Big Oil's Production Stance Ahead Of OPEC+ Meeting

Table of Contents

Current Global Oil Market Dynamics

Supply and Demand Imbalances

The global oil market is a complex interplay of supply and demand. Currently, we see a delicate balance, with several factors impacting both sides of the equation.

- Recent Production Figures: Major oil-producing nations like Saudi Arabia, Russia, and the United States have shown varying production levels in recent months. Saudi Arabia, for example, has demonstrated capacity to increase or decrease production significantly, influencing global supply.

- Global Oil Consumption: Global oil consumption has fluctuated due to economic growth in certain regions, seasonal changes in demand (typically higher in summer), and the ongoing energy transition. A global recession could significantly impact demand.

- Geopolitical Factors: Sanctions against certain oil-producing nations, ongoing conflicts, and political instability in key regions consistently disrupt supply chains and inject volatility into the market. This uncertainty significantly complicates production planning for Big Oil.

Inventory Levels and Their Influence

Global oil inventories play a crucial role in shaping production decisions. These inventories act as a buffer against unexpected supply disruptions or surges in demand.

- Current Inventory Levels: Current inventory levels are being closely monitored against historical averages. Lower-than-average inventories often signal potential price increases, prompting producers to consider adjustments.

- Influence on Crude Oil Prices: Low inventory levels generally lead to higher crude oil prices due to increased scarcity, while higher inventories can put downward pressure on prices. This creates a constant balancing act for OPEC+.

- Strategic Inventory Management: Maintaining healthy inventory levels is a strategic imperative for oil producers and consuming nations. Low inventories can leave markets vulnerable to shocks, while excessive inventories can tie up capital and reduce profitability.

Big Oil's Financial Performance and Production Strategies

Profitability and Investment Decisions

The financial health of major oil companies heavily influences their production choices. Profitability directly impacts investment decisions in exploration, extraction, and infrastructure development.

- Recent Earnings Reports: Recent earnings reports from major oil producers provide insights into their profitability and financial stability. High profits may incentivize increased production, while lower profits may lead to a more cautious approach.

- Shareholder Pressure: Shareholders exert significant pressure on oil companies to maximize returns. This can influence production decisions, often prioritizing short-term gains over long-term sustainability.

- New Oil Production Projects: Planned investments in new oil production projects demonstrate long-term production strategies and confidence in future demand. These projects are subject to economic viability, requiring careful consideration of various market dynamics.

Sustainability Concerns and the Energy Transition

The increasing focus on Environmental, Social, and Governance (ESG) factors is transforming Big Oil's operational landscape.

- Pressure to Reduce Emissions: Investors and governments are increasingly pressuring oil companies to reduce their carbon footprint and transition towards cleaner energy sources.

- Balancing Production and Climate Goals: This creates a conflict between maximizing oil production for profit and meeting ambitious climate goals. Big Oil companies are navigating this complex challenge by exploring carbon capture technologies and investing in renewable energy sources.

- Commitments to Renewable Energy: Many Big Oil companies are making public commitments to invest in renewable energy sources such as solar and wind power, signaling a shift towards a more sustainable future, albeit a gradual one.

OPEC+ Dynamics and Potential Outcomes

Potential Production Adjustments

The OPEC+ meeting presents various potential scenarios regarding production adjustments.

- Production Increases: Increased production could alleviate supply concerns and potentially lower oil prices. This is often driven by economic considerations, but depends on the willingness of key players like Saudi Arabia.

- Production Decreases: Decreased production would aim to support higher oil prices by creating artificial scarcity. This requires consensus within the OPEC+ alliance and can be politically sensitive.

- Maintaining Current Levels: Maintaining current production levels is a neutral strategy, allowing for market forces to determine price fluctuations. This is often a preferred outcome when uncertainty is high.

- Differing Opinions within OPEC+: Reaching a consensus within OPEC+ can be challenging, with member states having diverse economic and political interests. Disagreements can lead to unpredictable outcomes.

Impact on Global Oil Prices

The OPEC+ decision will significantly impact global oil prices.

- Potential Price Ranges: Depending on the outcome, we could see oil prices move within a wide range, impacting everything from consumer spending to industrial production.

- Financial Market Reactions: Financial markets react quickly to OPEC+ decisions, with significant price swings in oil futures and related stocks.

- Impact on Consumers and Industries: Fluctuations in oil prices have ripple effects across various industries, impacting transportation, manufacturing, and consumer spending.

Conclusion

Big Oil's production stance ahead of the crucial OPEC+ meeting is a result of complex interplay between global supply and demand, financial performance, sustainability concerns, and geopolitical factors. The decisions made will significantly impact global oil prices and the energy market. The outcome depends on the delicate balance between various competing interests within the OPEC+ alliance.

Call to Action: Stay informed about this crucial OPEC+ meeting and its impact on the future of global oil prices. Follow us for ongoing analysis of Big Oil's production strategies and their implications for the energy market. Continue to monitor developments surrounding OPEC+ decisions and their effect on oil production and global oil supply.

Featured Posts

-

Cannes Film Market Studiocanal Acquires Rights To Cedric Klapischs The Colours Of Time

May 04, 2025

Cannes Film Market Studiocanal Acquires Rights To Cedric Klapischs The Colours Of Time

May 04, 2025 -

West Bengal Weather Rain On The Way For North Bengal Regions

May 04, 2025

West Bengal Weather Rain On The Way For North Bengal Regions

May 04, 2025 -

Opec Meeting Big Oils Resistance To Increased Production

May 04, 2025

Opec Meeting Big Oils Resistance To Increased Production

May 04, 2025 -

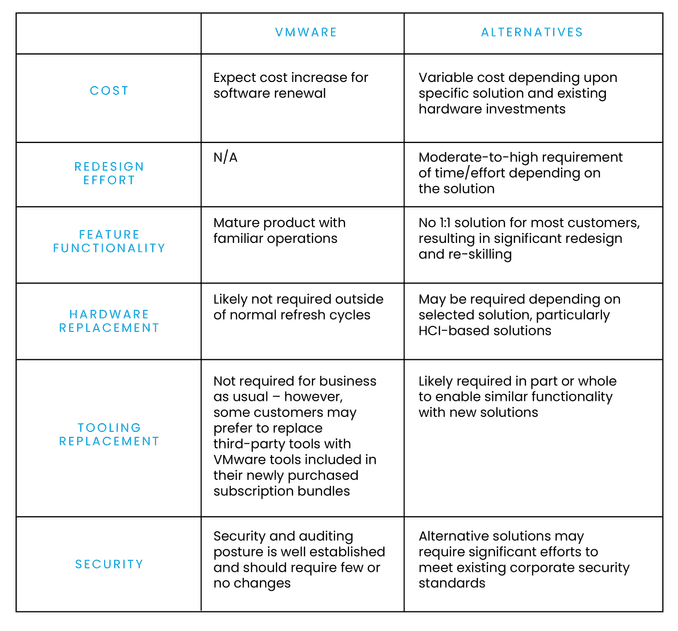

1050 Price Hike At And T Sounds Alarm On Broadcoms V Mware Acquisition Costs

May 04, 2025

1050 Price Hike At And T Sounds Alarm On Broadcoms V Mware Acquisition Costs

May 04, 2025 -

Revolutionizing Voice Assistant Development Open Ais New Tools

May 04, 2025

Revolutionizing Voice Assistant Development Open Ais New Tools

May 04, 2025