FTC, Microsoft, Activision Blizzard, acquisition, antitrust, merger, gaming industry.

FTC, Microsoft, Activision Blizzard, acquisition, antitrust, merger, gaming industry.

The FTC's primary argument against the Microsoft-Activision Blizzard merger centers on the potential for reduced competition and the creation of a monopoly. The commission argues that Microsoft, already a major player in the gaming market with its Xbox console and Game Pass subscription service, acquiring Activision Blizzard – the publisher of hugely popular franchises – would give them undue market dominance. This dominance, the FTC claims, could stifle competition and ultimately harm consumers. Specifically, the FTC highlights concerns about:

The FTC's antitrust lawsuit rests heavily on the potential for Microsoft to use its newfound power to restrict access to Activision Blizzard games on competing platforms, making Game Pass the only viable option for many gamers. Keywords: antitrust lawsuit, monopoly, competition, market dominance, Call of Duty, Game Pass, Xbox.

Microsoft counters the FTC's claims by emphasizing its commitment to keeping popular Activision Blizzard games available on multiple platforms, including PlayStation. They argue that the merger will actually benefit gamers by expanding access to more games through Game Pass and promoting cross-platform play. Microsoft's defense strategy relies on several key points:

Essentially, Microsoft argues that the acquisition will foster a more competitive and beneficial landscape for gamers, rather than diminishing it. Keywords: Microsoft defense, competitive landscape, consumer benefits, PlayStation, cross-platform gaming.

The FTC's appeal is not isolated. Other regulatory bodies worldwide are scrutinizing the Microsoft-Activision Blizzard merger. The European Union, for instance, has already approved the deal under certain conditions. This highlights the complexity of international antitrust law and the potential for differing outcomes across jurisdictions. The varied responses from different regulatory bodies underscore the global implications of this merger and the nuanced considerations involved in assessing its impact on competition. Keywords: EU regulation, global antitrust, regulatory approval, international competition.

The outcome of the FTC's appeal will have a profound impact on the gaming industry. If the appeal is successful, the merger will be blocked, potentially leaving the gaming landscape largely unchanged. However, a successful appeal could also trigger a wave of further regulatory scrutiny on other large gaming mergers and acquisitions.

Conversely, if the FTC's appeal is unsuccessful, the merger will proceed, significantly altering the industry. Microsoft would gain control of major gaming franchises, bolstering its position in the market and potentially shifting the balance of power among console manufacturers and subscription services. This could lead to various scenarios, including:

The potential market impact is vast and multifaceted, with long-term consequences yet to be fully understood. Keywords: merger outcome, market impact, gaming industry future, Microsoft strategy.

The FTC's appeal against the Microsoft-Activision Blizzard acquisition represents a critical juncture for the gaming industry. The arguments presented by both sides highlight the complex issues surrounding antitrust concerns, market dominance, and the future of gaming. The outcome will shape not only the competitive landscape but also the experience of millions of gamers worldwide. Stay tuned for updates on the FTC's appeal and the future of the Microsoft Activision Blizzard merger, as this pivotal decision will reshape the industry for years to come.

Ai Driven Podcast Creation Transforming Scatological Data Into Engaging Content

Ai Driven Podcast Creation Transforming Scatological Data Into Engaging Content

Virginia Giuffres Passing Impact On Prince Andrew Case And Epstein Legacy

Virginia Giuffres Passing Impact On Prince Andrew Case And Epstein Legacy

The China Factor How Its Affecting Luxury Car Brands Like Bmw And Porsche

The China Factor How Its Affecting Luxury Car Brands Like Bmw And Porsche

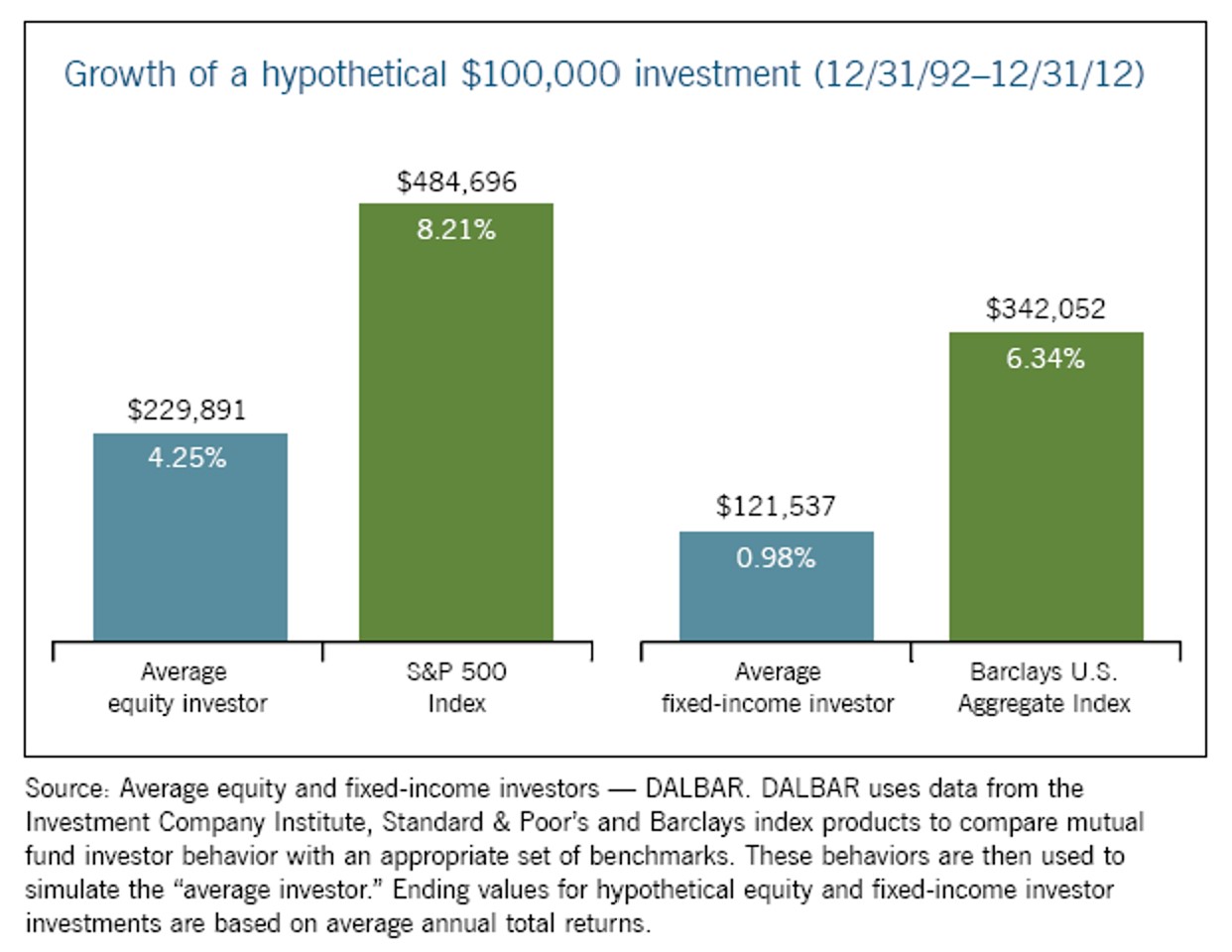

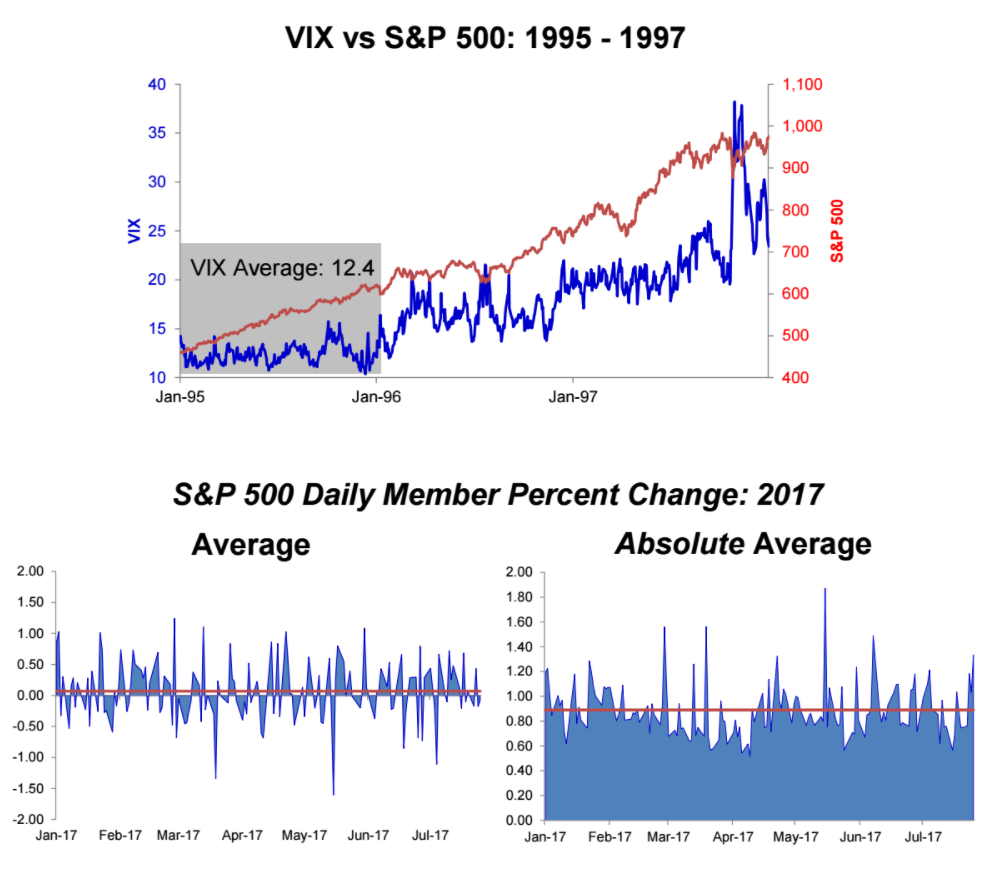

Analyzing Market Behavior Professionals Vs Individuals During Downturns

Analyzing Market Behavior Professionals Vs Individuals During Downturns

Lab Owners Guilty Plea Faked Covid Test Results During Pandemic

Lab Owners Guilty Plea Faked Covid Test Results During Pandemic

Lingering Effects Toxic Chemicals In Buildings After Ohio Train Derailment

Lingering Effects Toxic Chemicals In Buildings After Ohio Train Derailment

Ohio Train Derailment Prolonged Exposure To Toxic Chemicals In Buildings

Ohio Train Derailment Prolonged Exposure To Toxic Chemicals In Buildings

Months Of Toxic Chemical Contamination Following Ohio Train Derailment

Months Of Toxic Chemical Contamination Following Ohio Train Derailment

Ohio Train Derailment Toxic Chemical Lingering In Buildings Months Later

Ohio Train Derailment Toxic Chemical Lingering In Buildings Months Later

Understanding The Volatility Of Gpu Prices

Understanding The Volatility Of Gpu Prices