Billionaires' Favorite ETF: Projected 110% Soar In 2025

Table of Contents

Unveiling the Billionaires' Favorite ETF

While we'll reveal the name at the end to maintain a bit of suspense, this ETF focuses on a rapidly expanding sector with immense growth potential: renewable energy technologies. This strategically chosen sector positions the ETF for significant gains as the global shift towards sustainable energy accelerates.

- Low Expense Ratio: This ETF boasts a remarkably low expense ratio compared to its competitors, maximizing returns for investors. Lower fees mean more of your investment works towards generating profits.

- Strong Historical Performance: Its historical performance has consistently outpaced many benchmark indices, showcasing the fund manager's keen investment acumen. Past performance, while not indicative of future results, demonstrates a strong track record.

- Expert Fund Management: The experienced fund managers behind this ETF have decades of experience navigating complex markets and making sound investment decisions, providing investors with confidence and reassurance.

The 110% Growth Projection: A Realistic Forecast?

The projected 110% growth by 2025 is based on several key factors, but it's crucial to remember that all investments carry risk, and past performance is not indicative of future results. This projection is an estimate and not a guarantee.

- Booming Renewable Energy Sector: The global transition to renewable energy sources is accelerating, fueled by increasing environmental concerns and government incentives. This sector is expected to experience exponential growth in the coming years.

- Technological Advancements: Breakthroughs in battery technology, solar panel efficiency, and wind turbine design are driving down costs and improving the performance of renewable energy solutions, further boosting the sector's potential.

- Government Regulations and Incentives: Many governments worldwide are implementing supportive regulations and providing substantial financial incentives to promote the adoption of renewable energy technologies.

- Potential Risks and Downsides: While the outlook is positive, potential risks include fluctuations in commodity prices, changes in government policies, and unexpected technological setbacks. Investing in this ETF involves a degree of risk, and potential losses are possible.

Why Billionaires are Investing in This ETF

High-net-worth individuals are drawn to this ETF for several compelling reasons:

- High-Growth Potential: The potential for substantial returns aligns perfectly with the investment goals of billionaires seeking significant capital appreciation.

- Diversification Benefits: This ETF offers effective diversification, reducing the overall portfolio risk by investing in a diverse range of renewable energy companies.

- Long-Term Investment Horizon: The ETF's focus on a long-term growth sector complements the long-term investment strategies employed by many high-net-worth investors.

- Potential Tax Advantages: Certain aspects of investing in this ETF may offer tax advantages, depending on individual circumstances and applicable tax laws. It's crucial to consult with a qualified financial advisor to understand the tax implications.

- Sophisticated Investor Profile: This ETF is best suited for sophisticated investors with a high-risk tolerance and a long-term investment horizon, aligning with the profiles of many billionaires.

Analyzing the Competition

Compared to similar ETFs in the renewable energy sector, this ETF demonstrates a clear competitive advantage due to its lower expense ratio, strong historical performance, and focused investment strategy on the most promising segments within the renewable energy market. Competitor ETFs often have higher expense ratios and less focused approaches, resulting in potentially lower returns.

How to Invest in the Billionaires' Favorite ETF

Investing in this ETF is a straightforward process:

- Open a Brokerage Account: You'll need a brokerage account with a reputable online brokerage firm. Many firms offer commission-free trading of ETFs.

- Search for the ETF Ticker Symbol: Once your account is set up, locate the ETF using its ticker symbol (which we will reveal shortly).

- Place Your Order: Specify the number of shares you wish to purchase and execute your order. Most platforms provide detailed instructions on how to buy ETFs.

- Minimum Investment Requirements: Most brokerage accounts have no minimum investment requirements for ETFs, however, this can vary. Please check with your selected broker.

- Brokerage Fees: While many brokerage firms offer commission-free ETF trading, there may be other fees associated with your account, such as account maintenance fees or inactivity fees.

Conclusion

The projected 110% growth potential, coupled with the strategic investment approach and the interest from high-net-worth investors, makes this ETF a compelling investment opportunity. We've discussed the factors contributing to this projected growth, the advantages of this ETF over competitors, and the steps to investing. Remember that investment decisions should be based on your personal financial goals, risk tolerance, and thorough research. This article should not be construed as financial advice.

The ETF we've been discussing is [Insert ETF Ticker Symbol Here]. The potential returns of the [Insert ETF Name Here] are significant, but remember to conduct your own thorough research before investing. Learn more about the Billionaires' Favorite ETF and explore its potential today! Consider consulting a qualified financial advisor before making any investment decisions.

Featured Posts

-

Mookie Betts Illness Keeps Him Out Of Freeway Series Game

May 08, 2025

Mookie Betts Illness Keeps Him Out Of Freeway Series Game

May 08, 2025 -

Thunder Grizzlies Preview A Challenging Game On The Horizon

May 08, 2025

Thunder Grizzlies Preview A Challenging Game On The Horizon

May 08, 2025 -

Toronto Housing Market Cools Sales Plummet 23 Prices Dip 4

May 08, 2025

Toronto Housing Market Cools Sales Plummet 23 Prices Dip 4

May 08, 2025 -

Rogue The Reluctant X Men Leader

May 08, 2025

Rogue The Reluctant X Men Leader

May 08, 2025 -

Mapping The Rise Of New Business Hot Spots Across The Country

May 08, 2025

Mapping The Rise Of New Business Hot Spots Across The Country

May 08, 2025

Latest Posts

-

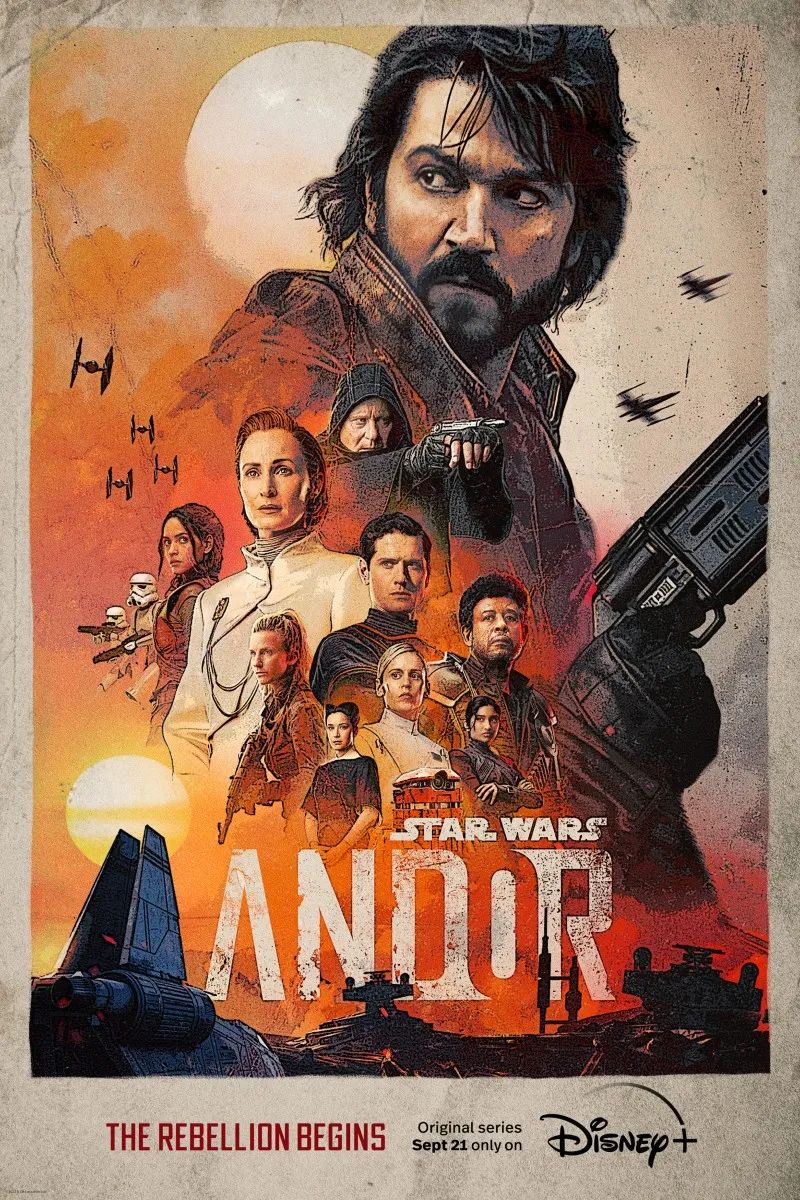

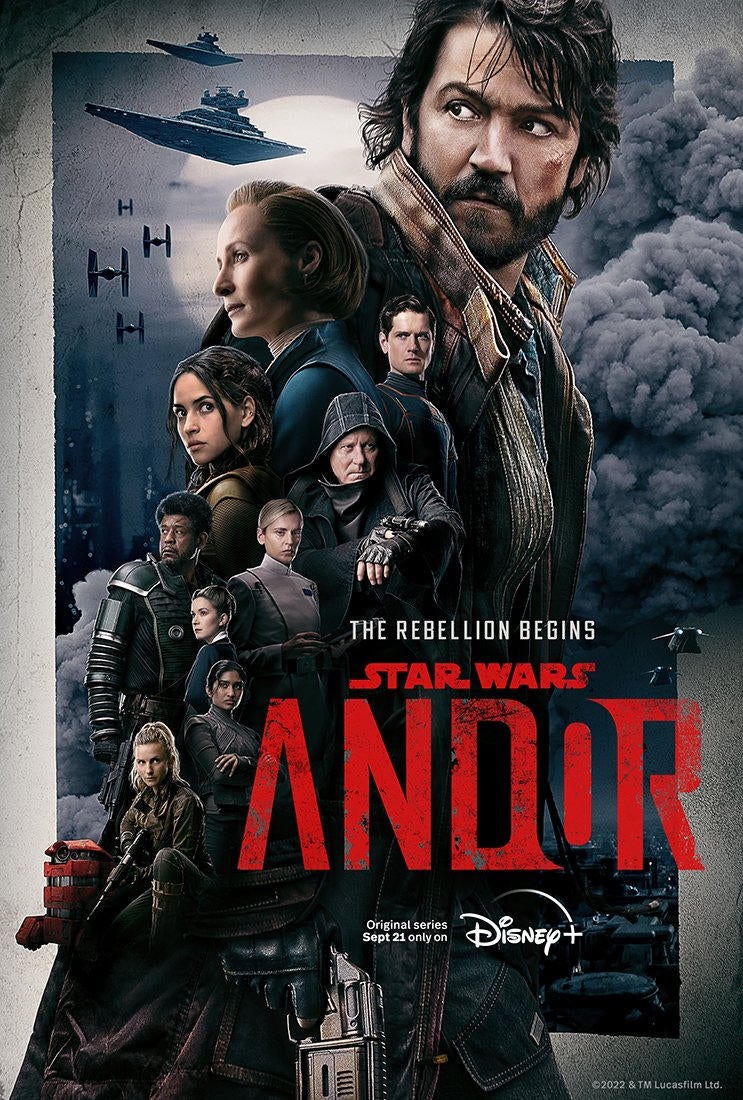

The Planet Star Wars Has Kept Hidden For 48 Years Is The Wait Finally Over

May 08, 2025

The Planet Star Wars Has Kept Hidden For 48 Years Is The Wait Finally Over

May 08, 2025 -

Star Wars The Andor Story Book Project Cancelled Amidst Ai Debate

May 08, 2025

Star Wars The Andor Story Book Project Cancelled Amidst Ai Debate

May 08, 2025 -

Andor Novel Axed Publishers Ai Related Concerns

May 08, 2025

Andor Novel Axed Publishers Ai Related Concerns

May 08, 2025 -

Star Wars Andor Book Cancelled The Ai Controversy

May 08, 2025

Star Wars Andor Book Cancelled The Ai Controversy

May 08, 2025 -

Reaction Kuzma Addresses Tatums Trending Instagram Picture

May 08, 2025

Reaction Kuzma Addresses Tatums Trending Instagram Picture

May 08, 2025