April Outlook Update: What's New This Month

Table of Contents

Economic Indicators and Market Trends

Understanding the broader economic picture is crucial for any April forecast. This section dives into key economic indicators and emerging market trends that will shape the coming weeks.

Inflation and Interest Rates

Inflation remains a dominant theme in the April forecast. Analyzing the latest data from the Consumer Price Index (CPI) and Producer Price Index (PPI) is critical.

- CPI and PPI Implications: A sustained rise in CPI and PPI suggests persistent inflationary pressures, potentially prompting further action from central banks. Conversely, a slowdown could signal a potential easing of monetary policy.

- Interest Rate Hikes: The Federal Reserve and other central banks are closely watching inflation figures. High inflation may lead to further interest rate hikes, impacting borrowing costs for consumers and businesses alike. This directly affects investment strategies and economic growth projections.

- Inflation and Economic Growth: The relationship between inflation and economic growth is complex. High inflation can stifle economic growth by reducing consumer spending and business investment. The April forecast will depend heavily on the balance between these forces.

Global Supply Chain Developments

Global supply chains continue to evolve, impacting various industries and the overall economic outlook.

- Key Industries Affected: Sectors like manufacturing, automotive, and technology remain vulnerable to supply chain disruptions. These disruptions can lead to production delays, shortages, and increased costs.

- Impact on Inflation and Consumer Prices: Supply chain bottlenecks contribute directly to inflation by increasing the cost of goods. This, in turn, affects consumer prices and purchasing power.

- Mitigating Supply Chain Risks: Businesses are actively seeking ways to mitigate these risks, including diversifying suppliers, investing in inventory, and improving supply chain visibility. The April forecast will reflect the ongoing efforts to improve global supply chain resilience.

Industry-Specific Updates

Let's delve into specific sectors and analyze their individual April outlooks.

Technology Sector Outlook

The technology sector is dynamic, with constant innovation and shifts in market leadership.

- Emerging Technologies: Artificial intelligence (AI), cloud computing, and cybersecurity continue to drive significant growth, presenting both opportunities and challenges.

- Performance of Major Tech Companies: The April forecast will analyze the performance of leading tech companies, considering factors like earnings reports, product launches, and regulatory changes.

- Investment Opportunities and Risks: Investing in the tech sector requires careful consideration of risk and reward. Emerging technologies offer high-growth potential but also carry inherent risks.

Real Estate Market Analysis

The real estate market is highly sensitive to interest rate changes and economic conditions.

- Property Values and Rental Rates: The April outlook will analyze trends in property values and rental rates across various geographic locations, considering factors like supply and demand.

- Impact of Interest Rates: Rising interest rates directly impact mortgage affordability and borrowing costs, potentially affecting both buyers and sellers in the housing market.

- Investment Opportunities: The real estate sector still presents investment opportunities, but careful analysis of market conditions and risk assessment are crucial.

Investment Strategies and Portfolio Management

Navigating the current market requires a well-defined investment strategy.

Portfolio Adjustments for April

Based on the April forecast, we offer some recommendations for portfolio adjustments.

- Asset Allocation Strategies: Investors should consider adjusting their asset allocation strategies based on their risk tolerance and investment goals. Diversification is key.

- Specific Investment Opportunities: The current market presents certain investment opportunities, which our April forecast will highlight. This might include specific sectors or asset classes.

- Risks and Mitigation Strategies: Investors should be aware of potential risks and implement appropriate mitigation strategies, such as hedging or diversification.

Risk Management and Diversification

Managing risk effectively is paramount.

- Diversification Across Asset Classes: Diversifying investments across different asset classes reduces the overall portfolio risk.

- Hedging Strategies: Implementing hedging strategies can help protect against potential market downturns.

- Long-Term Investment Strategy: Maintaining a long-term investment horizon is crucial for weathering short-term market volatility.

Conclusion

This April Outlook Update has highlighted significant changes and trends impacting various sectors. We've analyzed key economic indicators, discussed industry-specific developments, and provided insights into investment strategies for navigating the evolving market. Understanding these shifts is critical for making informed financial decisions.

Call to Action: Stay informed on the latest market movements with our regular outlook updates. Subscribe to our newsletter for timely insights and analysis to help you optimize your strategies based on the evolving monthly outlook. Download our April outlook report for a deeper dive into these key trends. Don't miss out on valuable insights; get your April outlook update now!

Featured Posts

-

Fans Disappointment As Garnacho Appears To Ignore Autograph Request

May 28, 2025

Fans Disappointment As Garnacho Appears To Ignore Autograph Request

May 28, 2025 -

Urgent Claim Your 300 000 Euro Millions Prize Before The Deadline

May 28, 2025

Urgent Claim Your 300 000 Euro Millions Prize Before The Deadline

May 28, 2025 -

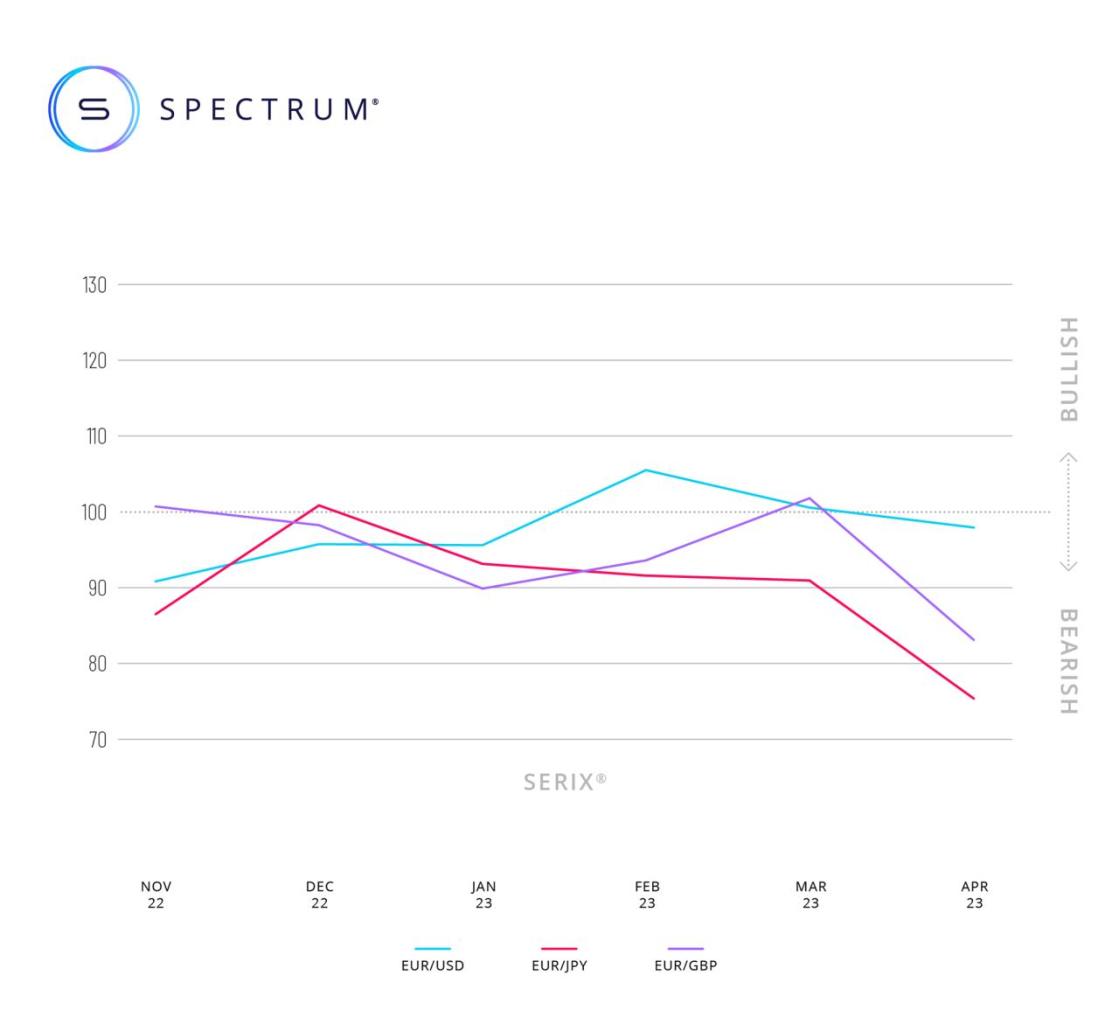

Strengthening The Euro Lagardes Eur Usd Initiatives And Their Global Impact

May 28, 2025

Strengthening The Euro Lagardes Eur Usd Initiatives And Their Global Impact

May 28, 2025 -

Ryan Reynolds Faces Backlash Justin Baldonis Legal Team Vows To Continue Fight

May 28, 2025

Ryan Reynolds Faces Backlash Justin Baldonis Legal Team Vows To Continue Fight

May 28, 2025 -

Piratska Strana Odchod Peksy A Jeho Dusledky

May 28, 2025

Piratska Strana Odchod Peksy A Jeho Dusledky

May 28, 2025

Latest Posts

-

Le Combat Des Salaries D Amilly Pour Sauver L Usine Sanofi D Aspegic

May 31, 2025

Le Combat Des Salaries D Amilly Pour Sauver L Usine Sanofi D Aspegic

May 31, 2025 -

Sanofi Ne Doit Pas Vendre Son Usine D Aspegic A Amilly Appel A La Mobilisation

May 31, 2025

Sanofi Ne Doit Pas Vendre Son Usine D Aspegic A Amilly Appel A La Mobilisation

May 31, 2025 -

Amilly Mobilisation Contre La Vente Du Site Sanofi Producteur D Aspegic

May 31, 2025

Amilly Mobilisation Contre La Vente Du Site Sanofi Producteur D Aspegic

May 31, 2025 -

1 9 Milliarden Us Dollar Sanofi Erweitert Portfolio An Autoimmun Medikamenten

May 31, 2025

1 9 Milliarden Us Dollar Sanofi Erweitert Portfolio An Autoimmun Medikamenten

May 31, 2025 -

Autoimmunkrankheiten Sanofi Taetigt Milliarden Deal Fuer Neue Therapie

May 31, 2025

Autoimmunkrankheiten Sanofi Taetigt Milliarden Deal Fuer Neue Therapie

May 31, 2025