Berkshire Hathaway's Apple Stock: Post-Buffett CEO Transition Analysis

Table of Contents

Warren Buffett's legacy at Berkshire Hathaway is undeniable, particularly his massive investment in Apple stock. This monumental stake, built over years, has significantly contributed to Berkshire's overall success. This article analyzes the impact of the CEO transition on Berkshire Hathaway's Apple holdings and explores the future direction of this crucial investment. We'll examine the potential strategies under new leadership and consider the implications for both Berkshire Hathaway and Apple shareholders. Understanding the future of this investment is crucial for anyone interested in the stock market and the future of these two iconic companies.

Buffett's Apple Investment Strategy

The Rationale Behind the Investment

Warren Buffett's admiration for Apple wasn't based on fleeting market trends; it stemmed from a deep understanding of the company's fundamental strengths. He recognized Apple's incredibly strong brand, a fiercely loyal customer base, and robust, consistent cash flow as key indicators of long-term success. These factors, coupled with Apple's impressive ability to generate significant profits, made it a compelling long-term investment. The significant returns generated since Berkshire Hathaway's initial investment only solidified this assessment.

- Long-Term Vision: Buffett's approach is fundamentally different from short-term trading strategies. He's known for his "buy and hold" philosophy, focusing on companies with sustainable competitive advantages.

- Consistent Profitability: Apple's consistent profitability, even during economic downturns, is a major factor contributing to the attractiveness of the investment. This predictability offers a level of security uncommon in many tech stocks.

- Brand Strength and Ecosystem: Buffett also highlighted the strength of the Apple ecosystem and the brand loyalty it fosters. This creates a sticky user base, less susceptible to competitor encroachment.

The Impact of Buffett's Leadership

Buffett's presence undeniably influenced Berkshire's Apple holdings and decision-making. His reputation and unwavering confidence in Apple instilled considerable investor confidence, driving up the stock price and potentially influencing other investors to follow suit. His public comments on Apple, though infrequent, often carried significant weight within the financial community.

- Investor Confidence: Buffett's endorsement acted as a powerful catalyst, attracting investors who trusted his judgment and expertise.

- Strategic Stability: His long-term investment approach provided stability, preventing impulsive reactions to short-term market fluctuations.

- Public Statements: While not frequent, Buffett's occasional positive comments about Apple significantly influenced market sentiment.

Post-Buffett Leadership and Apple

The New CEO's Approach

The transition to new leadership at Berkshire Hathaway introduces an element of uncertainty regarding the future of the Apple investment. While the new leadership team likely appreciates the success of the Apple investment, their specific approach to portfolio management might differ from Buffett's. Analyzing their investment philosophies and experience with technology companies is crucial to predicting the future of this massive holding.

- Potential Shifts in Strategy: The new leadership might opt for increased diversification, reducing the concentration of assets in Apple. Alternatively, they might maintain the current strategy or even increase holdings depending on their assessment of future prospects.

- Experience with Tech: The new CEO's (or leadership team's) prior experience in investing in technology companies will significantly influence their decisions regarding Apple.

- Focus on Specific Sectors: The shift in leadership could indicate a change in the overall investment strategy of Berkshire Hathaway, focusing on different sectors or investment styles.

Potential Scenarios for Apple Stock Ownership

Several scenarios are plausible for the future of Berkshire Hathaway's Apple stock ownership:

- Maintaining the Current Position: This is a likely scenario, given the historical success of the investment. The massive stake already held represents a significant portion of Berkshire's portfolio.

- Increasing Holdings: Depending on market conditions and Apple's continued performance, Berkshire might choose to increase its stake. This would demonstrate continued confidence in Apple's future.

- Decreasing Holdings: This scenario, while less likely, remains possible. Factors such as market corrections or changes in Berkshire's overall investment strategy might lead to a gradual reduction in holdings.

The decision-making process will be influenced by several factors including:

- Market Conditions: Broad market volatility, economic slowdowns, or unexpected geopolitical events can significantly impact investment decisions.

- Apple's Financial Performance: Apple's future earnings reports and overall financial health will be key in shaping Berkshire's strategy.

- Economic Climate: The broader economic outlook plays a critical role in influencing investment decisions.

Analyzing the Future of Berkshire Hathaway's Apple Investment

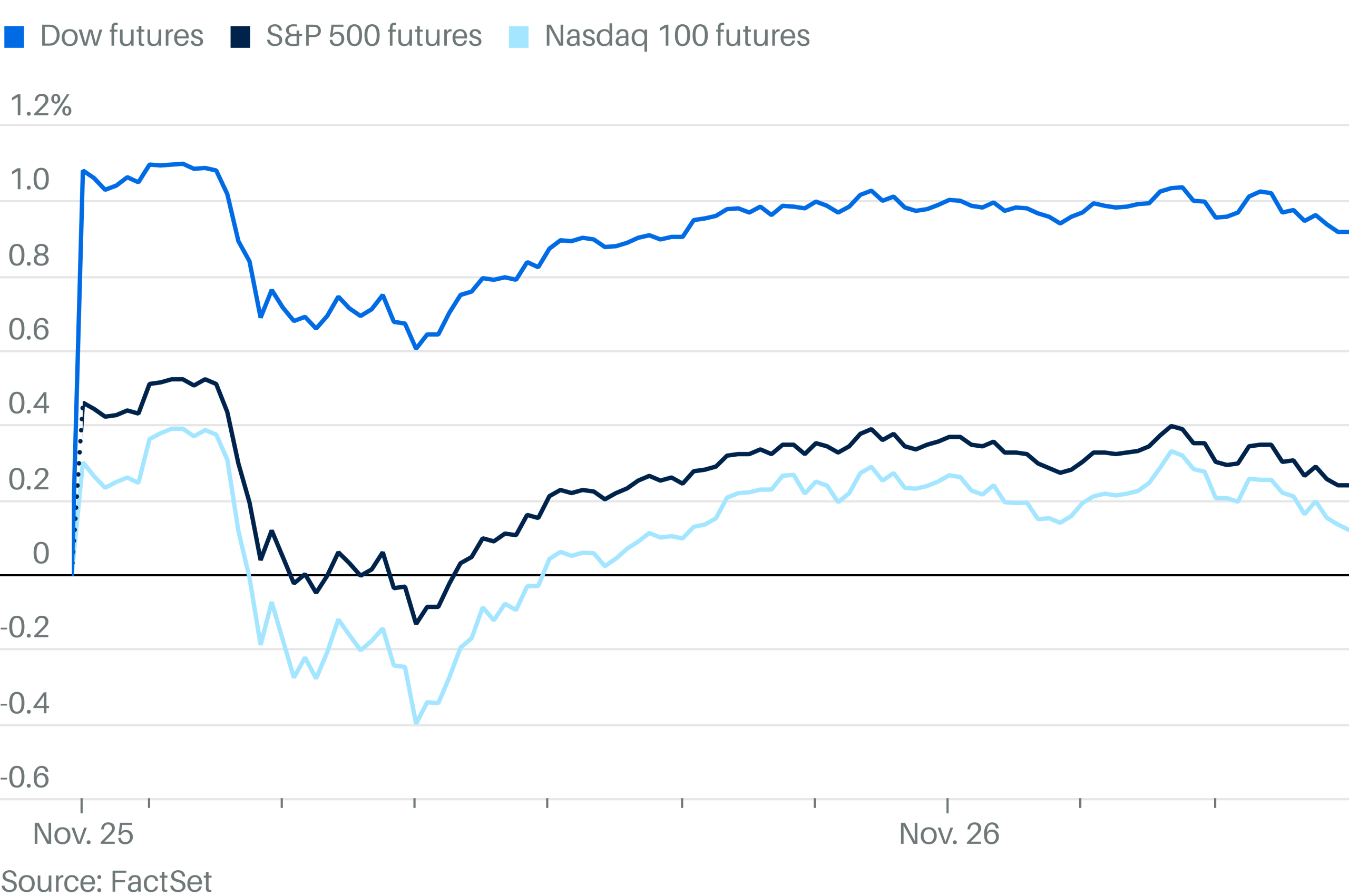

Market Volatility and its Impact

External factors, such as market corrections, economic downturns, and geopolitical events, will inevitably influence Berkshire's Apple investment strategy. Effective risk management and diversification strategies will be crucial in navigating these uncertainties.

- Market Corrections: Sharp market declines might necessitate adjustments to the portfolio, potentially involving the sale of some Apple stock to mitigate losses.

- Economic Downturns: A recessionary environment could negatively impact Apple's performance, leading to a reevaluation of Berkshire's holdings.

- Geopolitical Risks: Global political instability can trigger market uncertainty, requiring Berkshire to adapt its investment strategy accordingly.

Long-Term Outlook and Projections

The long-term prospects for Berkshire Hathaway's Apple investment are positive, assuming Apple continues its trajectory of innovation and growth. However, various scenarios need to be considered.

- Optimistic Scenario: Continued strong performance by Apple, coupled with a positive economic environment, could result in significant capital appreciation and healthy dividend income for Berkshire Hathaway.

- Pessimistic Scenario: Factors like increased competition, economic downturn, or a significant shift in consumer preferences could negatively impact Apple's performance, leading to lower returns for Berkshire.

- Projected Returns: Precise return projections are impossible, but various models can be used to estimate potential gains based on different growth scenarios for Apple.

Conclusion

The CEO transition at Berkshire Hathaway introduces uncertainty regarding the future management of its substantial Apple stock holdings. While maintaining the current position is the most likely scenario, the new leadership team's investment philosophy and market conditions will ultimately shape the future of this crucial investment. The various scenarios explored highlight the complexities involved, emphasizing the need for a nuanced understanding of both Berkshire Hathaway's investment strategies and the broader economic landscape.

Call to Action: Continue the discussion on the implications of the post-Buffett era for Berkshire Hathaway's Apple stock by leaving your comments below, sharing this article on social media, and subscribing to stay updated on future analyses of Berkshire Hathaway's investment strategies. Understanding Berkshire Hathaway's Apple stock holdings remains crucial for investors seeking to navigate the complexities of the modern stock market.

Featured Posts

-

Fatal Shop Stabbing Police Rearrest Teen Previously Granted Bail

May 24, 2025

Fatal Shop Stabbing Police Rearrest Teen Previously Granted Bail

May 24, 2025 -

Porsche Classic Art Week Indonesia 2025 Seni Dan Otomotif Berkolaborasi

May 24, 2025

Porsche Classic Art Week Indonesia 2025 Seni Dan Otomotif Berkolaborasi

May 24, 2025 -

Gucci Under Demna Gvasalia A Look At The New Collections

May 24, 2025

Gucci Under Demna Gvasalia A Look At The New Collections

May 24, 2025 -

Kak Zhenyatsya Na Kharkovschine Svadebniy Bum Bolee 600 Brakov Za Mesyats

May 24, 2025

Kak Zhenyatsya Na Kharkovschine Svadebniy Bum Bolee 600 Brakov Za Mesyats

May 24, 2025 -

Amsterdam Stock Market Suffers 2 Drop Due To Trump Tariff Announcement

May 24, 2025

Amsterdam Stock Market Suffers 2 Drop Due To Trump Tariff Announcement

May 24, 2025

Latest Posts

-

Canadas 7 Eleven Stores Add Odd Burgers Vegan Menu

May 24, 2025

Canadas 7 Eleven Stores Add Odd Burgers Vegan Menu

May 24, 2025 -

Dogum Tarihi 16 Mart Olanlarin Burcu Ve Analizi

May 24, 2025

Dogum Tarihi 16 Mart Olanlarin Burcu Ve Analizi

May 24, 2025 -

16 Mart Burc Yorumu Kisilik Oezellikleri Ve Uyumu

May 24, 2025

16 Mart Burc Yorumu Kisilik Oezellikleri Ve Uyumu

May 24, 2025 -

16 Mart Burcu Nedir Oezellikleri Nelerdir

May 24, 2025

16 Mart Burcu Nedir Oezellikleri Nelerdir

May 24, 2025 -

Londons Odd Burger Expands To 7 Eleven Stores Across Canada

May 24, 2025

Londons Odd Burger Expands To 7 Eleven Stores Across Canada

May 24, 2025