BigBear.ai Stock: Investment Opportunities And Risks

Table of Contents

BigBear.ai's Business Model and Market Position

BigBear.ai offers a diverse range of AI-powered solutions, including machine learning algorithms, data analytics platforms, and advanced cybersecurity tools. Their primary target markets are the government sector, particularly focused on national security and defense contracts, and the commercial sector, where they provide data-driven insights and solutions for various industries.

Analyzing BigBear.ai's competitive landscape reveals a dynamic market with both established players and emerging startups. Competitors range from large technology companies offering similar AI capabilities to smaller, specialized firms focusing on niche applications. BigBear.ai's competitive advantages lie in its deep expertise in government contracting, its strong relationships within the national security community, and its proprietary AI algorithms developed for specific mission-critical applications.

- Market share and growth potential: BigBear.ai has significant growth potential within the rapidly expanding AI and government contracting sectors. The increasing demand for advanced analytical tools and cybersecurity measures presents a substantial opportunity for expansion.

- Key contracts and partnerships: Securing large-scale government contracts is critical to BigBear.ai's revenue stream. Analyzing these contracts and their potential renewals is essential for evaluating the company's future performance. Strategic partnerships with technology providers and integrators further enhance their market reach.

- Technological edge and innovation: BigBear.ai's commitment to research and development is crucial for maintaining its technological edge. Continuous innovation and the development of cutting-edge AI solutions are vital for staying competitive in this rapidly evolving market.

Investment Opportunities in BigBear.ai Stock

The potential for significant growth within the AI and government contracting markets presents compelling investment opportunities for BigBear.ai stock. The increasing adoption of AI across various sectors, coupled with rising government investment in national security, creates a favorable environment for the company's expansion.

Positive financial indicators, including revenue growth and strategic acquisitions, are important factors to consider. Analyzing these indicators alongside the company's expansion plans provides insights into its future performance.

- Potential for significant returns: Based on market projections and the company's strategic direction, there is a potential for substantial returns on investment. However, this should be weighed against the inherent risks involved.

- Long-term vs. short-term investment: BigBear.ai stock may be more suitable for long-term investors who can tolerate higher volatility in exchange for potentially higher rewards, rather than short-term traders focused on quick profits.

- Valuation compared to competitors: Comparing BigBear.ai's valuation to its competitors allows investors to assess whether the stock is currently undervalued or overvalued, providing a clearer perspective on its investment potential.

Analyzing BigBear.ai's Financial Performance

A deep dive into BigBear.ai's financial statements is crucial for assessing its financial health and stability. Analyzing key metrics like revenue growth, profit margins, and debt levels provides a comprehensive understanding of the company's performance and its ability to generate sustainable returns.

- Review of recent financial reports: A thorough review of recent financial reports and quarterly earnings releases is essential for tracking the company's financial performance and identifying any significant trends.

- Debt-to-equity ratio: The debt-to-equity ratio provides insights into the company's financial leverage and its ability to meet its debt obligations. A high ratio may indicate increased risk.

- Cash flow analysis: Analyzing the company's cash flow statement is crucial for assessing its ability to generate cash from operations and fund its future growth.

Risks Associated with Investing in BigBear.ai Stock

Investing in BigBear.ai stock carries inherent risks, including those associated with the broader stock market and the tech sector. The company's dependence on government contracts, technological obsolescence, and economic downturns pose significant potential downsides.

- Dependence on government contracts: BigBear.ai's substantial reliance on government contracts makes it susceptible to budget cuts or changes in government priorities. This dependence introduces a level of uncertainty into its future revenue streams.

- Technological obsolescence: The rapid pace of technological change in the AI industry requires continuous innovation to maintain a competitive edge. Failure to adapt and innovate may lead to technological obsolescence.

- Geopolitical risks and economic downturns: Geopolitical events and economic downturns can significantly impact government spending, affecting the demand for BigBear.ai's services and potentially reducing its profitability.

Understanding the Geopolitical Landscape and its Impact

The geopolitical landscape significantly influences government spending on defense and national security, directly impacting BigBear.ai's business. Analyzing the potential risks and opportunities presented by global events is crucial for evaluating the company's future prospects.

- Impact of international relations: International relations and global conflicts can significantly affect the demand for BigBear.ai's services. Escalating tensions may lead to increased government spending, while periods of peace may lead to budget cuts.

- Increased demand due to global conflicts: Conversely, global conflicts can also create increased demand for BigBear.ai's analytical and cybersecurity capabilities, leading to an increase in contracts and revenue.

- Risks associated with operating in politically sensitive regions: BigBear.ai's operations in politically sensitive regions expose the company to various risks, including regulatory hurdles, political instability, and security concerns.

Conclusion

Investing in BigBear.ai stock presents both exciting opportunities and considerable risks. While the company operates in a high-growth sector with substantial potential for future expansion, investors must carefully consider the inherent volatility and potential downsides associated with its dependence on government contracts and the broader tech market. Thorough due diligence, including a detailed analysis of its financial performance and competitive landscape, is crucial before making any investment decisions regarding BigBear.ai stock. Remember to consult with a financial advisor before investing in any stock, including BigBear.ai stock, to ensure it aligns with your individual risk tolerance and financial goals. Careful consideration of the BigBear.ai stock market position and BigBear.ai financial performance is vital for a well-informed investment strategy.

Featured Posts

-

Sabalenka Secures Opening Win At Madrid Open

May 21, 2025

Sabalenka Secures Opening Win At Madrid Open

May 21, 2025 -

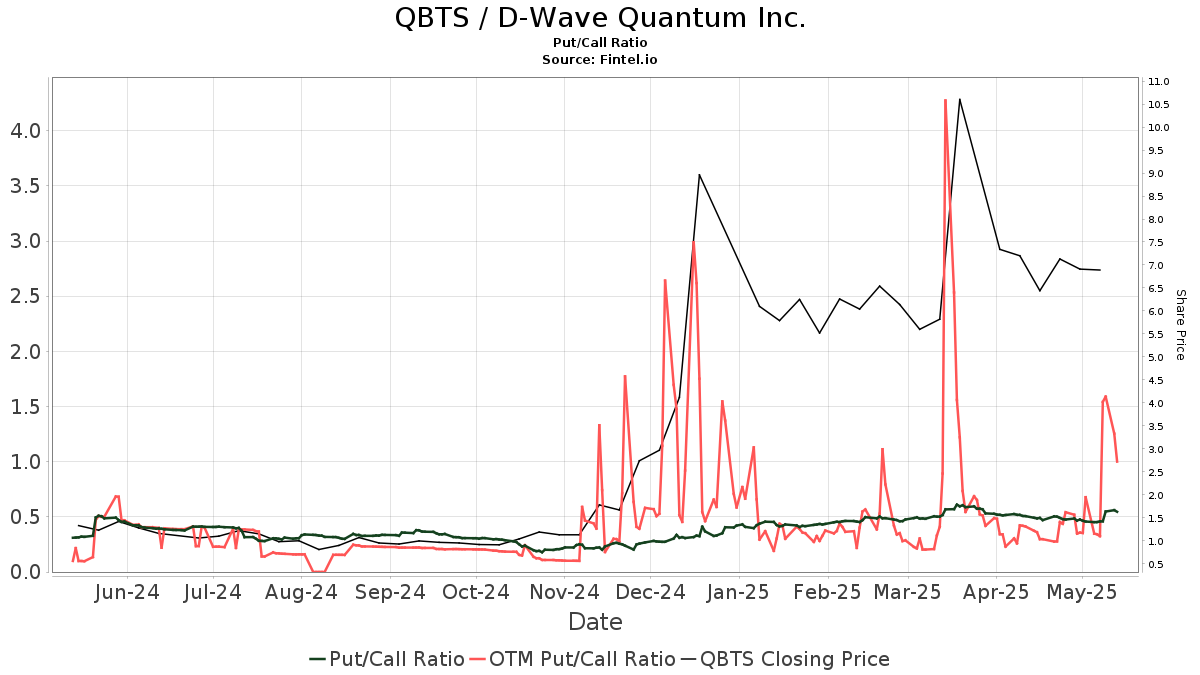

D Wave Quantum Qbts Stock Decline Explained Thursdays Market Activity

May 21, 2025

D Wave Quantum Qbts Stock Decline Explained Thursdays Market Activity

May 21, 2025 -

El Superalimento Que Combate Enfermedades Cronicas Y Promueve La Longevidad

May 21, 2025

El Superalimento Que Combate Enfermedades Cronicas Y Promueve La Longevidad

May 21, 2025 -

Celebrity Fallout David Walliams And Simon Cowells Public Dispute

May 21, 2025

Celebrity Fallout David Walliams And Simon Cowells Public Dispute

May 21, 2025 -

Nom De La Ville Un Havre D Architecture Toscane A La Maniere De La Petite Italie

May 21, 2025

Nom De La Ville Un Havre D Architecture Toscane A La Maniere De La Petite Italie

May 21, 2025