Auto Tariff Relief Speculation Lifts European Shares; LVMH Suffers Losses

Table of Contents

The Impact of Auto Tariff Relief Speculation on European Shares

Speculation regarding potential reductions or eliminations of auto tariffs has significantly influenced investor sentiment and the performance of European shares.

Positive Market Sentiment

The prospect of auto tariff relief has injected a dose of optimism into the market. Investors anticipate a range of benefits, leading to increased confidence and subsequent investment in the affected sectors.

- Boosted Investor Confidence: The potential for reduced trade barriers has led to a more positive outlook for the future profitability of European automakers and their supply chains.

- Beneficiary Sectors: Auto manufacturers, parts suppliers, and related logistics companies have been the primary beneficiaries of this positive sentiment. Companies heavily reliant on exports to regions impacted by tariffs have seen particularly significant gains.

- Examples of Share Price Increases: [Insert examples of specific companies and their percentage share price increases. Include links to relevant financial news sources]. For instance, [Company X] saw a [percentage]% increase in its share price following a particularly optimistic report on tariff negotiations.

- Supporting Statistics: [Include relevant statistics on market performance, trading volumes, and investor confidence indices. Source the statistics]. For example, the European Automotive Index [Insert Index Name] saw a [Percentage]% increase in the week following the announcement of potential tariff negotiations.

- Geopolitical Factors: The speculation is intertwined with broader geopolitical considerations, such as ongoing trade negotiations between [mention relevant countries or blocs]. Positive developments in these negotiations often fuel the optimism surrounding auto tariff relief.

Analyzing the Driving Forces Behind the Speculation

The speculation surrounding auto tariff relief isn't arbitrary; it stems from various sources:

- Government Statements: Official pronouncements from governments regarding trade negotiations and potential tariff adjustments significantly impact market sentiment.

- Industry Reports: Reports from industry analysts and organizations projecting the potential economic benefits of tariff reductions fuel positive speculation.

- Analyst Predictions: Predictions from financial analysts regarding the likelihood and impact of tariff changes influence investment decisions.

- Economic Benefits: Reduced tariffs promise increased competitiveness for European automakers in global markets, potentially leading to lower prices for consumers and increased profitability for companies.

- Uncertainties and Risks: However, the speculation is not without risk. The actual implementation of tariff reductions is subject to political and economic uncertainties. [Mention potential downsides, such as unexpected delays or partial reductions]. For instance, the potential for unexpected shifts in geopolitical relations could quickly dampen the positive sentiment. [Link to relevant news articles or official statements supporting these points].

LVMH's Contrasting Performance Amidst Auto Tariff Relief Speculation

While the automotive sector experienced a surge in share prices due to auto tariff relief speculation, LVMH, a leading luxury goods conglomerate, showed a contrasting performance.

The Luxury Goods Sector's Insulation

The luxury goods sector demonstrates a remarkable resilience to fluctuations in auto tariffs. This is primarily due to several factors:

- Different Market Dynamics: The luxury goods market operates under different economic principles than the automotive industry, with demand often less sensitive to price fluctuations.

- Global Brand Recognition: LVMH's brands enjoy strong global recognition, leading to relatively stable demand regardless of tariff changes impacting other sectors.

- High-Income Consumer Base: The luxury goods market predominantly caters to high-net-worth individuals whose purchasing power is less susceptible to broader economic downturns.

- Independent Market Factors: LVMH's stock price is influenced by factors specific to the luxury goods market, such as changing consumer preferences, brand image, and competition within the luxury segment. These factors can cause fluctuations regardless of the situation in the automotive market.

A Deeper Dive into LVMH's Recent Losses

Despite the positive market sentiment surrounding auto tariff relief, LVMH experienced [mention the nature and extent of losses]. Several reasons contribute to this:

- Specific LVMH-Related News: [Mention any negative news impacting LVMH, such as supply chain issues, negative press, or changes in consumer demand].

- Overall Market Trends: Although insulated from auto tariffs, LVMH is still subject to general market trends and broader economic concerns.

- Data on LVMH Stock Performance: [Provide concrete data on LVMH's stock performance during the period in question]. For example, LVMH’s stock price decreased by [Percentage]% in the last [time period].

- Future Outlook for LVMH: While the future is always uncertain, analysts’ predictions for LVMH’s stock performance should be considered. [Mention the predictions and source them].

Conclusion: Understanding the Complexities of Auto Tariff Relief and Market Volatility

The impact of auto tariff relief speculation on the European stock market highlights the complex interplay of various economic factors. While speculation surrounding tariff reductions fueled significant gains in the automotive sector, the luxury goods sector, exemplified by LVMH, showed a distinct and largely independent performance, influenced by its own set of market dynamics. It’s crucial to monitor auto tariff relief speculation and its implications for the European market. The uncertainties involved underscore the need for continuous analysis and informed decision-making.

To stay informed about developments concerning auto tariff relief and its broader implications for the European stock market, consider subscribing to reputable financial news services or following leading market analysts specializing in the automotive and luxury goods sectors. Further research into the effects of auto tariff relief speculation on individual companies will provide a more nuanced understanding of this dynamic market landscape.

Featured Posts

-

Nashemu Pokoleniyu Chto To Udalos Dostizheniya I Uroki Proshlogo

May 24, 2025

Nashemu Pokoleniyu Chto To Udalos Dostizheniya I Uroki Proshlogo

May 24, 2025 -

Schwerer Unfall In Stemwede Autofahrer Aus Bad Essen Bei Baumkollision Verletzt

May 24, 2025

Schwerer Unfall In Stemwede Autofahrer Aus Bad Essen Bei Baumkollision Verletzt

May 24, 2025 -

Ex French Prime Minister Critiques Macrons Policies

May 24, 2025

Ex French Prime Minister Critiques Macrons Policies

May 24, 2025 -

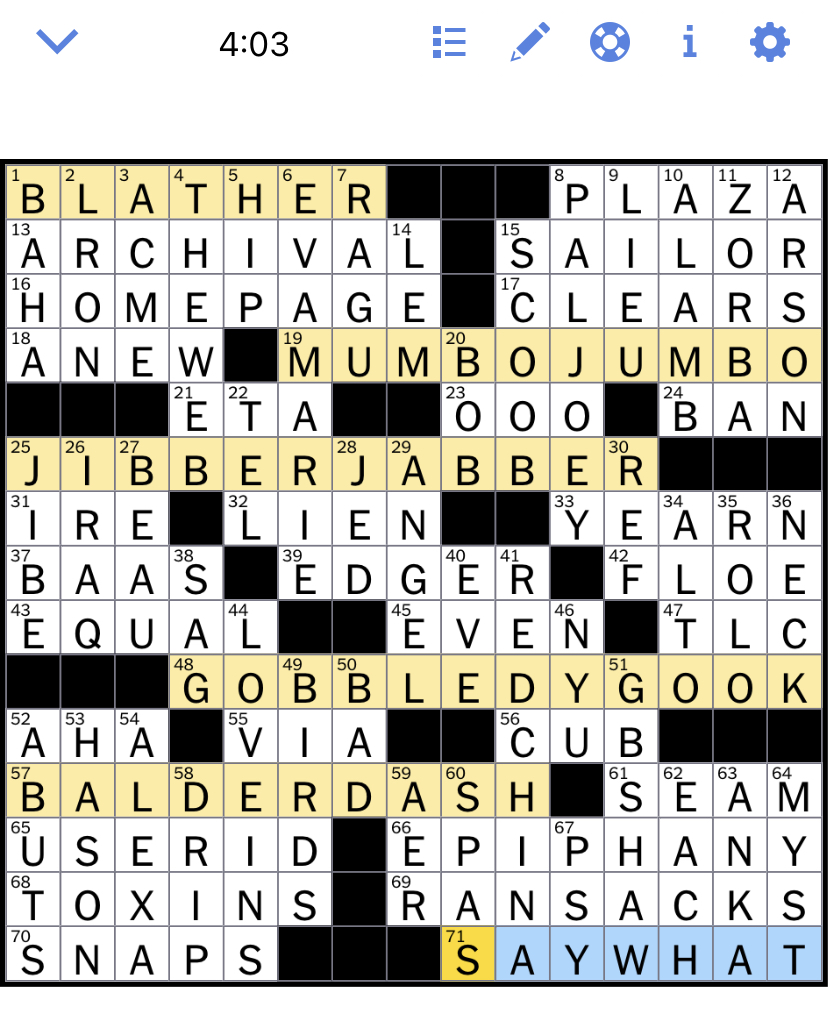

Solve The Nyt Mini Crossword March 12 2025 Clues And Answers

May 24, 2025

Solve The Nyt Mini Crossword March 12 2025 Clues And Answers

May 24, 2025 -

Record High Nears Frankfurt Equities And The Daxs Strong Opening

May 24, 2025

Record High Nears Frankfurt Equities And The Daxs Strong Opening

May 24, 2025

Latest Posts

-

The Thames Water Bonus Controversy Examining The Facts

May 24, 2025

The Thames Water Bonus Controversy Examining The Facts

May 24, 2025 -

Universals 7 Billion Investment Reigniting The Theme Park Arms Race

May 24, 2025

Universals 7 Billion Investment Reigniting The Theme Park Arms Race

May 24, 2025 -

Are Thames Water Executive Bonuses Fair A Critical Evaluation

May 24, 2025

Are Thames Water Executive Bonuses Fair A Critical Evaluation

May 24, 2025 -

Thames Water Executive Bonuses Performance Vs Reward

May 24, 2025

Thames Water Executive Bonuses Performance Vs Reward

May 24, 2025 -

The Alix Earle Effect How A Dancing With The Stars Contestant Became A Marketing Mastermind For Gen Z

May 24, 2025

The Alix Earle Effect How A Dancing With The Stars Contestant Became A Marketing Mastermind For Gen Z

May 24, 2025