BigBear.ai Stock Plunges Following Disappointing Q1 Earnings

Table of Contents

Disappointing Revenue and Earnings Figures Miss Analyst Expectations

BigBear.ai's Q1 2024 results significantly missed analyst expectations, fueling the subsequent stock plunge. The company reported a revenue of $56 million, falling short of the anticipated $65 million, representing a substantial 14% shortfall. Earnings per share (EPS) came in at -$0.15, considerably lower than the projected -$0.08. This represents a significant disappointment, especially when compared to the previous quarter's performance and year-over-year growth.

- Revenue: $56 million (vs. Analyst Expectation: $65 million)

- EPS: -$0.15 (vs. Analyst Expectation: -$0.08)

- YoY Revenue Growth: 5% (significantly below expectations for double-digit growth)

- QoQ Revenue Growth: -2% (indicating a decline in performance)

This significant revenue shortfall and EPS miss fueled investor concern, contributing significantly to the BigBear.ai stock plunge. The magnitude of the discrepancy between actual and expected results clearly indicated underlying issues within the company's operations and strategic execution. The market reacted negatively to this clear indication of financial underperformance.

Guidance for Future Quarters Fuels Further Investor Concerns

Adding to the negative sentiment surrounding the Q1 earnings report was BigBear.ai's conservative guidance for the remaining quarters of the fiscal year. The company projected full-year revenue between $240 million and $250 million, which, while representing year-over-year growth, fell below many analysts' projections and further dampened investor confidence.

- Full-Year Revenue Projection: $240 million - $250 million (below many analyst estimates)

- Concerns: The guidance lacks the aggressive growth trajectory that many investors had anticipated. The limited upside potential implied in this forecast suggests the company is facing headwinds in securing new contracts and expanding its market share.

- Impact: The cautious guidance significantly impacted investor sentiment, leading to increased selling pressure and further contributing to the BigBear.ai stock price decline.

This subdued outlook fuelled concerns about the company's ability to achieve its long-term growth targets and maintain its competitive position within the rapidly evolving AI and government contracting landscape.

Impact of Macroeconomic Factors and Competitive Landscape

While BigBear.ai's internal challenges contributed significantly to the disappointing Q1 results, external factors also played a role. The current macroeconomic environment, characterized by high inflation and potential economic slowdown, might have impacted government spending on technology solutions, affecting BigBear.ai's ability to secure new contracts. Additionally, the competitive landscape is intensifying, with numerous players vying for government contracts and private sector AI projects.

- Macroeconomic Factors: High inflation and potential recessionary pressures may have reduced government spending.

- Competitive Landscape: The increasing competition in the AI and data analytics sector puts pressure on BigBear.ai's margins and market share. Established players and new entrants are aggressively competing for contracts.

- Market Share Concerns: BigBear.ai’s inability to demonstrate robust growth against a backdrop of increasing competition significantly weighed on investor sentiment.

These external pressures exacerbated the impact of the company's internal challenges, resulting in a more significant decline in the BigBear.ai stock price than might have been seen under more favorable conditions.

Investor Reaction and Market Response

The market reacted swiftly and negatively to BigBear.ai's Q1 earnings report. Immediately following the release, the stock price plummeted by approximately 20%, indicating significant investor disappointment. Trading volume also spiked, suggesting considerable activity as investors responded to the news. Several analysts downgraded their ratings on BigBear.ai stock, further contributing to the negative sentiment.

- Immediate Stock Price Drop: ~20%

- Trading Volume: Significantly increased following the earnings report.

- Analyst Downgrades: Multiple analysts revised their price targets and ratings downward, reflecting their concerns about the company's future performance.

This immediate and sharp market response highlighted the severity of the situation and the lack of confidence in BigBear.ai's near-term prospects.

Conclusion: Navigating the BigBear.ai Stock Plunge

The BigBear.ai stock plunge is primarily attributable to disappointing Q1 earnings, significantly weaker-than-expected guidance for future quarters, and the influence of macroeconomic factors and intensified competitive pressures. While the company may experience some recovery, the short-term outlook remains uncertain. Investors should carefully consider these factors and conduct thorough due diligence before making any investment decisions regarding BigBear.ai stock. Stay tuned for further updates on BigBear.ai's performance and consider conducting thorough due diligence before making any investment decisions regarding BigBear.ai stock. Analyzing future earnings reports and the company's strategic responses to the challenges outlined above will be crucial in assessing its long-term prospects.

Featured Posts

-

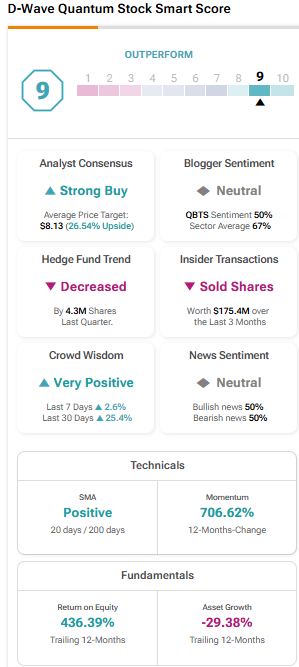

D Wave Quantum Qbts Stocks Significant Drop In 2025 A Comprehensive Look

May 21, 2025

D Wave Quantum Qbts Stocks Significant Drop In 2025 A Comprehensive Look

May 21, 2025 -

Man Achieves Fastest Ever Foot Crossing Of Australia

May 21, 2025

Man Achieves Fastest Ever Foot Crossing Of Australia

May 21, 2025 -

Analysis Ais Triumph In The Trump Era Legislation

May 21, 2025

Analysis Ais Triumph In The Trump Era Legislation

May 21, 2025 -

Meskr Mntkhb Amryka Bwtshytynw Ydm Thlatht Laebyn Lawl Mrt

May 21, 2025

Meskr Mntkhb Amryka Bwtshytynw Ydm Thlatht Laebyn Lawl Mrt

May 21, 2025 -

Blue Origin Cancels Launch Vehicle Subsystem Malfunction

May 21, 2025

Blue Origin Cancels Launch Vehicle Subsystem Malfunction

May 21, 2025