Apple Stock Price Decline Following Tariff Projection

Table of Contents

Impact of Tariffs on Apple's Manufacturing and Supply Chain

Apple's extensive reliance on Chinese manufacturing is well-documented. A significant portion of its products, from iPhones to MacBooks, are assembled in factories across China. The imposition of tariffs directly increases the production costs associated with these goods. This increase translates to reduced profit margins for Apple, potentially impacting its bottom line significantly. The ripple effects of these increased costs are substantial:

- Increased component costs: Tariffs raise the price of imported components needed for Apple's products, leading to higher overall manufacturing expenses.

- Potential delays in product launches: Supply chain disruptions caused by tariff-related issues could delay the release of new products, impacting sales and revenue streams.

- Reduced consumer demand due to higher prices: To offset increased production costs, Apple might need to raise product prices, potentially dampening consumer demand and affecting sales volume.

- Shifting manufacturing locations (potential costs and challenges): Relocating manufacturing facilities from China is a complex and costly undertaking, requiring significant investments and potentially compromising efficiency. Keywords: Apple manufacturing, China tariffs, supply chain disruption, import tariffs, production costs.

Investor Sentiment and Market Reaction to Tariff News

The projection of increased tariffs triggered an immediate and noticeable negative reaction in the stock market. Apple's stock price experienced a sharp drop, accompanied by heightened trading volume, reflecting investor anxiety. This market response underscores the significant impact of tariff uncertainties on investor confidence.

- Stock price drops and trading volume: The announcement led to a significant decline in Apple's stock price and a surge in trading activity as investors reacted to the news.

- Analyst downgrades and revised earnings predictions: Following the tariff projection, several financial analysts downgraded their ratings on Apple stock and revised their earnings predictions downward, reflecting their concerns about the company's future performance.

- Investor sell-offs and portfolio adjustments: Many investors responded by selling off their Apple shares, adjusting their portfolios to mitigate potential losses.

- Impact on other tech stocks: The negative sentiment surrounding Apple's stock also affected other technology companies, highlighting the interconnectedness of the tech sector. Keywords: Investor sentiment, market volatility, stock market reaction, Apple stock forecast, analyst predictions.

Apple's Strategic Response to Tariff Challenges

Apple isn't passively accepting the tariff challenges. The company is likely exploring a range of strategies to mitigate the impact:

- Price adjustments: Apple might choose to absorb some of the increased costs, impacting its profit margins, or pass them on to consumers through price increases.

- Diversification of manufacturing locations: Shifting some or all of its manufacturing operations out of China to countries with lower tariffs is a complex long-term strategy with significant costs and logistical implications.

- Lobbying efforts and political engagement: Apple might engage in lobbying efforts to influence trade policies and potentially reduce or eliminate the tariffs.

- Cost-cutting measures: The company may implement internal cost-cutting measures across various departments to offset the impact of increased production costs.

- Innovation and new product development: Focusing on innovation and developing new products could help Apple maintain its competitive edge and offset any negative impacts on sales. Keywords: Apple strategy, tariff mitigation, manufacturing diversification, price increase, cost reduction.

Long-Term Implications for Apple's Growth and Valuation

The long-term consequences of these tariff projections on Apple's growth and valuation are significant and uncertain. Reduced profitability, slower revenue growth, and potential market share loss are all possible outcomes.

- Reduced profitability: Increased production costs directly impact Apple's profitability, potentially squeezing margins and reducing overall earnings.

- Slower revenue growth: Higher prices or reduced consumer demand resulting from tariffs could contribute to slower revenue growth for Apple.

- Potential for long-term market share loss: Competitors may gain a market advantage if Apple is forced to raise prices or faces significant supply chain disruptions.

- Impact on future product development and innovation: The financial strain from tariffs could affect Apple’s investment in research and development, potentially slowing down innovation. Keywords: Apple growth, long-term impact, stock valuation, market capitalization, future outlook.

Conclusion: Navigating the Uncertainty of Apple Stock Price Following Tariff Projections

The projection of increased tariffs presents significant challenges to Apple, impacting its stock price and potentially affecting its long-term growth trajectory. The situation is dynamic and requires close monitoring. Investors should remain vigilant, carefully analyzing the evolving situation and Apple's strategic responses. A cautious outlook on future price movements is warranted. To make informed investment decisions, stay informed about the latest developments regarding Apple stock price and tariff projections. Consider consulting with a financial advisor for personalized guidance. Keywords: Apple stock outlook, tariff impact, investment strategy, financial advice.

Featured Posts

-

Borsa Piazza Affari In Attenzione Fed E Banche In Primo Piano

May 24, 2025

Borsa Piazza Affari In Attenzione Fed E Banche In Primo Piano

May 24, 2025 -

Bbc Radio 1 Big Weekend 2025 Ticket Information And Confirmed Lineup

May 24, 2025

Bbc Radio 1 Big Weekend 2025 Ticket Information And Confirmed Lineup

May 24, 2025 -

The Woody Allen Case A Look At Sean Penns Skepticism

May 24, 2025

The Woody Allen Case A Look At Sean Penns Skepticism

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf A Guide To Its Net Asset Value

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Guide To Its Net Asset Value

May 24, 2025 -

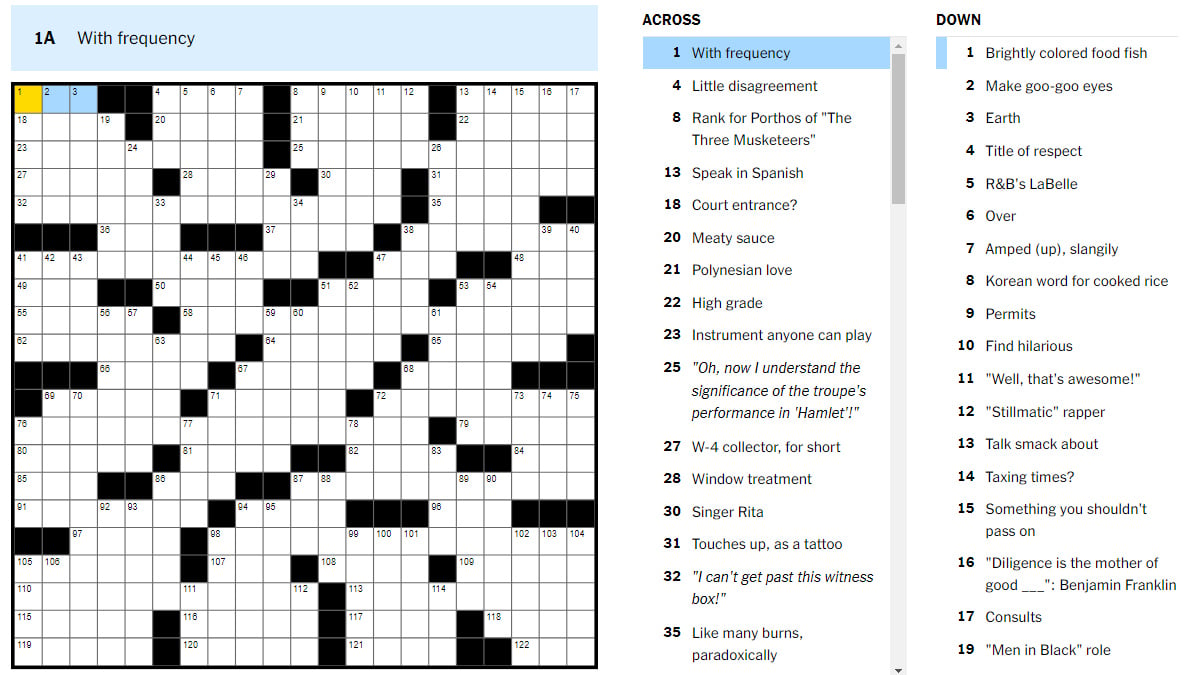

March 24 2025 Nyt Mini Crossword Complete Answers And Clues

May 24, 2025

March 24 2025 Nyt Mini Crossword Complete Answers And Clues

May 24, 2025

Latest Posts

-

Museum Funding Crisis The Legacy Of Trumps Budgetary Decisions

May 24, 2025

Museum Funding Crisis The Legacy Of Trumps Budgetary Decisions

May 24, 2025 -

How Trumps Budget Cuts Reshape Museum Programming In America

May 24, 2025

How Trumps Budget Cuts Reshape Museum Programming In America

May 24, 2025 -

The Fate Of Museum Programs Post Trump Administration Budget Reductions

May 24, 2025

The Fate Of Museum Programs Post Trump Administration Budget Reductions

May 24, 2025 -

Federal Funding Cuts And The Future Of Museum Programs

May 24, 2025

Federal Funding Cuts And The Future Of Museum Programs

May 24, 2025 -

Museum Programs Under Threat Examining The Impact Of Federal Funding Cuts

May 24, 2025

Museum Programs Under Threat Examining The Impact Of Federal Funding Cuts

May 24, 2025