Are Minnesota's Film Tax Credits Competitive Enough?

Table of Contents

Current Structure of Minnesota's Film Tax Credit Program

Minnesota's film tax credit program offers a percentage-based credit to qualifying productions. While the specifics can change with legislation, generally, the program incentivizes various types of Minnesota film production, including:

- Feature films

- Television shows and series

- Commercials

- Documentaries

The current Minnesota film tax credit rates and caps are crucial factors in determining its competitiveness. Historically, the credit percentage has been lower than some competing states, and caps on the total credits awarded have limited the program's impact. Data on the program's historical performance, including the number of jobs created and the total economic impact, is crucial for assessing its effectiveness. Detailed analysis of this data, readily available from the Minnesota Department of Employment and Economic Development, reveals the actual return on investment film tax credits generate for the state. Understanding Minnesota film tax credit eligibility requirements is also vital for producers considering filming in Minnesota.

Comparison with Other States' Film Incentives

To gauge the competitiveness of Minnesota's program, we need to compare it with other states. A key aspect of this analysis is comparing Minnesota film production incentives with those of neighboring states like Wisconsin, Iowa, and North Dakota, as well as major film production hubs such as California, Georgia, and New York.

| State | Credit Percentage | Caps | Eligibility Requirements |

|---|---|---|---|

| Minnesota | (Check current legislation) | (Check current legislation) | Varies, often requiring a certain level of spending in-state. |

| Wisconsin | (Check current legislation) | (Check current legislation) | Varies |

| Iowa | (Check current legislation) | (Check current legislation) | Varies |

| California | (Check current legislation) | (Check current legislation) | Varies |

| Georgia | (Check current legislation) | (Check current legislation) | Varies |

| New York | (Check current legislation) | (Check current legislation) | Varies |

(Note: This table requires up-to-date information from official state sources. Always consult the most current legislation for accurate data.)

This comparison highlights areas where Minnesota's film tax credit eligibility Minnesota requirements, credit percentage, and caps are competitive and where they fall short. The analysis should focus on the overall attractiveness of the package offered to producers deciding where to film their next project. This requires looking beyond just the raw numbers and considering factors like ease of application and processing times.

Analysis of Minnesota's Film Tax Credit Effectiveness

The effectiveness of Minnesota film tax credits hinges on their ability to attract productions and generate economic activity. Analyzing data on the number of productions attracted, jobs created, and economic impact is vital. Case studies of successful projects (those that leveraged the credits effectively) and unsuccessful projects (those that didn't materialize despite the incentive) can reveal valuable insights into the program's strengths and weaknesses. A key metric to track is the return on investment film tax credits provide for the state. Does the economic activity generated (jobs, tourism, spending) outweigh the tax revenue lost due to the credits? This impact of film tax credits Minnesota analysis is crucial for future policy decisions.

Potential Improvements to Minnesota's Film Tax Credit Program

To enhance the competitiveness of Minnesota film incentives, several improvements can be considered:

- Increase the credit percentage: A higher percentage could make Minnesota a more attractive location for productions.

- Raise the caps: Increasing the caps allows for larger-budget productions to benefit from the incentives.

- Expand eligibility criteria: Including a wider range of productions could broaden the program's impact.

- Simplify the application process: A streamlined application process can reduce administrative burdens for producers.

Each of these potential changes has associated costs and benefits. A thorough cost-benefit analysis should be conducted before implementing any modifications to the Minnesota film tax credit program.

The Future of Film Production in Minnesota

The future of Minnesota film hinges on the competitiveness of its tax credit program and other factors. Infrastructure development (soundstages, post-production facilities), workforce development (training programs for skilled labor), and proactive location scouting are equally important. Without a strong, competitive incentive program, Minnesota risks losing out on potential projects and economic benefits to states with more appealing offers. This growth of Minnesota film industry is directly linked to the strength of its film incentive program. The future of Minnesota film needs a holistic strategy, and a competitive tax credit is just one vital piece of the puzzle.

Conclusion: Is Minnesota's Film Tax Credit Program Competitive Enough? A Call to Action

This analysis shows that while Minnesota has potential as a film production location, the competitiveness of its film tax credits Minnesota is a critical factor influencing its success. The current structure may not be enough to attract large-scale productions compared to other states offering more generous incentives. A more robust and competitive Minnesota film tax credit program is crucial for attracting film productions, creating jobs, and boosting the state's economy. We need to advocate for improvements to the existing program to unlock the full potential of the Minnesota film industry. Contact your state representatives today and urge them to support Minnesota film tax credit reform and advocate for stronger Minnesota film incentives. Let's work together to strengthen Minnesota film production and secure a brighter future for the state's film industry!

Featured Posts

-

Announcing The Winning Names For Minnesota Snow Plows

Apr 29, 2025

Announcing The Winning Names For Minnesota Snow Plows

Apr 29, 2025 -

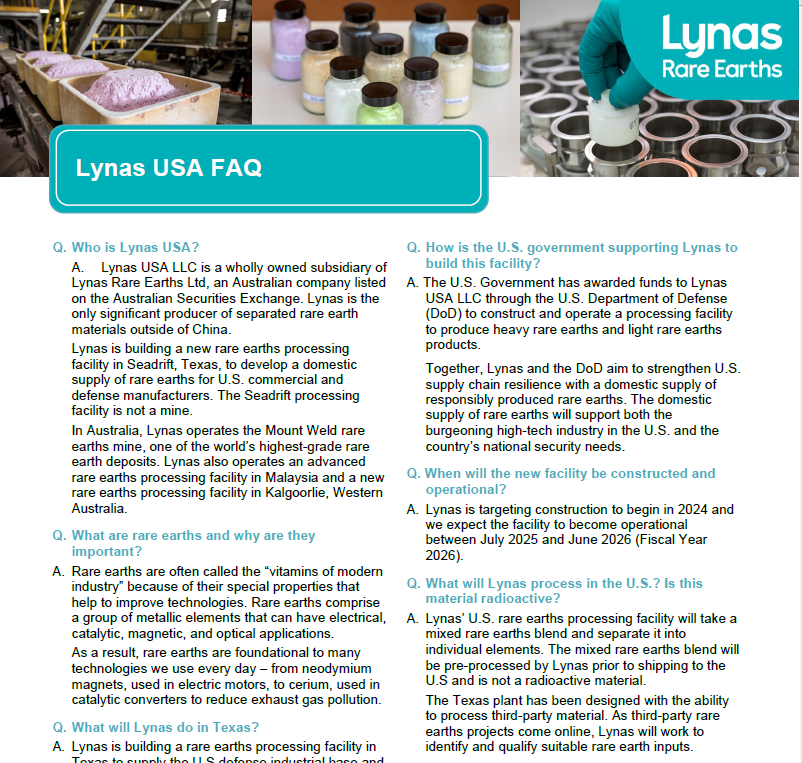

Lynas Seeks Us Aid To Fund Texas Rare Earths Refinery Project

Apr 29, 2025

Lynas Seeks Us Aid To Fund Texas Rare Earths Refinery Project

Apr 29, 2025 -

Analyzing The Effects Of Trumps Tariffs On Us Prices And Product Availability

Apr 29, 2025

Analyzing The Effects Of Trumps Tariffs On Us Prices And Product Availability

Apr 29, 2025 -

Accessibility And Affordability Examining Over The Counter Birth Control Post Roe

Apr 29, 2025

Accessibility And Affordability Examining Over The Counter Birth Control Post Roe

Apr 29, 2025 -

Minnesota Film Incentives A Comprehensive Look At Tax Credits

Apr 29, 2025

Minnesota Film Incentives A Comprehensive Look At Tax Credits

Apr 29, 2025

Latest Posts

-

Russias Military Posturing The Implications For European Security

Apr 29, 2025

Russias Military Posturing The Implications For European Security

Apr 29, 2025 -

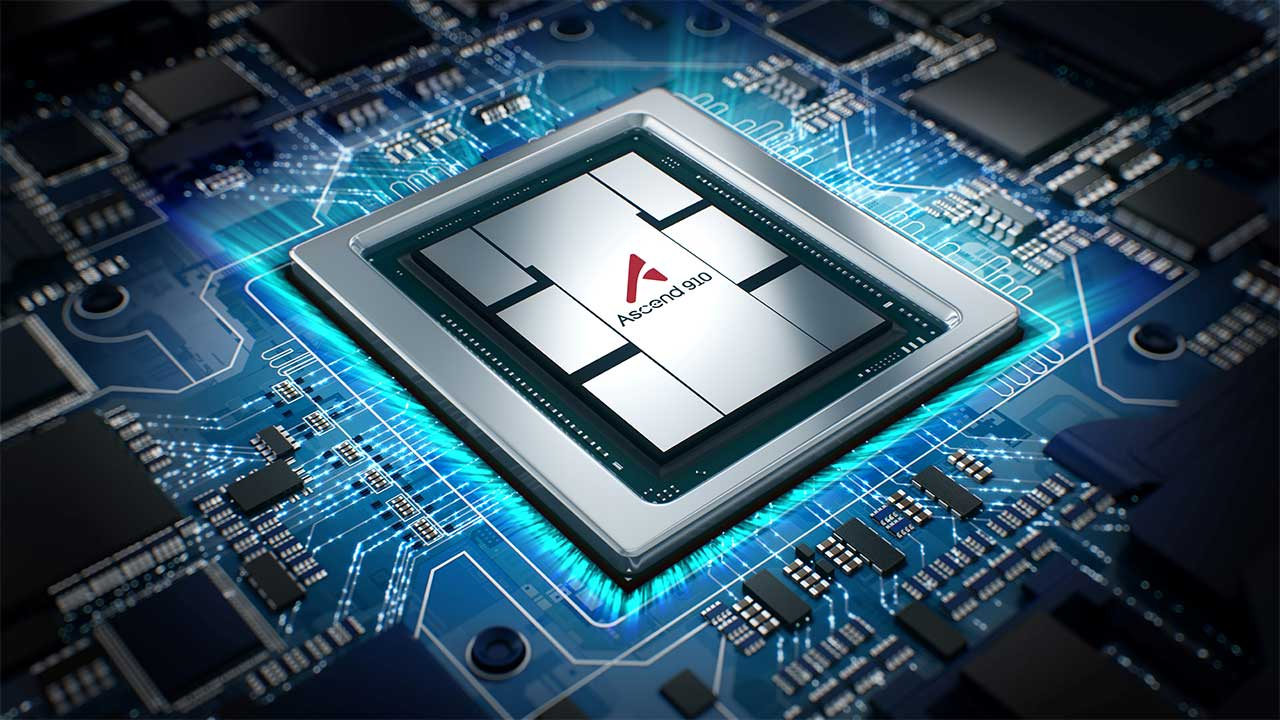

Huaweis Exclusive Ai Chip Specifications And Implications

Apr 29, 2025

Huaweis Exclusive Ai Chip Specifications And Implications

Apr 29, 2025 -

Europe On Edge Analyzing Russias Recent Military Moves

Apr 29, 2025

Europe On Edge Analyzing Russias Recent Military Moves

Apr 29, 2025 -

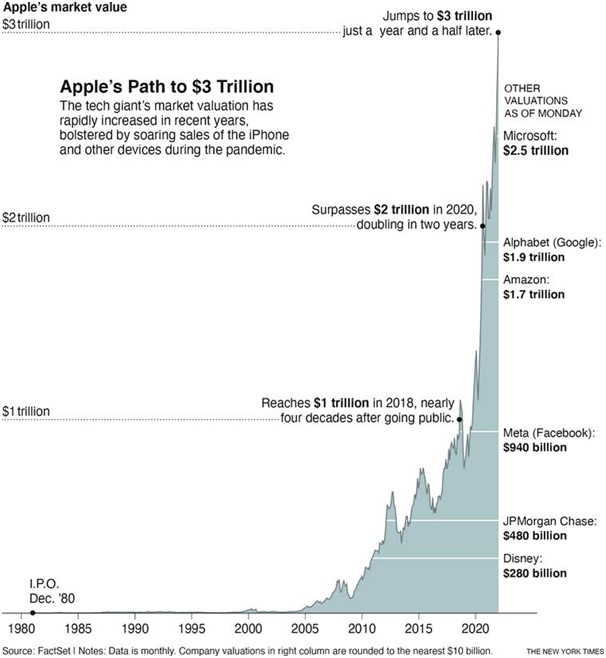

The Magnificent Sevens Fall Analyzing A 2 5 Trillion Market Value Decline

Apr 29, 2025

The Magnificent Sevens Fall Analyzing A 2 5 Trillion Market Value Decline

Apr 29, 2025 -

Exclusive Ai Chip Development Huawei Takes On Nvidia

Apr 29, 2025

Exclusive Ai Chip Development Huawei Takes On Nvidia

Apr 29, 2025