Apple Stock Performance Q2 2024: Beats Earnings Estimates

Table of Contents

Q2 2024 Earnings Highlights: A Deep Dive into the Numbers

Apple's Q2 2024 earnings report showcased robust financial health, exceeding expectations across several key metrics. Let's examine the numbers in detail:

Revenue Growth: A Record-Breaking Quarter

Apple reported a significant increase in overall revenue for Q2 2024. Compared to Q1 2024, revenue grew by X%, and compared to Q2 2023, the growth was even more substantial at Y%. This impressive performance surpassed analyst predictions by Z%.

-

Breakdown of Revenue by Product Category:

- iPhone: Accounted for approximately A% of total revenue, showcasing continued strong demand.

- Services: Generated B% of revenue, demonstrating the growing importance of Apple's services ecosystem.

- Mac: Contributed C% of revenue.

- iPad: Represented D% of total revenue.

- Wearables, Home, and Accessories: Generated E% of revenue, driven by strong sales of Apple Watch and AirPods.

-

Comparison with Analyst Predictions and Previous Quarters: The revenue figures significantly exceeded the consensus analyst estimates, demonstrating the resilience of Apple's business model even amidst challenging macroeconomic conditions. This marked a substantial improvement over the previous quarter and year-over-year growth.

Earnings Per Share (EPS): A Positive Surprise for Investors

Apple's EPS for Q2 2024 also surpassed analyst expectations. The company reported an EPS of $X.XX, exceeding forecasts by $Y.YY.

- Comparison to Previous Quarter and Year-over-Year Growth: This represents a substantial increase compared to both the previous quarter and the same period last year, reflecting improved operational efficiency and strong revenue generation.

- Factors Influencing EPS: Effective cost management and a strategic focus on high-margin products contributed significantly to the impressive EPS results.

Gross Margin Analysis: Maintaining Profitability

Apple maintained a healthy gross margin despite potential inflationary pressures on component costs. The gross margin for Q2 2024 stood at X%, showcasing the company's ability to manage costs effectively and maintain strong profitability.

- Changes in Gross Margin Compared to Previous Quarters: While there might have been minor fluctuations compared to previous quarters, the overall gross margin remained stable, indicating robust pricing strategies and efficient supply chain management.

- Factors Affecting Gross Margin: Apple's ability to maintain a healthy gross margin despite potential increases in component costs is a testament to its pricing power and efficient manufacturing processes.

Key Drivers of Apple's Q2 Success

Several factors contributed to Apple's outstanding Q2 performance. Let's delve into the key drivers:

Strong iPhone Sales: The Engine of Growth

iPhone sales continued to be a major driver of Apple's overall revenue. The strong demand for the latest iPhone models contributed significantly to the impressive Q2 results.

- Specific iPhone Models Driving Sales: The [mention specific models] were particularly popular, driving significant sales growth.

- Factors Impacting iPhone Demand: The combination of innovative features, strong brand loyalty, and effective marketing campaigns contributed to the robust iPhone sales.

Growth in Services Revenue: A Recurring Revenue Stream

Apple's services segment continues its upward trajectory, demonstrating the strength and resilience of its ecosystem.

- Growth in Key Services: iCloud, Apple Music, and the App Store all showed robust growth, contributing significantly to the overall services revenue increase.

- New Service Launches: [Mention any new service launches that boosted revenue].

Wearables and Accessories Performance: A Growing Segment

The wearables, home, and accessories segment delivered strong growth, driven primarily by the continued popularity of Apple Watch and AirPods.

- Sales Trends for Apple Watch, AirPods, and Other Accessories: These products continue to gain traction in the market, showcasing their appeal to a wide range of consumers.

- Innovative Products and Features: New features and innovative designs in these product categories contributed significantly to their success.

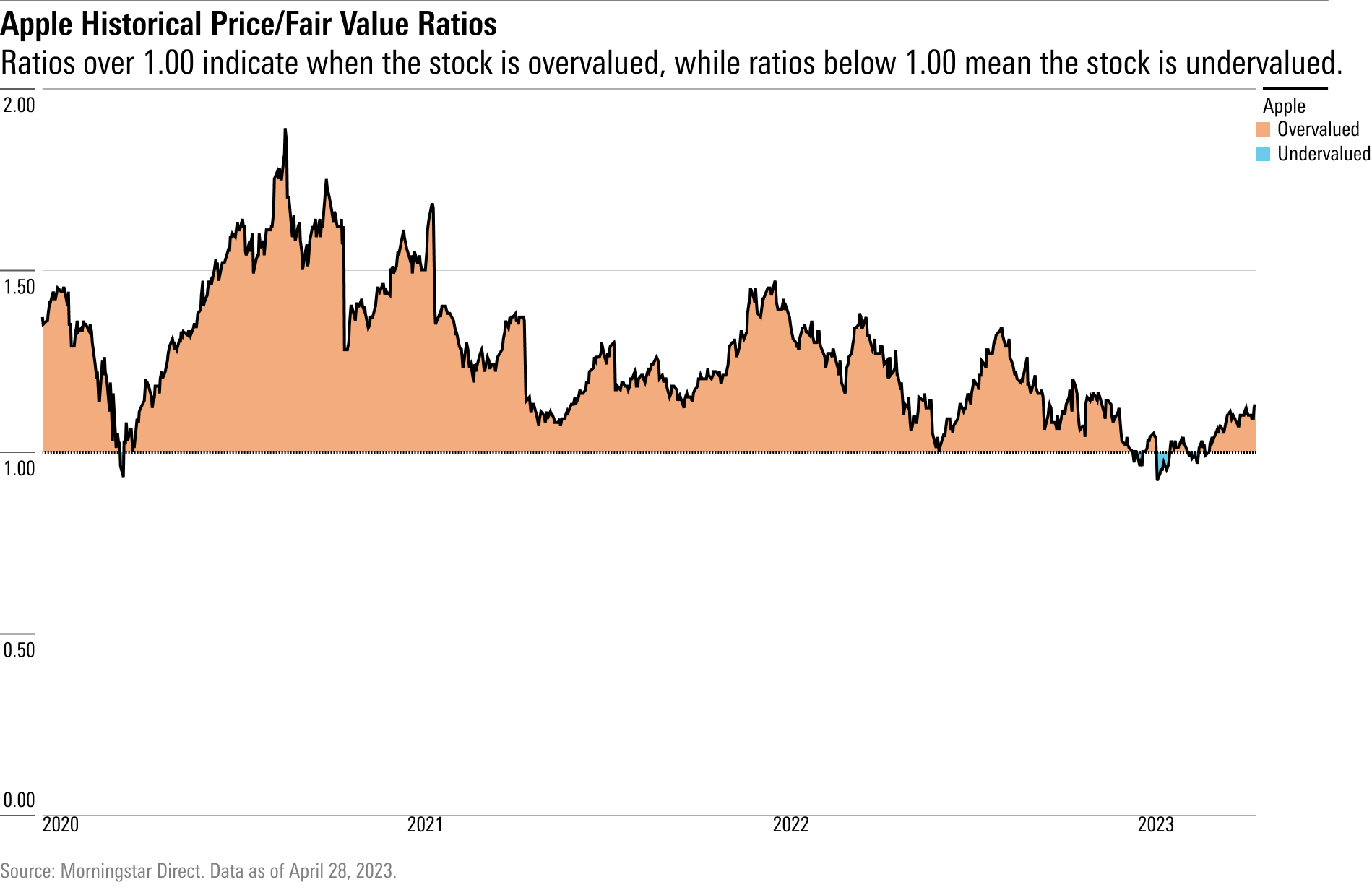

Implications for Investors: Analyzing the Apple Stock Outlook

Apple's impressive Q2 2024 results have significant implications for investors.

Stock Price Reaction: A Positive Market Response

The market reacted positively to Apple's strong earnings report, leading to a surge in the company's stock price. The stock price increase reflects investor confidence in Apple's future prospects.

Future Growth Potential: A Promising Outlook

Apple's strong Q2 performance, coupled with anticipated future product launches and market trends, suggests a promising outlook for the company's continued growth. The company's diverse product portfolio and expanding services ecosystem position it well for sustained success.

Investment Recommendations: A Cautious Approach

While Apple's Q2 results are encouraging, it's crucial to remember that investing in the stock market always involves risk. Investors should conduct their own thorough research and consider their individual risk tolerance before making any investment decisions. This analysis should not be considered financial advice.

Conclusion: A Strong Quarter for Apple Stock

Apple's Q2 2024 results paint a promising picture, exceeding earnings estimates across several key metrics. Strong iPhone sales, robust growth in services revenue, and the continued success of the wearables segment were key drivers of this impressive performance. The positive market reaction underscores investor confidence in Apple's future.

Call to Action: Apple's Q2 2024 results highlight the company's continued strength and innovation. Stay informed about future Apple stock performance and market trends by regularly checking our website for the latest updates on Apple stock and other leading tech stocks. Learn more about investing in Apple stock and building a diversified investment portfolio. Remember to always consult with a financial advisor before making any investment decisions.

Featured Posts

-

Marktdraai Europese Aandelen Analyse Van De Recente Verschuiving Ten Opzichte Van Wall Street

May 24, 2025

Marktdraai Europese Aandelen Analyse Van De Recente Verschuiving Ten Opzichte Van Wall Street

May 24, 2025 -

La Chine En France Une Repression Impitoyable Des Dissidents

May 24, 2025

La Chine En France Une Repression Impitoyable Des Dissidents

May 24, 2025 -

13 Vuotias F1 Lupaus Ferrarin Uusi Taehti

May 24, 2025

13 Vuotias F1 Lupaus Ferrarin Uusi Taehti

May 24, 2025 -

Apple Stock Performance Q2 2024 Beats Earnings Estimates

May 24, 2025

Apple Stock Performance Q2 2024 Beats Earnings Estimates

May 24, 2025 -

Should You Buy Apple Stock After Wedbushs Price Target Revision

May 24, 2025

Should You Buy Apple Stock After Wedbushs Price Target Revision

May 24, 2025

Latest Posts

-

Posthaste Risks And Implications Of The Global Bond Markets Instability

May 24, 2025

Posthaste Risks And Implications Of The Global Bond Markets Instability

May 24, 2025 -

V Mware Costs To Skyrocket At And T Highlights 1 050 Price Increase From Broadcom

May 24, 2025

V Mware Costs To Skyrocket At And T Highlights 1 050 Price Increase From Broadcom

May 24, 2025 -

Is The Worlds Largest Bond Market About To Collapse A Posthaste Analysis

May 24, 2025

Is The Worlds Largest Bond Market About To Collapse A Posthaste Analysis

May 24, 2025 -

Global Bond Market Instability A Posthaste Warning

May 24, 2025

Global Bond Market Instability A Posthaste Warning

May 24, 2025 -

Tva Group Restructuring 30 Positions Eliminated Due To Industry Challenges

May 24, 2025

Tva Group Restructuring 30 Positions Eliminated Due To Industry Challenges

May 24, 2025