Apple Stock: Long-Term Bullish Despite Price Target Cut - Wedbush's View

Table of Contents

Understanding Wedbush's Price Target Cut for Apple Stock

Wedbush Securities recently lowered its price target for Apple stock. While the exact amount varies depending on the source, the reduction signifies a shift in their short-term outlook. Their rationale centers around several key factors: concerns about slowing iPhone sales, particularly in China, the impact of the current macroeconomic environment (inflation, interest rate hikes), and increased competition in the smartphone market.

A Wedbush analyst reportedly stated (insert quote if available), highlighting the challenges Apple faces in maintaining its growth trajectory in the near term.

Key reasons for the price target revision include:

- Slower iPhone Sales Growth: Concerns over demand for the iPhone, particularly in key markets like China, where economic slowdown is impacting consumer spending.

- Macroeconomic Headwinds: Inflation and rising interest rates are affecting consumer discretionary spending, potentially reducing demand for premium electronics.

- Increased Competition: The intensifying competition from Android manufacturers offering compelling alternatives at lower price points is putting pressure on Apple's market share.

Keywords: Apple stock price, Wedbush price target cut, iPhone sales, macroeconomic environment, Apple competition.

Why Apple Stock Remains a Long-Term Bullish Investment

Despite the short-term concerns highlighted by Wedbush, the long-term bullish case for Apple stock remains compelling. This stems from Apple's consistently strong fundamentals:

- Market Leadership: Apple maintains a dominant position in the premium smartphone market and holds significant market share in other segments like wearables and tablets.

- Robust Ecosystem: The Apple ecosystem, encompassing iPhones, iPads, Macs, and Apple Watch, fosters strong customer loyalty and encourages repeat purchases.

- Innovative Products: Apple's history of innovation consistently delivers cutting-edge products and services, driving customer demand.

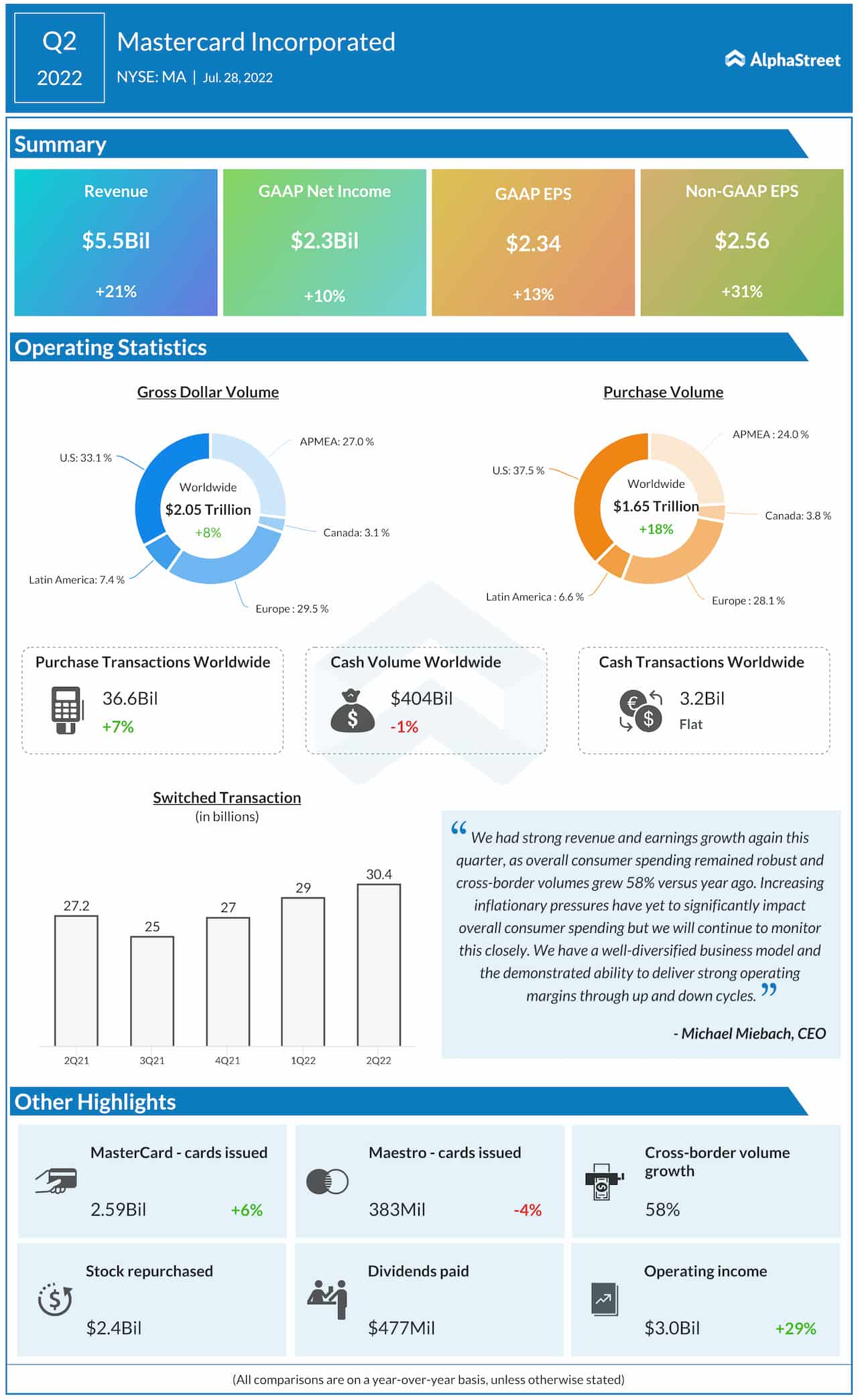

- Strong Financial Performance: Apple consistently generates substantial revenue and profits, providing a solid financial foundation.

- Diversification Beyond iPhones: Apple's diversification strategy into high-growth areas like services (Apple Music, iCloud, App Store), wearables (Apple Watch, AirPods), and other emerging markets, mitigates reliance on iPhone sales alone.

Apple's strong brand loyalty and a vast customer base provide a significant competitive advantage. Further growth potential is anticipated from emerging markets where smartphone penetration is still growing.

- Apple Services Revenue Growth: Apple's services segment is a significant and rapidly growing revenue stream.

- Wearables Market Dominance: Apple's wearables continue to gain market share, demonstrating consistent growth potential.

- Emerging Market Expansion: Significant untapped potential exists for Apple in developing economies.

Keywords: Apple services revenue, Apple wearables, Apple brand loyalty, Apple future growth, emerging markets.

Analyzing the Risk Factors Associated with Investing in Apple Stock

While the long-term outlook for Apple is positive, it's crucial to acknowledge potential risks:

- Economic Downturns: A global recession or significant economic slowdown could negatively impact consumer spending on electronics, affecting Apple's sales.

- Increasing Competition: Intensifying competition from Android manufacturers, particularly in the mid-range and budget smartphone segments, could erode Apple's market share.

- Supply Chain Disruptions: Geopolitical instability and unforeseen events can disrupt Apple's supply chain, impacting production and delivery.

- Global Events: Unexpected global events, such as pandemics or geopolitical crises, can negatively influence Apple's stock performance.

These factors present challenges, requiring investors to adopt a balanced and informed perspective. However, Apple's proven resilience and ability to adapt suggest that it is well-positioned to navigate these challenges.

Keywords: Apple stock risks, economic downturn, competition, supply chain, global events.

Comparing Apple Stock to its Competitors in the Tech Sector

Compared to its major tech rivals – Microsoft, Google (Alphabet), and Amazon – Apple holds a unique position. While Microsoft dominates enterprise software and cloud computing, Google excels in search and advertising. Amazon reigns supreme in e-commerce and cloud infrastructure.

Apple's strengths lie in its premium brand, loyal customer base, and integrated ecosystem. Its weaknesses include higher price points and a more limited product portfolio compared to its competitors. (Insert charts and graphs to visually compare key metrics like market capitalization, revenue growth, and P/E ratio).

- Apple vs. Microsoft: Different market focus; Apple in consumer electronics, Microsoft in software and enterprise.

- Apple vs. Google: Competition in mobile OS and advertising; different business models.

- Apple vs. Amazon: Different product offerings; limited direct competition except in digital services.

Keywords: Apple vs Microsoft, Apple vs Google, Apple vs Amazon, tech stock comparison, market capitalization.

Conclusion: Maintaining a Bullish Outlook on Apple Stock Despite Short-Term Volatility

While Wedbush's price target cut reflects legitimate concerns about short-term headwinds, the long-term bullish case for Apple stock remains robust. Apple's strong fundamentals, diversification strategy, and significant growth potential in emerging markets outweigh the near-term challenges. While acknowledging the inherent risks associated with any investment, the potential for long-term growth and returns makes Apple stock an attractive option for many investors.

Consider adding Apple stock to your long-term portfolio, taking into account the information presented here and conducting thorough due diligence. Remember to consult with a financial advisor before making any investment decisions. Keywords: Apple stock outlook, long-term investment strategy, Apple stock analysis, Apple stock portfolio, due diligence.

Featured Posts

-

A Reconsideration Of The Woody Allen Dylan Farrow Case Sean Penns Viewpoint

May 24, 2025

A Reconsideration Of The Woody Allen Dylan Farrow Case Sean Penns Viewpoint

May 24, 2025 -

Apple Stock Performance Q2 2024 Beats Earnings Estimates

May 24, 2025

Apple Stock Performance Q2 2024 Beats Earnings Estimates

May 24, 2025 -

Police Helicopter Pursuit Pair Refuel At 90mph While Texting

May 24, 2025

Police Helicopter Pursuit Pair Refuel At 90mph While Texting

May 24, 2025 -

2024 Porsche Macan Buyers Guide New Features And Updates

May 24, 2025

2024 Porsche Macan Buyers Guide New Features And Updates

May 24, 2025 -

Escape To The Country The Benefits Of A Slower Pace Of Life

May 24, 2025

Escape To The Country The Benefits Of A Slower Pace Of Life

May 24, 2025

Latest Posts

-

Nisan 2024 Para Bereketi Yasayacak Burclar

May 24, 2025

Nisan 2024 Para Bereketi Yasayacak Burclar

May 24, 2025 -

Oefkesini Hemen Cikaran Burclar Ihanetin Bedeli

May 24, 2025

Oefkesini Hemen Cikaran Burclar Ihanetin Bedeli

May 24, 2025 -

Inanilmaz Cekim Guecuene Sahip Burclar Seytan Tueyue Etkisi

May 24, 2025

Inanilmaz Cekim Guecuene Sahip Burclar Seytan Tueyue Etkisi

May 24, 2025 -

Nisan Ayinda Zenginlesen Burclar Beklenmedik Servete Ulasacaklar

May 24, 2025

Nisan Ayinda Zenginlesen Burclar Beklenmedik Servete Ulasacaklar

May 24, 2025 -

Ihanete Dayanmayan Burclar Aninda Tepki Veriyorlar

May 24, 2025

Ihanete Dayanmayan Burclar Aninda Tepki Veriyorlar

May 24, 2025