Bank Of Canada Rate Cut Less Likely After Strong Retail Sales

Table of Contents

Robust Retail Sales Figures Signal Economic Strength

July's retail sales data painted a picture of a surprisingly resilient Canadian economy. Retail sales surged by [Insert actual percentage increase here]%, a substantial jump exceeding analyst expectations. This robust growth wasn't isolated to a single sector; both durable goods (e.g., furniture, appliances) and non-durable goods (e.g., clothing, groceries) showed significant increases, reflecting broad-based consumer confidence. This strong performance points to healthy economic growth and robust consumer spending power within the Canadian economy.

- Strong Performers: The automotive sector saw particularly strong growth, alongside a significant increase in sales of home improvement goods, indicating a healthy consumer outlook.

- Year-over-Year Comparison: Compared to July of the previous year, retail sales were up [Insert year-over-year percentage increase here]%, further solidifying the strength of the current economic climate.

- Contributing Factors: Several factors likely contributed to this surge, including government stimulus programs [mention specific programs if applicable], increased consumer confidence following a period of relative economic stability, and pent-up demand following previous periods of caution. The ongoing strength of the Canadian job market also played a significant role.

Inflation Remains a Key Concern for the Bank of Canada

Despite the positive retail sales figures, inflation remains a central concern for the Bank of Canada. The current inflation rate in Canada is [Insert current inflation rate here]%, significantly above the Bank of Canada's target range of 1-3%. This persistent inflationary pressure limits the central bank's flexibility to implement further rate cuts. The Bank of Canada's monetary policy decisions are heavily influenced by its commitment to achieving its inflation target. Any further rate cuts risk exacerbating already elevated inflation.

- Inflation Trajectory: While some economists predict a gradual decline in inflation in the coming months, the current rate remains a significant challenge for the Bank of Canada.

- Contributing Factors to Inflation: Factors contributing to persistent inflation include supply chain disruptions, increased energy prices, and robust consumer demand.

- Impact of Rate Cuts on Inflation: Further rate cuts, while potentially stimulating economic growth, could fuel inflation further, making it more difficult to reach the Bank of Canada's target.

Analysis of Market Reactions to the Retail Sales Data

The market reacted positively to the strong retail sales data, with stock market indices generally rising following the announcement. Bond yields, however, showed a mixed reaction, reflecting some uncertainty about the implications for future interest rate decisions. This mixed market reaction suggests a degree of caution among investors. While some see the strong sales as a sign of economic strength, others remain concerned about the persistent inflationary pressures.

- Market Movements: The TSX Composite Index [Insert specific market movement details here], while the Canadian dollar experienced [Insert specific movement for Canadian dollar here] against the US dollar.

- Analyst Quotes: [Insert quotes from financial analysts regarding the market’s reaction to the data].

- Implications for the Canadian Dollar: The strong retail sales data may support the Canadian dollar in the short term, although continued inflation concerns could offset this effect.

Alternative Scenarios and Future Predictions

While the current economic indicators point away from an imminent Bank of Canada rate cut, alternative scenarios are possible. A significant slowdown in consumer spending in the coming months could alter the outlook. However, based on current data and predictive modeling, a rate cut remains unlikely in the short term. Factors that could still influence a future rate cut include a significant global economic downturn or a sharp unforeseen drop in inflation.

Conclusion: Bank of Canada Rate Cut Remains Unlikely – For Now

In summary, the unexpectedly strong retail sales figures, coupled with persistent inflation and a cautiously optimistic market reaction, significantly decrease the probability of a Bank of Canada rate cut in the near future. The robust consumer spending signals a healthy economy, but the ongoing inflation challenge remains a significant hurdle for the central bank. While unforeseen economic shifts are always possible, based on current data, a Bank of Canada rate cut seems less likely than previously thought. To stay informed about future Bank of Canada interest rate decisions and the evolving situation concerning Canadian monetary policy, continue to monitor future economic indicators and official announcements from the Bank of Canada. Stay tuned for updates on future rate cuts and shifts in Canadian monetary policy.

Featured Posts

-

Facing A 2 2 Million Medical Bill This Dad Took To The Oars

May 25, 2025

Facing A 2 2 Million Medical Bill This Dad Took To The Oars

May 25, 2025 -

How Demna Gvasalia Is Transforming Guccis Aesthetic

May 25, 2025

How Demna Gvasalia Is Transforming Guccis Aesthetic

May 25, 2025 -

Amundi Msci All Country World Ucits Etf Usd Acc Daily Nav And Its Importance

May 25, 2025

Amundi Msci All Country World Ucits Etf Usd Acc Daily Nav And Its Importance

May 25, 2025 -

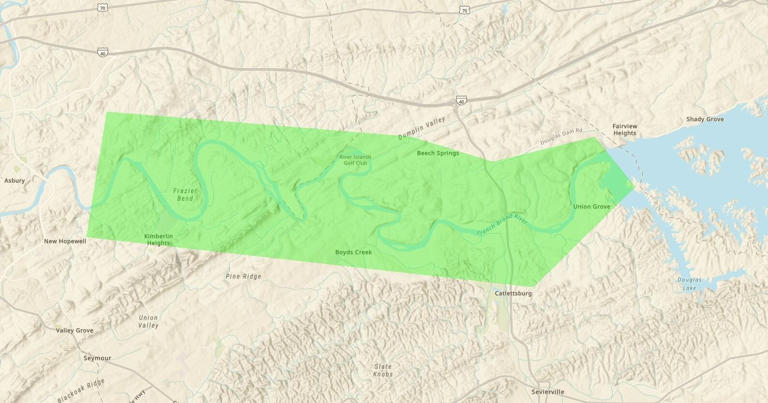

Nws Flood Warning Protecting Yourself And Your Property

May 25, 2025

Nws Flood Warning Protecting Yourself And Your Property

May 25, 2025 -

Bardellas Path To The French Presidency A Contender Emerges

May 25, 2025

Bardellas Path To The French Presidency A Contender Emerges

May 25, 2025

Latest Posts

-

Craig Mc Ilquham Hells Angels Details Of Sundays Memorial Service

May 25, 2025

Craig Mc Ilquham Hells Angels Details Of Sundays Memorial Service

May 25, 2025 -

Zurueck In Der Bundesliga Der Hsv Und Der Weg Nach Oben

May 25, 2025

Zurueck In Der Bundesliga Der Hsv Und Der Weg Nach Oben

May 25, 2025 -

Hafengeburtstag Roland Kaiser And Hsv Der Weg Zurueck In Die Bundesliga

May 25, 2025

Hafengeburtstag Roland Kaiser And Hsv Der Weg Zurueck In Die Bundesliga

May 25, 2025 -

Sundays Memorial Service Honors Hells Angels Member Craig Mc Ilquham

May 25, 2025

Sundays Memorial Service Honors Hells Angels Member Craig Mc Ilquham

May 25, 2025 -

Bundesliga Aufstieg Der Hsv Und Seine Euphorie

May 25, 2025

Bundesliga Aufstieg Der Hsv Und Seine Euphorie

May 25, 2025