Apple Stock Forecast: Wedbush's Bullish Stance Despite Lower Target

Table of Contents

Wedbush's Rationale for Maintaining a Bullish Apple Stock Forecast

Wedbush's positive Apple stock prediction rests on several key pillars, emphasizing the company's long-term growth potential. Their analysis highlights several factors contributing to a sustained bullish outlook, even in the face of macroeconomic headwinds. The firm believes Apple's robust ecosystem and diversified revenue streams provide a strong foundation for continued growth.

-

Strong iPhone Sales: Despite economic concerns and potential recessionary fears, Wedbush anticipates continued strong iPhone sales, fueled by the enduring appeal of Apple's flagship product and consistent innovation. They believe that Apple's loyal customer base and premium pricing strategy will continue to drive sales.

-

Booming Services Revenue: Apple's services sector, encompassing Apple Music, iCloud, Apple TV+, and other subscription offerings, continues to demonstrate impressive growth. This recurring revenue stream provides a significant buffer against fluctuations in hardware sales and contributes significantly to Apple's overall profitability.

-

Expansion into New Markets and Product Categories: Wedbush notes Apple's ongoing expansion into new markets and product categories, such as the growing wearables market (Apple Watch, AirPods), augmented reality (AR), and potential advancements in other areas like electric vehicles, as catalysts for future growth. These initiatives represent significant opportunities for revenue diversification and expansion.

-

Potential for Significant Future Innovations: Apple's history of disruptive innovation is a key factor in Wedbush's bullish stance. The anticipation of groundbreaking new products and technologies in the coming years contributes to their long-term positive Apple stock prediction. The potential for advancements in areas such as AR/VR, chips, and services keeps the growth outlook strong.

These factors, according to the Wedbush report, support their continued belief in Apple's long-term potential for growth and profitability.

The Lowered Price Target: Understanding the Nuances

While maintaining a bullish outlook on Apple stock, Wedbush did lower its price target. This adjustment doesn't necessarily signal a change in their fundamental view on the company's future but rather reflects a recalibration in light of prevailing macroeconomic factors.

-

Global Inflation and Recessionary Fears: The current global economic climate, characterized by high inflation and recessionary fears, has led to a more cautious approach in many market sectors. This uncertainty necessitates a more conservative valuation for even strong companies like Apple.

-

Potential Impact on Consumer Spending: Concerns about the potential impact of inflation and recession on consumer spending prompted the price target reduction. A weakening economy could lead to decreased discretionary spending on high-priced electronics, including iPhones.

-

Competition in the Tech Market: The tech market remains fiercely competitive, with several strong players vying for market share. This competitive landscape necessitates a reassessment of Apple’s valuation and its ability to consistently outperform expectations.

It is important to note that the lowered price target doesn't necessarily negate Wedbush's overall bullish sentiment on Apple; it simply reflects a more cautious approach given the current economic climate.

Analyzing the Implications for Investors

Wedbush's Apple stock forecast holds significant implications for investors. The maintained bullish stance, despite the lowered price target, suggests a long-term positive outlook, but it's crucial to consider both potential opportunities and risks.

-

Potential Risks: Investing in any stock carries inherent risks. Factors such as economic downturns, increased competition, and unforeseen technological disruptions could negatively impact Apple's performance.

-

Opportunities for Long-Term Investors: For investors with a long-term horizon, Wedbush's forecast presents potential opportunities to capitalize on Apple's anticipated future growth. The company's strong brand, loyal customer base, and diversified revenue streams suggest resilience against market volatility.

-

Recommendations Based on Risk Tolerance: Investors should tailor their investment strategy based on their individual risk tolerance. Conservative investors might adopt a "hold" strategy, while more aggressive investors might view this as a buying opportunity.

It's important to consider alternative viewpoints and conduct thorough research before making any investment decisions. The analysis presented here represents just one perspective.

Comparing Wedbush's Forecast to Other Analyst Predictions

While Wedbush maintains a bullish outlook, it's crucial to consider the broader analyst consensus. Other analysts hold varying perspectives on Apple's stock price, reflecting differing interpretations of the market and Apple's prospects. Some may offer more conservative Apple stock predictions, while others might share Wedbush’s bullish sentiment, albeit with potentially different price targets. A comparison of these diverse opinions helps provide a comprehensive understanding of the market sentiment surrounding AAPL. Examining these different forecasts and their underlying rationales provides a more balanced view for informed decision-making.

Conclusion

Wedbush Securities remains bullish on Apple stock, despite a lowered price target. This optimistic Apple stock prediction is grounded in Apple's strong fundamentals, including robust iPhone sales, a rapidly growing services sector, expansion into new markets, and the anticipation of future innovations. However, the lowered price target reflects a cautious approach given current macroeconomic headwinds and potential impacts on consumer spending. Investors must carefully consider both the positive and negative aspects of this forecast, performing their own due diligence and aligning their investment decisions with their individual risk tolerance and financial goals. Stay informed on the latest Apple stock forecast and learn more about the Apple stock prediction to make the best choices for your portfolio. The future of Apple stock remains promising, but informed decision-making remains key.

Featured Posts

-

Trade War Intensifies Another Drop For Dutch Stocks

May 25, 2025

Trade War Intensifies Another Drop For Dutch Stocks

May 25, 2025 -

Leeds Uniteds Bid For Kyle Walker Peters Transfer Speculation Mounts

May 25, 2025

Leeds Uniteds Bid For Kyle Walker Peters Transfer Speculation Mounts

May 25, 2025 -

Relx Doorstaat Zwakke Economie Dankzij Ai Sterke Groei Voorspeld Tot 2025

May 25, 2025

Relx Doorstaat Zwakke Economie Dankzij Ai Sterke Groei Voorspeld Tot 2025

May 25, 2025 -

Sean Penns Allegiance To Woody Allen A Persistent Me Too Issue

May 25, 2025

Sean Penns Allegiance To Woody Allen A Persistent Me Too Issue

May 25, 2025 -

Annie Kilner Steps Out Solo After Kyle Walkers Night Out

May 25, 2025

Annie Kilner Steps Out Solo After Kyle Walkers Night Out

May 25, 2025

Latest Posts

-

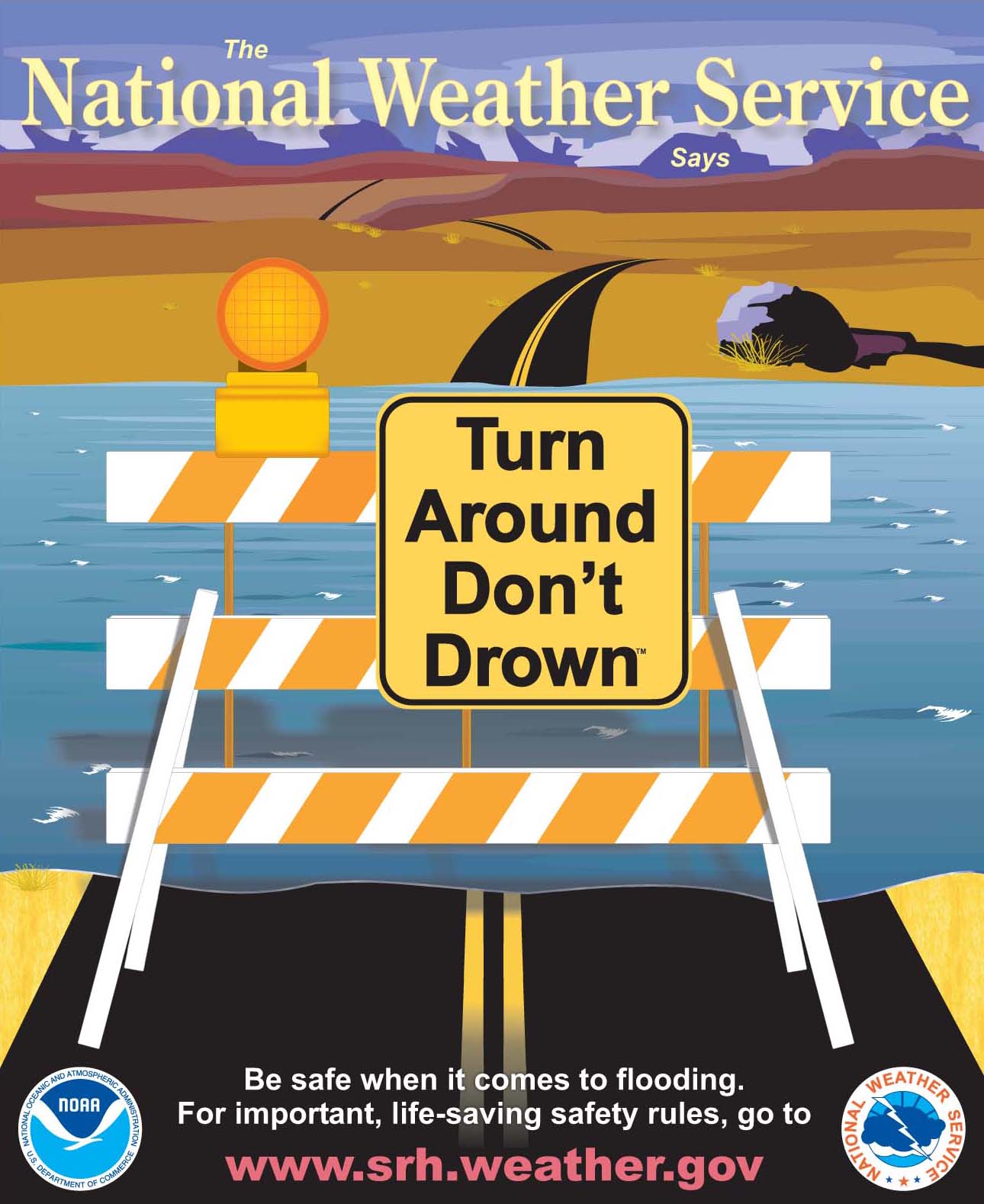

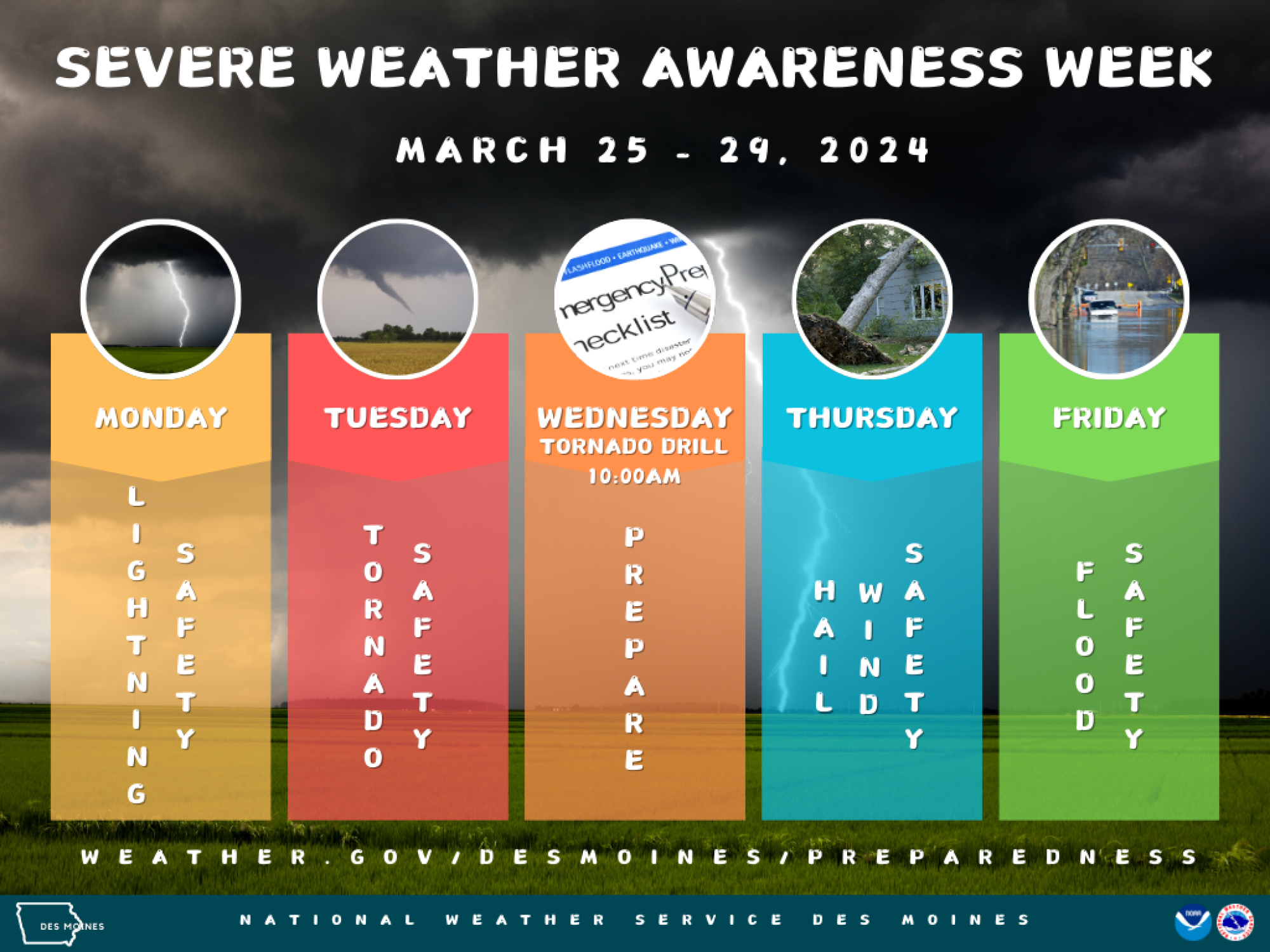

Severe Weather Awareness Week Day 5 Focus On Flood Safety

May 25, 2025

Severe Weather Awareness Week Day 5 Focus On Flood Safety

May 25, 2025 -

Extreme V Mware Price Increase At And T Details 1 050 Cost Surge From Broadcom

May 25, 2025

Extreme V Mware Price Increase At And T Details 1 050 Cost Surge From Broadcom

May 25, 2025 -

Protecting Yourself And Your Family From Floods Severe Weather Awareness Week

May 25, 2025

Protecting Yourself And Your Family From Floods Severe Weather Awareness Week

May 25, 2025 -

Severe Weather Report April 2nd Tornado Activity And Current Flash Flood Warnings April 4th 2025

May 25, 2025

Severe Weather Report April 2nd Tornado Activity And Current Flash Flood Warnings April 4th 2025

May 25, 2025 -

1 050 Price Hike At And T Sounds Alarm On Broadcoms V Mware Deal

May 25, 2025

1 050 Price Hike At And T Sounds Alarm On Broadcoms V Mware Deal

May 25, 2025