Betting On Natural Disasters: The Los Angeles Wildfires And The Changing Times

Table of Contents

The Rising Risk of Los Angeles Wildfires and its Financial Implications

The frequency and intensity of Los Angeles wildfires are escalating, driven by a confluence of factors with significant financial implications.

Increased Frequency and Severity

Climate change is undeniably fueling this trend. Rising temperatures, prolonged drought conditions, and the infamous Santa Ana winds create a perfect storm for devastating wildfires. Furthermore, increased urban sprawl has pushed development further into fire-prone areas, increasing both the risk and the potential for catastrophic losses.

- Rising temperatures: Average temperatures in Southern California have steadily increased over the past few decades, leading to drier vegetation and increased flammability.

- Drought conditions: Prolonged periods of drought severely deplete soil moisture, turning landscapes into tinderboxes.

- Santa Ana winds: These strong, dry winds rapidly spread wildfires, making them incredibly difficult to contain.

- Increased development in fire-prone areas: Expanding urban areas encroach upon wildlands, placing more homes and infrastructure at risk.

Data reveals a stark increase in wildfire occurrences and associated costs over the past decade. The cost of fighting these fires and the resulting property damage have placed a significant strain on both public and private resources.

The Insurance Industry's Response

The insurance industry is acutely aware of the heightened risk. We're seeing a range of responses, none of them positive for homeowners:

- Rising insurance premiums: Premiums in high-risk areas are skyrocketing, making homeownership increasingly unaffordable for many.

- Increased deductibles: Policyholders are facing higher out-of-pocket costs in the event of a wildfire.

- Limitations on coverage for wildfire damage: Insurance companies are increasingly limiting or excluding coverage for wildfire damage, leaving homeowners vulnerable.

- Reinsurance challenges: Reinsurers, who provide backup coverage to primary insurers, are also facing increased risk and are adjusting their pricing accordingly.

Impact on Real Estate Values

The ever-present threat of wildfires is significantly impacting property values in Los Angeles and its surrounding areas.

- Decreased property values in high-risk zones: Properties in areas deemed high-risk are seeing a decline in value, making it difficult for owners to sell or refinance.

- Increased demand for fire-resistant building materials: There's a growing demand for materials and construction techniques that offer greater fire resistance.

- Impact on mortgage lending: Lenders are increasingly scrutinizing properties in high-risk areas, making it harder for individuals to secure mortgages.

Investment Opportunities and Risks in the Wildfire Context

While devastating, wildfires also present unique investment opportunities and significant risks.

Investing in Wildfire Mitigation and Recovery

There is a growing market for technologies and services aimed at preventing and mitigating wildfires, as well as assisting in post-fire recovery efforts.

- Companies developing fire-resistant materials: Companies innovating in fire-resistant building materials and construction techniques are seeing increased demand.

- Wildfire detection technologies: Investment in advanced technologies for early wildfire detection and monitoring is attracting capital.

- Companies involved in post-fire restoration: Businesses specializing in reforestation, land reclamation, and rebuilding efforts are also experiencing growth.

Analyzing Wildfire-Related Stocks and Bonds

Investors can analyze the performance of companies directly or indirectly affected by wildfires.

- Stock performance analysis of relevant companies: Insurance companies, construction firms, and even timber companies experience fluctuating stock prices based on wildfire activity. Careful analysis is crucial.

- Bond yields and ratings of municipalities affected by wildfires: Municipal bonds issued by cities and counties affected by wildfires may experience changes in yield and ratings depending on the scale of the damage and the recovery efforts.

The Ethical Considerations of "Betting on Natural Disasters"

Profiting from natural disasters raises significant ethical concerns.

- Ethical dilemmas in disaster capitalism: The potential for exploitation and price gouging in the aftermath of a disaster necessitates careful consideration of ethical investing practices.

- Potential for price gouging: The increased demand for essential goods and services after a wildfire can lead to unethical price increases.

- The importance of responsible investing: Investors should prioritize companies and initiatives that demonstrate a commitment to ethical and sustainable practices.

The Future of "Betting on Natural Disasters" and Predictive Modeling

The future of investing in the context of natural disasters hinges on improved risk assessment and proactive mitigation strategies.

The Role of Data and Predictive Analytics

Advanced data analytics and predictive modeling are transforming risk assessment.

- Advanced wildfire modeling: Sophisticated models are being developed to predict wildfire risk based on climate data, vegetation patterns, and other factors.

- Climate change projections: Incorporating climate change projections into risk models is crucial for accurate long-term forecasting.

- Improved risk assessment tools: Better risk assessment tools will enable investors to make more informed decisions about investments in wildfire-prone areas.

Government Regulations and Policy Implications

Government regulations and policies play a significant role in shaping both the risk and the investment landscape.

- Building codes and regulations: Stringent building codes and regulations can reduce property damage from wildfires.

- Land management policies: Effective land management practices, such as controlled burns and forest thinning, can significantly reduce wildfire risk.

- Disaster relief funding: Government disaster relief funding can influence investment opportunities in post-fire recovery efforts.

The Importance of Sustainable Practices

Sustainable land management practices and responsible development are vital to reducing wildfire risk.

- Forest management techniques: Implementing sustainable forest management practices, such as controlled burns and forest thinning, can significantly reduce the risk and severity of wildfires.

- Urban planning strategies to reduce wildfire risk: Careful urban planning can help to reduce the impact of wildfires by creating defensible spaces and minimizing development in high-risk areas.

Conclusion

The financial implications of Los Angeles wildfires are undeniable and growing. "Betting on natural disasters" presents both significant opportunities and inherent ethical challenges. Understanding the risks and opportunities associated with this requires careful research and ethical consideration. Learn more about responsible investing in the face of climate change and natural disaster risk by researching reputable organizations focused on sustainable and ethical investing strategies. Informed decisions, a focus on mitigation, and a commitment to responsible practices are key to navigating this increasingly complex investment landscape.

Featured Posts

-

Ftcs Appeal Could Block Microsofts Activision Purchase

Apr 28, 2025

Ftcs Appeal Could Block Microsofts Activision Purchase

Apr 28, 2025 -

The Countrys New Business Hot Spots Investment Opportunities And Growth Potential

Apr 28, 2025

The Countrys New Business Hot Spots Investment Opportunities And Growth Potential

Apr 28, 2025 -

Cocaine Found At White House Secret Service Announces Conclusion Of Investigation

Apr 28, 2025

Cocaine Found At White House Secret Service Announces Conclusion Of Investigation

Apr 28, 2025 -

Alberta Economy Suffers Dow Megaproject Delay Amid Tariff Disputes

Apr 28, 2025

Alberta Economy Suffers Dow Megaproject Delay Amid Tariff Disputes

Apr 28, 2025 -

The Unseen Cracks Identifying The Signs Of A Silent Divorce

Apr 28, 2025

The Unseen Cracks Identifying The Signs Of A Silent Divorce

Apr 28, 2025

Latest Posts

-

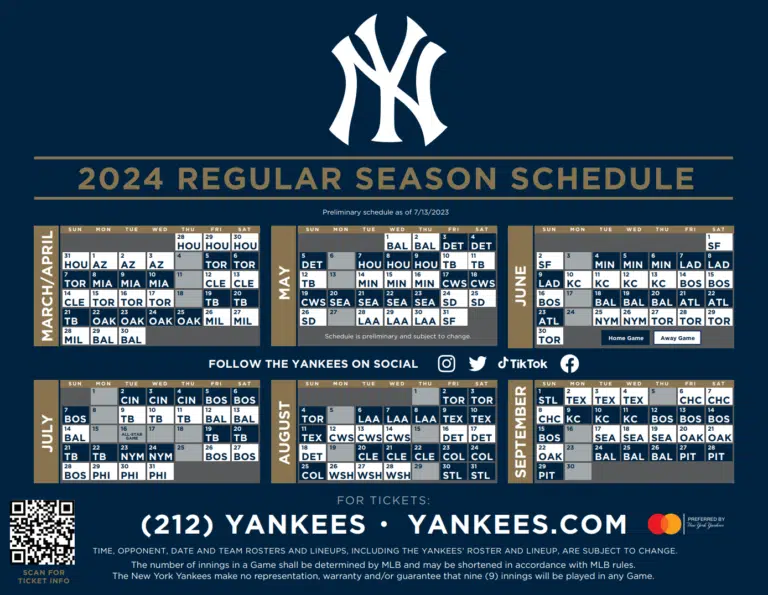

Live Stream Blue Jays Vs Yankees Mlb Spring Training Free Online Viewing Guide March 7 2025

Apr 28, 2025

Live Stream Blue Jays Vs Yankees Mlb Spring Training Free Online Viewing Guide March 7 2025

Apr 28, 2025 -

Watch Blue Jays Vs Yankees Mlb Spring Training Game Online Free Live Stream And Tv Channel

Apr 28, 2025

Watch Blue Jays Vs Yankees Mlb Spring Training Game Online Free Live Stream And Tv Channel

Apr 28, 2025 -

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game Free Live Stream Guide

Apr 28, 2025

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game Free Live Stream Guide

Apr 28, 2025 -

Blue Jays Vs Yankees Spring Training Live Stream Time And Channel Info

Apr 28, 2025

Blue Jays Vs Yankees Spring Training Live Stream Time And Channel Info

Apr 28, 2025 -

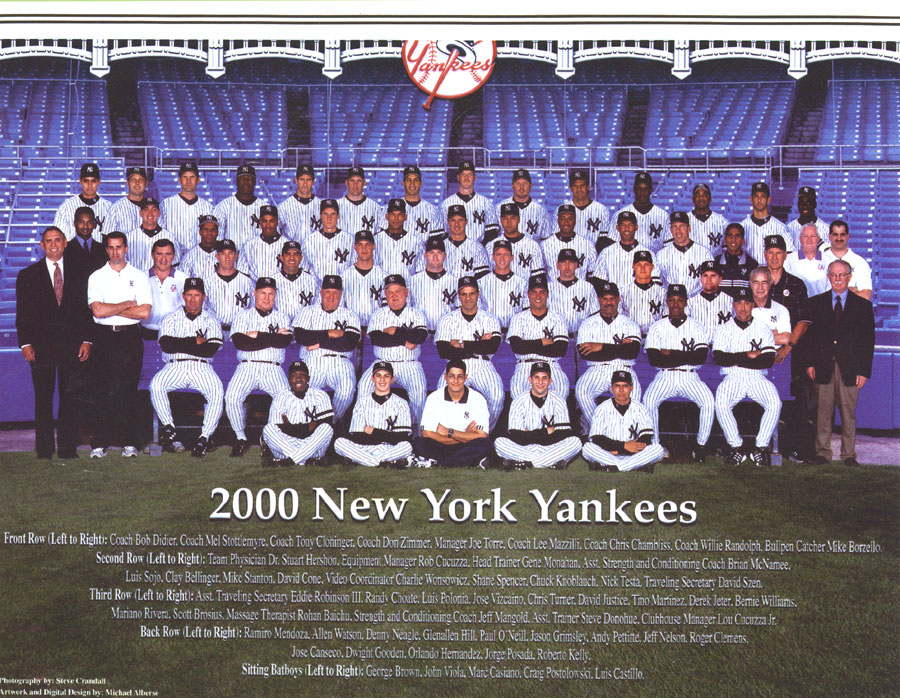

New York Yankees 2000 Diary Of A Victory Against Kansas City

Apr 28, 2025

New York Yankees 2000 Diary Of A Victory Against Kansas City

Apr 28, 2025