Are High Stock Market Valuations A Worry? BofA's Take

Table of Contents

BofA's Current Market Outlook

BofA's current market outlook is generally cautious, acknowledging the elevated levels of stock market valuations. While not outright bearish, their analysts express concerns about the sustainability of current prices given various economic factors. They advocate for a balanced approach, emphasizing both the potential for continued growth and the risks associated with high valuations.

-

Key Arguments: BofA points to a confluence of factors contributing to their outlook. These include persistently high inflation, although potentially slowing, the impact of rising interest rates on corporate profitability, and geopolitical uncertainty. They highlight that while corporate earnings have been relatively resilient, the current price-to-earnings (P/E) ratios across many sectors suggest a potential overvaluation.

-

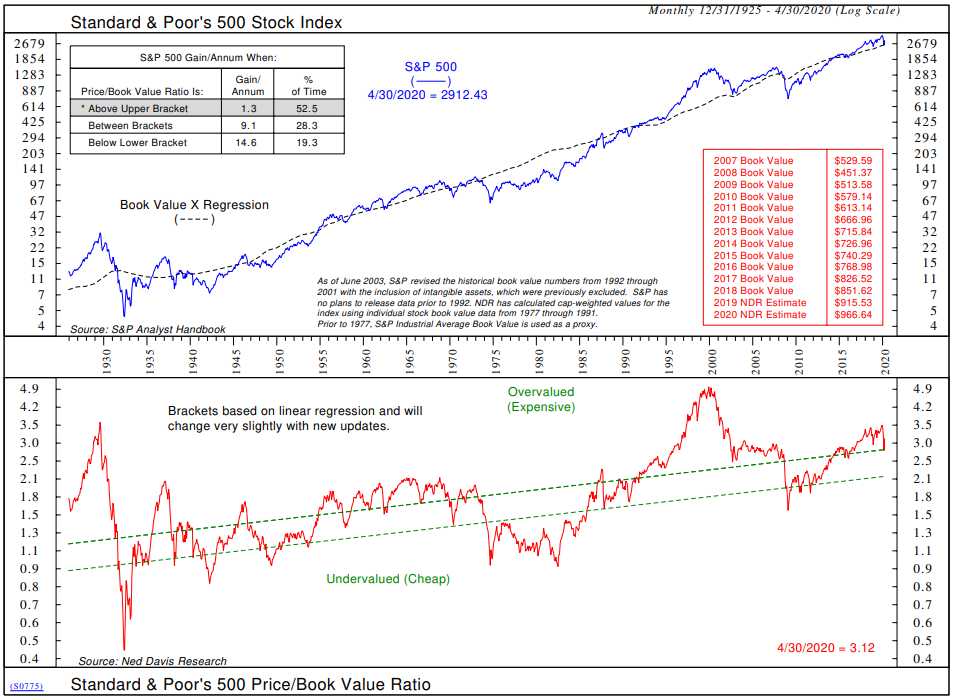

Market Indicators: BofA's analysis incorporates a range of key market indicators. They closely monitor P/E ratios, comparing them to historical averages and considering variations across different sectors. Interest rate movements, particularly the Federal Reserve's actions, are also central to their assessment. Inflation data, including the Consumer Price Index (CPI) and Producer Price Index (PPI), plays a crucial role in understanding the broader economic landscape and its impact on stock prices.

-

Supporting Data: While specific data points change frequently, BofA reports often cite examples of sectors with particularly high valuations relative to historical norms or projected earnings growth. These reports frequently emphasize the need for careful analysis of individual company fundamentals before investment decisions are made.

Assessing the Risks of High Valuations

High stock market valuations present several significant risks for investors. The inherent danger lies in the potential for a sharp correction or even a market crash if valuations fail to align with underlying fundamentals.

-

Overvaluation and Returns: Overvaluation means that asset prices exceed their intrinsic value, based on factors such as earnings, dividends, and future growth prospects. This reduces potential future returns, meaning investors may not see the same level of growth as they might have in the past, when valuations were lower.

-

Market Corrections and Crashes: History shows that periods of high valuations are often followed by significant market corrections or crashes. These events can lead to substantial losses for investors who are heavily invested in the market. Such corrections can stem from a sudden shift in investor sentiment or a negative economic event.

-

Inflation and Interest Rates: Rising inflation and interest rates further exacerbate the risks associated with high stock market valuations. Inflation erodes the purchasing power of returns, while higher interest rates increase borrowing costs for companies, potentially impacting profitability and slowing economic growth. This can influence investors to shift away from equities to potentially safer, higher-yielding investments.

Identifying Potential Opportunities Despite High Valuations

Despite the risks, BofA identifies potential opportunities for shrewd investors, even within the context of high stock market valuations. Their approach emphasizes selectivity and a focus on long-term value.

-

Sector-Specific Opportunities: BofA’s analysts suggest focusing on sectors that exhibit more resilient earnings growth and less sensitivity to rising interest rates. Companies with strong balance sheets and a demonstrated capacity to weather economic downturns might offer more attractive risk-adjusted returns. They often point out undervalued segments within otherwise high-valued sectors, encouraging detailed fundamental analysis.

-

Investment Strategies: BofA may suggest strategies like value investing, focusing on companies whose stock prices are below their intrinsic worth. Dividend-paying stocks are frequently mentioned as an element of a balanced portfolio. Furthermore, selective growth investing, carefully assessing the future potential of individual companies, remains a suggested tactic, particularly within sectors showing long-term growth prospects.

-

Rationale: The rationale for these recommendations hinges on the belief that while overall market valuations may be high, there are still opportunities to find undervalued assets or companies with strong growth potential that can outperform the broader market over the long term. This requires thorough research and a long-term investment horizon.

BofA's Advice for Investors

Navigating high stock market valuations requires a prudent approach. BofA advises investors to adopt several key strategies:

-

Diversification: Diversification across different asset classes (stocks, bonds, real estate, etc.) and sectors is crucial to mitigate risk. Don't put all your eggs in one basket.

-

Risk Management: Investors should carefully assess their risk tolerance and adjust their portfolios accordingly. This may involve reducing exposure to high-risk assets or increasing the allocation to more conservative investments.

-

Investment Horizon: A long-term investment horizon is generally recommended to weather market fluctuations. Short-term market timing attempts are often discouraged.

-

Individual Risk Tolerance: It’s critical for investors to understand their individual circumstances and make investment decisions that align with their risk tolerance and financial goals.

Navigating the Challenges of High Stock Market Valuations

In summary, BofA's perspective on high stock market valuations is one of cautious optimism. They acknowledge the risks associated with elevated valuations, including the potential for market corrections and the impact of inflation and rising interest rates. However, they also identify opportunities for selective investment within specific sectors and through carefully chosen strategies. Understanding BofA's perspective on high stock market valuations is crucial for making informed investment decisions. Continue your research and develop a robust investment strategy that aligns with your risk tolerance and financial goals. Remember that this information is for general knowledge and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Exploring The Candidacy Of A Canadian Billionaire As Warren Buffetts Heir

May 09, 2025

Exploring The Candidacy Of A Canadian Billionaire As Warren Buffetts Heir

May 09, 2025 -

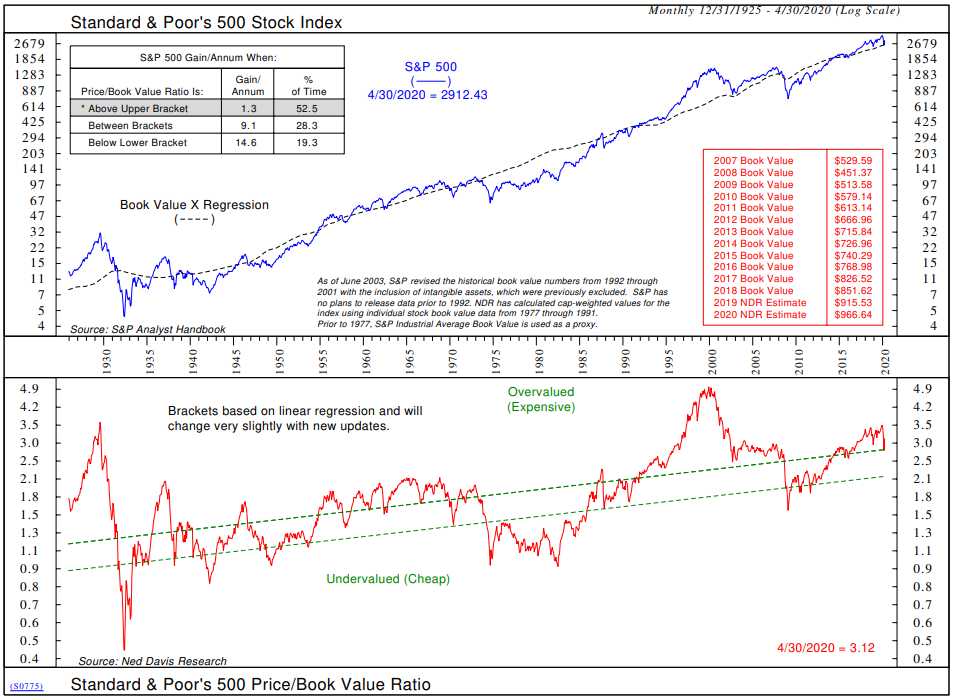

Imalaia I Krisimi Meiosi Ton Xionoptoseon

May 09, 2025

Imalaia I Krisimi Meiosi Ton Xionoptoseon

May 09, 2025 -

Uk Government To Restrict Student Visas Implications For International Students

May 09, 2025

Uk Government To Restrict Student Visas Implications For International Students

May 09, 2025 -

Summer Walkers Childbirth Complications A Harrowing Account

May 09, 2025

Summer Walkers Childbirth Complications A Harrowing Account

May 09, 2025 -

Mans 3 K Babysitting Bill Leads To 3 6 K Daycare Cost A Costly Lesson

May 09, 2025

Mans 3 K Babysitting Bill Leads To 3 6 K Daycare Cost A Costly Lesson

May 09, 2025