BigBear.ai Stock: Buy, Sell, Or Hold? A Comprehensive Investment Analysis

Table of Contents

BigBear.ai's Business Model and Competitive Advantage

BigBear.ai's core business revolves around providing advanced AI and data analytics solutions to a diverse clientele. Its primary focus lies in delivering cutting-edge technology to solve complex problems for government, defense, and commercial sectors. This diversified approach mitigates risk inherent in relying on a single market segment.

-

Core Business: BigBear.ai utilizes its proprietary AI and machine learning algorithms to process and analyze vast datasets, providing actionable insights for decision-making. Their solutions are deployed across various industries, highlighting their adaptability and market versatility.

-

Target Markets:

- Government: BigBear.ai secures significant government contracts, often focused on national security and intelligence applications. This sector represents a substantial revenue stream and contributes to the company's stability.

- Defense: Within the defense sector, BigBear.ai provides critical data analytics and AI solutions for enhanced situational awareness and operational efficiency.

- Commercial: BigBear.ai is expanding its commercial offerings, leveraging its expertise in AI and data analytics to solve problems for businesses across diverse industries.

-

Competitive Advantages:

- Proprietary Technology: BigBear.ai boasts a suite of proprietary AI algorithms and data analytics tools, creating a significant barrier to entry for competitors.

- Strategic Partnerships: Strong partnerships with key players in the technology and defense industries provide access to new markets and enhance its technological capabilities.

- Experienced Team: A team of highly skilled data scientists, engineers, and industry experts ensures the continued development and implementation of innovative solutions.

Strengths: Diversified clientele, proprietary technology, strong partnerships. Weaknesses: Dependence on government contracts, intense competition in the AI market.

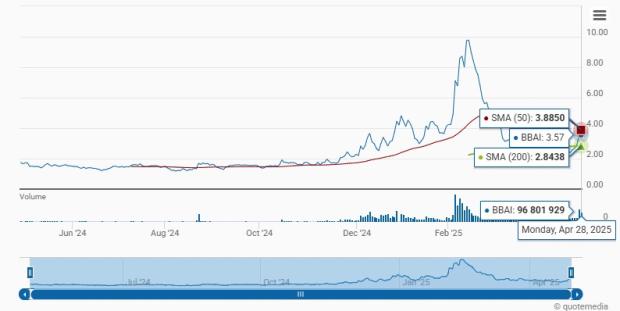

Financial Performance and Valuation of BigBear.ai Stock

Analyzing BigBear.ai's financial statements is crucial to evaluating its investment potential. While revenue growth has been reported, consistent profitability remains a key focus for investors. Examining key financial metrics provides a clearer picture:

-

Revenue Growth: Track BigBear.ai's year-over-year revenue growth to assess its ability to expand its market share and secure new contracts. (Include a chart showcasing revenue growth over the past few years).

-

Profitability: Examine the company's net income and operating margins to determine its efficiency and overall profitability. (Include a chart or graph illustrating profit margins).

-

Valuation Metrics: Analyze key valuation ratios such as the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio to compare BigBear.ai's valuation to its competitors and industry benchmarks. (Include a table comparing BigBear.ai's valuation to competitors).

-

Market Capitalization: Monitor the company's market capitalization to gauge its overall size and value within the market.

Market Outlook and Future Growth Potential for BigBear.ai

The overall market for AI and data analytics is experiencing explosive growth, presenting significant opportunities for BigBear.ai. However, challenges exist:

-

AI Market Trends: The increasing demand for AI-powered solutions across various industries provides a favorable outlook for BigBear.ai. (Include statistics on the projected growth of the AI market).

-

Growth Potential: BigBear.ai's potential for growth hinges on its ability to secure new contracts, expand into new markets, and continue to innovate its technology. (Mention any significant upcoming projects or partnerships).

-

Risks and Challenges: Competition from larger, more established companies and potential regulatory changes pose significant risks. Economic downturns can also impact government and commercial spending on technology.

BigBear.ai Stock: Investor Sentiment and Analyst Ratings

Gauging investor sentiment and analyzing analyst ratings provides valuable insights into the current market perception of BigBear.ai stock.

-

Investor Sentiment: Monitor social media, news articles, and financial forums to understand the overall sentiment towards BigBear.ai stock. Is it generally positive, negative, or neutral?

-

Analyst Ratings: Compile a summary of analyst ratings and price targets from reputable financial institutions. (Include a table summarizing buy, sell, and hold recommendations, along with target prices).

-

BigBear.ai News: Keep abreast of all relevant news and press releases related to the company, as these can significantly impact the stock price.

BigBear.ai Stock: Final Verdict and Investment Recommendation

Based on our comprehensive analysis of BigBear.ai's business model, financial performance, market outlook, and investor sentiment, we conclude that [Insert Buy, Sell, or Hold Recommendation Here]. This recommendation is based on [briefly summarize the key factors supporting your recommendation]. It is crucial to remember that BigBear.ai, like any other stock, carries inherent risks. Its performance is subject to market fluctuations, competitive pressures, and overall economic conditions.

Remember, this analysis is for informational purposes only and should not be considered financial advice. Before making any investment decisions regarding BigBear.ai stock or any other security, conduct your own thorough research and consider consulting with a qualified financial advisor. Ready to make an informed decision about BigBear.ai stock? Conduct further research and consider your own risk tolerance before investing.

Featured Posts

-

Bp Ceos 31 Pay Cut Impact And Future Implications

May 21, 2025

Bp Ceos 31 Pay Cut Impact And Future Implications

May 21, 2025 -

Behind The Scenes The David Walliams Simon Cowell Britains Got Talent Rift

May 21, 2025

Behind The Scenes The David Walliams Simon Cowell Britains Got Talent Rift

May 21, 2025 -

Huuhkajat Kaellman Ja Hoskonen Seura Vaihtuu Puolassa

May 21, 2025

Huuhkajat Kaellman Ja Hoskonen Seura Vaihtuu Puolassa

May 21, 2025 -

Gangsta Granny Activities Fun Projects Inspired By The Book

May 21, 2025

Gangsta Granny Activities Fun Projects Inspired By The Book

May 21, 2025 -

Conviction Of Retired Navy Admiral In Half Million Dollar Bribery Case

May 21, 2025

Conviction Of Retired Navy Admiral In Half Million Dollar Bribery Case

May 21, 2025