April 24 Oil Market Report: Prices, Trends, And Analysis

Table of Contents

Crude Oil Price Analysis for April 24

Benchmark Prices

The closing prices for major crude oil benchmarks on April 24th showed considerable movement compared to previous trading days. The following table summarizes the key data:

| Benchmark | Closing Price (USD/barrel) | % Change (Day) | % Change (Week) |

|---|---|---|---|

| Brent Crude | [Insert Brent Closing Price] | [Insert % Change] | [Insert % Change] |

| WTI Crude | [Insert WTI Closing Price] | [Insert % Change] | [Insert % Change] |

- Brent Crude Closing Price: [Insert Price] – This reflects [brief explanation of the price movement].

- WTI Crude Closing Price: [Insert Price] – Similar to Brent, the WTI price experienced [brief explanation of the price movement].

- Percentage Change Compared to Previous Day: The daily fluctuations highlight the market's volatility, driven by [mention briefly one or two key factors].

- Percentage Change Compared to Previous Week: The weekly change provides a broader perspective on the recent trend in oil prices.

Price Volatility and Factors

The considerable price swings witnessed on April 24th were influenced by a confluence of factors.

- Geopolitical Tensions: Ongoing conflicts in [mention specific regions, e.g., Eastern Europe] continue to disrupt supply chains and create uncertainty, leading to price increases. Sanctions imposed on [mention countries] also play a role.

- OPEC+ Production Decisions: The recent OPEC+ meeting resulted in [summarize the decision, e.g., a decision to maintain production levels or adjust them]. This decision significantly impacted market sentiment and price trajectory.

- Impact of the US Dollar: The strength of the US dollar against other major currencies influenced oil prices, as crude oil is priced in USD. A stronger dollar can make oil more expensive for buyers using other currencies.

- Inventory Levels: Current global oil inventories are [mention whether they are high, low, or stable] which [explain the effect on prices]. Changes in these levels often impact short-term price fluctuations.

- Demand Forecasts: The outlook for global oil demand in the coming months is [mention whether demand is expected to increase, decrease, or remain stable], which influences investor behavior and subsequently, prices.

Market Trends and Predictions

Short-Term Outlook

Based on the current market dynamics, the short-term outlook for oil prices suggests:

- Expected Price Range for the Coming Week: We anticipate a price range between [Insert Lower Bound] and [Insert Upper Bound] USD/barrel for Brent crude, and a range between [Insert Lower Bound] and [Insert Upper Bound] USD/barrel for WTI crude.

- Potential Catalysts for Price Increases: Further escalation of geopolitical tensions, unexpected supply disruptions, or a significant increase in global demand could push prices higher.

- Potential Catalysts for Price Decreases: A sudden increase in global oil supply, a significant slowdown in economic growth, or a substantial strengthening of the US dollar could lead to price declines.

- Analysis of Market Sentiment: Current market sentiment appears to be [mention whether it is bullish, bearish, or neutral], indicating [explain what this means for future price movements].

Long-Term Outlook

The long-term outlook for oil prices is subject to several significant factors.

- Impact of Renewable Energy Sources: The continued growth of renewable energy sources like solar and wind power is expected to gradually reduce the demand for oil over the long term, potentially leading to lower prices.

- Predictions for Global Oil Demand: Global oil demand is projected to [mention the expected trend - increase, decrease or plateau] over the next [timeframe] years, depending on economic growth and energy transition policies.

- Potential for Future Price Shocks: Unexpected geopolitical events or technological breakthroughs could still cause significant price fluctuations in the future.

Geopolitical and Economic Influences

Geopolitical Risks

Geopolitical events continue to cast a significant shadow over the oil market.

- Specific Geopolitical Events and Their Impact: The ongoing situation in [mention specific region/event] is causing significant uncertainty and impacting oil supply chains and prices. [Explain in more detail the impact].

- Potential Disruptions to Supply Chains: Geopolitical instability can easily disrupt oil transportation routes, leading to supply shortages and price spikes.

Economic Indicators

Macroeconomic factors play a crucial role in shaping oil demand and price.

- Relationship Between Economic Growth and Oil Demand: Strong global economic growth generally leads to increased oil demand, boosting prices. Conversely, a slowdown in economic activity can suppress demand.

- Impact of Inflation on Energy Consumption: High inflation can reduce consumer spending on energy, leading to lower oil demand.

- Influence of Interest Rates on Investment in Oil Exploration: Higher interest rates make it more expensive for oil companies to invest in exploration and production, potentially limiting future supply.

OPEC+ and Production Levels

Recent OPEC+ Decisions

The recent OPEC+ meeting held on [date] resulted in [summarize their decision].

- Summary of the Latest OPEC+ Meeting: [Provide a detailed summary of the meeting's outcome and the reasoning behind the decisions].

- Changes in Production Targets: OPEC+ decided to [mention specific changes in production quotas].

- Impact on Global Supply: These production adjustments are likely to [explain the impact on global oil supply and prices].

Production Capacity and Constraints

Current and projected oil production capacity are influenced by several factors.

- Analysis of Production Capacity by Major Oil-Producing Countries: [Provide a brief overview of production capacities of major players].

- Potential Supply Bottlenecks: Existing and potential bottlenecks in oil production and transportation could constrain supply and push prices higher.

- Impact of Sanctions on Oil Production: Sanctions imposed on certain oil-producing countries continue to limit their production capacity, affecting global supply.

Conclusion

This April 24 Oil Market Report highlights significant price fluctuations driven by a complex interplay of geopolitical events, OPEC+ decisions, and economic indicators. The short-term outlook suggests [mention predicted price range or trend], while the long-term forecast remains [mention long-term prediction]. Staying informed about these factors is crucial for navigating the volatile oil market. For continuous updates and deeper analysis on the oil market, check back regularly for our daily oil market reports, or subscribe to our newsletter for in-depth market analysis. Stay tuned for tomorrow's Oil Market Report!

Featured Posts

-

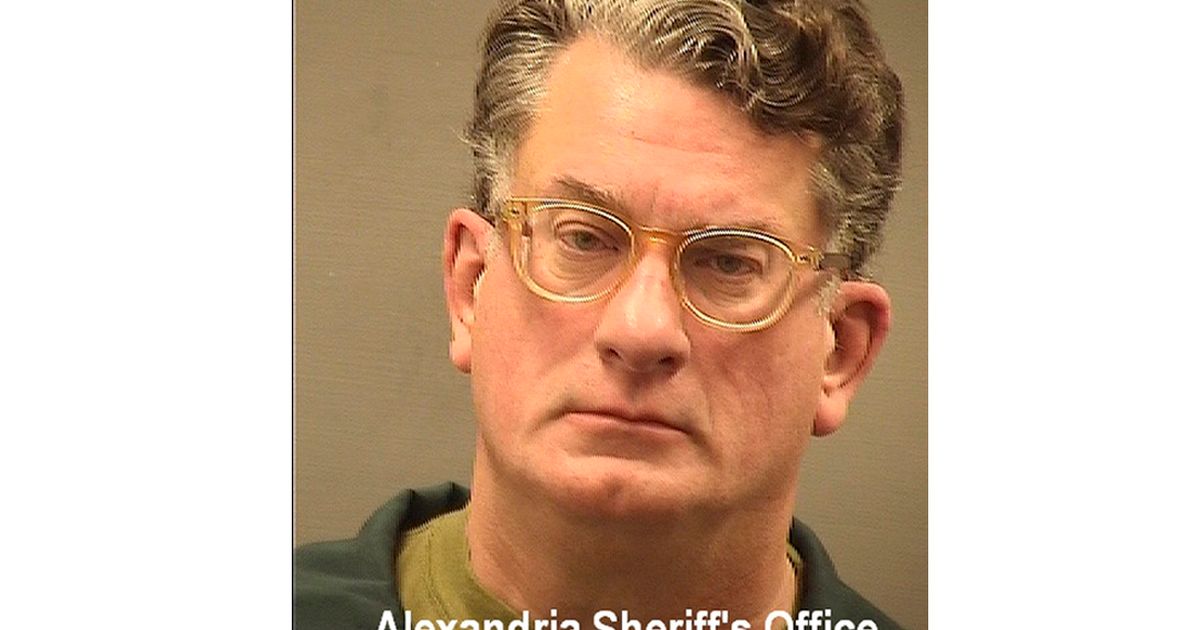

Former Tv Meteorologist Josh Fitzpatrick Charged With Sexual Extortion

Apr 25, 2025

Former Tv Meteorologist Josh Fitzpatrick Charged With Sexual Extortion

Apr 25, 2025 -

Voyna V Ukraine Buduschee Mirnogo Soglasheniya I Rol Trampa

Apr 25, 2025

Voyna V Ukraine Buduschee Mirnogo Soglasheniya I Rol Trampa

Apr 25, 2025 -

Bob Fickels 40th Canberra Marathon Run A Local Legends Endurance

Apr 25, 2025

Bob Fickels 40th Canberra Marathon Run A Local Legends Endurance

Apr 25, 2025 -

Is Apple Tv S Next Crime Thriller Its Masterpiece A Look At The Genres Future On The Platform

Apr 25, 2025

Is Apple Tv S Next Crime Thriller Its Masterpiece A Look At The Genres Future On The Platform

Apr 25, 2025 -

California Governor Newsom Sparks Controversy With Toxic Label

Apr 25, 2025

California Governor Newsom Sparks Controversy With Toxic Label

Apr 25, 2025

Latest Posts

-

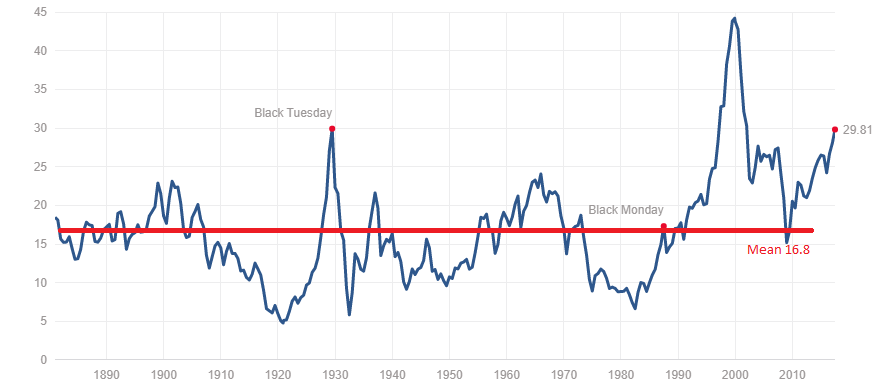

High Stock Market Valuations A Bof A Analysis For Investors

Apr 30, 2025

High Stock Market Valuations A Bof A Analysis For Investors

Apr 30, 2025 -

Stock Market Valuations Bof As Reassuring View For Investors

Apr 30, 2025

Stock Market Valuations Bof As Reassuring View For Investors

Apr 30, 2025 -

New Us Manufacturing Facility Merck Invests In Domestic Supply Of Key Drug

Apr 30, 2025

New Us Manufacturing Facility Merck Invests In Domestic Supply Of Key Drug

Apr 30, 2025 -

Mercks 1 Billion Investment A New Us Factory For Key Drug Production

Apr 30, 2025

Mercks 1 Billion Investment A New Us Factory For Key Drug Production

Apr 30, 2025 -

Russian Black Sea Oil Spill Leads To Extensive Beach Closures

Apr 30, 2025

Russian Black Sea Oil Spill Leads To Extensive Beach Closures

Apr 30, 2025