Record High Nears: Frankfurt Equities And The DAX's Strong Opening

Table of Contents

Factors Contributing to the DAX's Rise

Several key factors are contributing to the DAX's impressive climb towards a record high. A confluence of strong corporate earnings, positive economic indicators, and favorable global market sentiment has created a perfect storm for growth in German equities.

Strong Corporate Earnings

The current earnings season has been exceptionally positive for many major DAX companies, fueling investor confidence and driving up share prices. Increased profitability across various sectors is a key driver of this growth.

- Volkswagen (Automotive): Strong sales figures and successful new product launches have boosted Volkswagen's earnings, contributing significantly to the DAX's rise.

- SAP (Software): Consistent growth in cloud-based software subscriptions has resulted in impressive profitability for SAP, solidifying its position as a DAX heavyweight.

- Siemens (Engineering): Strong orders across various segments, particularly in energy and automation, have underpinned Siemens' robust financial performance, further bolstering the DAX.

Positive Economic Indicators

Encouraging economic data released recently has significantly improved investor sentiment. The German economy is exhibiting signs of resilience, bolstering confidence in the DAX's continued upward trajectory.

- GDP Growth: Recent reports indicate a steady growth in Germany's GDP, defying expectations of a significant slowdown. This positive economic indicator reassures investors about the country's economic health.

- Inflation Rate: While still elevated, the inflation rate shows signs of easing, reducing concerns about aggressive interest rate hikes from the European Central Bank (ECB).

- Unemployment Rate: The unemployment rate remains low, indicating a robust labor market and strong consumer spending power, which are positive signs for the overall economy.

Global Market Sentiment

The positive performance of the DAX is not isolated; it reflects a broader positive global market sentiment. The performance of other major indices is playing a role in boosting investor confidence.

- Correlation with other indices: The DAX's performance is correlated with other major indices like the S&P 500 and FTSE 100, suggesting a shared positive global economic outlook. A rise in these indices generally boosts investor confidence in the DAX as well.

- Geopolitical factors: While geopolitical uncertainties always exist, the current climate appears relatively stable, leading to reduced market volatility and improved investor confidence.

Implications of the DAX's Strong Performance

The strong performance of the DAX has significant implications for both the German economy and investors seeking opportunities in the Frankfurt Stock Exchange.

Impact on German Economy

A healthy DAX translates to positive economic ripple effects across various sectors of the German economy.

- Job Creation: Strong corporate performance often leads to increased hiring and investment in human capital, contributing to lower unemployment and overall economic growth.

- Investment: A rising stock market attracts more investment, both domestic and foreign, stimulating economic activity and furthering expansion in key industries.

- Consumer Spending: Increased consumer confidence, fueled by a robust job market and rising asset values, translates to higher consumer spending, further boosting economic growth.

Opportunities for Investors

The DAX's strong performance presents several attractive investment opportunities in the Frankfurt Stock Exchange. Both short-term and long-term investors can find potential avenues for growth.

- Short-term opportunities: Investors may find opportunities in sectors showing strong immediate growth, such as technology or renewable energy. However, short-term investments carry higher risks.

- Long-term opportunities: A long-term investment strategy in stable, established DAX companies can provide consistent returns while mitigating some of the risks associated with short-term investments. Diversification across various sectors remains crucial.

Disclaimer: Investing in the stock market involves inherent risks. Consult a financial advisor before making any investment decisions.

Record High Nears: Frankfurt Equities and the DAX's Strong Opening - A Look Ahead

The DAX's impressive surge towards a record high is driven by a combination of strong corporate earnings, positive economic indicators, and favorable global market sentiment. These factors point to a robust German economy and exciting opportunities for investors. The positive impact on job creation, investment, and consumer spending is significant and promises continued economic growth. To capitalize on this upward trend, investors should consider diversifying their portfolios to include German equities. Monitor the DAX, track Frankfurt equities closely, and explore investment opportunities in this dynamic market. Stay informed about the latest economic data and corporate earnings reports to make informed investment decisions. Consider researching further resources dedicated to investing in the German market for a deeper understanding.

Featured Posts

-

Kyle And Teddis Explosive Argument With Their Dog Walker

May 24, 2025

Kyle And Teddis Explosive Argument With Their Dog Walker

May 24, 2025 -

March 16 2025 Nyt Mini Crossword Complete Answers And Clues

May 24, 2025

March 16 2025 Nyt Mini Crossword Complete Answers And Clues

May 24, 2025 -

Protecting Your Investment Essential Gear For Ferrari Owners

May 24, 2025

Protecting Your Investment Essential Gear For Ferrari Owners

May 24, 2025 -

The Mystery Of Lauryn Goodmans Move To Italy Facts And Speculation After Walker Transfer

May 24, 2025

The Mystery Of Lauryn Goodmans Move To Italy Facts And Speculation After Walker Transfer

May 24, 2025 -

Analysis Brbs Acquisition Of Banco Master And Its Implications For The Brazilian Market

May 24, 2025

Analysis Brbs Acquisition Of Banco Master And Its Implications For The Brazilian Market

May 24, 2025

Latest Posts

-

From Grace To Disaster 17 Celebrities Who Ruined Their Images Overnight

May 24, 2025

From Grace To Disaster 17 Celebrities Who Ruined Their Images Overnight

May 24, 2025 -

17 Celebrities Whose Reputations Imploded Instantly

May 24, 2025

17 Celebrities Whose Reputations Imploded Instantly

May 24, 2025 -

Exploring Growth Opportunities Bangladesh And Europes Collaborative Future

May 24, 2025

Exploring Growth Opportunities Bangladesh And Europes Collaborative Future

May 24, 2025 -

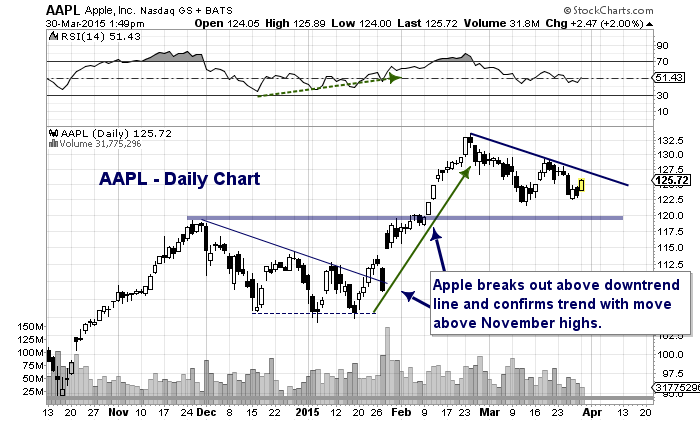

Apple Stock Aapl Important Price Levels And Their Implications

May 24, 2025

Apple Stock Aapl Important Price Levels And Their Implications

May 24, 2025 -

Analyzing Wedbushs Apple Price Target Cut And Long Term Outlook

May 24, 2025

Analyzing Wedbushs Apple Price Target Cut And Long Term Outlook

May 24, 2025