Their Impact on Apple Stock

Analyst predictions for Apple's Q2 earnings are closely watched. Key metrics like earnings per share (EPS), revenue growth, and product sales will heavily influence the market's reaction.

-

Consensus EPS and revenue estimates: Analysts provide consensus estimates for Apple's Q2 EPS and revenue. A significant deviation from these expectations, either positive or negative, can substantially impact the Apple stock price.

-

Potential drivers of revenue growth or decline (e.g., iPhone sales, services revenue): Analyzing the performance of key product lines like iPhones, iPads, Macs, and the services segment provides insight into Apple's overall financial health and growth potential. Strong iPhone sales, for example, often boost the Apple stock price.

-

Importance of Apple's guidance for future quarters: Apple's management typically provides guidance for future quarters, outlining their expectations for revenue and earnings. This guidance significantly affects investor sentiment and future price projections.

-

Market reaction scenarios based on earnings results: Exceeding expectations typically leads to a positive market reaction and an increase in the Apple stock price. Conversely, falling short of expectations usually results in a negative reaction and a price decline.

Risk Assessment and Investment Strategies

Investing in Apple stock, even with its strong track record, involves risk. Understanding and managing these risks is crucial.

-

Risks associated with market volatility: Broader market volatility can negatively impact even the strongest stocks. Unexpected economic downturns or geopolitical events can create uncertainty and affect the Apple stock price.

-

Potential impact of negative earnings surprises: If Apple's Q2 earnings fall short of expectations, it could lead to a significant drop in the Apple stock price. Investors need to consider the potential downside risk.

-

Strategies for mitigating risk (e.g., stop-loss orders, diversification): Implementing risk mitigation strategies, such as stop-loss orders (to limit potential losses) and diversifying investments across different asset classes, is crucial for managing risk.

-

Long-term vs. short-term investment approaches: Investors should consider their investment horizon. Long-term investors might weather short-term volatility, while short-term traders might be more sensitive to price fluctuations.

Conclusion

The recent Apple stock dip is a result of a confluence of factors, including macroeconomic conditions, competition, and investor sentiment. Monitoring key support and resistance levels, along with closely following Q2 earnings expectations, is crucial for navigating this period. The potential impact of the Q2 earnings report on the Apple stock price is significant, emphasizing the need for careful risk management and informed investment strategies. Stay informed about the Apple stock price and Q2 earnings to make informed investment decisions. Keep monitoring key levels and follow the market closely leading up to the Apple stock Q2 earnings release. Conduct thorough research and consider consulting a financial advisor before making any investment decisions related to Apple stock.

Featured Posts

-

Netherlands Hosts Major Bangladesh Investment Event 1 500 Attendees

May 25, 2025

Netherlands Hosts Major Bangladesh Investment Event 1 500 Attendees

May 25, 2025 -

Yevrobachennya Doli Peremozhtsiv Za Ostanni 10 Rokiv

May 25, 2025

Yevrobachennya Doli Peremozhtsiv Za Ostanni 10 Rokiv

May 25, 2025 -

Test Porsche Cayenne Gts Coupe Suv Dla Wymagajacych

May 25, 2025

Test Porsche Cayenne Gts Coupe Suv Dla Wymagajacych

May 25, 2025 -

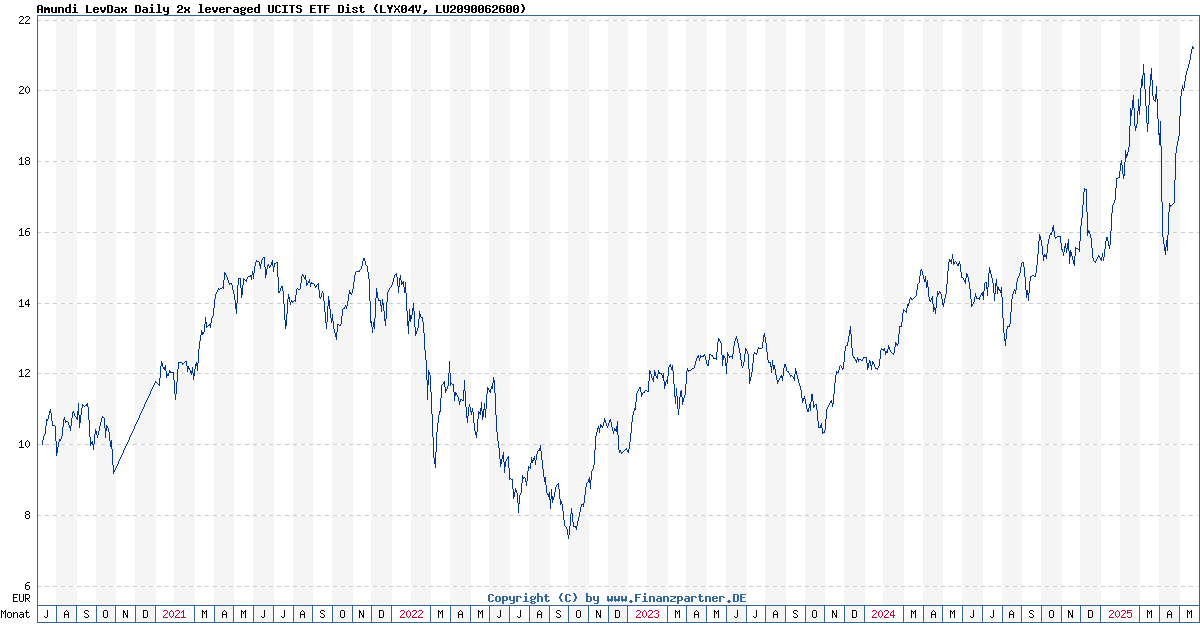

Amundi Msci World Ii Ucits Etf Dist Daily Nav And Its Implications

May 25, 2025

Amundi Msci World Ii Ucits Etf Dist Daily Nav And Its Implications

May 25, 2025 -

Paris Facing Financial Strain Amid Luxury Sector Slowdown

May 25, 2025

Paris Facing Financial Strain Amid Luxury Sector Slowdown

May 25, 2025

Latest Posts

-

Coheres Legal Battle Dismissal Sought In Copyright Infringement Case

May 25, 2025

Coheres Legal Battle Dismissal Sought In Copyright Infringement Case

May 25, 2025 -

Office365 Data Breach Millions Made From Executive Inboxes Fbi Investigation Reveals

May 25, 2025

Office365 Data Breach Millions Made From Executive Inboxes Fbi Investigation Reveals

May 25, 2025 -

The Ongoing Battle Car Dealers And Electric Vehicle Regulations

May 25, 2025

The Ongoing Battle Car Dealers And Electric Vehicle Regulations

May 25, 2025 -

Us Court Case Cohere Fights Media Copyright Infringement Allegations

May 25, 2025

Us Court Case Cohere Fights Media Copyright Infringement Allegations

May 25, 2025 -

Car Dealerships Push Back Against Mandatory Ev Quotas

May 25, 2025

Car Dealerships Push Back Against Mandatory Ev Quotas

May 25, 2025